Diatomite Market Size, Share & COVID-19 Analysis, By Type (Calcined, Flux-Calcined, and Natural), By Application (Filter Aids, Cementitious Materials, Fillers, Absorbents, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

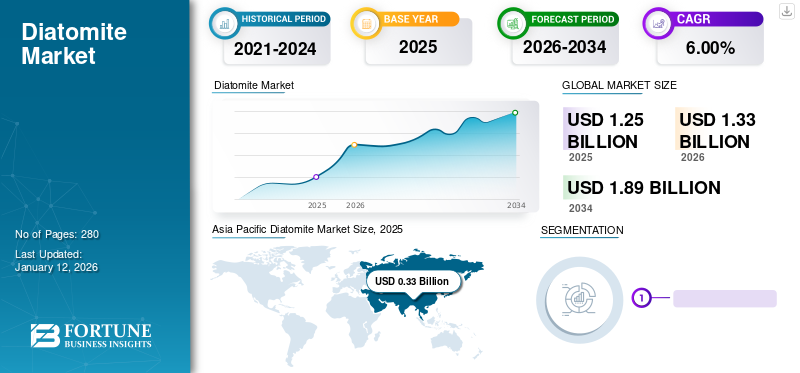

The global diatomite market size was valued at $1.25 billion in 2025 and is projected to grow from $1.33 billion in 2026 to $1.89 billion in 2034 at a CAGR of 6.00% during 2025-2032. Asia Pacific dominated the diatomite market with a market share of 24% in 2025.

The diatomite market has witnessed a steady growth in recent years, driven by the increasing demand from various end-use industries such as agriculture, paints and coatings, filtration, and construction. It is also known as diatomaceous earth, is a nature-forming sedimentary rock that is composed of the fossilized residue of diatoms.

It has a wide range of properties, such as high porosity, low density, and high surface area, which makes it an ideal material for various industrial applications such as filtration aid in beverages, food, and pharmaceuticals. The growth of the agriculture industry, particularly in developing countries, is expected to drive the demand for products, such as soil conditioners, in the coming years. Additionally, the increasing demand for water filtration systems and the rising construction activities are also expected to drive the global diatomite market growth.

GLOBAL DIATOMITE MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 1.25 billion

- 2026 Market Size: USD 1.33 billion

- 2034 Forecast Market Size: USD 1.89 billion

- CAGR: 6.0% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 24% share, rising from USD 0.31 billion in 2026 to USD 0.33 billion in 2034, driven by demand from agriculture, filtration, and construction.

- By type: Calcined diatomite dominated due to superior filtration, absorbent, and insulation properties.

- By application: Filter aids held the largest share, followed by cementitious materials (15.04% in 2024).

Key Country Highlights:

- United States: Largest North American market, with fillers segment at 13.8% share in 2024.

- China, Japan, India: Strong growth from food & beverage, healthcare, and agriculture industries.

- Germany, France, U.K.: Growth supported by EU investment in construction and filtration.

- Brazil, Mexico, Argentina: Demand from food, pharma, and agriculture sectors.

- Saudi Arabia: Infrastructure, absorbents, and oil & gas sector driving demand.

COVID-19 IMPACT

Static Supply Chain & Logistics Disruptions Impacted Market Growth during the COVID-19 Pandemic

The outbreak of COVID-19 had a significant impact on the industry. Its effects were felt globally, with supply chains experiencing significant disruptions and reduced demand for these products. As filtration and manufacturing activities are one of the primary activities that use diatomaceous earth and their slowdown reduced the demand for the product. Moreover, the closure of borders and ports disrupted the supply chains, leading to delays in the delivery of raw materials and finished products. Nonetheless, the industry is expected to recover as the world is slowly recovering from the pandemic and demand for diatomite-based products is expected to increase as construction and manufacturing activities pick up the pace.

LATEST TRENDS

Growing Awareness about the Benefits of the Product in Various Industrial Applications to Drive Market Growth

Diatomite has become increasingly popular in the water treatment industry in recent years due to its unique properties, which makes it an ideal filtration medium for water treatment processes. Due to its high surface area and unique pore structure, it can effectively remove impurities and contaminants from water, making it a valuable resource in the water treatment industry. With the growing demand for clean and safe drinking water, the demand for the product in the filtration industry is expected to continue to rise in the coming years.

- Asia Pacific witnessed a diatomite market growth from USD 0.27 billion in 2023 to USD 0.29 billion in 2024.

Diatomaceous Earth is a versatile and naturally occurring mineral used in various applications, such as filtration, agriculture, construction, and metal casting. Due to its high silica content, diatomaceous earth is used as a fluxing agent in the metal casting industry. It helps to reduce the melting point of metals and facilitates the flow of molten metal into molds. This, in turn, helps to produce high-quality castings with minimal defects and improved surface finish. The demand for metal casting products has been steadily increasing as more manufacturers seek to improve the quality of their castings.

Download Free sample to learn more about this report.

