Dry Ice Market Size, Share & Industry Impact Analysis, By Type (Dry Ice Sliced, Dry Ice Pellets, Dry Ice Blocks, and Others), By Application (Food Industry, Medical and Pharmaceutical, Transportation and Storage, Entertainment Industry, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

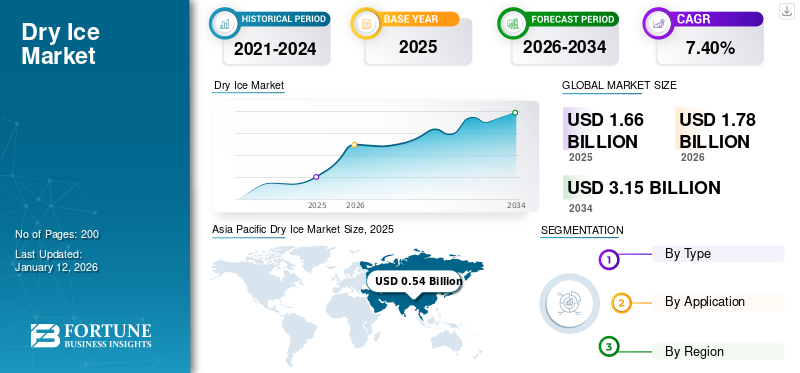

The global dry ice market size was valued at USD 1.66 billion in 2025 and is projected to grow from USD 1.78

billion in 2026 to USD 3.15 billion by 2034, exhibiting a CAGR of 7.40% during the forecast period. Asia Pacific dominated the dry ice market with a market share of 33% in 2025.

Dry ice is a solid form of carbon dioxide (CO2) that does not leave any residue and is an odorless, colorless, slightly acidic, and non-flammable material. It is produced by compressing and cooling gaseous carbon oxide (CO) at extremely high pressures, which produces liquid CO at the initial stage. The liquid form goes through pressurized expansion to obtain dry ice and is then compressed by a hydraulic press into convenient pellets, slices, or blocks. It has a low temperature of approximately -75°C when compared with water-based ice. Further, in the process of sublimation, when the solid form of carbon dioxide is heated, it directly changes into a gas instead of melting in the form of liquid. It is mainly used in refrigeration to keep frozen and medical products cold.

The rising product preference over water-based ice has fueled the profitable growth in the market. The product has a lower temperature than water-based ice and when heated it directly changes into the gas and does not leave any residue. It is cost-effective, non-combustible and non-toxic, and is used to make carbonated drinks and soda. These benefits increase its use over water-based ice in food & beverages, storage & preservation, machine blast cleaning, pharmaceutical, and entertainment industries. Hence, rising product demand from various industries due to its advantages over water-based ice will drive the market.

The COVID-19 pandemic significantly impacted the market in several ways. Initially, there was a surge in product demand as it became essential for storing and transporting vaccines, especially those requiring ultra-low temperatures, including the Pfizer-BioNTech COVID-19 vaccine. This led to shortages and supply chain disruptions as manufacturers struggled to meet the sudden increase in demand. As the pandemic progressed and vaccination efforts intensified, the product demand stabilized to some extent. Yet, the market continued to experience fluctuations influenced by factors such as vaccine distribution, economic recovery, and pandemic-related developments. Overall, the COVID-19 pandemic had a profound and multifaceted impact on the market, reshaping supply chains and highlighting the importance of this commodity in critical industries.

GLOBAL DRY ICE MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 1.66 billion

- 2026 Market Size: USD 1.78 billion

- 2034 Forecast Market Size: USD 3.15 billion

- CAGR: 7.40% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 33% share, driven by cold chain logistics growth, food & beverage demand, and pharmaceutical transport needs.

- By type: Dry ice pellets dominated due to high use in healthcare, logistics, and food preservation for stable temperature maintenance during transit.

- By application: Transportation & storage led in 2024, supported by temperature-controlled fleets for pharmaceuticals, perishable foods, and industrial goods.

Key Country Highlights:

- China, India: Strong demand from logistics, pharmaceuticals, and frozen food industries.

- United States, Canada: High consumption in food processing, vaccine storage, and dry ice blasting in manufacturing.

- Germany, France, U.K.: Growth from cold chain expansion and adoption in specialty manufacturing.

- Brazil, Mexico: Increased use in food export supply chains and healthcare logistics.

- Saudi Arabia, UAE: Demand supported by pharmaceutical imports and temperature-controlled logistics for perishables.

Dry Ice Market Trends

Green Initiatives and Sustainable Practices to Drive Innovation in Market

The market has been increasingly focusing on green initiatives and sustainable practices. