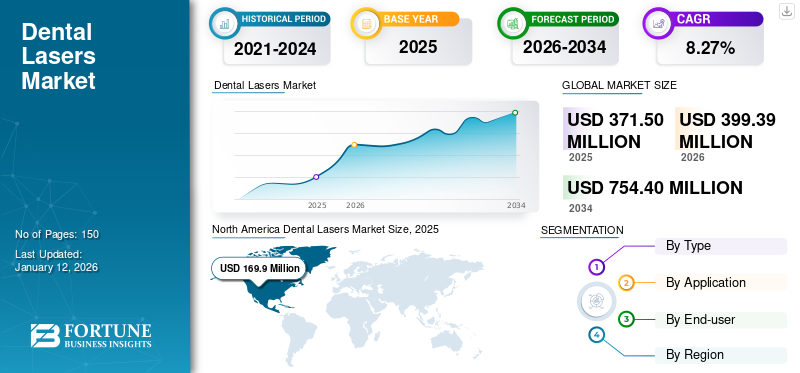

Dental Lasers Market Size, Share & Industry Analysis, By Type (Soft Tissue Lasers and All Tissue Lasers), By Application (Endodontics, Oral Surgery, Periodontics, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global dental lasers market size was valued at USD 371.5 million in 2025. The market is projected to grow from USD 399.39 million in 2026 to USD 754.4 million by 2034, exhibiting a CAGR of 8.27% during the forecast period. North america dominated the dental lasers market with a market share of 45.73% in 2025.

Dental lasers are innovative tools revolutionizing various dental procedures, such as oral surgery, periodontics, and endodontics. They emit concentrated light energy, which allows for precise treatment, such as cavity removals, gum reshaping, and whitening. Compared to the traditional methods, treatment through lasers often results in lesser pain, reduced bleeding, and faster healing times. In addition, they minimize the need for anesthesia and can sterilize the treatment areas, which lowers the risk of infection. These lasers encompass various types of products, including diode lasers for soft tissue procedures. Similarly, erbium lasers are used for both soft and hard tissue applications, and carbon dioxide lasers are primarily used for surgery.

The market’s growth is attributed to the various technological advancements that continually enhance laser capabilities, making procedures more efficient and precise. Growing patient demand for minimally invasive treatments fuels the adoption of these products, as lasers offer reduced pain, quicker recovery, and minimal tissue damage compared to traditional methods. In addition, increasing awareness amongst the various dental professionals about the benefits of lasers encourages their utilization in their practices. Furthermore, the increasing prevalence of dental conditions such as periodontal disease and dental caries necessitates effective treatment options, further propelling market growth.

In 2020 during the COVID-19 pandemic, the market experienced a significant decline in the adoption and demand for dental lasers due to temporary closures of dental practices and elective procedures being postponed. This decrease in the patient volume directly affected the demand for these laser procedures. Many practices focused solely on emergency care, delaying the non-urgent treatments that often utilize these lasers.

However, in 2021 and 2022, the market began to recover as dental services gradually resumed and the safety protocols were implemented. Furthermore, the increased awareness of oral health and a growing demand for minimally invasive treatments offered by these lasers is expected to contribute to the market's growth during the forecast period.

Dental Lasers Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 371.5 million

- 2026 Market Size: USD 399.39 million

- 2034 Forecast Market Size: USD 754.4 million

- CAGR: 8.27% from 2026–2034

Market Share:

- Region: North America dominated the global dental lasers market in 2025 with a market share of 45.73%, primarily due to the high prevalence of periodontal disease, increasing adoption of minimally invasive treatments, and strong technological advancements in dental procedures.

- By Type: The soft tissue lasers segment held the largest share in 2024 and is expected to continue its dominance in 2025, supported by its diverse benefits such as reduced bleeding, enhanced precision, faster healing, and a lower need for anesthesia.

Key Country Highlights:

- Japan: Demand for dental lasers in Japan is driven by the country’s aging population, rising awareness of oral health, and adoption of technologically advanced soft tissue procedures, especially in high-density urban clinics.