DRIVING FACTORS

Increasing Demand for Diatomite in Building & Construction Industry to Aid Market Growth

Diatomite is a sedimentary rock composed of the silica skeletons of diatoms and unicellular algae. Due to its unique properties, such as high porosity, low density, and high surface area, diatomaceous earth has several applications, including the construction industry. It is primarily used as an additive in cement and concrete. It can be used as a pozzolan, a finely ground material that reacts with calcium hydroxide to form cementitious compounds. This can enhance the strength and durability of concrete and reduce its carbon footprint by reducing the amount of cement required.

Diatomaceous earth can also produce lightweight concrete as a lightweight aggregate. This can be beneficial for reducing the weight of structures and improving their thermal insulation properties. Furthermore, it can be used as a natural filler to produce plaster, stucco, and other building materials. The product has great potential in the construction industry due to its unique properties and versatility.

RESTRAINING FACTORS

Availability of Alternative Materials for Various Applications May Hinder Market Growth

Although diatomaceous earth has many benefits, it may only sometimes be readily available or be cost-effective. Instead, some alternatives to diatomaceous earth can be used in specific applications. For example, perlite, vermiculite, and expanded clay are lightweight aggregates that can be used instead of diatomaceous earth for lightweight concrete. Fly ash and blast furnace slag can also be used as pozzolans in cement and concrete. Additionally, ground glass or ceramic waste can be used as a natural filler in some building materials. While these substitutes may not have all the same properties as diatomaceous earth, they still provide similar benefits in specific applications.

Several substitutes for a product can be used as filter aids. One such substitute is perlite, which is a volcanic rock that is lightweight and porous, making it an effective filter aid. Other substitutes include cellulose fibers, activated carbon, and bentonite clay. Each of these substitutes has unique properties and may be more suitable for specific applications. For instance, activated carbon is often used to remove impurities from water, while bentonite clay is commonly used to filtrate wine and beer. Thus, the emerging & evolving environment will bring hindrances for the product to sustain for a longer perspective in the global market.

SEGMENTATION

By Type Analysis

Calcined Segment Holds a Dominant Share Due to its Capabilities as a Superior Filtering Agent

Based on type, the market is categorized into calcined, flux-calcined, and natural.

The calcined segment is projected to dominate the market with a share of 57.14% in 2026. Calcined diatomite is a processed form of diatomaceous earth, a naturally occurring sedimentary rock composed of the fossilized remains of tiny aquatic organisms known as diatoms. The calcination process involves heating the product to high temperatures, which alters its physical and chemical properties. This results in a highly porous material, absorbent, and low density. The calcined grade is widely used in various industrial applications, including superior filtration agents, insulation, absorbents, and as a functional additive in paints, coatings, and plastics. Additionally, it is used in agriculture due to its unique properties and versatility.

Flux-calcined is a type of diatomaceous earth that has undergone a specific calcination process known as flux-calcination. This involves heating the material to high temperatures in the presence of a fluxing agent, typically soda ash or limestone.

The flux-calcination process alters the chemical composition of the diatomaceous earth, resulting in a material that has a higher concentration of amorphous silica and a lower concentration of crystalline silica compared to the natural grade. This makes it an excellent material for use in applications where high levels of amorphous silica are required, such as in producing silicon metal and other silicon-based products.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Filter Aids Segment Holds a Major Share Owing to the Growing Demand from Industrial Sector

By application, the market is segmented into filter aids, cementitious materials, fillers, absorbents, and others.

The filter aids segment is projected to dominate the market with a share of 57.14% in 2026. Diatomite is widely used as a filter aid due to its unique properties. As a filter aid, the product removes fine particles from liquids by creating a porous layer on top of a filter medium. This layer helps to trap particles and allows the liquid to pass through more easily. One of the main advantages of filter aid is its high porosity, which allows it to filter out even the smallest particles. Additionally, diatomaceous earth is chemically inert, as it does not react with other substances, making it an ideal material for filtration. Some typical applications for filter aids include food and beverage processing, pharmaceuticals, water treatment, and more.

It is also widely used as an absorbent due to its high porosity and ability to absorb liquids. As an absorbent, it is used to soak up spills, control odors, and maintain dry conditions in various settings, including industrial, agricultural, and household environments. One of the main advantages of diatomaceous earth as an absorbent is its ability to absorb up to 150% of its weight in liquid, making it highly effective at containing spills and preventing them from spreading.

Additionally, diatomaceous earth is non-toxic and environmentally friendly, making it a popular choice in areas where safety and sustainability is a concern. Some typical applications for diatomaceous earth absorbents include oil and gas drilling, pet litter, and spill cleanup products, which helps boost the market in the upcoming years. The cementitious materials segment is expected to hold a 15.04% share in 2024.

REGIONAL INSIGHTS

Asia Pacific Diatomite Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America will likely hold the largest diatomite market share considerably during the forecast period. The U.S. is a major contributor to the market in North America, accounting for a significant share of the region's overall market. The country's abundant resources of diatomaceous earth, coupled with the growing demand for the diatomite mineral in various applications, are expected to drive market growth in the region. Additionally, the increasing adoption of sustainable and eco-friendly products is expected to boost the demand for product in the region, as it is a natural and environmentally friendly mineral. The U.S. market is projected to reach USD 0.4 billion by 2026.

- In US, the fillers segment is estimated to hold a 13.8% market share in 2024.

Asia Pacific

The market in the Asia Pacific region is also expected to witness a significant growth in the coming years. The increasing demand for diatomaceous earth from various end-use industries, such as food and beverage, healthcare, and agriculture is driving the market growth in the region. China, Japan, and India are significant contributors to the market in the Asia Pacific region. The growing population and rapid industrialization in these countries are expected to boost the demand for the product in the region. The Japan market is projected to reach USD 0.05 billion by 2026, the China market is projected to reach USD 0.14 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe has witnessed significant industrial development in the last decade. The increasing investment of the European Union in construction, filtration, and agriculture industries is driving the demand for the mineral in the region. The market is expected to grow significantly in countries, such as Germany, France, and the U.K. The UK market is projected to reach USD 0.05 billion by 2026, while the Germany market is projected to reach USD 0.1 billion by 2026.

The demand is rising in Latin America, particularly in industries, such as food and beverage, pharmaceutical, and agricultural, which helps drive the market growth in the region. Countries such as Brazil, Mexico, and Argentina are major contributors to the diatomaceous earth market in Latin America.

The Middle East & Africa is expected to have a significant market growth driven by Saudi Arabia due to increased investment in infrastructure development and rapid growth in the absorbents industry. The growth of the oil and gas industry in the region is also expected to fuel the demand for a product in the coming years.

KEY INDUSTRY PLAYERS

Acquisition, Partnerships, and Capacity Expansion are the Key Strategic Initiatives Adopted by the Companies to Increase Market Presence

Major players operating in the market are Imerys, EP Minerals, Showa Chemical Industry Co., Ltd., Calgon Carbon Corporation, Dicalite Management Group, LLC, and others. Companies are involved in capacity expansion, new product launches, joint ventures, acquisitions, and partnerships to gain a competitive edge in the market.

Imerys has a strong presence in Europe and North America. The company is the region's biggest supplier of specialty solutions of industry-based mineral or advanced materials. Similarly, the other key market players have established a strong regional presence, robust distribution channels, and varied product offerings.

LIST OF KEY COMPANIES PROFILED:

- Imecarys (France)

- EP Minerals (U.S.)

- Showa Chemical Industry Co., Ltd. (Japan)

- Calgon Carbon Corporation (U.S.)

- Dicalite Management Group, LLC (U.S.)

- Diatomit CJSC (Armenia)

- JiLin Yuantong Mineral Co., Ltd. (China)

- Nova Industries Limited (Kenya)

- Reade International Corp. (U.S.)

- Seema Minerals & Metals (India)

KEY INDUSTRY DEVELOPMENTS:

- August 2023 – Dicalite Management Group has recently announced that there will be price increases across their diatomaceous earth line for all products produced in their Burney, CA, and Basalt, NV facilities. This increase will impact all scheduled shipments starting from August 1st, 2023. Despite the price increase, the demand for their DE products remains high, and they have been investing in mining and operations to meet that demand.

- May 2021 – ATPGroup and Imerys have joined forces to develop filtration solutions for various industries. The collaboration will leverage ATPGroup's expertise in filtration technology and Imerys' knowledge of mineral-based solutions to create innovative products from diatomite that meet customers' needs across various sectors. This partnership is expected to bring about significant advancements in filtration and offer new opportunities for both companies to expand their reach in the market.

- April 2019 – EP Minerals, LLC has recently announced an increase of 3%-6% in price for their diatomaceous earth powder, perlite, bleaching clay, adsorbent, and cellulose products. This act was made in response to the rising costs of raw materials and transportation and the increased demand for their products. The company believes these price adjustments are necessary to continue providing high-quality products and services to their customers. Despite the price increase, EP Minerals remains committed to maintaining its reputation as a leading provider of mineral-based solutions.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and applications. Also, the report offers insights into market trends and highlights vital industry developments. This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.00 % from 2026 to 2034 |

|

Unit |

Value (USD Billion); Volume (Million Ton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.25 billion in 2025 and is projected to reach USD 1.89 billion by 2034

In 2025, the market value stood at USD 1.25 billion.

Growing at a CAGR of 6.0%, the market will exhibit steady growth in the forecast period (2026-2034)

The filter aids segment leads under the application segment.

Rapid evolution with ongoing development in the filtration industry.

Imerys, EP Minerals, Showa Chemical Industry Co., Ltd., Calgon Carbon Corporation, and Dicalite Management Group, LLC are a few of the leading players in the global market.

North America dominated the global market in 2025.

The continuous growth in construction industry is expected to surge the product demand.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us