Drug Delivery Systems Market Size, Share & Industry Analysis, By Type (Inhalation, Transdermal, Injectable, and Others), By Device Type (Conventional and Advanced), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

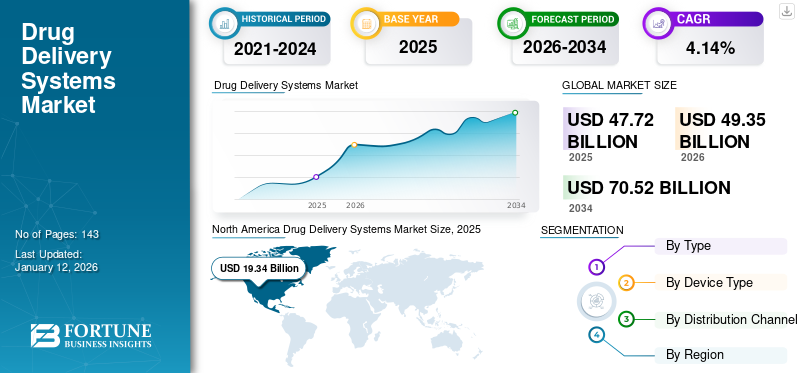

The global drug delivery systems market size was valued at USD 47.72 billion in 2025. The market is projected to grow from USD 49.35 billion in 2026 to USD 70.52 billion by 2034, exhibiting a CAGR of 4.14% during the forecast period. North America dominated the drug delivery systems market with a market share of 40.53% in 2025. Moreover, the U.S. drug delivery systems market size is projected to grow significantly, reaching an estimated value of USD 25.22 billion by 2032, driven by shifting preference towards self-administering drug delivery systems.

A drug delivery system is a device that enables the introduction of a drug in the body and improves its efficacy and safety by controlling its dosage form, time, and place of release. The systems include auto-injectors, jet-injectors, and syringes. The manufacturers of drug delivery systems distribute their products to pharmaceutical companies or consumers through various pharmacies, such as retail pharmacies, hospital pharmacies, and online pharmacies.

The large-scale vaccination drives to minimize the spread of the COVID-19 pandemic fueled the demand for drug delivery systems. Moreover, factors, such as the surging number of chronic diseases, growing awareness & adoption of advanced delivery systems for drug administration, and emerging novel technologies are driving the market. Furthermore, the market players focusing on various strategies, such as new product launches and collaborations, are expected to contribute to the drug delivery market growth in the coming years.

- For instance, in October 2021, Nemera launched an ENT drug delivery device, UniSpray, to broaden its product portfolio and is expected to increase market revenue.

The COVID-19 pandemic slowed down the market in 2020 due to reduced hospital admissions, disruptions in supply chain, temporary halt in manufacturing, and other factors. However, with the launch of COVID-19 vaccines and mass vaccination drives, there was a significant acceleration in manufacturers’ production of injectable drug delivery systems to meet global medical needs.

- For instance, according to the World Health Organization (WHO), more than 10 billion doses of COVID-19 vaccines were given to the global population in February 2022, increasing the production capacity of the systems.

Moreover, a decrease in patient visits to hospitals and clinics during COVID-19 increased the demand for safe and easy-to-use homecare solutions, which can be achieved using self-injection devices. The market players also developed advanced drug delivery devices that can be easily self-administered at home. The market in the post-pandemic period is expected to grow significantly due to increased hospital visits and the launch of advanced drug delivery systems, among others.

Drug Delivery Systems Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 47.72 billion

- 2026 Market Size: USD 49.35 billion

- 2034 Forecast Market Size: USD 70.52 billion

- CAGR: 4.14% from 2026–2034

Market Share:

- North America dominated the drug delivery systems market with a 40.53% share in 2025. This dominance is driven by large-scale COVID-19 vaccination campaigns, increased hospital admissions, and a strong preference for self-administered drug delivery devices in the U.S.

- By type, the injectable segment held the largest market share in 2024, supported by rising demand for syringes and wearable injectable systems, propelled by global vaccination efforts and chronic disease management.

- In device type, the conventional segment led the market in 2024 due to its low cost and high adoption for biosimilar drugs, especially in developing countries, while the advanced segment is expected to grow fastest due to technological innovation and better therapeutic outcomes.

Key Country Highlights:

- Japan: Demand is driven by the need for advanced drug delivery devices to support the growing elderly population and management of chronic diseases, along with regulatory approvals for innovative products.

- United States: Growth is fueled by extensive vaccination programs, the increasing adoption of self-administered devices, and government support accelerating the production and use of advanced drug delivery systems.

- China: Rising healthcare expenditure, a large patient population, and expanding manufacturing capacity for drug delivery devices support rapid market growth. The country also benefits from COVID-19 vaccination drives and infrastructure development.

- Europe: Growth is supported by rising awareness and adoption of advanced drug delivery products, increasing clinical trials, and regulatory approvals, along with new product launches enhancing diabetes and respiratory disease management.

Drug Delivery Systems Market Trends

Strategic Collaborations and New Product Launches to Boost Market Growth

The companies operating in the market constantly focus on strategies, such as collaborations and development & introduction of new products. These strategies will help the companies increase their revenue, thereby propelling market growth.

The advent of new products with increased safety and user-friendly features is expected to fuel the pharmaceutical industry’s growth. Additionally, better dosing features also complement drug treatment outcomes and increase the potential of disease management in homecare settings.

- For instance, in November 2021, Ypsomed launched YpsoMate, the world’s first auto-injector for prefilled syringes with integrated connectivity.

Moreover, a rise in collaborations between market players and pharmaceutical companies to develop and launch products will further boost the market growth. For instance, in April 2021, KINDEVA DRUG DELIVERY collaborated with Cambridge Healthcare Innovations Limited (CHI) to develop and commercialize CHI’s αeolus Dry Powder Inhaler (DPI) platform technology.

Download Free sample to learn more about this report.

Drug Delivery Systems Market Growth Factors

Increase in Shift of Patients Toward Advanced Drug Delivery Systems to Favor Market Growth

The rise in patients’ preference toward advanced drug delivery systems is due to their decreased variability in systemic drug concentrations and ability to deliver a drug to a specific site with greater accuracy. These features have led to an increased adoption of self-administered devices among patients.

- For instance, in May 2021, Gerresheimer AG, in collaboration with SensAir, presented an on-body drug delivery platform that can deliver high-viscosity drugs, such as biologics. The SensAir on-body drug delivery device is said to be easy to use and allows patients to start medications at home.

Moreover, the digitalization of medical devices has increased the awareness of advanced products among patients. Digitalization of these products provides various advantages, such as needle-free injection, controlled dosage, and higher flexibility of self-administration, leading to an increase in the adoption of these devices.

- In December 2022, Biocorp received the U.S. FDA approval for its smart sensor, Mallya, which connects directly to insulin pen injectors to transform them into connected devices. The sensor automatically collects data and transmits it to the dedicated application.

Furthermore, the shift of patient focus toward an advanced drug delivery system has increased in recent years due to its efficiency and reduced side effects. Also, several drug delivery systems have been developed using advanced systems for more convenient, controlled, and targeted delivery.

- For instance, according to the data published by Heliyon in June 2023, modern drug delivery systems use advanced technology to expedite targeted medication delivery, optimizing its effectiveness while minimizing off-target accumulation in the body. As a result, this system plays an important role in disease management and treatment.

Thus, the patients’ shift toward advanced products, combined with increased government initiatives to raise public awareness of these products, are expected to boost the drug delivery systems market growth in the coming years.

Increasing Burden of Chronic Diseases to Drive Market Growth

In recent years, chronic diseases, such as asthma, Chronic Obstructive Pulmonary Disease (COPD), cancer, diabetes, and other diseases, have been the leading cause of death globally. Factors, such as the growing prevalence of these chronic diseases and emerging technologies for treating them are expected to fuel the market progress during the forecast period. According to the United Health Foundation, in 2022, about 56 million adults (16.9% of the total population) in the U.S. were aged 65 years and above. Such a large group of the geriatric population is susceptible to chronic diseases, which is expected to increase the adoption of such systems.

Moreover, in the past years, targeted drugs have improved the management of several chronic diseases. An optimal drug delivery system has the potential to enhance the therapeutic benefits of targeted drugs and reduce systemic adverse effects, providing advantages for patients with chronic diseases.

Furthermore, the increase in product launches and digitalization in the healthcare sector have generated massive growth opportunities for the market players.

RESTRAINING FACTORS

Product Recalls and Stringent Regulations to Hinder Market Growth

The major factors restraining the market growth are strict regulations and guidelines associated with the approval of drug delivery devices, and product recalls by the U.S. FDA. According to an article published by Drugwatch in 2021, on average, about 4,500 drugs and devices are recalled from the U.S. shelves each year.

The product recalls are mainly due to adverse effects, non-compliance with standards, and data security issues, thereby limiting the growth of the market.

- For instance, in October 2022, Roche recalled its new eye drug delivery device, Susvimo, from the market. The problem is related to the septum or seal on the port delivery device, which keeps the medication from leaking out once it has been injected. As the product did not meet the company’s performance standards, it decided to stop the port delivery system’s distribution.

- Similarly, in June 2021, Smiths Medical initiated a class I recall for Jelco Hypodermic Needle-Pro Fixed Needle Insulin Syringe, owing to the incorrect graduated markings. Such manufacturing defects can cause overdose or under-dose of insulin, leading to serious problems among patients.

Technologically advanced products undergo various regulatory approval processes. The stringent regulations of regulatory bodies to evaluate the performance and safety of the products are expected to limit the launch of innovative products during the forecast period.

The invasive nature of the products could impact the trust of the customer in the device, and strict regulations to approve the products are limiting the growth of the market.

Drug Delivery Systems Market Segmentation Analysis

By Type Analysis

Rising Demand for Syringes to Fuel Adoption of Injectable Drug Delivery Systems

Based on type, the market is segmented into inhalation, transdermal, injectable, and others.

The injectable segment held the highest market with a share of 82.83% in 2026 and is projected to record the highest growth rate during the forecast period. The rising demand for wearable injectable systems for drug delivery is expected to increase product launches, thereby spurring the segment’s growth. Moreover, the increasing number of vaccination drives across the world is boosting the demand for syringes, which is expected to contribute to the segment’s growth in the future.

- For instance, in 2021, Becton, Dickinson, and Company (BD) announced that it had received orders for needles and syringes, totaling 2 billion injection devices, to support the global COVID-19 vaccination efforts. Such a high requirement of syringes and needles is expected to boost the segment’s growth.

The inhalation segment is predicted to register a substantial CAGR during the forecast period of 2024-2032. The growth of the inhalation segment is attributed to the rising adoption of inhalers to tackle the increasing prevalence of respiratory disorders, such as asthma and other bronchial conditions. In addition, growth in the product launches of inhalation systems in the market by the key players is expected to fuel the market growth. Also, several market players are partnering with contract development and manufacturing organizations for the modification of existing drug delivery systems.

- For instance, in December 2023, Kindeva Drug Delivery and Orbia Fluorinated Solutions (Koura) announced a co-development collaboration to convert existing marketed pressurized Metered Dose Inhaler (pMDI) products into Koura’s more sustainable and environmentally conscious medical propellant.

To know how our report can help streamline your business, Speak to Analyst

By Device Type Analysis

Rising Demand for Biosimilar Products to Trigger Adoption of Conventional Drug Delivery Systems

Based on device type, the market is segmented into conventional and advanced.

The conventional segment held the largest market with a share of 78.33% in 2026 and is projected to record a substantial CAGR during the forecast period. The segment’s considerable expansion is due to the growing demand for biosimilar products and low cost of devices. Furthermore, the rising prevalence of chronic diseases, such as asthma and diabetes, and Cardiovascular Diseases (CVD) is expected to increase the demand for conventional systems, especially in developing countries that are more dependent on conventional systems than advanced systems.

- For instance, according to a study published by the NCBI in June 2021, the prevalence of at least one chronic disease was more than 43% in the Southeast region of Brazil, which is expected to fuel the adoption of conventional systems during the forecast period.

The advanced segment is expected to register the highest CAGR during the forecast period. The high preference and increasing adoption of advanced products is due to their high therapeutic effectiveness, better patient compliance, and reduced treatment cost. Furthermore, the rising geriatric population, technological advancements in oral drug delivery systems, among others, and increasing demand for novel products in the market are the key factors driving the growth of the segment.

By Distribution Channel Analysis

Surge in Hospital Admissions to Drive Product Sales across Hospital Pharmacies

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and others.

The hospital pharmacies segment is expected to dominate the market with a share of 63.77% in 2026 due to the large number of patient visits to hospitals. Hospital pharmacies are an integral unit of hospitals. Thus, an increase in patient visits to these medical centers will increase the distribution of drug delivery devices from hospital pharmacies. The rising number of hospitals in various countries is also expected to increase the distribution of these systems from hospital pharmacies.

The retail pharmacies segment is anticipated to account for a substantial market share during the forecast period. The segment’s growth is attributed to an increase in the number of retail pharmacies and rising investments by governments and other organizations. For instance, in February 2021, Clicks opened its 600th in-store pharmacy in South Africa. Such new retail pharmacies are expected to increase the distribution of these systems in the coming years.

The instant spike in demand for these systems from the others segment, which includes e-pharmacies and homecare pharmacies, is attributed to the rise in awareness of these types of pharmacies, which provide people with limited mobility better access to low-cost products.

REGIONAL INSIGHTS

On the basis of region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Drug Delivery Systems Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America was valued at USD 18.69 billion in 2024 and will dominate the global drug delivery systems market share during the forecast period. Some of the contributing factors include rapid increase in the COVID-19 vaccination drives by the U.S. government, which boosted the demand for syringes. Furthermore, strong demand for these systems due to the increased number of hospital admissions in the region is expected to drive the region’s market growth during the forecast period. The U.S. market is projected to reach USD 18.87 billion by 2026.

- For instance, according to an article published by CIHI, in April 2021, there were over 3 million acute inpatient hospitalizations in Canada in 2019-2020. These hospitalizations are expected to increase the demand for these systems in the region.

The rise in demand for advanced drug delivery systems, such as sensor-embedded devices and metered-dose inhalers, and growing incidence of chronic diseases are likely to drive market growth in the region.

Europe held the second-largest market share in 2023 and is projected to register a significant CAGR during the forecast period. The region’s growth can be credited to the rising awareness regarding advanced drug delivery devices and increasing adoption of advanced products in the region. Moreover, clinical trials to get key regulatory approvals for new products and the introduction of new products by key players are expected to propel the market growth. The UK market is projected to reach USD 2.07 billion by 2026, while the Germany market is projected to reach USD 3.69 billion by 2026.

- For instance, in September 2023, Medtronic received the CE mark approval for its new Simplera Continuous Glucose Monitor (CGM). This device seamlessly integrates with the InPen smart insulin pen for real-time, personalized dosing guidance to simplify diabetes management.

- Similarly, in April 2021, Medtronic introduced its extended infusion set, an insulin delivery device, in select European countries, which can be worn for up to seven days.

Asia Pacific is expected to record the highest CAGR during the forecast period of 2025-2032. Some of the critical factors contributing to the market’s growth across the region include a large patient population, growing prevalence of chronic diseases, increasing healthcare expenditure in China and India, and rising COVID-19 vaccination drives by these countries. Furthermore, manufacturers in India are increasing their production capacities to meet the rising demands for various types of drug delivery systems, such as syringes, thereby fostering overall market growth across the region.The Japan market is projected to reach USD 2.82 billion by 2026, the China market is projected to reach USD 3.32 billion by 2026, and the India market is projected to reach USD 0.81 billion by 2026.

Latin America held a substantial market share in 2023 and is projected to register a moderate CAGR during the forecast period. The region is experiencing an increase in healthcare expenditure to enhance the overall healthcare system, which is expected to improve the current services provided in healthcare facilities. This will result in a rise in the demand for drug delivery devices. The market growth in the Middle East & Africa is attributed to the increase in prevalence of chronic diseases, surge in hospital admissions, and growing burden of asthma and diabetes.

Key Industry Players

Companies with Diversified and Strong Product Portfolios to Hold Key Market Share

The competitive landscape reflects a highly fragmented market with the entry of many small players in 2024.

BD, Baxter International Inc., Gerresheimer AG, and West Pharmaceutical Services Inc. are some of the prominent players operating in the market. BD is constantly focusing on introducing new products in the market.

- For instance, in September 2022, BD (Becton, Dickinson, and Company) launched a next-generation pre-fillable vaccine syringe, BD Effivax. The launch of this product will support the growth of the dedicated business of the company.

Other market players include Ypsomed, Medtronic, Nemera, and E3D Elcam Drug Delivery Devices. These companies are anticipated to increase their market shares during the forecast period by launching new and advanced products and increasing their production capacities to meet the demand for drug delivery devices.

- For instance, in January 2023, Nemera inaugurated a new manufacturing facility in Poland to expand its manufacturing capacity of drug delivery solutions.

Thus, a growing number of product launches and other strategic initiatives, such as geographical expansion, among others, are further likely to contribute to the global drug delivery systems market growth.

List of Top Drug Delivery Systems Companies:

- Gerresheimer AG (Germany)

- BD (Becton, Dickinson and Company) (U.S.)

- Kindeva Drug Delivery (U.S.)

- Baxter (U.S.)

- West Pharmaceutical Services Inc. (U.S.)

- Ypsomed (Switzerland)

- Medtronic (Ireland)

- Nemara (France)

- E3D Elcam Drug Delivery Devices (Israel)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: Innovation Zed, one of the leading key players, received the CE mark for its InsulCheck DOSE, a single-unit add-on device for insulin pen injectors.

- September 2022: Corium, Inc., a biopharmaceutical company, launched ADLARITY, a donepezil transdermal system in the U.S. for treating patients suffering from mild to severe Alzheimer’s.

- August 2022: Baxter announced the U.S. FDA Clearance of the Novum IQ Syringe Infusion Pump with Dose IQ Safety Software. The Novum IQ Syringe infusion pumps precisely deliver small amounts of fluid at low rates, frequently in pediatric, neonatal or anesthesia care settings.

- June 2022: Gufic Biosciences Ltd launched a new drug delivery system, dual-chamber bags, in India. These dual-chamber IV bags are made of polypropylene with peelable aluminum foil, allowing the storage of unstable drugs that need reconstitution just before their administration to the patient.

- March 2022: Vitaris, Inc., in partnership with Kindeva Drug Delivery L.P., received the U.S. FDA approval for Breyna, a drug-device inhalation aerosol combination for patients suffering from asthma and COPD.

- December 2021: Gerresheimer AG signed an agreement with American Biotech to develop a new pump to deliver a drug for the treatment of rare diseases via continuous parenteral administration.

- November 2021: AMW GmbH entered a partnership with AdhexPharma to strengthen its transdermal drug delivery technologies. Through this partnership, the former focused on the development, marketing authorization, and licensing of its novel transdermal delivery systems.

REPORT COVERAGE

The research report delivers a detailed market analysis and focuses on key aspects, such as new product launches and technological advancements. Additionally, it includes an overview of all the segments and key industry developments, such as mergers, partnerships, and acquisitions. Moreover, it covers regional analysis of segments, key trends, and company profiles of top market players. Besides this, it offers an overview of market trends, opportunities, and the impact of the drug delivery systems on the stakeholders. It also encompasses qualitative and quantitative insights that contribute to the growth of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.14% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Device Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 47.72 billion in 2025.

In 2025, North America’s market value stood at USD 19.34 billion.

The market is projected to record a CAGR of 4.14% during the forecast period.

The injectable segment holds the leading position in the market.

The key factors driving the market are new product launches, increased R&D, rising prevalence of chronic diseases, and emerging novel technologies.

BD, Baxter International Inc., Gerresheimer AG, and West Pharmaceutical Services Inc. are some of the major players in the global market.

North America dominated the market in 2025 by capturing the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us