- United States: The U.S. dental lasers market is expanding due to the Infrastructure Investment and Jobs Act, increasing the focus on healthcare infrastructure. Furthermore, initiatives like partnerships between BIOLASE and dental education institutions are fueling long-term adoption by new dentists. Additionally, nearly 50% of adults aged 30+ suffer from gum disease, making the country a strong adopter of laser-based periodontic care.

- China: China’s market is expanding due to rising cases of dental caries and periodontal disorders, urbanization, and growing healthcare investments. Government-supported health initiatives and increasing dental clinic chains are driving widespread adoption of soft and all-tissue laser systems in clinical settings.

- Europe: Europe’s market growth is supported by investments in dental technology infrastructure, strong presence of leading players like Fotona and Dentsply Sirona, and a high prevalence of gingivitis, especially among children. The region is also benefitting from supportive reimbursement environments and stringent hygiene standards, making laser-based procedures more appealing.

Dental Lasers Market Trends

Technological Advancements in Dental Lasers to Provide Broader Treatment Options

The technological advancements in this market encompass the various aspects of laser technology, which include wavelength optimization, delivery systems, and software integration, to address the evolving needs of dental practitioners and patients across the world. Laser scanning software can be used to create detailed 3D models of the teeth and gums, which can then be used for treatment planning, device design, and simulation.

Laser systems that offer a broader range of wavelengths provide practitioners with greater flexibility and versatility in terms of treating a variety of dental conditions. For instance, lasers with wavelengths customized for soft tissue procedures enable precise and efficient treatment of gum disease, gingival recontouring, and oral surgery. In contrast, lasers optimized for hard tissue procedures facilitate precise cutting and ablation of tooth structure for cavity preparation and dental restoration.

Furthermore, advanced software and digital imaging technologies have been integrated into dental laser systems. Real-time feedback systems, guided by digital imaging and diagnostic tools, enable practitioners to target and monitor treatment areas precisely, ensuring optimal outcomes and patient safety. In addition, the integration of Artificial Intelligence (AI) and machine learning algorithms into dental laser systems holds immense potential for optimizing treatment planning, customization, and patient care.

- North America witnessed a growth from USD 149.0 Million in 2023 to USD 159.0 Million in 2024.

Download Free sample to learn more about this report.

Dental Lasers Market Growth Factors

Transition Toward Minimally Invasive Dental Procedures to Drive Market Growth

The shift in the preference toward minimally invasive or non-invasive procedures owing to factors such as shorter recovery times and minimal post-operative complications is propelling the dental lasers market growth.

Traditional dental procedures often involve invasive techniques, which can result in patient anxiety and discomfort. In contrast, dental lasers provide a minimally invasive alternative by precisely targeting specific tissues without the need for incisions or sutures. This enhances the patient's comfort and promotes faster recovery, enabling individuals to return to their daily activities swiftly. Such factors associated with these products are expected to boost their adoption across the regions.

Furthermore, the rising demand for aesthetic dental procedures has significantly contributed to the adoption of these lasers. Lasers offer unmatched versatility, enabling practitioners to perform a wide range of cosmetic treatments with exceptional precision and minimal discomfort.

- For instance, according to the study published by the National Center for Biotechnology Information (NCBI) in October 2022, the majority, which is 90.7% of the dental practitioners surveyed, believed that there is an increase in the demand for aesthetic dental procedures and social media is a major contributor to it.

Gum contouring and teeth whitening can be performed with these soft tissue dental lasers, and they deliver aesthetically pleasing solutions to patients. Such solutions provided by these products are expected to propel market growth during the forecast period.

Growing Cases of Peri-implantitis and Other Dental Disorders to Boost Market Growth

The rising incidence of dental disorders and infections associated with dental implants serves as a significant driver for the adoption of dental lasers. Dental disorders, including periodontal disease, dental caries, and peri-implantitis, pose significant challenges to the oral health of an individual and require effective treatment modalities.

