Dental Intraoral Cameras Market Size, Share & Industry Analysis, By Type (Wired, and Wireless), By Technology (Complementary Metal-Oxide-Semiconductor (CMOS), and Charge-Coupled Device (CCD)), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

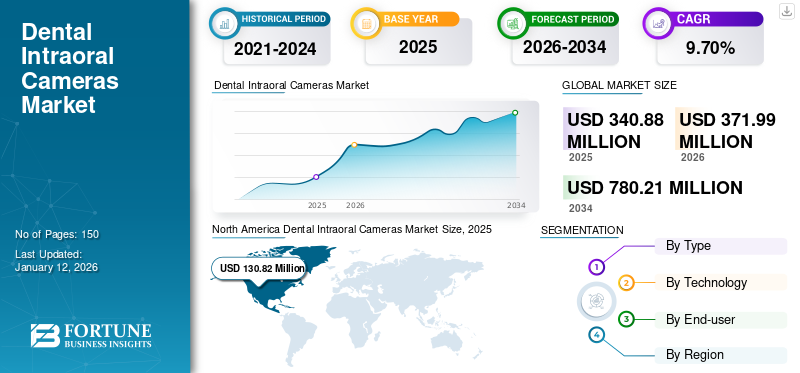

The global dental intraoral cameras market size was valued at USD 340.88 million in 2025. The market is projected to grow from USD 371.99 million in 2026 to USD 780.21 million by 2034, exhibiting a CAGR of 9.70% during the forecast period. North America dominated the dental intraoral cameras market with a market share of 38.40% in 2025.

Intraoral cameras are small, handheld devices that are used in dentistry to capture high-quality images of the inside of a patient's mouth. These cameras feature a lens and a light source that is designed to provide detailed views of the teeth, gums, and oral tissues. Intraoral cameras help dentists visualize dental conditions, such as cavities, cracks, and plaque buildup, allowing for more accurate diagnoses. They also facilitate patient education by displaying real-time images, enhancing the communication between dental professionals and their patients during the stages of treatment planning.

The growth of the global dental intraoral cameras market is attributed to their technological advancements, such as high-definition imaging and 3D capabilities, which enhances the diagnostic accuracy and treatment planning. Additionally, the rise of digital dentistry promotes the integration of intraoral cameras with CAD/CAM systems and Electronic Health Records (EHR), streamlining the workflows and improving efficiency. Moreover, the growing awareness of oral health and preventive care practices further boosts market growth, alongside supportive regulatory frameworks and investments in the healthcare infrastructure across the world.

In 2020 due to COVID-19 pandemic, the market saw a significant decline in the adoption of dental intraoral cameras due to dental practice closures. Many dental practices postponed their non-essential purchases, which affected the new camera sales. Additionally, the reduced number of patient visits and financial constraints among dental professionals have led to decreased investments in dental equipment, including intraoral cameras. In 2021 and 2022, the market started to rebound as dental services resumed and new safety protocols were put in place. Furthermore, the manufacturers are focusing on the innovation of these devices with improved disinfection capabilities and integrating advanced technologies to provide better consultations, reflecting evolving healthcare needs.

Global Dental Intraoral Cameras Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 340.88 million

- 2026 Market Size: USD 371.99 million

- 2034 Forecast Market Size: USD 780.21 million

- CAGR: 9.70% from 2026–2034

Market Share:

- Region: North America dominated the market with a 38.40% share in 2025. This leadership is driven by the significant shift toward minimally invasive procedures, the adoption of tele-dentistry, and supportive regulatory frameworks with favorable reimbursement policies.

- By Type: The wired segment held the largest market share in 2024. These cameras are favored for their reliable connectivity and stable data transmission, which ensure consistent, high-resolution imaging, along with benefits like enhanced lighting and ergonomic designs.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, demand is spurred by rising dental tourism, government initiatives to improve healthcare infrastructure, and a growing awareness of oral health.

- United States: Growth is fueled by the move toward tele-dentistry, regulatory support for advanced technologies, and favorable reimbursement policies that encourage dental practices to invest in intraoral imaging.

- China: The market is expanding as part of the high-growth Asia Pacific region, driven by rising oral health awareness, government efforts to enhance healthcare infrastructure, and an increasing number of patients seeking advanced dental treatments.

- Europe: The market is propelled by a large number of practicing dentists, increasing adoption of advanced dental technologies, and a strong emphasis on early diagnosis and preventive care to improve patient outcomes.

Dental Intraoral Cameras Market Trends

Increasing Introduction of Innovative Devices to Provide Better Prospects of Examination

These advanced devices have revolutionized the way dental professionals diagnose and treat oral health issues. Intraoral cameras offer high-resolution imaging capabilities that allow dentists to capture detailed images of teeth, gums, and other oral structures in real-time. This visual information enhances diagnostic accuracy by enabling dentists to detect dental problems such as cavities, cracks, and gum disease at early stages.

Manufacturers are introducing intraoral cameras with enhanced features, such as improved resolution, ergonomic designs for ease of use, and compatibility with digital dental systems. These innovations cater to dental professionals seeking to optimize their diagnostic capabilities and enhance patient care experiences.

- For instance, in July 2024, Dr. Petra Wilder-Smith collaborated with Rongguang Liang at the University of Arizona's Wyant College of Optical Sciences to develop a commercial intraoral camera that could screen for cancer.

The market trend toward the increasing adoption of intraoral cameras is driven by the technological advancements that have made these devices more compact, user-friendly, and integrated with digital dental systems. Dental practices are recognizing the value of intraoral cameras in improving overall efficiency, treatment outcomes, and patient care experiences. Hence, this is identified as a prominent dental intraoral camera market trend.

Download Free sample to learn more about this report.

Dental Intraoral Cameras Market Growth Factors

Transition Towards Digital Dentistry to Drive Market Growth

The adoption of digital dentistry is significantly driving the growth of the intraoral cameras market by revolutionizing how dental practices operate and deliver care. Digital dentistry encompasses a range of technologies, including intraoral cameras, digital scanners, CAD/CAM systems, and digital impressions, all aimed at improving efficiency, accuracy, and patient outcomes. These augmented capabilities of the intraoral cameras enhance diagnostic accuracy, allowing dentists to detect issues early and plan treatments more precisely. Digital workflows facilitated by the intraoral cameras enable seamless integration with CAD/CAM systems for designing and manufacturing dental restorations, such as crowns and bridges.

- For instance, Oasis Scientific Inc. offered an advanced product called the ViSee T11 Wi-Fi/USB wireless digital dental camera. It has high-definition 720P HD video quality and versatile connectivity options, including Wi-Fi for smartphone/iPad use and USB for PC/MacBook integration. Additionally, it offers a free Patient Management System (PMS) for Windows and supports various modes, such as snapshot, video recording, and zoom.

Moreover, intraoral cameras support patient engagement and education by enabling real-time visualization of dental conditions. Patients can see exactly what the dentist sees, which improves understanding and trust in the proposed treatments. This interactive approach enhances the overall patient experience and satisfaction. The shift towards digital dentistry also emphasizes efficiency and productivity in dental practices. Intraoral cameras reduce the time needed for traditional impression-taking and streamline communication between dental teams and laboratories.

Technological Advancements in Intraoral Cameras to Boost Market Growth

Technological advancements have significantly boosted the adoption of intraoral cameras in the dental market. These devices have evolved from basic imaging tools to sophisticated systems capable of High-Definition (HD) imaging, 3D scanning, and integration with digital dental workflows. The shift toward digital dentistry has propelled their popularity as more dentists seek more accurate diagnostic capabilities and enhanced patient communication. Thus, these technological advancements further contribute to the dental intraoral cameras market growth.

The introduction of wireless connectivity and cloud-based storage solutions has further streamlined workflow efficiencies in dental practices. Dentists can now capture, store, and share high-quality images instantly, improving treatment planning and patient education.

- For instance, according to an article published by Discovery Dental in July 2024, imaging technologies, such as intraoral cameras, can detect oral health issues earlier than the traditional methods, such as tooth decay, gum disease, and even oral cancer. The advanced treatment provided by these devices compared to traditional devices is expected to increase their demand in the market.

Moreover, the surge in their ergonomic designs and user-friendly interfaces has enhanced the operator’s comfort and usability, encouraging wider acceptance among dental professionals. As dental professionals increasingly prioritize these benefits, the demand for intraoral cameras continues to grow, supported by ongoing technological innovations and regulatory advancements ensuring their reliability and safety in clinical use. This is contributing to the growth of the market for intraoral cameras.

RESTRAINING FACTORS

Challenges in Adoption of Intraoral Cameras Hampers Market Growth

Training requirements and resistance to change are the significant challenges that limit the growth of the intraoral camera market within the dental industry. The need for training presents a barrier as dental professionals must learn how to effectively operate and integrate intraoral cameras into their practice routines.

Training involves familiarizing dentists and dental hygienists with new technology, understanding software interfaces, and optimizing workflow efficiencies. This process demands time and resources, which can deter adoption, particularly in smaller practices, where staffing and scheduling challenges may arise.

Furthermore, resistance to change among dental practitioners poses a considerable hurdle. Established dental practices often rely on traditional methods of diagnosis and treatment planning, such as visual examination and physical impressions. Some dentists might be hesitant to invest in new technology due to concerns about disruption to established workflows, uncertainties about return on investment, or perceived reliability issues compared to conventional methods. Such factors create a reluctance to embrace intraoral cameras despite their potential benefits in enhancing diagnostic accuracy, patient communication, and overall efficiency in dental care. Hence, these factors may restrict the global intraoral cameras market growth.

Dental Intraoral Cameras Market Segmentation Analysis

By Type Analysis

Wired to Hold Largest Share Owing to Its Diverse Benefits

Based on type, the market is segmented into wired and wireless.

In 2024, the wired segment held the largest share of the dental intraoral cameras market due to benefits associated with it, such as enhanced lighting and ergonomic designs, which appeals to dental professionals seeking reliable and efficient diagnostic tools. Furthermore, these cameras are favored for their reliable connectivity and stable data transmission, ensuring consistent high-resolution imaging in dental practices. Moreover, the rise in the intraoral cameras market for the wireless segment is due to the growing number of oral diseases, such as dental caries and tooth decay. Such growing prevalence is expected to increase the demand for wired cameras for better examination, thereby propelling the segment growth. The wired segment is projected to dominate the market with a share of 57.8% in 2026.

- For instance, according to a study published by NCBI in June 2021, the overall prevalence of dental caries in India was 54.16%. Such a large population suffering from oral disease, such as dental caries, is expected to increase the demand for cameras.

The wireless segment holds a significant share of the dental intraoral cameras market. These cameras offer enhanced mobility and flexibility in dental practices, allowing dentists to move freely during examinations and treatments. They utilize Bluetooth or Wi-Fi connectivity for seamless image transfer to digital devices, facilitating efficient workflow and patient engagement.

To know how our report can help streamline your business, Speak to Analyst

By Technology Analysis

Complementary Metal-Oxide-Semiconductor (CMOS) Held the Largest Share Owing to Its Superior Quality and Efficiency

Based on technology, the market is segmented into Complementary Metal-Oxide-Semiconductor (CMOS) and Charge-Coupled Device (CCD).

In 2024, the Complementary Metal-Oxide-Semiconductor (CMOS) segment held the largest share of the market due to benefits associated with it, such as higher image quality, compact size, and lower power consumption, which enhances its adoption among dental practitioners. Moreover, the growing number of oral diseases leads to a rise in the number of patient visits to clinics, driving the demand for advanced diagnostic tools, including intraoral cameras. The CMOS segment will account for 56.84% market share in 2026.

The Charge-Coupled Device (CCD) segment holds a significant share of the dental intraoral cameras market. These cameras have established their presence in the market and compatibility with the existing dental equipment, which further contributes to their adoption. Furthermore, the benefits, such as their cost effectiveness and the ability to capture detailed images in low-light conditions, are expected to increase its demand in the market, thereby propelling segmental growth.

By End-user Analysis

Solo Practices to Hold Major Share Due to Increasing Patient Visit in These Settings

As per end-user, the market is segmented into DSO/group practices, solo practices, and others.

In 2024, the solo practices segment accounted for the highest dental intraoral cameras market share. The growth is attributed to the large number of people visiting these practices for preventative dental treatment, stimulating these clinics to adopt cameras. Moreover, the trend toward digital dentistry and teledentistry has spurred solo practices to invest in intraoral cameras to streamline workflows and enhance efficiency in delivering dental care, thereby propelling segmental growth during the forecast period. The solo practices segment is expected to account for 53.1% of the market in 2026.

The DSO/group practices segment is projected to grow at the highest CAGR during the forecast period. These practices also benefit from economies of scale in purchasing and implementing advanced dental products, such as intraoral cameras, driving the market growth in this segment. Furthermore, various dental practices are focusing on introducing new and advanced dental groups to provide better and advanced treatment, which is expected to increase the adoption of intraoral cameras.

- For instance, in January 2024, Dental Associates of Connecticut introduced Archway Dental Partners, a multispecialty dental partnership organization. The launch of group practices is expected to increase the demand for these devices.

The others segment includes dental hospitals and academic research institutes. This segment is expected to grow at a moderate CAGR during the forecast period.

REGIONAL INSIGHTS

As per region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Dental Intraoral Cameras Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 130.82 million in 2025 and is expected to continue its dominance during the forecast timeframe. The share is due to the shift toward minimally invasive procedures and the adoption of tele-dentistry. Moreover, regulatory support and favorable reimbursement policies in the region have encouraged dental practices to invest in advanced intraoral imaging technologies, driving market growth in the region. The U.S. market is estimated to reach USD 132.86 billion by 2026.

Europe

Europe held the second-highest share in 2024. Increasing adoption of advanced dental technologies, rising awareness about oral health, and the emphasis on early diagnosis and preventive care are driving market expansion. Moreover, the presence of key market players and their focus on introducing novel and advanced products further stimulated market growth in the region. The UK market is expected to reach USD 17.48 billion by 2026, while the Germany market is anticipated to reach USD 33.22 billion by 2026.

- For instance, according to the European Union, in 2020, the number of practicing dentists was 71,108 and 42,844 in Germany and France, respectively. Such a large number of dentists is expected to increase the adoption of digital dentistry products, such as intraoral cameras.

Asia Pacific

The Asia Pacific market is expected to grow at the highest CAGR over the projected years. The growth is attributed to the growing prevalence of dental disorders, coupled with a rising awareness of oral health, which has boosted the adoption rates of the device. Furthermore, government initiatives to improve healthcare infrastructure and rising dental tourism in countries such as India and Thailand are propelling demand for laser technologies in the region. The Japan market is forecast to reach USD 19.73 billion by 2026, the China market is set to reach USD 23.01 billion by 2026, and the India market is likely to reach USD 9.01 billion by 2026.

- For instance, according to the Ministry of Health and Family Welfare, India, in 2021, 0.30 million patients visited the country for their treatment, and approximately 10.0% to 20.0% of these medical tourists arrived in India to seek dental treatments.

Rest of The World

The Middle East & Africa and Latin America markets are expected to grow at a significant CAGR during the forecast period. The growth is due to increasing healthcare expenditures and a growing focus on improving dental care infrastructure, which is driving demand for advanced dental technologies, including intraoral cameras.

KEY INDUSTRY PLAYERS

Companies with Advanced Product Portfolios to Hold Key Market Share

The competitive landscape of the market reflects a consolidated structure with the presence of a few market players with significant revenue share in the global market. Carestream Dental LLC, Aceton, and PLANMECA OY Inc held a significant market share in 2024. Carestream Dental LLC is in a prominent position due to its strong geographical presence, robust and diversified product portfolio, and large customer base across the globe. Furthermore, the focus on new product launches is expected to strengthen its position in the global market.

Other companies operating in this market include Owandy, OMNIVISION, and other small & medium-sized players. These companies are engaged in various strategic activities, such as consistently introducing advanced solutions, such as wireless cameras, that meet the evolving needs of practitioners, ensuring their increasing business revenue in the long run.

List of Top Dental Intraoral Cameras Companies:

- Carestream Dental LLC (Germany)

- VATECH (South Korea)

- PLANMECA OY (Finland)

- Acteon (U.K.)

- Owandy (U.S.)

- Mouthwatch, LLC (U.S.)

- Dentsply Sirona (U.S.)

- OMNIVISION (U.S.)

- Dental Imaging Technologies Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024 - OMNIVISION announced the new OCH2B30 camera module for three-dimensional intraoral dental scanners.

- February 2024 - MouthWatch, LLC, showcased its intraoral cameras and teledentistry software to dental professionals attending the Chicago Dental Society Midwinter Meeting.

- April 2023 - Acteon introduced its most advanced intraoral camera, the next-generation C50.

- October 2021 - MouthWatch, LLC, showcased the debut of its MouthWatch Plus+ HD intraoral camera at booth #B3309 during SmileCon 2021 in Las Vegas, U.S.

- August 2019 - Digital Doc launched the IRIS X80 camera with Liquid Lens autofocus.

REPORT COVERAGE

The research report extensively covers the competitive landscape, emphasizing key industry developments such as mergers, partnerships, and acquisitions. It also offers insights into the number of dentists in key countries and technological advancements within the market and analyzes various segments across different regions. Additionally, it profiles key companies that provide dental intraoral cameras and analysis of the COVID-19 pandemic on the market. The report includes qualitative and quantitative insights that foster market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.7% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Technology

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 340.88 million in 2025 and is projected to record a valuation of USD 780.21 million by 2034.

In 2025, the North American market stood at USD 130.82 million.

The market is expected to exhibit a CAGR of 9.7% during the forecast period.

Based on type, the wired segment leads the market.

The growing integration of digital dentistry among dentists, coupled with increasing patient visits to dental clinics for various dental treatments, are the key factors driving the market growth.

Carestream Dental LLC, Acteon, and PLANMECA OY are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us