Dental Handpiece Market Size, Share & Industry Analysis, By Type (In-Office and In-Lab), By Product Type (Electric and Air-Driven), By Design (Straight and Contra-Angle), By Speed (High Speed and Low Speed), By End-user (Dental Clinics, Dental Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

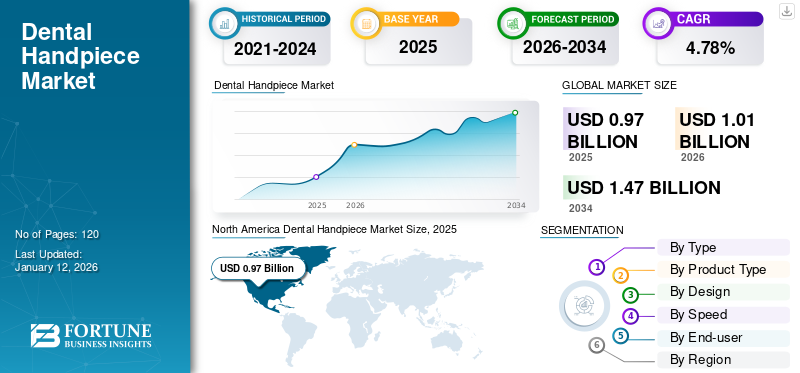

The global dental handpiece market size was valued at USD 0.97 billion in 2025. The market is projected to grow from USD 1.01 billion in 2026 to USD 1.47 billion by 2034, exhibiting a CAGR of 4.78% during the forecast period. North America dominated the dental handpiece market with a market share of 40.91% in 2025.

Dental handpieces refer to small, handheld devices used by dentists and dental hygienists to perform a variety of procedures in the mouth, such as polishing, cutting, drilling, and shaping of the teeth. These are essential tools used in dental clinics and laboratories. Generally, two types of devices are used - electric and air-driven.

The global dental handpiece market is expected to grow significantly in the coming years, driven by factors, such as increasing prevalence of dental diseases and growing geriatric population. In addition, technological advancements in these devices, such as introduction of electric handpieces that offer greater precision and control are also contributing to the market growth.

Other factors driving the global dental handpiece market growth include the rising awareness about dental hygiene and implementation of strategic initiatives by market players to increase their global presence. Additionally, the market is expected to grow due to numerous product launches and technological innovations. Moreover, the market is expected to grow in the future owing to the rising number of distribution collaborations, which can result in increased availability of products across the globe.

- In August 2019, KaVo Dental announced the expansion of its partnership agreement with DKSH HOLDING AG to distribute KaVo Dental’s products in Thailand.

The market experienced a decline in revenue in 2020 due to the COVID-19 pandemic. Many dental offices were forced to close or limit their operations only for urgent cases, which significantly reduced the demand for these devices. Global lockdowns resulted in travel restrictions that negatively impacted the market. However, the market rebounded in 2021 as dental practices reopened and there was a rise in the adoption of tele-dentistry and digital tools. The increased adoption of orthodontic services, dental implants, and endodontics in 2021 led to a substantial market growth as the handpiece was an essential tool for these procedures. However, the high costs associated with these tools and lack of skilled dental professionals in some regions may hinder the market growth to some extent.

Global Dental Handpiece Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 0.97 billion

- 2026 Market Size: USD 1.01 billion

- 2034 Forecast Market Size: USD 1.47 billion

- CAGR: 4.78% from 2026–2034

Market Share:

- North America dominated the dental handpiece market with a 40.91% share in 2025, driven by the widespread adoption of advanced dental handpieces, growing number of dental professionals, and increasing patient visits for dental procedures.

- By product type, air-driven handpieces held the largest share in 2024, attributed to their lighter weight, ease of maintenance, and rising awareness about oral health leading to frequent dental visits for hygiene procedures.

Key Country Highlights:

- United States: Rising collaborations among major dental handpiece manufacturers and distributors are enhancing product availability and adoption across dental practices.

- Europe: Increasing demand for dental caries and tooth filling treatments, along with growing expenditure on oral care services, is supporting market growth in key countries.

- China: Rapid rise in dental diseases, expansion of local manufacturing, and efforts to introduce innovative yet affordable handpieces are fueling market growth.

- Japan: Surge in dental clinics focusing on precision dental procedures and the increasing popularity of technologically advanced electric handpieces are contributing to market expansion.

Dental Handpiece Market Trends

Transition from Air-Driven Toward Electric Handpieces

The dental handpieces market witnessed a shift toward electric handpieces in the last decade.

Electric handpieces offer several advantages over the traditional air-driven ones, including a more consistent cutting power, lesser vibration & noise, and greater precision during dental procedures.

The increasing adoption of electric handpieces by dental professionals is driving the market growth as these devices are becoming more widely available. In addition, advancements in the electric handpiece technology, such as improved battery life and ergonomics are expected to further fuel the market expansion.

Furthermore, growing emphasis on infection control in the dental practices is also driving the shift toward electric handpieces as they are easier to sterilize and maintain compared to the air-driven ones. Moreover, various product launches and availability of advanced products will augment the adoption of these handpieces.

- For instance, in March 2022, Bien-Air Dental S.A. launched Nova, a new contra-angle electric handpiece. It is a multiplier contra-angle device designed to rotate in multiple angles.

Download Free sample to learn more about this report.

Dental Handpiece Market Growth Factors

High Prevalence of Dental Disorders to Drive Market Growth

The increasing prevalence of oral diseases, such as periodontal diseases, tooth decay, and malocclusion is driving the demand for a wide range of dental prosthetics and implants. These handpieces are used to polish the prosthetics and have a wide application in dental surgeries. The demand for these dental procedures will increase the adoption of handpieces in various settings, such as dental clinics and laboratories.

- According to the World Health Organization, approximately 19% of the adult population worldwide is affected by severe periodontal diseases, bringing the total number of cases to over 1 billion.

Companies are focusing on the development of innovative products to launch ergonomically efficient and technologically advanced products. A combination of factors, such as high prevalence rate of dental disorders and introduction of new products is expected to fuel the expansion of the global market.

Significant Rise in Dental Practices to Boost Market Growth

The global dental handpieces market is set to witness significant growth in the coming years, driven by a surge in the number of dental clinics worldwide. Growing awareness about one’s oral health and the importance of regular dental check-ups is leading to a surge in the demand for dental services. This, in turn, is leading to a higher demand for these essential tools, which are used by dentists during various dental procedures.

- For instance, in May 2024, Clove Dental, which is India’s largest dental chain, opened 12 new dental practices in a single day across India. The rising number of dental settings in high growth countries, such as India can increase the demand for essential devices including the dental handpiece.

Additionally, technological advancements, such as the introduction of air-driven and electric handpieces are further driving the market growth. These advanced handpieces offer higher precision, better control, and improved patient comfort, leading to their increased adoption by dental professionals.

Moreover, many manufacturers in the market are focusing on the development of innovative products to cater to the evolving needs of dental professionals and patients, further boosting the market growth.

RESTRAINING FACTORS

Lack of Proper Sterilization Practices in Emerging Countries Can Hamper Market Growth

Dental handpieces are a crucial tool in a dental practice and have major applications, such as cutting, polishing, and shaping teeth. Due to their close contact with patients' mouths, it is essential to ensure that these devices are properly sterilized to prevent the spread of infection.

An improperly sterilized or non-sterilized handpiece can increase the risk of infections for both dental professionals and patients. Inadequate sterilization practices can result in poor outcomes for patients, including higher rates of complications and subpar treatment outcomes. This can deter patients from seeking dental care, leading to reduced demand for dental handpieces and slower market growth, especially in emerging countries. This is because these countries lack proper sterilization facilities in their healthcare settings.

Additionally, improper sterilization practices can shorten the lifespan of these devices, leading to more frequent replacements and higher costs for dental practices. This can deter investment in high-quality handpieces and slow the market growth.

Dental Handpiece Market Segmentation Analysis

By Type Analysis

Rising Prevalence of Oral Disorders Helped In-Office Segment Dominate Market in 2024

Based on design, the market is segmented into in-office and in-lab.

The in-office segment dominated the global dental handpiece market share 75.38% in 2026. The segment’s growth is primarily attributed to the rising prevalence of dental diseases and increasing demand for dental procedures. Additionally, technological advancements in handpieces and growing awareness about oral health among the population are accelerating the segment’s growth. Moreover, the in-office devices have multiple applications in the endodontics, orthodontics, implantology, and general hygiene fields.

- For instance, according to the WHO data in 2019, approximately 900 million cases of oral diseases, such as edentulism, dental caries, and periodontal diseases were estimated across South East Asia. Such high prevalence will increase the number of dental procedures, thereby augmenting the product demand.

The in-lab segment is also projected to grow, driven by the increasing demand for precision engineering and high-quality dental prosthetics. In-lab dental devices are used for the polishing and finishing of the prosthetics. As the demand for crowns, bridges, and dentures continues to grow, the market for in-lab handpiece is expected to grow considerably in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Product Type Analysis

Rising Dental Hygiene Procedures to Boost Air-Driven Handpieces Adoption

In terms of product type, the market is classified into electric and air-driven.