- For instance, according to the study published by the NCBI in March 2022, 33.0% of patients develop an implant-associated infection after suffering an open fracture. Such large cases of implant-associated infection are expected to increase the demand for laser treatment in the future.

Traditional treatment methods for these conditions often involve the implementation of invasive procedures, which may result in post-operative complications and prolonged recovery times. Dental lasers offer a minimally invasive and highly precise alternative for the treatment of various dental disorders and infections, thereby driving the market growth.

For instance, in the cases of periodontal disease, laser-assisted periodontal therapy allows for the removal of diseased gum tissue and bacterial biofilms with minimal trauma to the surrounding tissues. This targeted approach reduces the risk of post-operative complications, such as bleeding and swelling, and promotes faster healing compared to traditional periodontal surgery.

Overall, the rising incidence of dental disorders and infections, coupled with the demand for these minimally invasive treatment options, are significant drivers for the adoption of these lasers in modern dental practice.

RESTRAINING FACTORS

High Cost of Dental Lasers Hampers the Market Growth Prospects

Dental lasers offer numerous benefits and innovative capabilities. However, the high costs and ongoing maintenance costs associated with these products are expected to hinder their adoption across various regions.

The cost of purchasing high-quality lasers can be prohibitively expensive, especially for small solo practices in developing countries. These expenditures can often limit the practitioners from integrating these lasers into their clinical workflows, leading to slower adoption rates and restricted market growth.

- For instance, the average retail price of a laser used in the dental industry is between USD 3,500.0 and 20,000.0. Such a high cost of the laser is expected to restrict the growth of the market.

Furthermore, the restricted reimbursement policies and coverage limitations by healthcare payers may pose challenges for practitioners seeking to recoup the costs associated with dental laser procedures. Moreover, limited or inadequate reimbursement rates for laser-based treatments can hinder the demand for these lasers, thereby limiting market growth. In conclusion, the high costs of these lasers represent a significant market restraint, inhibiting the widespread adoption and utilization within the dental industry.

Dental Lasers Market Segmentation Analysis

By Type Analysis

Soft Tissue Lasers Segment Held the Largest Share Owing to Diverse Benefits

Based on type, the market is segmented into soft tissue lasers and all tissue lasers.

In 2026, the soft tissue lasers segment held the largest share 85.73% of the market due to its versatility, precision, and minimal invasiveness in terms of periodontal and gingival procedures. They offer enhanced patient comfort, reduced bleeding, and faster healing times compared to the traditional methods. In addition, soft tissue lasers minimize the need for anesthesia and sterilize treatment areas, lowering the risk of infection. Such a wide range of benefits has increased the focus of market players in terms of the introduction of novel devices into the market.

For instance, in December 2023, Zolar Technologies and Oral Science launched the New Photon EXE Soft-Tissue Diode Laser. The product’s interactive control interface provides instant access to more than 30 preset laser treatment protocols.

All tissue lasers segment also held a significant share of the global market in 2024. This significant market share of the segment can be attributed to the growing use of these lasers in cavity preparation and dental ablation. In addition, it enables the conduction of conservative tooth preparations, leading to the preservation of a healthier tooth structure. Furthermore, the advancements in laser technology have improved their efficiency and reliability, making them increasingly popular among dental practitioners seeking efficient and patient-friendly alternatives for hard tissue treatments.

By Application Analysis

Periodontics Segment Held a Major Share Owing to the Rising Adoption of Minimally Invasive Endodontic Techniques

By application, the market is segmented into endodontics, oral surgery, periodontics, and others.

The periodontics segment accounted for the largest share 53.96% in 2026 and is expected to grow at a substantial CAGR during the forecast period. The segmental growth is attributed to the various endodontic applications associated with the product, such as enabling the practitioners to effectively disinfect root canals, remove infected tissue, and reshape root surfaces with minimal invasiveness. Furthermore, the increasing adoption of minimally invasive endodontic techniques and the growing demand for alternative treatments in contrast to conventional root canal therapy is anticipated to propel the segmental growth during the forecast period.

In 2024, the oral surgery segment accounted for the substantial global dental lasers market share and is projected to register a moderate CAGR during the forecast period. The segment’s growth is attributed to the versatility and efficacy of these lasers in various oral surgical procedures. These lasers offer unparalleled precision, which enables precise incisions, tissue ablation, and coagulation, which are essential for surgeries, such as gum contouring, biopsies, and frenectomy. Furthermore, the increasing rate of oral surgery as a treatment of dental disorders has increased the adoption of these lasers, which is expected to propel segment growth.

- For instance, according to the American Dental Association (ADA), the number of oral and maxillofacial surgeons was 158,240 in 2019, which increased to 159,265 in 2023. Such a high number of surgeons in the U.S., is expected to increase the number of oral surgeries conducted, thereby boosting the adoption of these lasers in their facilities.

In addition, advancements in laser technology, including improved wavelength options and delivery systems, have enhanced the capabilities and reliability of these lasers for surgical applications.

The others segment include pedodontics, orthodontics, and prosthodontics, which held a notable share in 2024.

- The endodontics segment is expected to hold a 11.4% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Registered a Major Share Due to Increasing Patient Visits in These Settings

In terms of end-user, the market is segmented into solo practices, DSO/group practices, and others.

In 2026, the solo practices segment held the largest market share 51.96% and is anticipated to grow at a substantial CAGR during 2025-2032. This growth is attributed to the large number of maxillofacial surgeons and periodontists working in these practices. Moreover, the growing number of periodontal and other oral diseases, coupled with the surge in patient visits to these practices for laser treatment, is expected to propel segmental growth during the forecast period.

- For instance, according to a data in 2019, 65.5% of adults aged 18–64 had a dental visit in the U.S., which reflects the potential of the U.S. market.

The DSO/group practices segment is projected to grow at the highest CAGR during the forecast period. The growth is attributed to the surging transition of dentists from solo to group practices due to the benefits offered by a group compared to solo practices. Hence, the growth of this segment is estimated to propel during the forecast timeframe.

The others segment include the dental hospitals and the academic research institutes. The segment is expected to grow at a moderate CAGR during the forecast period.

REGIONAL INSIGHTS

By region, the market is divided into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Lasers Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a revenue of USD 169.9 million in 2025 and is expected to continue its dominance during the forecast timeframe. The region’s growth is due to the increasing adoption of minimally invasive procedures and the technological advancements for the enhancement of precision and efficacy. Moreover, the growing prevalence of dental disorders and their advanced treatment options are further propelling the market’s growth in the region. The U.S. market is expected to reach USD 165.25 billion by 2026.

- For instance, according to the CDC, nearly half of adults in the U.S. who are 30 or older have some form of gum disease. Such a large population with gum diseases is expected to augment the demand for these laser products in the near future.

Europe

Europe held the second-highest market share in 2024. Increasing investments in healthcare infrastructure, particularly in advanced dental technologies, supports the market’s expansion. Moreover, the presence of key market players and robust research and development initiatives further stimulated the market growth. In addition, the increasing prevalence of periodontal diseases, such as gingivitis, is expected to increase the demand for these lasers for the treatment of these diseases. For instance, according to an article published by American Hospital of Paris in April 2021, 50% of children under 15 suffer from gingivitis in France. The U.K. market is projected to reach USD 12.71 billion by 2026, while the Germany market is anticipated to reach USD 25.75 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth is attributed to the growing prevalence of dental disorders, coupled with a rising awareness of oral health, which has boosted the adoption rates of these devices. Furthermore, the rapid urbanization and expanding disposable incomes of the middle-class populations in China and India have increased the accessibility to advanced dental care, propelling demand for laser technologies in the region. The Japan market is expected to reach USD 20.19 billion by 2026, the China market is projected to reach USD 23.7 billion by 2026, and the India market is anticipated to reach USD 8.21 billion by 2026.

The Middle East & Africa and Latin America markets are expected to grow at a significant CAGR during the forecast period. The growth is due to increasing healthcare investments, growing awareness of oral health, and favorable government regulations, boosting accessibility and adoption of advanced dental technologies. Furthermore, the growing cases of periodontal disease in these regions are expected to boost market growth.

List of Key Companies in Dental Lasers Market

Companies with Soft Tissue Lasers in their Product Portfolios to Hold Key Market Share

The market reflects a consolidated and competitive structure with the presence of a few market players holding substantial shares. BIOLASE, Inc. held a significant market share in 2024 owing to its strong geographical presence, robust and diversified product portfolio, and large customer base. Furthermore, the company’s intense focus on new product launches is expected to strengthen its presence in the global market. For instance, in January 2022, BIOLASE, Inc. and EdgeEndo announced the FDA 510(k) clearance of the EdgePRO system for endodontists seeking a more effective cleaning and disinfection alternative within root canal procedures.

Similarly, the focus of the company in spreading awareness of lasers in oral healthcare by providing free services to children is expected to increase its brand presence in the market.

Other companies operational in the dental lasers market include Fotona, Dentsply Sirona, J. MORITA CORP., and other small & medium-sized players. These players have advanced all tissue and soft tissue lasers in their product portfolio. These companies are consistently engaged in various strategic activities, such as the introduction of advanced solutions for practitioners and patients, ensuring their prominence in the industry.

LIST OF KEY COMPANIES PROFILED:

- BIOLASE, Inc. (U.S.)

- Fotona (U.S.)

- Dentsply Sirona (U.S.)

- DEKA Dental Lasers North America (U.S.)

- amdlasers (U.S.)

- J. MORITA CORP. (U.S.)

- Den-Mat Holdings, LLC (U.S.)

- THE YOSHIDA DENTAL MFG. CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- August 2023 - Shofu announced the introduction of the DentaLaze wireless diode laser. The device is indicated for soft tissue procedures, and this compact diode laser is said to be optimal for clinicians looking for a lightweight and effective tissue solution.

- August 2022 - Biolase, Inc. announced a strategic plan to partner with postgraduate dental specialty programs throughout the North America region in order to provide new dentists with the benefits of Waterlase technology.

- July 2022 - BIOLASE, Inc. partnered with TeamSmile. This partnership provided free dental care to children with the help of its Waterlase technology. BIOLASE also donated the iPlus Waterlase laser systems to provide free preventative dental care and oral education to the children.

- November 2020 – Fotona announced the purchase of the Fox III and Fox IV laser systems and the EmunDo Therapy system from A.R.C. This purchase includes all medical specialties, including dentistry.

- October 2020 - Summus Medical Laser announced the launch of the Horizon Dental Laser System, the first Class IV therapy laser system designed specifically for the dental industry. These lasers can modulate the inflammatory process, reduce pain, and accelerate tissue healing.

REPORT COVERAGE

An Infographic Representation of Dental Lasers Market

To get information on various segments, share your queries with us

The global dental lasers market research report provides a detailed competitive landscape and focuses on key aspects such as major industry developments, such as mergers, partnerships, and acquisitions. Furthermore, it provides strategic initiatives by the key companies, such as product launches, and technological advancements of the products. Moreover, it provides an analysis of the different segments in various regions, profiles of key companies, and the impact of COVID-19 on the market. The report also encompasses qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.27% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Type

By Application

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 371.5 million in 2025 and is projected to reach USD 754.4 million by 2034.

In 2025, North Americas market stood at USD 169.9 million.

The market is expected to exhibit a CAGR of 8.27% during the forecast period.

By type, the soft tissue lasers segment led the market in 2024.

The increasing demand for these lasers, coupled with the growing cases of periodontal diseases, are the key factors driving market growth.

BIOLASE, Inc. and Fotona are the top players in the market.

North America dominated the market in 2025 by holding the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic