Dental Intraoral Sensors Market Size, Share & Industry Analysis, By Type (Wired and Wireless), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

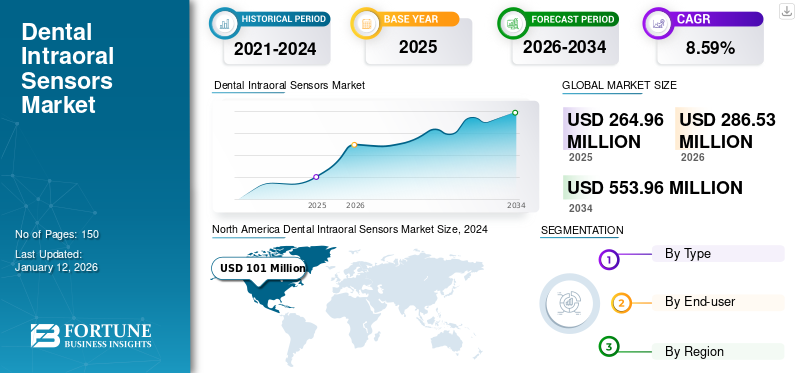

The global dental intraoral sensors market size was valued at USD 264.96 million in 2025. The market is projected to grow from USD 286.53 million in 2026 to USD 553.96 million by 2034, exhibiting a CAGR of 8.59% during the forecast period. North America dominated the dental intraoral sensors market with a market share of 40.92% in 2025.

Dental intraoral sensors are digital devices used in dentistry to capture X-ray images of teeth and gums. They are small, flat, and typically covered with a protective layer for patient comfort. These sensors replace the traditional photographic film, offering faster image processing and reduced radiation exposure. When placed inside the patient's mouth, they capture high-resolution images that can be instantly viewed on a computer screen. This technology aids dentists in the diagnosis and treatment of dental conditions more efficiently and accurately.

The global market growth is attributed to the advancements in digital imaging technology, which offers higher image quality and quicker image acquisition compared to traditional methods. Additionally, the shift toward digitalization in dental practices enhances the workflow efficiency and patient comfort. Rising awareness amongst dentists about the benefits of digital radiography, such as reduced radiation exposure and enhanced diagnostic capabilities, also contributes to the market expansion. Moreover, the increasing adoption of integrated electronic health records (EHR) systems further fuels the demand for intraoral sensors in dental care.

During the COVID-19 pandemic, in 2020, the market experienced a significant decline in the adoption and demand for dental intraoral sensors due to restrictions on non-essential dental procedures during the lockdowns. This led to a reduced demand for dental imaging equipment, including intraoral sensors, in the short term. However in post pandemic years, as the dental services gradually resumed, there was an increased focus on infection control and patient safety, accelerating the adoption of digital radiography solutions, such as intraoral sensors. This shift toward digitalization supported market recovery and long-term growth prospects for the intraoral sensors.

Global Dental Intraoral Sensors Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 264.96 million

- 2026 Market Size: USD 286.53 million

- 2034 Forecast Market Size: USD 553.96 million

- CAGR: 8.59% from 2026–2034

Market Share:

- North America dominated the dental intraoral sensors market with a 40.92% share in 2025, driven by the strong adoption of digital dentistry, increasing prevalence of oral diseases, and growing emphasis on aesthetic dental treatments.

- By type, Wired Intraoral Sensors held the largest share in 2024 due to their affordability, reliability, and seamless integration with existing dental systems, making them a preferred choice in dental practices.

Key Country Highlights:

- United States: The growing focus on aesthetic dentistry and the rising awareness about oral health check-ups are driving the adoption of digital intraoral sensors in dental practices.

- Europe: The increasing number of practicing dentists, combined with rising patient visits to dental clinics, is fostering demand for digital imaging solutions like intraoral sensors.

- China: The rapid adoption of advanced digital dentistry technologies, supported by government initiatives to modernize dental care, is propelling the market growth.

- Japan: The country's emphasis on integrating high-precision dental imaging technologies to enhance diagnostic accuracy is fueling the demand for intraoral sensors in dental clinics.

Dental Intraoral Sensors Market Trends

Integration of Photon Counting Device (PCD) Technology in Intraoral Sensors to Provide Broader Treatment Options

Photon Counting Device (PCD) technology enhances the capabilities of dental intraoral sensors by offering higher resolution and sensitivity in the X-ray imaging. Unlike traditional sensors that use analog technology, PCDs can detect the individual photons, providing superior image quality with reduced radiation exposure for patients. This advancement provides broader treatment options for dental professionals.

Furthermore, through enhanced image clarity and precision, dentists can more accurately diagnose and treat dental conditions such as cavities, periodontal disease, and root canal infections. The detailed images produced by PCD-enabled intraoral sensors enable better visualization of dental anatomy, including small structures and soft tissues, improving diagnostic accuracy and treatment planning.

- Moreover, companies, such as XpectVision Technology Co., Ltd. introduced a novel sensor with PCD technology in developed and especially developing countries, such as India. For instance, XpectVision Technology Co., Ltd.’s XpectVision intraoral sensor utilizes cutting-edge photon-counting technology to provide direct imaging in dentistry, minimizing light scattering for stable image acquisition. Its broad dynamic range eliminates the need for time-consuming exposure adjustments, ensuring efficient clinical image production.

Additionally, these sensors use silica-based chips instead of cesium iodide. This enhances image clarity and durability, setting a new standard in intraoral imaging technology. Hence, this is identified as a prominent global market trend.

Download Free sample to learn more about this report.

Dental Intraoral Sensors Market Growth Factors

Technological Advancements in Dental Sensors to Boost the Market Growth

Technological advancements in the dental intraoral sensors are poised to drive the market growth by enhancing the diagnostic capabilities, improving the workflow efficiency, and increasing the patient comfort and safety. The evolution from traditional film-based X-rays to digital intraoral sensors has revolutionized dental imaging, offering several key benefits.

Furthermore, the digital sensors provide higher image resolution and clarity, enabling dentists to detect dental conditions such as cavities, fractures, and gum disease with greater accuracy. This leads to more precise treatment planning and improved patient outcomes.

Moreover, advancements such as photon counting devices (PCD) enhance sensor sensitivity and reduce radiation exposure, addressing concerns over patient safety while complying with stringent regulatory standards. These technologies enable dentists to capture detailed images with minimal radiation doses, appealing to both practitioners and patients.

Market players involved in the development of photon counting devices (PCD) showcase their product at various events to increase awareness among dentists.

- For instance, in September 2023, XpectVision Technology Co., Ltd showcased its cutting-edge photon-counting technology at AEEDC 2023 Dubai.

Additionally, the integration of artificial intelligence (AI) and machine learning algorithms in intraoral sensors facilitates automated analysis and interpretation of images, further improving diagnostic accuracy and efficiency. Such technological advancements are driving the global dental intraoral sensors market forecast.

Increased Shift toward Digital Dentistry to Boost Market Growth

Digital dentistry, which embraces advanced technologies, such as intraoral sensors, revolutionizes the dental imaging by offering superior diagnostic capabilities, streamlined workflow efficiency, and enhanced patient comfort.

- For instance, the Indian Dental Association (IDA) has encouraged dentists to adopt advanced technologies in patient care to become familiar with the latest developments in AI and digital dentistry.

Digital intraoral sensors facilitate immediate image capture and display on computer screens, eliminating the need for traditional film processing and reducing patient waiting times. This efficiency enables dentists to promptly assess and diagnose dental conditions, leading to faster treatment planning and improved patient outcomes.

Wireless intraoral sensors, a key component of digital dentistry, further enhance flexibility and convenience in dental practices. They eliminate the constraints of wires, allowing for easier positioning and greater patient comfort during imaging procedures. This wireless technology also supports seamless integration with digital imaging systems, enhancing workflow efficiency and practice productivity. Moreover, digital sensors provide high-resolution images that surpasses the quality of traditional X-rays, enabling dentists to detect dental issues such as cavities, fractures, and periodontal disease with enhanced precision. This capability improves diagnostic accuracy and supports comprehensive treatment planning.

Overall, the shift toward digital dentistry driven by the benefits of intraoral sensors including wireless capabilities, advanced imaging quality, and improved workflow efficiency is expected to drive dental intraoral sensors market growth.

RESTRAINING FACTORS

Concerns Over Radiation Exposure of Intraoral Sensors Hampers Market Growth

Despite the technology advancements that have reduced radiation doses compared to traditional film-based X-rays, there remains a persistent concern among patients and healthcare providers regarding potential health risks from ionizing radiation. Dental intraoral sensors expose patients to a small amount of ionizing radiation, which potentially pose various health risks.

Regulatory bodies have imposed stringent guidelines to limit the radiation exposure in dental settings, requiring adherence to the safety protocols and regular monitoring. These regulations increase the compliance costs and administrative burden for dental practices, influencing their adoption decisions. Additionally, the patient awareness of radiation risks influences their treatment choices, with some opting for alternative diagnostic methods or delaying the necessary dental procedures.

- For instance, in October 2019, the U.S. FDA warned Denterprise over radiation exposure which might affect the patient’s health. The dental X-ray supplier had not reported on an allegation regarding the halt of its QuickRay HD dental X-ray sensor device without saving the data. This affected 12 patients, leading to 16 additional cases of radiation exposure.

Moreover, the patients, especially children, are often more sensitive to radiation exposure, leading to apprehension and reluctance to undergo frequent X-ray examinations. This reluctance can delay or reduce the frequency of diagnostic procedures, affecting the demand for intraoral sensors.

Dental Intraoral Sensors Market Segmentation Analysis

By Type Analysis

Wired Segment Held the Largest Share Owing to Their Diverse Benefits

Based on type, the market is segmented into wired and wireless.

In 2024, the wired segment held the largest share of the dental intraoral sensors market due to their established reliability and lower initial costs compared to wireless sensors. Additionally, the wired sensors often integrate seamlessly with existing dental imaging systems, minimizing the compatibility issues. Such a wide range of benefits has increased the focus of companies operating in the market on introducing the new devices into the market, propelling the segmental growth during the forecast period.

The wireless segment is projected to dominate the market with a share of 93.97% in 2026. This significant share can be attributed to the enhanced convenience and flexibility of these sensors. Wireless technology also enables a greater mobility within dental practices, facilitating the quicker patient turnaround times and improved workflow efficiency. Moreover, the advancements in the wireless transmission technology have enhanced the image quality and reliability, which is expected to increase its adoption in the market. Such above mentioned factors are anticipated to drive the segmental growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Held a Majority Share due to Increasing Patient Visit in these settings

In terms of end-user, the market is trifurcated into DSO/group practices, solo practices, and others.

In 2026, the solo practices segment is projected to lead the market with a 52.48% share. The growth is attributed to the cost-effectiveness of intraoral sensors over traditional X-ray methods, ease of use, and improved diagnostic capabilities. Solo practitioners benefit from enhanced patient care and efficiency, driving their preference for these technologies which is anticipated to boost the segment growth.

The DSO/group practices segment is projected to grow at the highest CAGR during the forecast period. The growth is due to economies of scale in equipment purchases, including intraoral sensors, which lowers the costs. Their centralized management facilitates streamlined the adoption of advanced technologies across multiple locations, thereby driving the segmental growth during the forecasted timeframe.

The others segment includes dental hospitals and academic research institutes. The segment is expected to grow at a moderate CAGR during the forecast period.

REGIONAL INSIGHTS

As per region, the market for dental oral sensors is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Intraoral Sensors Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 116.53 million in 2026 and is expected to continue its dominance during the forecast timeframe. The dominance is due to the well-established healthcare infrastructure and high adoption rates of advanced dental technologies. Moreover, the growing awareness of oral health has stimulated the population to visit for dental clinics for monthly/yearly checkup, which is expected to increase the adoption of these sensors in the dental facilities. Additionally, growing prevalence of oral disorders and strong emphasis on aesthetic dentistry drives the demand for precise and efficient imaging solutions, such as intraoral sensors in the region. The U.S. market is projected to reach USD 105.88 million by 2026.

- For instance, according to the CDC (Centers for Disease Control and Prevention), approximately half of adults aged 30 and older in the U.S. experience some level of gum disease, indicating a substantial patient population expected to drive increased demand for dental devices in the coming years.

The Europe market held the second-highest share in 2023. This can be attributed to several factors, such as the growing establishment of dental clinics and increasing visits of patients to these clinics, which are expected to surge the usage of sensors in the region. Moreover, the well-established network of dental professionals adopting innovative technologies, contributes to the substantial market growth and adoption of dental intraoral sensors across the region. The UK market is projected to reach USD 11.71 million by 2026, while the Germany market is projected to reach USD 23.81 million by 2026.

- For instance, according to the European Union, in 2020, the number of practicing dentists was 51,678, and 18,298 in Italy and Romania respectively. Such a large number of dentists is expected to increase the adoption of digital dentistry products, such as intraoral cameras.

The Asia Pacific market for dental intraoral sensors is expected to grow at the highest CAGR over the projected years. The growth is attributed to the large population base and increasing dental health awareness and expenditure. Additionally, technological advancements, rising disposable incomes, and growing dental tourism further contribute to the expanding adoption of intraoral sensors across the region. The Japan market is projected to reach USD 16.15 million by 2026, the China market is projected to reach USD 18.99 million by 2026, and the India market is projected to reach USD 6.59 million by 2026.

The Middle East & Africa and Latin America markets are expected to grow at a significant CAGR during the forecast period. The growth is due to supportive government initiatives, expanding dental care infrastructure, and a rising elderly population with dental care needs that contributes to the adoption and growth of intraoral sensors in these regions.

KEY INDUSTRY PLAYERS

Companies with Wired Intraoral Sensors in their Product Portfolios to Hold Key Market Share

The market is consolidated with the presence of market players with significant market share in the market. PLANMECA OY, VATECH, Dentsply Sirona, and Carestream Dental LLC held a significant market share in 2024. Carestream Dental LLC is one of the leading players in the market as it is continuously involved in research and development initiatives, improving the product offerings to maintain its position in the market. Furthermore, focus on the introduction of new sensors in various regions is expected to help strengthen its position in the global market.

Other companies operating in this market include XpectVision Technology Co., Ltd, Trident, Acteon, Freedom Technologies Group, LLC., and other small & medium-sized players. These companies have strong global distribution network. Furthermore, the companies are focusing on the integration of novel technology in dental intraoral sensors to increase their revenues.

List of Top Dental Intraoral Sensors Companies:

- Dentsply Sirona (U.S.)

- Carestream Dental LLC (Germany)

- XpectVision Technology Co.,Ltd (China)

- VATECH (South Korea)

- PLANMECA OY (Finland)

- Acteon (U.K.)

- Trident (Italy)

- NEWTOM (U.S.)

- Freedom Technologies Group, LLC. (U.S.)

- Midmark Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 - DEXIS announced the launch of DEXIS Titanium Sensor, with the new Ti2 intraoral sensor. The new product has new features including a more durable housing design and access to 2D artificial intelligence (AI) dental findings.

- December 2022 - XpectVision Technology Co., Ltd launched a novel Xpect vision intraoral sensor in India through a local distributor called Unicorn Denmart Ltd.

- September 2021 - Air Techniques, Inc., provided a first look at its new SensorX Intraoral Sensor at CDA Presents in San Francisco, U.S.

- August 2020 – Dentsply Sirona introduced intraoral sensors known as Schick AE. The product is equipped with an in-office exchangeable cable, reinforced cables, ultrasonically welded sensor housing, and protected cable plugs.

- November 2019 - VATECH announced the launch of EzSensor Wave in the region including North America and Europe. The sensor has imaging accuracy and usability.

REPORT COVERAGE

The market report provides a detailed competitive landscape. It focuses on key aspects such as key industry developments such as mergers, partnerships, and acquisitions, and market dynamics. Furthermore, the report also provides insights on the number of dentists in key countries, along with technological advancements in the market. Moreover, it provides analysis of different segments in various regions, profiles of key companies offering dental intraoral sensors, and the impact of COVID-19 on the market. The report also encompasses qualitative and quantitative market insights that contribute to the growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.59% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 286.53 million in 2026 and is projected to reach USD 553.96 million by 2034.

In 2025, the North America market stood at USD 108.43 million.

The market is expected to exhibit a CAGR of 8.59% during the forecast period.

By type, the wired segment led the market in 2025.

Growing integration of digital dentistry among dentist and increasing patient visit to dental clinics are the key factors driving the market growth.

Carestream Dental LLC, VATECH, and Dentsply Sirona are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us