The air-driven segment dominated the market share contributing 74.46% globally in 2026. Some of the factors contributing to its dominance include the rising awareness of oral health among individuals and increasing number of dental visits to enhance oral hygiene. Moreover, their advantages, such as lesser weight and easy maintenance are also expected to drive the demand for these devices.

The electric segment is anticipated to record the highest CAGR during the forecast period. The growth of the segment can be attributed to the advantages of electric handpieces, such as consistent torque and speed control that facilitate the conduct of precise and efficient procedures. These advantages are often useful in restorative procedures, and as the demand for these procedures increases, the adoption of these handpieces is expected to rise across the globe. Additionally, the growing number of products in the market and innovative product launches are expected to drive the segment growth.

- For instance, in May 2023, J. MORITA CORP. launched the Tri Auto ZX2+. It is a cordless electric handpiece that will be used in endodontic applications.

By Design Analysis

Contra-Angle Segment Dominated Market Due to Surge in Root Canal Procedures

By design, the market is divided into straight and contra-angle.

The contra-angle segment dominated accounting for 72.14% market share in 2026. It is primarily due to its applications in endodontics and oral surgery for procedures, such as extractions and implants, where precision and control are essential. The rising number of tooth extractions and root canal procedures are the key trends expected to drive the adoption of contra-angle handpieces.

- For instance, an article published in the Journal of Conservative Dentistry in February 2020 stated that more than 41,000 root canal treatments are performed on a daily basis in India. Such trends will increase the adoption of contra-angle handpieces for accuracy and better visibility during the procedure.

The straight segment also accounted for a significant market share in 2024. The growth of the segment can be attributed to its wider application in the general dental procedures, such as routine cleanings, fillings, and extractions. These devices are also used in hygiene and infection prevention procedures. Moreover, the wide availability of these devices in both the air-driven and electric options is expected to increase their adoption, especially in the emerging regions.

By Speed Analysis

Rising Demand for Aesthetic Dentistry to Boost High Speed Handpieces Segment Growth

Based on speed, the market is classified into high speed and low speed.

The high speed segment accounted for the dominant share of 70.66% in 2026. High-speed handpieces are commonly used for dental procedures, such as cavity filling and polishing. The increasing prevalence of dental diseases and rising demand for aesthetic dentistry are driving the growth of the high-speed handpiece segment. Additionally, the segment’s growth is expected to be fueled by the launch of technologically advanced products and increasing adoption of high speed electric handpieces.

Low-speed handpieces are used for procedures, such as polishing, finishing, and prevention. The growing awareness about preventive dental care and rising number of dental procedures are expected to boost the demand for low-speed handpieces.

By End-user Analysis

Dental Clinics Segment Dominated Market Due to Large Procedural Volume in 2024

Based on end-user, the market is classified into dental clinics, dental laboratories, and others.

The dental clinics segment generated a higher revenue in 2024. These clinics are the primary product end-users as it is a key equipment for carrying out various dental procedures, such as cavity filling, root canal treatment, tooth extraction, and cleaning. The expansion of this segment can also be attributed to the presence of a significant number of dental clinics and an increasing patient pool for dental procedures across the globe.

The dental laboratories segment is expected to witness rapid growth during 2025-2032. The use of handpieces for crafting dental prosthetics, such as crowns, bridges, and dentures in dental laboratories is growing due to the rising demand for artificial teeth. Additionally, an increasing number of product launches are expected to drive the segment’s growth in the future.

- For instance, according to the American College of Prosthodontists, around 120 million people in the U.S. have at least one missing tooth and these numbers are anticipated to rise in the next two decades. This factor is expected to increase the demand for artificial teeth and the adoption of dental handpieces in laboratories in the coming years.

The others segment comprises hospitals and research institutes, which are expected to witness considerable growth. The rising number of oral surgeries in these settings are predicted to drive the handpiece adoption for enhanced accuracy and efficiency.

REGIONAL INSIGHTS

In terms of region, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

North America Dental Handpiece Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

In 2024, North America held the largest share of the global market. The regional market value stood at USD 0.38 billion in 2024. The widespread adoption of handpieces and presence of technologically advanced products are the factors expected to drive the regional market growth. The continuously growing number of dental professionals and rising number of patient visits are also anticipated to support the market growth. Moreover, rising collaborations between key players is expected to drive the region’s market growth. The U.S. market is projected to reach USD 0.38 billion by 2026.

- For instance, in May 2021, KaVo Dental collaborated with A-dec Inc. to expand its distribution network in the global market. This can increase the product availability, and enhance its adoption in the future.

Europe

Europe also held a significant market share in 2024 and is expected to experience substantial growth over the forecast period. The increase in the number of dental caries and tooth filling treatments, along with a rise in the spending on oral care services, are factors contributing to the market growth in countries, such as the U.K., Germany, and other parts of Europe. Additionally, the rising number of product launches are expected to boost the growth of electric and other segments in the region. The UK market is projected to reach USD 0.04 billion by 2026, while the Germany market is projected to reach USD 0.06 billion by 2026.

Asia Pacific

Asia Pacific is forecasted to register the fastest growth rate from 2025 to 2032, driven by the high prevalence of dental diseases in the region. Additionally, the growing number of regional players and introduction of R&D initiatives to launch innovative and affordable products will propel the region’s growth. Moreover, the rising public awareness about oral health and increasing expenditure on dental procedures are expected to drive the regional market’s growth significantly. The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to grow considerably due to the high incidence of dental diseases, increasing healthcare investments, and steady introduction of technologically advanced products through strategic partnerships between reputed firms in these regions. Additionally, investments by key companies to develop their subsidiaries in South Africa and the Middle Eastern countries are some of the factors expected to fuel the market growth in the region.

- For instance, as per a WHO report in March 2023, around 44% of individuals in the African region were reported to suffer from oral diseases.

KEY INDUSTRY PLAYERS

KaVo Dental, Dentsply Sirona, and Bien-Air Dental SA Were Dominant Players in 2024 Owing to Their Wide Portfolio

KaVo Dental, Dentsply Sirona, and Bien-Air Dental SA were some of the key players in 2024. These companies’ strong and wide range of products, including air, electric, and high & low-speed devices, has been fueling their dominance in the market. Additionally, a rising focus on technologically advanced product launches is expected to drive the market in the coming years.

Companies, such as Nakanishi Inc. recorded significant revenue in 2024. The company is focusing on advanced product launches. Additionally, strategic acquisitions by these companies are strengthening their portfolios. TEALTH FOSHAN MEDICAL EQUIPMENT CO., LTD. and W&H recorded considerable revenue in 2024. These players’ initiatives, such as strategic collaborations and geographical expansion are expected to be the key factors driving their growth in the market.

LIST OF TOP DENTAL HANDPIECE COMPANIES

- KaVo Dental (Germany)

- Dentsply Sirona (U.S.)

- Nakanishi Inc. (Japan)

- TEALTH FOSHAN MEDICAL EQUIPMENT CO., LTD. (China)

- W&H (Austria)

- Brasseler USA (U.S.)

- Dentflex (Brazil)

- J. MORITA CORP. (Japan)

- Bien-Air Dental S.A. (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- January 2023: KaVo Dental collaborated with MELAG Medizintechnik GmbH & Co. KG to expand its sales network across Germany.

- December 2021: KaVo Dental was acquired by the Finnish dental company, PLANMECA OY. KaVo Dental has a strong network with more than 400 partners and presence in 26 locations across the world.

- December 2020: MICRO-NX launched the EXTREME 150K electric handpiece. It is a 150,000 RPM electric handpiece that uses high speed zirconia-based trimming motor.

- February 2020: B.A. International launched a range of slow-speed handpieces. These products are contra-angled for better cleaning.

- April 2019: Premier Dental launched AeroPro, a new cordless handpiece. It has light-weight, ergonomic, cordless, and pedal-less design.

REPORT COVERAGE

An Infographic Representation of Dental Handpiece Market

To get information on various segments, share your queries with us

The report provides an in-depth market analysis. It focuses on market segmentation, such as by type, product type, design, speed, end-user, and region. Besides, it offers the global market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market statistics. Additionally, it consists of details about the market share held by various segments and the factors driving the growth of the market. The report also provides the key players operating in the market & their SWOT analysis, and competitive landscape of the market at global level. Moreover, it provides key insights on technological advancements, prevalence of dental disorders, and key industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.78% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Product Type

|

|

|

By Design

|

|

|

By Speed

|

|

|

By End-user

|

|

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 1.01 billion in 2026 and is projected to reach USD 1.47 billion by 2034.

The market will exhibit a steady CAGR of 4.78% during the forecast period.

Currently, the air-driven segment is leading the market by product type.

High prevalence of malocclusion and significant rise in the adoption of lingual and ceramic braces are the key factors anticipated to drive the market.

KaVo Dental, Dentsply Sirona, and Bien-Air Dental SA are some of the key players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic