Dispersing Agents Market Size, Share & Industry Analysis, By Type (Waterborne, Solventborne, and Others), By Application (Paints & Coatings, Pulp & Paper, Building & Construction, Detergent, Adhesives & Sealants, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

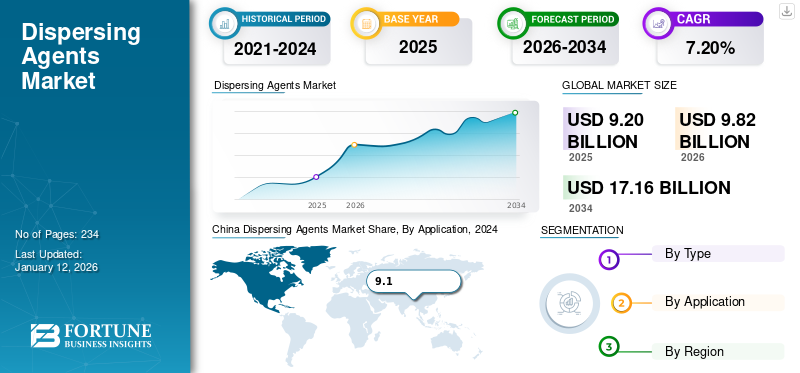

The global dispersing agents market size was valued at USD 9.2 billion in 2025. The market is projected to grow from USD 9.82 billion in 2026 to USD 17.16 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. Asia Pacific dominated the dispersing agents market with a market share of 30% in 2025.

Dispersing agents (dispersants) are the chemical compounds that facilitate separation or disperse suspension solutions and prevent settling or coagulation of the particles present in the solution. Additionally, they lower the viscosity of dispersions or paste and facilitate smooth flow and improved properties. The majority of the dispersants are based on polyacrylates, polyethers, and polysorbate. Different applications require different formulations, thus various chemicals are used in formulating dispersing agents. Dispersants for water-based systems and solvent-based systems are formulated differently for proper functioning and applications.

The dispersing agent market is driven by wide adoption in various end-use industries such as paints & coatings, construction, and pharmaceuticals. Dispersing agents are highly important in dispersion formulations, making their usage prevalent in various formulations. The market is driven by the high adoption of low-foam dispersants in the paints & coating industry to create stable formulations while making pigment concentrates. In oil spills, dispersants are used to disperse large oil molecules into small particles that help to protect marine habitats. These dispersants are sprayed using special boats and planes.

The COVID-19 pandemic had a mixed impact on the market. While there was a temporary slowdown in certain industries such as construction and automotive due to lockdowns and supply chain disruptions, there was increased demand in other industries such as healthcare and personal care for products containing dispersants such as pharmaceuticals and sanitizers. Overall, although the market saw fluctuations, it is expected to grow and gradually recover as economies stabilize and industries resume normal operations.

Global Dispersing Agents Market Overview

Market Size & Forecast

- 2025 Market Size: USD 9.2 billion

- 2026 Projected Market Size: USD 9.82 billion

- 2034 Forecast Market Size: USD 17.16 billion

- CAGR: 7.20% (2026–2034)

Market Share

- Asia Pacific: 30% (Largest share)

Regional Insights

- Asia Pacific: Leading region, fueled by industrialization in China, India, and SE Asia.

- North America: Stable growth from paints, construction, and pharma sectors.

- Europe: Strong shift to water-based, eco-friendly formulations.

- Latin America: Growth due to industrial and automotive expansion.

- Middle East & Africa: Driven by UAE, Saudi Arabia, South Africa industrial activity.

Dispersing Agents Market Trends

Increasing Emphasis on Sustainability is the Prominent Market Trend

With growing concerns about environmental impact and climate change, there is a significant shift toward sustainability across industries including chemicals. Manufacturers are exploring and investing in dispersing agents derived from renewable sources such as plant-based materials or waste streams from other industries. These bio-based dispersing agents offer an alternative to traditional petroleum-based products, reducing dependency on finite fossil resources and lowering carbon footprint.

Download Free sample to learn more about this report.

Dispersing Agents Market Growth Factors

Growing Industrialization to Spur Market Growth

As industrial activities expand globally, there is a continuous demand for dispersants across various sectors such as paints and coatings, construction, pharmaceuticals, agriculture, and textiles. These agents are essential for achieving the desired properties and performance in products and processes. Industrialization drives the requirement for high-performance products that meet stringent quality standards and consumer expectations. Dispersing agents play a crucial role in achieving desired properties such as color intensity, stability, rheological control, and compatibility in formulations. For example, in the automotive industry, dispersants are used in paint formulations to ensure uniform color distribution and durability.

Industrialization often entails mass production and streamlined manufacturing processes to meet the growing demand for goods. Dispersants facilitate efficient dispersion of raw materials and additives, leading to improved process efficiency, reduced production costs, and enhanced product consistency. Furthermore, industrial progress drives technological advancements and innovation in manufacturing processes and materials. Technological innovations contribute to the continuous evolution of the market, enabling industries to achieve greater efficiency and product differentiation. These factors are driving the global dispersing agents market size.

RESTRAINING FACTORS

Presence of Substitutes May Hamper Market Growth

In some applications, dispersants face competition from alternative technologies or additives that offer similar functionalities. For instance, advancements in formulation chemistry and processing techniques enable manufacturers to achieve dispersion without the need for traditional dispersants. Additionally, the development of novel additives or formulation strategies could lead to substitution, reducing demand for conventional products.

In the coatings industry, dispersants are traditionally used to ensure the uniform dispersion of pigments and fillers in paint formulations. However, advancements in nanoparticle technology have led to the development of self-dispersing nanoparticles, which can disperse evenly in a liquid medium without the need for external dispersants. The adoption of self-dispersing nanoparticles in coatings formulations represents a form of substitution for traditional dispersants. While dispersants remain essential in many applications, the availability of alternative technologies such as self-dispersing nanoparticles may reduce reliance on dispersants in specific formulations or industries, hindering dispersing agents market growth.

Dispersing Agents Market Segmentation Analysis

By Type Analysis

Waterborne Segment Accounted for the Largest Share Due to Growing Shift toward Sustainable Formulations

Based on type, the market is segmented into waterborne, solventborne, and others.

The waterborne segment held the largest dispersing agents market share of 65.27% in 2026. Waterborne dispersants are additives used to facilitate the dispersion of solid particles or liquid components in water-based systems. These agents help improve stability, homogeneity, and performance in various applications such as paints and coatings, adhesives, inks, ceramics, and agricultural formulations. Waterborne agents are favored over solvent-based alternatives due to environmental concerns and regulatory restrictions on volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). Regulatory initiatives promoting the use of water-based coatings and formulations drive demand for waterborne dispersants. Growing awareness of sustainability and eco-friendliness is driving the adoption of waterborne formulations across industries. Waterborne dispersants play a crucial role in enabling manufacturers to develop environmentally friendly products with reduced emissions and environmental impact.

Solventborne dispersants are additives designed to facilitate the dispersion of solid particles or pigments in solvent-based systems, such as paints, coatings, inks, adhesives, and sealants. The demand for solventborne dispersants is driven by factors such as growth in end-use industries such as construction, automotive, packaging, and printing, which rely heavily on solvent-based coatings and inks. Additionally, technological advancements in dispersant chemistry, increasing emphasis on product performance and aesthetics, and expanding applications in emerging economies contribute to market growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Building & Construction Segment Accounted for the Largest Share Due to Facilitation of Sustainable Practices

Based on application, the market is segmented into paints & coatings, pulp & paper, building & construction, detergent, adhesives & sealants, and others.

Building & construction held the largest market share of 26.78% in 2026. Dispersing agents are commonly used in concrete and cementitious materials to improve workability, reduce water content, enhance flowability, and control setting time. By evenly dispersing cement particles, these agents help achieve higher strength, durability, and consistency in concrete mixes. They also facilitate the incorporation of supplementary cementitious materials such as fly ash, slag, and silica fume, improving overall performance and sustainability. Dispersants play a vital role in enhancing the performance, durability, and sustainability of building and construction materials and products. Their ability to improve workability, dispersion, adhesion, and performance properties makes them indispensable additives in various construction applications, contributing to the quality and longevity of built environments.

Dispersants play a crucial role in pulp and paper applications, particularly in the production of paper, paperboard, and related products. Dispersing agents play a critical role in optimizing pulp and paper manufacturing processes, enhancing product quality, and meeting customer requirements for performance, efficiency, and sustainability in the paper industry. Their versatile applications contribute to the production of a wide range of paper and paperboard products used in packaging, printing, hygiene products, and other applications.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into Europe, North America, the Asia Pacific, Latin America, and the rest of the world.

