Delivery Robots Market Size, Share & COVID-19 Impact Analysis, By Type (Indoor and Outdoor), By Load Carrying Capacity (Upto 10 Kg, 11 Kg to 50 Kg, and More than 50 Kg), By Number of Wheels (3 Wheels, 4 Wheels, and 6 Wheels), By End User (Healthcare, Food & Beverages, Retail, Logistics, and Others), Regional Forecast, 2026-2034

Delivery Robots Market Size

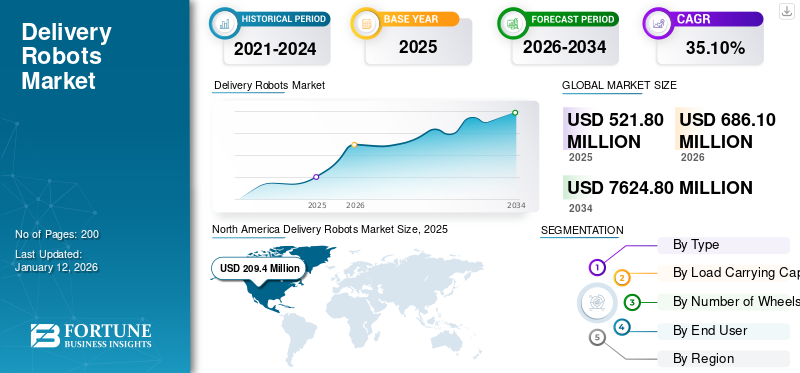

The global delivery robots market size was valued at USD 521.8 Million in 2025 and is projected to grow from USD 686.1 Million in 2026 to USD 7,624.80 Million by 2034, exhibiting a CAGR of 35.10% during the forecast period. The North America dominated global market with a share of 40.10% in 2025. The delivery robots market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.40 Bn by 2032.

A delivery robot is an automated robot that helps in last-mile delivery. It is engaged in providing goods and food parcels to end users without any human interaction. It is assembled with sensors that can detect obstacles and be able to travel from one location to another. The product finds application in various end-user industries such as healthcare, retail, logistics, and food & beverages sectors. In addition, it may be used in food deliveries, online shopping, and e-commerce applications.

Moreover, labor shortages, rise in the e-commerce industry, and the growing need for contactless services are driving the market growth of delivery robots. An increasing internet penetration rate around the globe is also leading to market growth. Moreover, the expansion of the e-commerce sector results in a rise in demand for the online purchase of products, which further enhances the growth of the market. According to the International Trade Administration (ITA), the net retail sale of the e-commerce sector is anticipated to grow by 17.8% from 2022 to 2024.

Furthermore, the growth in the food delivery and logistics sectors fuels the demand for such products for delivery applications. These factors are expected to escalate product demand, driving the delivery robots market growth.

The imposition of lockdowns globally to stop the spread of COVID-19 resulted in an increased demand for e-commerce. Moreover, halt in public transportation and social distancing norms generated the sales of these products during the pandemic. Delivery robots were increasingly used in healthcare, logistics, pharmaceutical, and medical sectors. They were used to provide face masks, health kits, and other essential items. These factors propelled the market growth during the pandemic period.

Delivery Robots Market Trends

Technological Advancements in the Product to Strengthen Market Growth

Post-pandemic trends across the food industry for online ordering got pace with the extension of work-from-home culture and consumers’ change in cooking habits. As a result, the demand for delivery robots increased as they help minimize the cost of delivery and enhance user experience with more safe, hygienic, and contactless delivery. Major players are deploying Artificial Intelligence (AI), Internet of Things (IoT), and Machine Learning (ML) technologies in their product portfolio to understand the environment with object detection technology and manage paths accordingly for fast delivery. For instance, Starship Technologies is making deliveries easier and smarter, powered by electric drive systems and guided by a combination of LiDAR and radar sensors, machine learning, and artificial intelligence.

The integration of 3D cameras along with structured lights with delivery robots helps capture high-quality digital images without reliance on human intervention. Citing another instance, in December 2022, Hyundai motor group initiated a pilot project for delivery operations across the hospitality sector. The product has a load-bearing capacity of up to 10 kg and is equipped with LiDAR and camera solutions enabling easy object detection and safer delivery to consumers in hotels. These factors are set to propel the market growth.

