Drug-eluting Balloon Catheters Market Size, Share & COVID-19 Impact Analysis, By Drug (Paclitaxel, Sirolimus, and Others), By Indication (Coronary Intervention and Peripheral Intervention), By End-user (Hospitals & ASCs and Specialty Clinics and Catheterization Laboratories), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

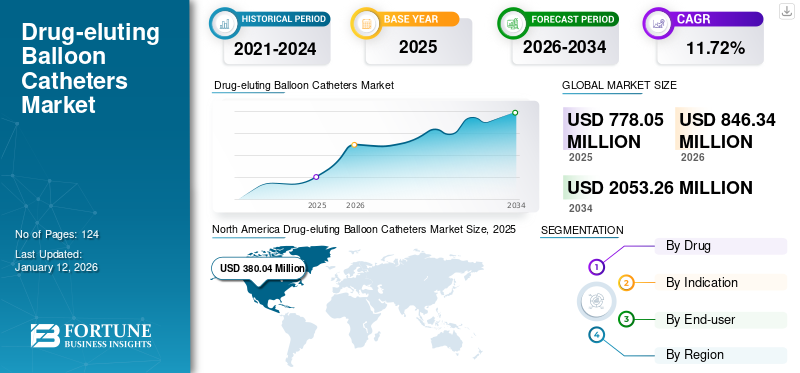

The drug-eluting balloon catheters market size was valued at USD 778.05 million in 2025 and is projected to grow from USD 846.34 million in 2026 to USD 2,053.26 million by 2034, exhibiting a CAGR of 11.72% during 2026-2034. North America dominated the global drug-eluting balloon catheters market with a market share of 48.84% in 2025. The rising prevalence of heart disease, the advantages of drug-eluting balloon catheters over drug-eluting stents, and the increasing preference for minimally invasive diseases are the key driving factors in the market.

Drug-eluting balloon catheters, also known as drug-coated balloon catheters, are devices that deliver anti-proliferative drugs through inflated balloons and are processed by the vessel wall. This is done to restore luminal vascularity in order to treat atherosclerosis, in-stent restenosis and to reduce the risk of late thrombosis without implanting a permanent foreign object. The balloon technology relies on the concept of targeted drug delivery, which helps in the rapid healing of the vessel wall and prevents the proliferation of smooth muscle cells.

The global drug-eluting balloon catheters market growth is attributed to the increasing prevalence of heart diseases, increasing preference for minimally invasive procedures, and advantages of balloon catheters over drug-eluting stents (DES).

- For instance, as per a research article published by American Heart Association, Inc. (AHA) in 2025, atherosclerotic lower extremity Peripheral Artery Disease (PAD) is the major cause of cardiovascular morbidity and mortality that has affected around 230 million people globally. The increasing prevalence of such diseases has increased the demand for these catheters.

Global Drug-Eluting Balloon Catheters Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 778.05 million

- 2026 Market Size: USD 846.34 million

- 2034 Forecast Market Size: USD 2,053.26 million

- CAGR (2026–2034): 11.72%

Market Share Analysis:

- North America dominated the market with a 48.84% share in 2025, driven by the rising burden of heart disease, technological advancements, and presence of key players.

- By Indication, the Peripheral Intervention segment held the largest share, while Coronary Intervention is projected to grow at the fastest CAGR due to expanding clinical trials and product approvals.

Key Country Highlights:

- United States: Leads globally due to high PAD & CAD prevalence, increasing angioplasty procedures, and continuous product launches by companies like Medtronic and BD.

- Germany, France, U.K.: Significant contributors in Europe owing to strong healthcare infrastructure, rising vascular disease cases, and presence of key market players.

- China & India: Fast-growing markets in Asia Pacific with increasing preference for minimally invasive procedures and growing investments in cardiovascular healthcare infrastructure.

- Brazil & Mexico: Leading Latin American countries with rising PAD prevalence and increasing accessibility to advanced interventional procedures.

- Middle East & Africa: Gradual adoption driven by improving healthcare access and rising incidence of cardiovascular diseases, though regulatory hurdles remain a challenge.

Key Takeaways

- North America holds the largest market share, contributing USD 256.9 million in 2021.

- Based on drug, paclitaxel segment generated over 99% of the market share in 2021.

- Medtronic, BD, and B. Braun SE are the prominent players in the market.

COVID-19 IMPACT

COVID-19 Negatively Impacted the Market due to Low Demand for these Devices

The impact of COVID-19 resulted in the decline of the market growth during the pandemic. This was due to the lockdown restrictions and less number of people going for the diagnosis and treatment of cardiovascular diseases. Based on revenue, the global market witnessed a decline in its growth by -13.7% in 2020 as compared to the prior year. This was due to the decline in the number of surgical procedures for coronary and peripheral intervention.

- For instance, as per an article by NCBI published in 2020, in Europe, the COVID-19 pandemic had a major impact on the treatment of patients with ST-segment elevation myocardial infarction (STEMI), with a 19.0% reduction in primary percutaneous coronary intervention (PPCI) procedures.

Moreover, the market players also experienced a decline in the sales of their products due to low demand during the pandemic. This resulted in a decline of the revenues generated from the company’s drug-eluting product portfolio.

- For instance, Boston Scientific Corporation’s interventional cardiology business segment which includes drug-eluting balloon catheters, generated a revenue of USD 2,299 million in 2020 from its and experienced a decline of -18.4% in its revenue from the prior year.

However, in 2021, with the implementation of COVID-19 guidelines, the release of lockdown restrictions, and mass vaccinations, the number of angioplasty procedures increased globally. This increased the demand for these catheters globally.

LATEST TRENDS

Download Free sample to learn more about this report.

Increasing Demand for Minimally-invasive Procedures to Boost the Product Adoption

Minimally invasive procedures are the techniques that limit the size and number of cuts or incisions that are required during the surgical procedure. This makes the surgeries less painful and helps in fast recovery.

Angioplasty surgeries are also minimally invasive procedures in nature. These procedures are an alternative to open cardiovascular surgeries. They are more beneficial as compared to conventional surgeries as they reduce hospital stays and increase recovery rates.

Furthermore, various advantages of these catheters over drug-eluting stents in targeted drug delivery have increased their use in angioplasty surgeries for various cardiovascular indications. They provide better angiographic and clinical outcomes.

- For instance, in February 2021, as per the NCBI article, the drug-coated balloon is the most adaptive therapeutics approach for coronary disease due its various advantages including minimal side effects as compared to the drug-eluting stents.

- Similarly, in December 2021, according to the NEWS Medical Life Sciences article, drug-coated balloon catheter usage with minimally invasive procedures are preferable replacements over risky stent treatment for the myocardial infarction.

Moreover, in Percutaneous Transluminal Angioplasty (PTA) procedures, paclitaxel-coated balloon catheters are used. This is a minimally invasive treatment for femoropopliteal long lesions in diabetes. Paclitaxel-coated balloon catheter angioplasty is more efficient as compared to uncoated balloon angioplasty. These factors have been fueling the demand for the device globally.

DRUG-ELUTING BALLOON CATHETERS MARKET GROWTH FACTORS

Increasing Prevalence of Heart Diseases to Increase the Demand for Drug-eluting Balloon Catheters

Globally, the prevalence of peripheral and coronary heart diseases, including heart arrhythmias, heart failure, heart valve disease, and pericardial disease has been increasing at a faster pace.

- As per CDC, in the U.S., coronary heart disease is the most common type of heart disease, killing 382,820 people in 2020. About 20.1 millions of adults aged 20 and older suffered from coronary artery disease in the U.S.

Cigarette smoking and diet high in trans-fat, saturated fats, and cholesterol are the major causes of coronary and peripheral artery diseases.

- In July 2020, according to the article of NCBI, active and passive smoke exposure caused more than 30.0% of coronary heart disease, which led to an increasing number of angioplasty surgeries and enhanced the product demand in this market.

Drug-eluting balloon catheters are indicated during the angioplasty procedures to treat blocked or narrowed coronary arteries. Therefore, the increase in angioplasty surgeries is expected to increase the demand for these catheters.

- In March 2021, according to the NCBI article, over 965,000 angioplasties were performed in the U.S.

Furthermore, the market players have increased their emphasis on research and development for the launch of advanced catheters. This is expected to increase the accessibility of these products among the patient population.

- In July 2021, Medtronic launched the Prevail drug-coated balloon (DCB) catheter in Europe for coronary artery disease. This product launch is expected to expand the product offerings of these catheters in Europe.

Such high incidences of heart diseases are expected to fuel the demand for these catheters in the long run.

Higher Efficiency Associated with Drug-eluting Balloon Catheter Over Drug-eluting Stents to Increase the Demand for these Catheters

Drug-eluting balloon catheters through minimally invasive surgery deliver an anti-proliferative drug into the vessel wall without implanting a stent. These devices are a promising technique in the treatment of coronary artery disease.

The positive results related to safety and efficacy of these catheters angioplasty in the treatment of diseases such as in-stent restenosis, high bleeding risk, and small-vessel disease has been shown in several research studies. Moreover, by the use of these catheters, limitations associated with drug–eluting stents such as incomplete stent apposition, adverse drug interactions, and increased in-stent thrombosis rates can be eliminated.

Therefore, the increasing preference for minimally invasive cardiac surgeries and advantages associated with the use of these catheters over drug-eluting stents have been increasing its demand.

RESTRAINING FACTORS

Limitations Associated with Drug-eluting Balloon Catheters to Hamper Market Growth

Even though these catheters have been proven to be more efficient than drug-eluting stents but there are several factors which are expected to limit the market growth during the forecast period.

Several studies have stated the high risk of death associated with the paclitaxel‐coated balloon catheters treatment for femoropopliteal artery of the leg. This factor is anticipated to limit the market growth.

- For instance, in December 2018, according to the Journal by the American Heart Association (AHA), after the treatment of patients with paclitaxel‐coated balloon catheters, all patient deaths occurred within 1 to 5 years.

Furthermore, many companies also stated that there is a risk associated with the use of these catheters.

- For instance, Medtronic has warned about the increased risk of late mortality for its product IN.PACT AV drug-coated balloon. This risk factor associated with the use of the company’s product can restrict the adoption of these products in the market.

Moreover, stringent government regulations for the approval and commercialization of these catheters also restrict its growth in the market.

- For instance, no drug-eluting balloon catheters for coronary indication are approved in the U.S. Although, in Europe these catheters have an established market but lack government approval in the U.S.

Such limitations associated with use of these catheters are expected to hamper the market’s growth during the forecast period.

SEGMENTATION

By Drug Analysis

To know how our report can help streamline your business, Speak to Analyst

Launch of Paclitaxel-coated Balloon Catheter Products in the Market to Fuel the Segment’s Growth

Based on drug, the market is segregated into paclitaxel, sirolimus, and others. The paclitaxel segment generated the highest revenue in 2026, accounting for 93.72% of the market with a size of USD 793.16 million. The segment’s dominant share is attributed to the well established presence of paclitaxel-eluting balloon catheters and increasing focus of market players on launching new products.

- For instance, in May 2022, Medtronic announced the U.S. Food and Drug Administration (FDA) approval of IN.PACT 018, which is a paclitaxel-coated percutaneous Transluminal Angioplasty (PTA) balloon catheter, indicated for the interventional treatment of Peripheral Arterial Disease (PAD) in the superficial femoral and popliteal arteries.

Furthermore, sirolimus segment is expected to grow at a significant CAGR during the forecast timeframe. Sirolimus has a stronger anti-proliferation effect on atherosclerosis related hypoxic cells than paclitaxel, which is expected to make sirolimus more suitable for the treatment of vascular restenosis. This factor is expected to fuel the segment’s growth during the forecast period.

By Indication Analysis

Strong Presence of the Drug-coated Balloon Catheters for Peripheral Indication to Boost Segment Growth

Based on indication, the market is classified into coronary intervention and peripheral intervention. The peripheral intervention segment generated the highest revenue in 2026, accounting for 76.00% of the market with a size of USD 643.24 million. The growth of the segment is due to the increasing prevalence of peripheral artery disease globally and a strong focus of the market players on launch of new products for peripheral indication.

- For instance, as per a research article published by Frontiers Media S.A., in 2019, around 6.7 million people in Central Latin America were affected with peripheral artery disease which accounted for 1.6% of the total population in the sub-region.

Furthermore, the coronary intervention segment is expected to grow at the fastest CAGR during the forecast timeframe. Many players, such as Boston Scientific Corporation, have increased their focus on the launch of drug-eluting balloon catheter for coronary intervention. This factor is responsible for the segment’s highest growth during the forecast period.

- In December 2019, Boston Scientific Corporation started a clinical trial in Japan to study the efficacy of Agent paclitaxel-coated PTCA balloon catheter for coronary intervention.

By End-user Analysis

Increased Preference of the Patients to Visit Hospitals for Angioplasty Procedures to Fuel Segment’s Growth

Based on end-user, the market is categorized into hospitals & Ambulatory Surgical Centers (ASCs) and specialty clinics and catheterization laboratories.

The hospitals & ASCs segment accounted for a significant share of the market in 2026, representing 66.32% of the market with a size of USD 561.3 million. The large share of the segment is attributed to increasing hospital expenditure and increasing number of hospitals performing angioplasty surgeries. Moreover, the patients prefer visiting hospitals more as they can get diagnosed and treated both at the same place. This factor has increased the number of patients visiting the hospitals for angioplasty procedures, thereby fueling the segment’s growth.

The specialty clinics and catheterization laboratories segment is estimated to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the rising number of catheterization laboratories in many countries globally which has been increasing the accessibility of the treatment options for the patients suffering from coronary and peripheral vascular diseases.

REGIONAL INSIGHTS

North America Drug-eluting Balloon Catheters Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025, accounting for a 48.84% share. Holding the maximum market share due to rising heart disease and new product launches by market players. The US market is projected to reach USD 381.95 million by 2026.

- For instance, as per a research article published by MDPI in, in the U.S., 8 to 12 million of the population suffered from peripheral artery disease (PAD), with an overall prevalence of 3.0%–10.0%.

The market in Europe accounted for a significant market share in 2021 and is projected to witness considerable growth during the forecast period. The market growth in Europe is attributed to the increasing prevalence of peripheral artery disease in the region and the strong presence of market players such as MicroPort Medical (Group) Co., Ltd. and B. Braun SE in the region. The UK market is projected to reach USD 36.31 million by 2026, while the Germany market is projected to reach USD 58.78 million by 2026.

The market across Asia Pacific region is expected to expand at the fastest CAGR in the projected years. The high growth market in the region is attributed to the increasing patient population preference for minimally invasive procedures and the increasing prevalence of peripheral artery disease in the region. The Japan market is projected to reach USD 41.38 million by 2026, the China market is projected to reach USD 44.49 million by 2026, and the India market is projected to reach USD 19.37 million by 2026.

- For instance, as per a research article published by Frontiers Media S.A., in 2019, around 23.86 million people in East Asia were affected with peripheral artery disease accounting for 1.4% of the total population in the sub-region.

KEY INDUSTRY PLAYERS

Companies with Strong Focus on Expansion of Drug-eluting Balloon Catheters Portfolio to Hold Key Market Share

Medtronic, BD, and B. Braun SE are the prominent players in the market and captured a considerable global drug-eluting balloon catheters market share in 2021.

Medtronic and BD accounted for major shares of the market in 2021. Medtronic dominated the market in 2021, and accounted for a significant market share. This was due to the company’s strong emphasis on product launches. Moreover, the company’s product IN.Pact generates significant revenue from the U.S. This factor is also responsible for the company’s dominance in the market.

- In July 2021, Medtronic announced the launch of the Prevail DCB catheter in Europe following CE (Conformité Européene) mark. This launch expanded the company’s product portfolio in Europe.

Similarly, BD held a considerable share of the market in 2021. This was due to the company’s strong global presence in over 190 countries. Furthermore, the company’s focus on R&D for the development and commercialization of new advanced products also contributed to the company’s strong market share.

- In May 2020, BD announced the U.S. FDA approval and launch of longer lengths of Lutonix 018 DCB for the treatment of femoropopliteal lesions up to 300mm

Other significant players, including Koninklijke Philips N.V., Boston Scientific Corporation, and MicroPort Medical (Group) Co. Ltd. are emphasizing on research and development activities for the launch of technologically advanced products to strengthen their position in the market.

KEY COMPANIES IN DRUG-ELUTING BALLOON CATHETERS MARKET:

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- B. Braun SE (Germany)

- Meril Life Sciences Pvt. Ltd. (India)

- BIOTRONIK (Germany)

- Cordis (U.S.)

- MicroPort Medical (Group) Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- August 2022 – BD announced the launch of first-in-human prevision trial of peripheral sirolimus drug-coated balloon (DCB) to study its safety and efficacy. The aim of the trials was to analyze the capability of sirolimus as a future treatment option for patients suffering from Peripheral Artery Disease (PAD).

- January 2021 - MicroPort Medical (Group) Co., Ltd. received an EU CE mark for Reewarm PTX Drug Coated Balloon PTA catheter for femoral popliteal artery indication during percutaneous transluminal angioplasty.

- November 2020 – Boston Scientific Corporation announced the U.S. Food & Drug Administration (FDA) approval of Ranger, a drug-eluting balloon catheter to treat patients with PAD, Superficial Femoral Artery (SFA), and Proximal Popliteal Artery (PPA).

- October 2019 – Koninklijke Philips N.V. announced the U.S. FDA approval for its product Stellarex 200mm and 150mm 0.035 low-dose DCB to treat PAD. This approval diversified the range of products available under Stellarex.

- June 2017 – Koninklijke Philips N.V. announced the acquisition of Spectranetics Corporation, which is involved in the development of drug-coated balloons for peripheral artery disease. This acquisition enhanced the company's product portfolio.

REPORT COVERAGE

The drug-eluting balloon catheters market report provides a detailed competitive landscape. It includes the prevalence of peripheral and key industry developments such as partnerships, mergers, and acquisitions. Additionally, it focuses on key points such as new product launches in the market. Furthermore, the report covers regional analysis of different segments, company profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that contribute to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Drug

|

|

By Indication

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global drug-eluting balloon catheters market was valued at 778.05 million in 2025. It is projected to grow from USD846.34 million in 2026 to USD 2,053.26 million by 2034.

The market is expected to exhibit a CAGR of 11.72% during the forecast period (2026-2034).

The paclitaxel segment is set to lead the market by drug.

The key factors driving the market are rising prevalence of heart disease, advantages of drug-eluting balloon catheter over drug-eluting stents, and increasing preference of minimally invasive diseases.

Medtronic, BD, and B. Braun SE are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us