Asia Pacific Dispersing Agents Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region accounted for the largest size of the global market USD 2.75 billion in 2025. This is due to undergoing rapid industrialization, with countries such as China, India, and Southeast Asian countries experiencing robust economic growth and infrastructure development. The region’s burgeoning population, rising urbanization, and increasing disposable incomes have led to growing demand for consumer goods, automobiles, housing, and infrastructure. This drives the demand for products that utilize dispersants, such as paints, adhesives, sealants, and agricultural chemicals. Moreover, many multinational companies and local players in the Asia Pacific region are investing heavily in research and development to innovate and improve the performance of dispersing agents. This focus on innovation drives the development of advanced dispersants tailored to meet the specific needs of regional industries. The Japan market is valued at USD 0.22 billion by 2026, the China market is valued at USD 1.84 billion by 2026, and the India market is valued at USD 0.52 billion by 2026.

The UK market is valued at USD 0.54 billion by 2026, while the Germany market is valued at USD 0.30 billion by 2026.

China Dispersing Agents Market Share, By Application, 2024

To get more information on the regional analysis of this market, Download Free sample

The market in North America has been experiencing steady growth over the years. North America is home to diverse industries such as paints and coatings, automotive, construction, pharmaceuticals, and agriculture, all of which are significant consumers of dispersants. The expansion of these industries, driven by factors such as urbanization, infrastructure development, and technological advancements, contributes to the product demand. The U.S. market is valued at USD 2.32 billion by 2026.

The shift toward water-based formulations in various industries, driven by environmental concerns and regulatory requirements, has boosted the demand for waterborne dispersants in Europe. Water-based formulations offer advantages such as lower VOC emissions, improved safety, and easier disposal, making them increasingly popular across different applications.

The market in Latin America is poised for growth due to factors such as industrialization, infrastructure development, automotive expansion, agricultural activities, investments, regulatory compliance, and market liberalization.

The Middle East & Africa region has been witnessing significant industrial expansion, particularly in countries such as the UAE, Saudi Arabia, and South Africa. Industrial growth in sectors such as paints and coatings, construction, automotive, textiles, and agriculture fuels the product demand used in various applications such as pigment dispersion, formulation stabilization, and agrochemical dispersion.

KEY INDUSTRY PLAYERS

Key Players are Adopting Strategies to Strengthen their Market Position

The global market share is fragmented, with key players operating in the industry as BASF SE, Arkema SA, Altana AG, Clariant AG, and Dow Inc. Most manufacturers are expanding their businesses to gain competency in the industry and alleviate new entrants’ threats. Market participants are fiercely competing with international and regional players with extensive distribution networks, regulatory know-how, and suppliers. In addition, companies sign contracts, acquisitions, and strategic partnerships with other market leaders to expand their existing markets.

List of Top Dispersing Agents Companies:

- BASF SE (Germany)

- Arkema SA (France)

- Altana AG (Germany)

- Clariant AG (Switzerland)

- Dow Inc. (U.S.)

- Lanxess AG (Germany)

- RUDOLF GmbH (Germany)

- Lubrizol (U.S.)

- Evonik Industries AG (Germany)

- Croda International (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: BASF SE introduced a new production plant in Dilovasi, Turkey for the production of water-soluble dispersants based on acrylic acid. This investment aimed to support BASF’s customers in the detergent, cleaning and chemical processing industry across Europe, the Middle East and Africa.

- July 2022: Evonik launched its new sustainable dispersing additive, TEGO Dispers 658. The TEGO dispersing agent is readily biodegradable, improving the sustainability of pigment and coloured coatings production, while offering formulators a similar high-performance profile to other comparable Evonik products.

- May 2021: Clariant introduced Hostatint, the newest addition to its dispersant product portfolio. Hostatint is an aqueous pigment dispersant designed to grow the color palette for architectural paints used both outdoors and indoor buildings. With the launch, manufacturers in the Americas would gain access to a wider range of colors, allowing them to offer consumers more wide-ranging options.

REPORT COVERAGE

The research report provides both qualitative & quantitative insights on dispersing agents across the world. Quantitative insights include market sizing in terms of value (USD Billion) & volume (Kilotons) across each segment, sub-segment, and region profiled in the scope of the study. Additionally, it provides market analysis and growth rates of segments, sub-segments, and key counties across each region. Qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.20% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 9.82 billion in 2026 and is projected to reach USD 17.16 billion by 2034.

Growing at a CAGR of 7.20%, the market will exhibit steady growth in the forecast period.

The building & construction segment led the market.

The rising demand for better-quality dispersing agents is a key factor driving market growth.

Asia Pacific captured the largest market share in 2025.

In 2026, the Asia Pacific market size stood at USD 2.95 billion.

BASF SE, Arkema SA, Altana AG, Clariant AG, and Dow Inc. are a few of the leading players in the market.

The rising adoption of dispersing agents due to their superior properties is expected to drive their adoption and create new market opportunities.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us