Download Free sample to learn more about this report.

Delivery Robots Market Growth Factors

Strong Network Infrastructure to Boost Autonomous Robots Demand Fueling the Market Growth

In the digital era, fast internet accessibility and demand for connected devices rose astonishingly, spurring the smart robotics market share. Consumers across the U.S., U.K., Canada, Europe, and other developed countries need smart tracking that helps them save time. For instance, Starship Technologies, a global leader in these products, offers a delivery feature that gets integrated into the delivery partner’s website or mobile app and allows them to track and monitor as part of their fleet. The availability of high-speed network connectivity supports fast data transfer, which enables the handling of large amounts of data generated by AI robots using various advanced networking technologies.

Moreover, autonomous robot delivery is a new segment that is enormously being praised by consumers who want their package deliveries in the local areas while minimizing the cost of delivery. In April 2023, Uber Eats, in collaboration with the autonomous delivery robot start-up Cartken expanded their delivery services to Virginia, which will enable easier food delivery with an advanced array of sensors to navigate through the environment. All such aforementioned factors are expected to drive the growth of the market.

RESTRAINING FACTORS

Straggling Infrastructure and High Expenses to Obstruct the Market Growth

Autonomous delivery faces a lot of challenges in the form of electricity storage and consumption that is expected to impact the technological and operational growth of autonomous products. Moreover, the deployment of every product comes with operational complexities and challenges. Therefore, human intervention is much needed for business operations.

Furthermore, manufacturing this robot incurs a high investment of around USD 20,000-50,000. Such investments are not affordable for small - medium enterprises, which restricts the growth of the market.

In addition, slow poised logistic infrastructure growth owing to current war situations across different nations and slow economic growth globally is forcing businesses to cut down costs to keep the business running, impeding market growth. For instance, in October 2022, Amazon stopped the autonomous product live tests stating the causes as a shortfall in meeting consumer needs and that it needs reorientation for further growth.

Delivery Robots Market Segmentation Analysis

By Type Analysis

Outdoor Segment Dominates the Market Owing to the Door-to-door Delivery Feature

Based on type, the market is segmented into indoor and outdoor. The outdoor segment dominates the market share with share of 54.76% in 2026 and indoor segment is projected to witness the highest growth over the forecast period.

Outdoor robots are specifically designed for the e-commerce, retail, and logistics sectors. These robots are engaged in providing deliveries to outdoor environments. In addition, they are used for hospitality and door-to-door delivery and can deliver parcels of up to 35 kg. These robots have several benefits such as accurate delivery, enhanced consumer experience, and reduced labor costs.

Indoor robots are engaged in providing parcels to a wide range of applications such as express delivery, food services, warehousing, healthcare, and logistics sectors. They can deliver parcels with a carrying capacity of 10 to 20 kg. These robots are suitable for last mile delivery and food parcel delivery. Such factors fuel the growth of this industry.

By Load Carrying Capacity Analysis

11 Kg to 50 Kg Segment to Dominate the Market Owing to Strong Demand from Logistics Sector

Based on load carrying capacity, the market is classified into up to 10 kg, 11 kg to 50 kg, and more than 50 kg. The 11 kg to 50 kg segment dominates the market share with share of 53.11% in 2026 and is anticipated to expand with the highest growth rate over the forecast period. Robots with 11 kg to 50 kg load-bearing capacity are mainly utilized in warehouses, logistics centers, and e-commerce sectors. These robots are able to pick weights more than 11 kg and up to 50 kg and are used to deliver products in shorter ranges.

The up to 10 kg segment is projected to exhibit substantial growth potential during the forecast period. The growth can be attributed to the increased adoption of robots with up to 10 kg load-bearing capacity in local restaurants and small hotels to deliver food parcels and beverages to customers. Major players are engaged in offering small robots for autonomous food and product delivery. For instance, in 2021, Starship launched an automated delivery robot with a carrying capacity of up to 10 kg. Such innovation is expected to boost the product portfolio and drive market growth.

