Current Sensor Market Size, Share & Industry Analysis, By Sensor Type (Hall Effect Sensors, Shunt Resistor Sensors, Current Transformers, and Others), By Loop Type (Open Loop and Closed Loop), By Current Sensing Type (Direct Current Sensing and Indirect Current Sensing), By Output Type (AC and DC), By Distribution Channel (Online and Offline), By Application (Automotive, Energy and Power Systems, Industrial Automation, Consumer Electronics, Aerospace and Defense, and Others), and Regional Forecast, 2026 – 2034

CURRENT SENSOR MARKET OVERVIEW AND FUTURE OUTLOOK

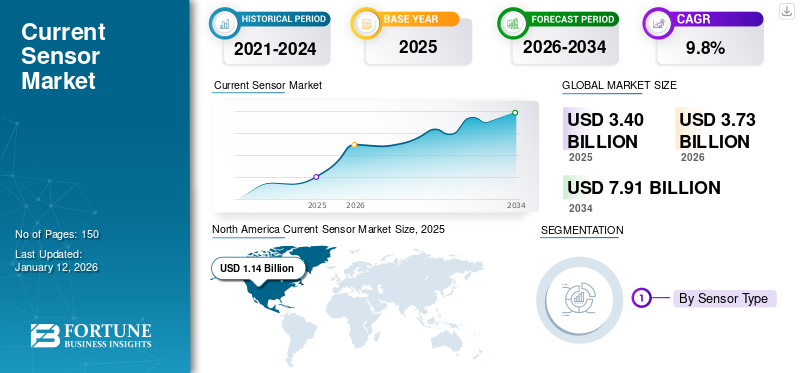

The global current sensor market size was valued at USD 3.40 billion in 2025. The market is projected to grow from USD 3.73 billion in 2026 to USD 7.91 billion by 2034, exhibiting a CAGR of 9.8% during the forecast period. North America dominated the global market with a share of 33.4% in 2025.

The current sensor industry involves the design, production, and sale of devices used to measure electrical current in various applications. It includes a wide range of current sensing technologies, such as hall effect sensors, shunt resistors, current transformers, and others. These sensors have applications in industries including automotive, power management, industrial automation, consumer electronics, aerospace, and defense. They are essential for monitoring and controlling power supply systems, ensuring efficient energy usage, improving safety, and enabling real-time monitoring in applications, such as power grids, motor control, smart meters, and energy storage. The increasing demand for energy-efficient solutions, rise of Electric Vehicles (EVs), and expansion of renewable energy sources will drive the market. For instance,

- According to the IEA, the Electric Vehicle (EV) market achieved nearly 14 million sales in 2023, representing 18% of the total car sales. This figure was up from just 4% in 2020.

The COVID-19 pandemic initially disrupted the market by causing supply chain delays and halting production in various industries. However, the market saw a recovery as demand grew for energy-efficient solutions, remote monitoring, and automation, particularly in sectors including healthcare, EV, and renewable energy. This accelerated the market’s growth post-pandemic.

MARKET DYNAMICS

Market Drivers

Increasing Shift toward Non-Invasive Sensing Technologies to Fuel Market Growth

Companies in the market are shifting toward non-invasive sensing technologies, such as Hall Effect sensors, which are significantly fueling the growth of the market. For instance,

- In August 2024, Melexis achieved the Automotive Safety Integrity Level (ASIL) C safety compliance with its smart IVT sensing platform, featuring the Shunt interface MLX91231 and Hall-effect MLX91230. This solution simplifies the ISO 26262 ASIL C compliance for critical vehicle functions, including battery management systems, smart pyro fuses, and high-voltage charging systems.

These sensors enable accurate current measurement without direct electrical contact with the conductor, offering enhanced safety and reliability. These sensors detect the magnetic field generated by the flow of current and convert it into a proportional output. Hence, they can monitor high-voltage and high-current systems without the need for physical connections, making them ideal for applications in EVs, renewable energy, and industrial automation, where safety and precision are critical. This trend is further supported by the growing demand for smaller, cost-effective, and highly accurate sensors across various industries. In EVs, Hall Effect sensors are used to monitor the charging and discharging cycles of batteries, ensuring efficient energy management and optimizing battery life. The non-invasive nature of these sensors reduces maintenance costs and enhances system reliability, making them increasingly attractive to industries focused on sustainability, energy efficiency, and smart grid applications.

Market Restraints

High Cost of Sensor Technologies and Complexity of Integration and Calibration to Hinder Market Growth

Advanced sensors, such as Hall Effect and fluxgate offer high precision and safety, but come with higher production costs, limiting their affordability for price-sensitive industries or regions. Additionally, the complexity of integration and calibration can pose challenges. Advanced sensors often require careful calibration to ensure accuracy, and their integration into existing systems can be time-consuming and technically demanding. This can lead to increased installation costs and longer deployment timeframes. Furthermore, varying environmental factors, such as temperature and electromagnetic interference may necessitate additional adjustments, adding to the overall complexity and cost. These factors can slow down the product’s adoption in smaller-scale or cost-conscious applications.

Market Opportunities

Growing Demand for Smart Grids and Energy Management Systems to Create Significant Market Opportunities

Smart grids require precise and real-time monitoring of electrical currents to efficiently manage power distribution, detect faults, and optimize energy flow. Current sensors in these systems provide accurate measurements of power consumption, load balancing, and grid stability. As more countries and regions invest in upgrading their energy infrastructure to integrate renewable energy sources, these sensors will be essential for ensuring grid reliability, enhancing efficiency, and facilitating the transition to sustainable energy systems. Energy management systems, which focus on optimizing the use of electrical energy across industries and commercial buildings, also rely heavily on these sensors. These systems need to continuously monitor current flow for predictive maintenance, performance optimization, and energy conservation. The prioritization of businesses and governments for energy efficiency is raising the demand for these sensors. For instance,

- The National Mission for Enhanced Energy Efficiency (NMEEE), part of the NAPCC, aims to reduce 19,598 MW of capacity, saving 23 million tons of fuel, and cutting 98.55 million tons of emissions. This drive will boost the demand for advanced sensors, particularly in energy monitoring, smart meters, and IoT systems, fueling the current sensor market growth.

CURRENT SENSOR MARKET TRENDS

Growing Adoption of Electric Vehicles (EVs) to Drive Market

These sensors are essential for tracking the flow of electricity in components, such as the battery, motor, and charging circuits. These sensors provide real-time data that aids in managing battery performance, thereby ensuring proper charging and discharging cycles. This optimizes battery life, enhances energy efficiency, and prevents overcharging or undercharging in EVs. The growing demand for EVs, driven by environmental concerns and government policies promoting sustainable transportation, is encouraging companies to offer fully integrated and programmable current sensors. For instance,

- In July 2024, Infineon and Swoboda collaborated to develop current sensor modules for applications in the automotive sector. This accelerated time-to-market for hybrid and electric vehicle solutions, such as traction inverters and battery management systems.

These sensors are crucial in monitoring the high-voltage systems of EVs, detecting faults, and preventing overheating, thus ensuring the longevity and safety of electric drivetrains.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Sensor Type

Need for Reliable Measurements Boosts Adoption of Hall Effect Sensors

Based on sensor type, the market is divided into hall effect sensors, shunt resistor sensors, current transformers, and others.

The hall effect sensors segment dominates the global market due to their non-contact, highly accurate, and durable nature. They provide reliable measurements for a wide range of currents, making them ideal for diverse applications, such as EVs, industrial automation, and renewable energy systems. This segment held 37.66% of the market share in 2026.

The others segment, which includes Rogowski coils and fluxgate sensors, is expected to record the highest CAGR due to the ability of these sensors to provide precise, high-frequency measurements with minimal size and weight. As industries move toward more compact and efficient systems, these sensors are becoming increasingly popular for advanced applications, such as power quality monitoring, grid management, and electric vehicle charging.

By Loop Type Analysis

Open Loop is Highly Preferred Due to its Ability to Measure both AC and DC Currents

Based on loop type, the market is categorized into open loop and closed loop.

The open loop segment holds the highest market share due to its simpler design, cost-effectiveness, and ability to measure both AC and DC currents accurately without the need for complex feedback systems. Their reliability and ease of integration into various applications, such as motor control and power monitoring further contribute to their widespread adoption. The segment is set to attain 53.96% of the market share in 2026, exhibiting a CAGR of 9.32% during the forecast period (2025-2032). For instance,

- In May 2024, LEM launched a new generation of eco-friendly open loop coreless integral current sensors designed to support renewable energy and global electrification. These sensors offer accurate measurements on large busbars with a 1MHz bandwidth for high-frequency applications. They are more cost-efficient and 80% lighter than traditional current transducers in the same range.

The closed loop current sensors segment is expected to record the highest CAGR due to their superior accuracy, stability, and ability to provide precise current measurements with minimal error, even in high-power applications. As demand increases for more reliable and high-performance sensors in fields, such as electric vehicles, renewable energy, and industrial automation, closed-loop systems offer better performance for these advanced applications.

By Current Sensing Type

Direct Current Sensing Leads Owing to its High Accuracy and Efficiency Requirements

Based on current sensing type, the market is segmented into direct current sensing and indirect current sensing.

The direct current sensing segment holds the highest share of the market due to the widespread use of DC power in applications, including EVs, battery systems, and renewable energy storage. DC sensing offers high accuracy and efficiency in monitoring battery charging and discharging, which is crucial for optimizing energy management in these growing sectors. This segment is projected to gain 65.03% of the market share in 2026, recording a considerable CAGR of 9.60% during the forecast period (2025-2032).

The indirect current sensing segment is expected to record the highest CAGR due to its ability to measure current without direct electrical contact, thereby enhancing safety and reducing component wear & tear. This feature makes it ideal for applications in EVs, industrial automation, and power distribution systems, where non-invasive and high-precision current monitoring is increasing in demand.

By Output Type Analysis

AC Output Type’s Dominance is led by its Widespread Use in Various Applications

Based on output type, the market is divided into AC and DC.

The AC segment holds the highest market share due to the widespread use of Alternating Current (AC) in residential, commercial, and industrial applications. As most power grids, electrical appliances, and industrial machinery rely on AC, the demand for accurate and efficient AC sensors remains high for energy management, power distribution, and monitoring systems. This segment is expected to hold 55.29% of the market share in 2026, documenting a significant CAGR of 9.39% during the forecast period (2025-2032).

The DC segment is expected to record the highest CAGR due to the increasing adoption of EVs, renewable energy systems (like solar and wind), and battery storage solutions. The expansion of these sectors will demand precise DC measurements to optimize energy efficiency and performance, driving the demand for advanced DC sensors.

By Distribution Channel Analysis

Online Channels Hold Major Share Fueled by Rising Trend of E-commerce

Based on distribution channel, the market is divided into online and offline.

The online segment holds the highest share of the market due to the growing trend of e-commerce, thereby offering customers a broader range of products, competitive pricing, and the convenience of direct shipping. Additionally, online platforms provide easy access to product reviews, technical specifications, and support, which makes it easier for businesses and consumers to make informed purchasing decisions. This segment is foreseen to capture 64% of the market share in 2025, registering a CAGR of 10.53% during the forecast period (2025-2032).

The offline segment holds a lesser share of the market due to the higher operational costs and limited reach of physical stores compared to those of online platforms. The increasing reliance on e-commerce for convenience, pricing transparency, and faster access to global suppliers has encouraged customers to prefer online channels over traditional retail outlets.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Demand for EVs and ADAS Solutions to Fuel Product Use in Automotive Applications

By application, the market is categorized into automotive, energy and power systems, industrial automation, consumer electronics, aerospace and defense, and others.

The automotive segment holds the highest share of the market due to the growing demand for EVs, battery management systems, and Advanced Driver-Assistance Systems (ADAS). Current sensors are crucial for monitoring and optimizing power usage, enhancing energy efficiency, and ensuring safety in these increasingly electrified and automated vehicles. The segment is set to hold 32% of the market share in 2025, exhibiting a substantial CAGR of 8.72% during the forecast period (2025-2032).

The energy and power systems segment is expected to register the highest CAGR due to the rising demand for renewable energy sources, smart grids, and efficient energy management solutions. Accurate current sensing is essential for optimizing power distribution, monitoring grid stability, and improving the performance of renewable energy systems, such as solar and wind power.

CURRENT SENSOR MARKET REGIONAL OUTLOOK

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Current Sensor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market share valued at USD 1.14 billion in 2025 and USD 1.24 billion in 2026. North America accounts for the largest share of the market due to its advanced industrial infrastructure, high adoption of EVs, and strong presence of technology companies. The region’s growing focus on renewable energy, smart grids, and energy-efficient systems will further drive the demand for precise current measurement. Additionally, North America’s well-established automotive, healthcare, and manufacturing sectors will contribute significantly to the market's expansion.

The U.S. holds the highest share of the North American market due to its strong presence in industries, such as automotive, consumer electronics, and industrial automation. The country benefits from advanced technological development, significant investment in R&D, and a large demand for energy-efficient solutions. Additionally, the country has a well-established infrastructure and a robust manufacturing base, which will boost the adoption of sensor technologies. The U.S. market is expected to be valued at USD 0.72 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the third largest market expected to gain USD 0.76 billion in 2026. The Asia Pacific market is expected to register the highest CAGR due to rapid industrialization, urbanization, and the increasing adoption of EVs, mainly in China and India. The Chinese market is foreseen to hold USD 0.22 billion in 2026. The region’s strong manufacturing base and government initiatives to promote renewable energy and smart grid technologies will further fuel the demand for efficient current sensing solutions. Additionally, the growing focus on energy management and infrastructure development across the region is anticipated to fuel the current sensor market share in the region. Indian market is predicted to hold USD 0.15 billion in 2026, while Japan is poised to be valued at USD 0.18 billion in the same year.

Europe

Europe is the second largest market poised to hold USD 1.07 billion in 2026, documenting a considerable CAGR of 9.74% during the forecast period (2025-2032). Europe holds the second-largest share of the market due to its strong emphasis on EVs, renewable energy adoption, and smart grid technologies. The U.K. market continues to grow, projected to reach a market value of USD 0.26 billion in 2026. The region's commitment to reducing carbon emissions and transitioning to sustainable energy solutions will boost the demand for advanced sensors. Additionally, its robust automotive and industrial sectors and significant government incentives for green technologies are boosting the market’s growth. Germany is foreseen to reach USD 0.22 billion in 2026, while France is expected to hold USD 0.18 billion in 2025.

Middle East & Africa (MEA) and South America

South America is the fourth largest market likely to gain USD 0.37 billion in 2025. The Middle East & Africa are expected to register the second-highest CAGR in the market due to rising investments in renewable energy, smart grid development, and electrification projects. The expansion of its energy sources in its industrial sectors and the demand for advanced current sensing solutions in energy management and power distribution are increasing. Moreover, South America is expected to grow at an average rate in the market due to steady industrialization and the gradual adoption of renewable energy and EVs. Economic challenges and slower infrastructure development may limit the regional market’s growth, but investments in smart grids and sustainable energy will enable its steady expansion. The GCC market is likely to stand at USD 0.08 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players to Launch New Products to Strengthen Market Positioning

Many leading players are launching new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. Companies in the market are prioritizing portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches will help them maintain and grow their share in a rapidly evolving market.

LIST OF CURRENT SENSOR COMPANIES PROFILED:

- Honeywell International, Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- Infineon Technologies AG (Germany)

- Analog Devices. Inc. (U.S.)

- Sensitec GmbH (Germany)

- LEM Holdings SA (Switzerland)

- Vishay Intertechnology Inc. (U.S.)

- Omron Corporation (Japan)

- Microchip Technology, Inc. (U.S.)

- Schneider Electric (France)

- Allegro MicroSystems, Inc. (U.S.)

- Asahi Kasei Microdevices Corporation (Japan)

- CTS Corporation (U.S.)

- KOHSHIN ELECTRIC CORPORATION (Japan)

- Melexis (Belgium)

KEY INDUSTRY DEVELOPMENTS:

In September 2024, Allegro Microsystems introduced two XtremeSense TMR sensors, the CT456 and CT455, designed to streamline high-power density designs while reducing space and costs. These high-bandwidth, low-noise sensors enable precise current measurements for data center and automotive powertrain applications.

In July 2024, Molex launched Percept Current Sensors to meet the increasing need for precise busbar current sensing in the automotive and industrial sectors. These sensors are smaller, lighter, and easier to install and integrate.

In July 2024, Allegro MicroSystems unveiled the ACS37220 current sensor and advertised the ACS37041, the industry’s smallest leaded magnetic current sensor. These solutions improve reliability, efficiency, and system protection, offering a more compact and cost-effective alternative to discrete shunt resistors and op-amp-based sensors.

In June 2024, Yokogawa Test & Measurement launched the CT1000S AC/DC split core current sensor, designed for high-current, wide-bandwidth applications in industries including renewable energy, automotive, shipbuilding, and railways. This sensor offers precise measurements with a clamp design, high common mode rejection, and improved frequency performance up to 10kHz and beyond.

In February 2024, Asahi Kasei Microdevices launched the CZ39 series current sensors for automotive applications, featuring high-speed response, low heat generation, and noise immunity. They support the miniaturization of onboard chargers and DC/DC converters and are suitable for electronic fuses.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investments in upgrading sensor technology will fuel the demand for these sensors by improving its performance, accuracy, and energy efficiency. Innovations, such as enhanced sensitivity, miniaturization, and better integration with smart systems will cater to the growing demands in sectors including automotive, healthcare, and industrial automation. These advancements enable sensors to support applications in electric vehicles, renewable energy, and IoT devices, driving the market’s expansion. Additionally, the emergence of advanced technologies will enhance product offerings and foster market growth. For instance,

- In April 2022, ABB invested USD 1.1 million in a sensor production line at its Brno facility in the Czech Republic, the world's largest facility of its kind. The expansion will double the medium voltage sensor production, aiming for 100,000 units per year by 2026.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects, such as leading companies, product types, and leading product applications. Besides, it offers insights into the market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 9.8% from 2026 to 2034 |

|

|

Segmentation |

By Sensor Type

By Loop Type

By Current Sensing Type

By Output Type

By Distribution Channel

By Application

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach USD 6.95 billion by 2034.

In 2026, the market size stood at USD 4.61 billion.

The market is projected to record a CAGR of 9.8% during the forecast period.

The automotive segment is leading the market.

The growing adoption of EVs is driving the market growth.

Honeywell International Inc., Texas Instruments Incorporated, Infineon Technologies AG, and Analog Devices Inc. are the top players in the market.

North America dominated the global market with a share of 33.4% in 2025.

Asia Pacific is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us