Drone ISR Payload Sensors Market Size, Share & Industry Analysis, By Sensor Type (Electro-Optical/Infrared Sensors, Radar Sensors, Signals Intelligence Sensors, Acoustic Sensors, CBRNe Sensors), By Component (Camera & Optics, Radars, Communications Equipment, Processing Units, Power Systems), By Drone Type (Fixed & Rotary-Wing, and Hybrid), By Range (Short, Medium & Long)), By Application (Military ISR Missions, Border & Maritime Security, Law Enforcement & Public Safety Operations), By End-User (Defense, Government & Homeland Security, Commercial Enterprises), & Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

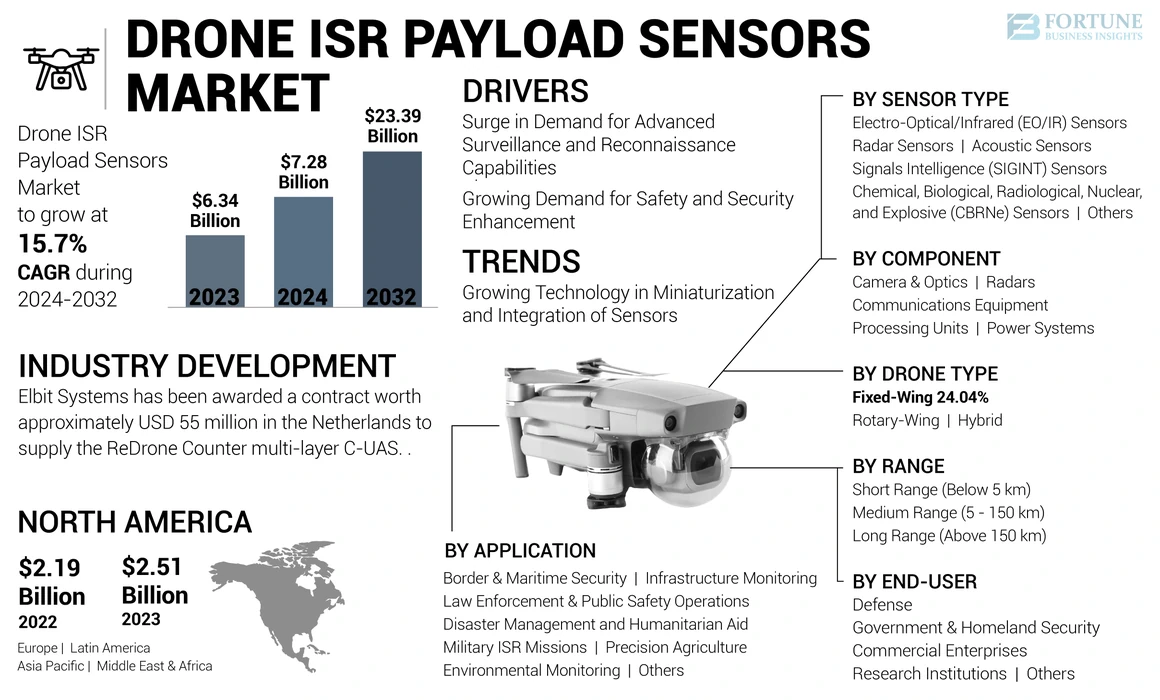

The global drone ISR payload sensors market size was valued at USD 6.34 billion in 2023. The market is projected to grow from USD 7.28 billion in 2024 to USD 23.39 billion by 2032, exhibiting a CAGR of 15.7%. North America dominated the drone ISR payload sensors market with a market share of 39.59% in 2023.

The increasing use of unmanned systems in commercial applications will contribute to the growth of the drone ISR payload sensors market during the forecast period. Drone technology continues to expand its scope in different countries by increasing the range of commercial applications for drones, such as aerial photography, transportation, transportation and delivery, precision agriculture, and surveillance. Hands-free systems are widely used in industrial and civil applications due to their good imaging and safety monitoring capabilities.

These applications are possible because better-quality sensors provide the system with accurate information for successful long-distance flights. Hands-free systems rely entirely on system sensors for accurate decision-making and successful flows. Most of the sensors in the system include inertial sensors, image sensors, speed and distance sensors, position sensors, pressure sensors, and other supporting sensors for accurate determination. The increasing demand for wireless systems is expected to contribute to the growth of the global market in the coming years.

The COVID-19 pandemic affected the drone ISR (Intelligence, Surveillance, and Reconnaissance) payload sensors market by disrupting supply chains and delaying product development due to restrictions and reduced workforce availability. This resulted in a slowdown in demand as many defense and commercial projects were postponed or canceled during the height of the pandemic. However, the market recovered due to increased defense budgets and a growing need for surveillance capabilities.

GLOBAL DRONE ISR PAYLOAD SENSORS MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 6.34 billion

- 2024 Market Size: USD 7.28 billion

- 2032 Forecast Market Size: USD 23.39 billion

- CAGR: 15.7% from 2024–2032

Market Share

- North America dominated the drone ISR payload sensors market with a 37.3% share in 2023, driven by extensive military drone deployment, R&D funding, and the presence of key players.

- By type, the electro-optical/infrared (EO/IR) sensors segment held the largest market share in 2023 due to its high usage in surveillance, target acquisition, and intelligence gathering.

Key Country Highlights

- United States: Major investments in tactical and strategic drone ISR systems amid rising global security concerns.

- China: Expansion of UAV ISR capabilities driven by regional power projection goals and indigenous sensor development.

- Russia: Despite sanctions, ISR drone deployment has increased in conflict zones, particularly in Ukraine.

- India: Growing border surveillance needs and indigenous UAV programs drive demand for EO/IR and radar payloads.

- Israel: Leading exporter of advanced drone ISR technologies with continuous innovation in miniaturized sensors.

- Ukraine: Significant increase in adoption of commercial and military-grade ISR drones due to ongoing conflict.

Drone ISR Payload Sensors Market Trends

Growing Technology in Miniaturization and Integration of Sensors is Propelling Market Growth

The main technological advancements driving the market are:

Miniaturization and integration of sensors: Rapid advancements in micro-miniaturization, Micro Electro Mechanical devices (MEMS), and integrated computer application chips (ASIC) are enabling the development of smaller, lighter, and more functional sensors for drone ISR payloads. This allows for the integration of multiple sensors to enhance data collection and fusion capabilities.

Advancements in camera and optics technology: High-resolution electro-optic cameras, both in the visual spectrum and infrared, are driving the adoption of drone ISR payloads for applications such as surveillance, reconnaissance, inspection, mapping, and monitoring across various industries.

These technological advancements are collectively driving the growth and development of the drone ISR payload market, enabling the deployment of more advanced and capable systems for both military and commercial applications.

Download Free sample to learn more about this report.

Drone ISR Payload Sensors Market Growth Factors

Surge in Demand for Advanced Surveillance and Reconnaissance Capabilities across Military, Commercial, and Civil Government Applications Will Catalyze Market Growth

The global demand for advanced surveillance and reconnaissance capabilities is significantly influencing the growth of the Drone ISR (Intelligence, Surveillance, and Reconnaissance) payload sensors market. This surge is driven by military, commercial, and civil government applications, reflecting a broader trend toward enhanced situational awareness and intelligence gathering.

Technological Advancements: Innovations in drone technology, including improved image capture and communication systems, are facilitating the deployment of ISR capabilities. The use of Unmanned Aerial Vehicles (UAVs) is particularly advantageous due to their cost-effectiveness and operational flexibility compared to manned aircraft. This trend is noted across various regions, including Latin America, where the demand for ISR solutions is increasing due to security concerns and defense budget growth.

Commercial and Civil Applications: Beyond military uses, there is a growing interest in ISR capabilities within commercial and civil government sectors. This includes applications in environmental monitoring, disaster response, and infrastructure inspection, which further expands the market potential for drone ISR payload sensors.

Geopolitical Factors: Heightened global tensions and conflicts are increasing the urgency for effective surveillance and reconnaissance capabilities. The demand for ISR products is expected to rise dramatically in conflict scenarios as military forces seek to reduce uncertainty and enhance operational effectiveness.

The surge in demand for advanced surveillance and reconnaissance capabilities across military, commercial, and civil government applications is catalyzing the growth of the global drone ISR payload sensors market share. This trend is supported by increased military investments, technological advancements, and geopolitical factors, indicating a robust future for ISR solutions.

Growing Demand for Safety and Security Enhancement is Anticipated to Propel Drone ISR Payload Sensors Market Growth

Next-generation rotorcraft are often equipped with state-of-the-art communication systems, advanced sensors, and improved maneuverability, enhancing their capabilities for intelligence gathering and mission execution. Additionally, the increasing concerns on border security, counter-terrorism efforts, and disaster response have contributed to the growing demand for rotorcraft within defense forces.

Moreover, governments and defense agencies globally are investing substantially in the procurement and modernization of their rotorcraft fleets to maintain a competitive edge and meet the evolving demands of contemporary military operations.

- For instance, in December 2023, Airbus announced that it had signed a contract with the German Bundeswehr for a deal of approximately USD 2.3 million. The procurement agreement encompasses a maximum of 82 multi-role H145M rotary-wing Drone, consisting of 62 confirmed orders and an additional 20 optional units. This stands as the most extensive order ever made for the H145M, and as a result, it represents the largest acquisition for the HForce weapon management system.

The contractual terms also encompass seven years of comprehensive support and services, guaranteeing an optimal commencement of operational service. Specifically, the German Army is set to receive fifty-seven Drone, while the Luftwaffe's Special Forces will be allocated five units.

- For Instance, in February 2024, Air Center, Inc (ACHI) signed an Airbus HCare In-Service contract to support their fleet of 18 H225 Drone for the next five years. ACHI uses the versatile H225 Drone ISR Payload Sensors to carry out a wide range of missions across the globe, including expeditionary airlift, personnel recovery, search and rescue, medevac/casevac, Department of Defense real-world scenario training, ship-based services, and disaster relief.

RESTRAINING FACTORS

UAS Conducting ISR Missions in GPS and Communications-Denied Environments Hamper Market Growth

Unmanned Aircraft Systems (UAS) conducting ISR missions have difficulty operating in environments blocked by Global Positioning System (GPS) and communications, such as inside a building, in urban canyons, underground, or under forest canopies. GPS and communications can also be jammed due to weather conditions, enemy jamming, or deception tactics. In such situations, the UAS must use other sensors for navigation, such as machine vision systems, which, in turn, can lead to uncertainty about its exact location. As a result, the U.S. military is undertaking a number of initiatives to advance the detection of conventional controllers in UAS.

DARPA is researching high-resolution GPS-independent positioning, navigation, and precision timing systems that allow operations to continue in the event of GPS failures. One recognized industry standard for precision time is the IEEE (Institute of Electrical and Electronics Engineers) 1588 Precision Time Protocol (PTP), which helps synchronize clocks over a computer network. It is intended for systems that require greater accuracy than can be achieved with NTP (Network Time Protocol) and for situations where GPS signals are not available. Therefore, IEEE 1588/PTP is a growing requirement for unmanned vehicle navigation in areas where GPS satellite signals are jammed or otherwise blocked.

Because of DARPA's FLA program, a team at the Charles Stark Draper Laboratory and the Massachusetts Institute of Technology developed vision-enhanced navigation techniques for UAS that do not rely on GPS, maps, or motion capture systems. The team developed and implemented unique sensor and algorithm configurations and conducted time trials and performance evaluations in indoor and outdoor environments. The result is a UAS system that can fly autonomously in mixed indoor and outdoor environments without GPS or any form of communication at speeds up to 45 miles per hour.

Drone ISR Payload Sensors Market Segmentation Analysis

By Sensor Type Analysis

Electro-Optical/Infrared (EO/IR) Sensors Segment to Depict Fast Growth Due to their Ability to Offer High-Resolution Imagery for ISR Missions

The market by sensor type is sub-segmented into Electro-Optical/Infrared (EO/IR) Sensors, Radar Sensors, Signals Intelligence (SIGINT) sensors, acoustic sensors, Chemical, Biological, Radiological, Nuclear, and Explosive (CBRNe) sensors, and others. Electro-Optical/Infrared (EO/IR) sensors is anticipated to be the fastest-growing segment during the forecast period of 2024-2032. The demand for Electro-Optical/Infrared (EO/IR) sensors in drone ISR payloads is increasing due to their ability to provide high-resolution imagery for Intelligence, Surveillance, and Reconnaissance (ISR) missions. EO/IR sensors are essential for tactical UAVs to enhance situational awareness and support decision-making at the battalion and brigade levels.

The others segment currently accounts for a large market share. The demand for others (inertial sensors, image sensors, speed & distance sensors, position sensors, pressure sensors, ultrasonic sensors, altimeter sensors, current sensors, and light sensors) segment in drone payload sensors, particularly in the context of Intelligence, Surveillance, and Reconnaissance (ISR) operations, is driven by advancements in technology and the evolving requirements of military and civilian applications.

By Component Analysis

Power Systems Hold Leading Position Due to their Growing Applications and Capabilities

The market by component is classified into camera & optics, radars, communications equipment, processing units, and power systems. Power systems hold the largest share of the market. The growing capabilities and applications of drone ISR payloads, especially advanced sensors, such as EO/IR cameras, are fueling demand for innovative power systems that can support extended flight times and heavy payloads. Lightweight, high-energy density power sources are a key enabling technology for the drone ISR payload market.

Camera & optics is anticipated to be the fastest-growing segment during the forecast period of 2024-2032. The demand for cameras and optics in the drone ISR payload sensors market is robust, fueled by technological innovations and expanding applications in both military and civilian sectors. As the market continues to evolve, the integration of advanced imaging technologies will play a pivotal role in enhancing the capabilities of drone systems.

By Drone Type Analysis

Mounting Demand for Rotary-Wing Drones Due to Their Versatility Makes Them Market Leader

The drone type segment is categorized into fixed-wing, rotary-wing, and hybrid. The rotary-wing segment is projected to be the leading segment in the market. The rotary-wing segment of the drone ISR payload sensors market is poised for significant growth, fueled by technological advancements and increasing military applications. The versatility and operational capabilities of rotary-wing drones make them essential tools for modern surveillance and reconnaissance missions. As the market evolves, continued innovation and strategic partnerships will likely shape the future landscape of rotary-wing drone applications.

Hybrid segment is expected to register fastest-growth during the forecast period of 2024-2032. Hybrid drones are poised for robust growth driven by rising demand for advanced ISR payloads and sensors across military, commercial, and consumer applications globally. Technological advancements and supportive regulations are further catalyzing this trend.

To know how our report can help streamline your business, Speak to Analyst

By Range Type Analysis

Efficient Surveillance Capabilities in Various Sectors Drive Short Range Drone Sensors to Apex Position

The market by range type is differentiated into short range (below 5 km), medium range (5 - 150 km), and long range (above 150 km). The short range (below 5 km) segment holds the highest share of the market. The demand for Drone ISR (Intelligence, Surveillance, and Reconnaissance) payload sensors with short range, particularly for operations below 5 km, is experiencing significant growth. This is driven by advancements in technology and the increasing need for efficient surveillance capabilities in various sectors, including military and civilian applications.

The medium range (5 - 150 km) is projected to witness the fastest-growth during the forecast period. The medium-range drone ISR payload sensors market is poised for significant growth, driven by military modernization efforts, technological advancements, and increasing global security demands. As countries invest in sophisticated drone capabilities, the role of medium-range UAVs equipped with advanced ISR sensors will become increasingly vital in both military and civilian applications.

By Application Analysis

Need for Enhanced Situational Awareness in Military Operations to Steer Military ISR Missions’ Dominance

The market by application is divided into military ISR missions, border & maritime security, law enforcement & public safety operations, infrastructure monitoring, environmental monitoring, precision agriculture, disaster management and humanitarian aid, and others. The military ISR missions segment leads and is analyzed to register fastest-growth. The demand for military Intelligence, Surveillance, and Reconnaissance (ISR) missions is significantly driving the drone ISR payload sensors market growth. This sector is poised for substantial expansion due to the increasing emphasis on advanced ISR capabilities by military forces worldwide.

The demand for drone ISR (Intelligence, Surveillance, and Reconnaissance) payload sensors in the context of disaster management and humanitarian aid is driven by the need for rapid response and effective situational awareness during emergencies. Drones equipped with advanced sensors play a crucial role in enhancing disaster response capabilities, allowing for quicker assessments and more efficient resource allocation.

By End-User Analysis

Need for Enhanced Situational Awareness in Military Operations is Leading Market Growth of Military ISR Missions Segment

The market by end-user is segregated into defense, government & homeland security, commercial enterprises, research institutions, and others. Defense is the leading segment in the market. The demand for drone ISR payload sensors is set to rise substantially, fueled by technological innovations and increased military investments. As the landscape of warfare continues to evolve, the role of drones in providing critical intelligence and surveillance capabilities will become increasingly vital.

Commercial enterprises are estimated to exhibit fastest-growth during the analysis period. The demand for drone ISR payload sensors is set to rise significantly, fueled by technological advancements and expanding applications across commercial sectors. The market dynamics indicate a promising future for drone technology, particularly as regulatory barriers continue to ease and industries increasingly adopt UAVs for diverse operational needs.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Drone ISR Payload Sensors Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American drone ISR (Intelligence, Surveillance, and Reconnaissance) payload sensors market is projected to grow significantly in the coming years. The regional market’s growth is driven by increasing defense investments in U.S. for unmanned technologies, the development of advanced drone payloads, and surging demand for improved surveillance capabilities.

Europe’s drone ISR payload sensors market is poised for strong growth over the next decade, fueled by the increasing adoption of drones for military and commercial applications that require advanced sensor payloads for intelligence gathering, surveillance, and reconnaissance.

The Asia Pacific Drone ISR (Intelligence, Surveillance, and Reconnaissance) payload sensors market is poised for significant growth. Factors, including increased defense investments, advancements in drone technology, and a rising demand for improved surveillance capabilities are responsible for the region’s market growth.

- Defense Investments: There is a marked increase in defense spending on unmanned technologies, which is critical for ISR operations.

- Technological Advancements: Innovations in artificial intelligence and autonomous systems are enhancing the functionality of drones, making them more effective for surveillance and reconnaissance tasks.

- Market Demand: The growing need for location-based services and improved surveillance solutions is propelling the demand for sophisticated drone payloads.

The Middle East & Africa drone ISR payload sensors market is poised for substantial growth, driven by military demand, technological advancements, and regional leadership, particularly from the UAE. The integration of advanced technologies, such as AI, in UAV operations is expected to propel market expansion further.

The Latin America drone ISR payload sensors market is on a growth trajectory, supported by increased defense spending, technological advancements, and expanding applications in both military and civilian sectors. As the market evolves, the integration of advanced sensor technologies will play a crucial role in shaping the capabilities and applications of UAVs in the region.

KEY INDUSTRY PLAYERS

Strong Portfolio of Major Players to Lead Global Drone ISR Payload Sensors Market Growth

The market is divided into developed and emerging countries due to the strong product portfolio and distribution breadth of the major companies. Currently, the companies BAE Systems PLC (U.K.), Elbit Systems Ltd. (Israel), L3Harris Technologies, Inc. (U.S.), Lockheed Martin Corporation (U.S.), and Northrop Grumman Corporation (U.S.) led the market with the highest shares in 2023. However, most of the world's customers are in the commercial and defense sectors. The number of domestic players entering the international market is expected to increase, which may create a highly fragmented market by 2032. Other key players such as AeroVironment Inc. (U.S.), Israel Aerospace Industries (Israel), Teledyne FLIR LLC (U.S.), Parrot Drone SAS (France), and Yuneec International (China) have also entered the market with advanced UAV sensor products. Introduction of these new sensor products and heavy investments in the development of smart sensors are some of the key strategies adopted by the players who are active in the market.

List of Top Drone ISR Payload Sensors Companies:

- BAE Systems PLC (U.K.)

- Elbit Systems Ltd. (Israel)

- L3Harris Technologies, Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- AeroVironment Inc. (U.S.)

- Israel Aerospace Industries (Israel)

- Teledyne FLIR LLC (U.S.)

- Parrot Drone SAS (France)

- Yuneec International (China)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – The MQ-4C Triton for the unmanned aerial vehicle received a major upgrade through a new partnership with L3Harris. Northrop Grumman Australia signed a contract with L3Harris to monitor and coordinate the operational and control systems of these aircraft. The UAV added an Electro-Optical/Infrared (EO/IR) sensor tower, an Automatic Identification System (AIS), and an Electronic Support System (ESM).

- February 2024 – Israeli defense company Elbit Systems unveiled its new spy drone. The drone received an order from an unnamed customer and is scheduled to go into mass production in 2025. Between the 450 and 900 models, the Hermes 650 can carry 260 kg of the charge, divided between the two loading points. It can fly up to 300 km in visual range with satellite communication capability.

- August 2023 – Elbit Systems has been awarded a contract worth approximately USD 55 million in the Netherlands to supply the ReDrone Counter multi-layer Unmanned Aerial System (C-UAS). ReDrone's solution includes Elbit Systems' advanced DAiR radar, Signals Intelligence (SIGINT) and COAPS-L Electro-Optical payload (EO), providing advanced integrated aerial imagery and electronic attack capabilities, all in one. A command and control system manages it.

- May 2023 – BAE Systems announced enhanced features for its TWV640 thermal insulation core, designed for developers of thermal insulation solutions for the defense, aerospace, and commercial sectors. This technology is used in car cameras, security and surveillance, fire detection systems, and more. The TWV640 is powered by a BAE Systems Athena™ 640 series focal plane, an uncooled long-wave infrared microbolometer.

- January 2021 - The Indian Army has finalized a USD 20 Million agreement for undisclosed amounts of a high-altitude version of ideaForge's SWITCH UAV, with deliveries scheduled over the next year. ideaForge received this contract as it was the sole vendor that met the operational criteria during an assessment conducted in real-world scenarios for expedited procurement.

REPORT COVERAGE

The drone ISR payload sensors market research report provides detailed information on the market and focuses on key segments such as leading companies, product types, and major product applications. Additionally, it highlights market trends and highlights key industry developments. In addition to the aforementioned, it includes several factors that have contributed to the growth of the advanced market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 15.7% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Sensor Type

|

|

By Component

|

|

|

By Drone Type

|

|

|

By Range

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 6.34 billion in 2023.

The market is likely to grow at a CAGR of 15.7% during the forecast period of 2024-2032.

The market size in North America stood at USD 2.51 billion in 2023.

Some of the top players in the market are BAE Systems PLC, Elbit Systems Ltd., L3Harris Technologies, Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, AeroVironment Inc., Israel Aerospace Industries, Teledyne FLIR LLC, and others.

The U.S. dominated the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us