By Number of Wheels Analysis

4 Wheeled Robots to Witness High Demand Owing to their Multiple Benefits

Based on number of wheels, the market is categorized into 3 wheels, 4 wheels, and 6 wheels. The 4 wheels segment dominates the market share with share of 54.48% in 2026 and is projected to grow with the highest CAGR during the forecast period.

This segment accounted for the largest delivery robots market share in 2022. 4-wheeled robots have features such as zero radius turning, are more efficient, have multiple cameras, 360-degree versions, and GPS-enabled devices.

The 3 wheels and 6 wheels segments are projected to show considerable growth potential during the forecast period. The growth can be credited to the increasing adoption of 3 and 6-wheeled robots for delivering foods, products, and packaged products with bulk weight. These robots have the ability to deliver parcels with heavy-weight materials. They might be used in the logistics and e-commerce sectors to transfer products from one place to another. Such factors drive the growth of this segment.

By End User Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Product Demand from the Food and Beverages Industry to Propel Market Growth

Based on end user, the market is classified into healthcare, food & beverages, retail, logistics, and others. The food & beverages segment dominates the market share with share of 39.99% in 2026 and is expected to witness substantial growth during the forecast period.

The product is largely used in the food & beverages sector to deliver food and beverages parcels from quick-service restaurants, hotels, and kiosk areas. Such products are used for providing meal parcels to various restaurants. In December 2022, Uber Eats signed a partnership with Cartken based in Miami, U.S. to use sidewalks and automated robots to deliver products or parcels to users.

The healthcare and logistics segments are projected to expand at a moderate growth rate during the forecast period owing to rising demand for robots from the healthcare and logistics sectors. In addition, an increasing penetration rate of the internet and increasing spending on online shopping, which drives the demand for such products, fuels market growth.

The retail and logistics segments are projected to hold considerable growth potential during the forecast period due to increasing spending on groceries and packaged food parcels. According to Atos, 60% of customers switch their e-commerce platforms to avoid the extra shipping cost charged due to long-distance deliveries. Thus, the growing use of delivery robots helps optimize delivery routes in urban areas. These factors are anticipated to fuel the market growth.

REGIONAL INSIGHTS

The market report covers an in-depth analysis of five main regions, North America, Europe, the Asia Pacific, the Middle East and Africa, and Latin America.

North America

North America Delivery Robots Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America held the dominant share in 2026 valuing at USD 274.5 Million and also took the leading share in 2025 with USD USD 209.4 Million. North America is expected to dominate the market during the forecast period due to the presence of several key regional players, increasing internet penetration rate, and strong economic growth. According to the World Bank Group, the net penetration rate of the internet in North America increased by 1.1% in 2021 as compared to 2020. Such a growth in the penetration rate is set to propel the market expansion.

U.S. to Dominate the Market Due to Strong Product Portfolio of Manufacturers

The U.S. is anticipated to dominate the market during the forecast period, owing to strong economic growth and key players investing in research & development to expand business across the country, which enhances the demand for delivery robots, and drives the growth of the market. The U.S. market is projected to reach USD 242.4 Million by 2026. For instance, in November 2021, Nuro Inc invested around USD 600.0 million to open a new manufacturing facility in the U.S. The new manufacturing facility was built to bring robotic delivery services into the company’s product portfolio. Such product development strategies propel the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific market is anticipated to grow with substantial growth during the forecast period, owing to strong investment in healthcare sectors, growth in e-commerce sectors, and rising internet penetration rates. In addition, the growing demand for delivery robots for fast and reliable delivery services and spending on online shopping across Asia Pacific countries such as South Korea, Japan, and China are contributing to regional market growth. The Japan market is projected to reach USD 28.4 Million by 2026, the China market is projected to reach USD 142.2 Million by 2026, and the India market is projected to reach USD 38.2 Million by 2026.

Europe

As per our analysis, Europe is anticipated to witness potential growth during the forecast period, owing to the growing internet penetration rate, strong presence of key players across Germany, France, and Italy, and investment in startup funding. For instance, in January 2022, Starship Technologies got funding of USD 57 million from the European Investment Bank. This investment aimed to expand the company’s product portfolio of autonomous robots for diversified locations. The UK market is projected to reach USD 41.9 Million by 2026, while the Germany market is projected to reach USD 72.2 Million by 2026.

Middle East & Africa and Latin America

The Middle East & Africa and Latin America regions are expected to grow decently during the forecast period owing to growing product demand for logistics, last-mile delivery, and healthcare applications. For instance, in February 2023, the Roads and Transport Authority, Dubai, formed a partnership with Talabat, an online food ordering company and launched food delivery robots called “Talabots” to serve food to the residents of the Cedre Villas community.

KEY INDUSTRY PLAYERS

Major Players Adopt Key Development Strategies to Strengthen Their Industry Positions

Key players engaged in the manufacturing of robots are deploying product development, acquisition, business expansion, and partnership as key developmental strategies to increase product footprint and extend geographical presence. For instance, in June 2022, Relay Robotics Inc launched a new autonomous robot named “Relay + Robotics.” It is specifically designed for the hospitality sector. The robot can make deliveries in 10 minutes and operates at a revenue of USD 4 per hour. Such product innovations are anticipated to fuel market growth.

List of Top Delivery Robots Companies:

- Segway Robotics (Ninebot) (U.S.)

- Nuro Inc (U.S.)

- Panasonic Corporation (Japan)

- Zebra Technologies (Fetch Robotics) (U.S.)

- Starship Technologies (U.S.)

- ST Engineering Aethon Inc (U.S.)

- Teleretail (Germany)

- Deutsche Post (DHL) (Germany)

- Piaggio & C SpA (Italy)

- JD.Com (China)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: Peachtree Corners, the U.S. smart city developed a under-ground autonomous robot delivery system named as “Clevon”. This delivery robot collects orders from retailers, warehouses, and dark stores and delivers to the people around the city to provide timely customer delivery experience.

- March 2023: Neubility, a last-mile robotics start-up, planned to roll out 400 new autonomous robots that would be Lidar-free. The company also planned to develop a new range of security robots alongside delivery robot models.

- December 2022: Hyundai Motor Group initiated a pilot project for delivery operations by using autonomous robots across the hospitality sector. The products are equipped with LiDAR and camera solutions, enabling easy object detection and safer delivery to consumers in the hotels, with load bearing capacity of up to 10 kg.

- August 2022: Ottonomy.io launched a new autonomous robot Ottobot 2.0. The product was circulated across the U.S., Canada, Europe, and Asia. This type of robot is used across restaurants, retailers, and e-commerce sectors.

- May 2022: Pudu Robotics intended to collaborate with Qualcomm to accelerate product innovation through cutting Edge 5G technology and AI-based solutions.

- March 2022: JD Logistics, a subsidiary of JD.Com Inc, developed new robots with a carrying capacity of more than 100 kg. These robots can travel for up to 80 to 90 km per charge. They are largely utilized in mile delivery and heavy-weight product transportation.

- January 2022: Nuro Inc launched a new autonomous delivery device, “Nuro.” The new robot is specifically designed for carrying bulk material and is also used across restaurants and logistics sectors.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report covers a detailed analysis of the type, load carrying capacity, number of wheels, and end users of the product. It provides information about leading players in the delivery robots and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, current market trends, and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 35.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Load Carrying Capacity, By Number of Wheels, By End User, and By Region |

|

Segmentation |

By Type

By Load Carrying Capacity

By Number of Wheels

By End User

By Region

|

Frequently Asked Questions

Fortune Business Market says that the market was valued at USD 521.8 Million in 2025.

According to our insights from the report, the market is expected to be valued at USD 7,624.80 Million by 2034.

The market is estimated to grow at a CAGR of 35.10% during the forecast period.

The North America region, valued at USD 209.4 Million in 2025, is expected to hold a major market share during the forecast period.

Based on number of wheels, the 4 wheels segment is expected to be the leading segment in the market during the forecast period.

An increasing penetration of delivery robots in the healthcare, hospitality, and restaurants sector is anticipated to drive the growth of the market.

Segway Robotics, Nuro Inc, Deutsche Post, Zebra Technologies, and ST Engineering Aethon Inc are some of the top companies operating in the market.

The 11 kg to 50 kg segment is expected to register the largest market share during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us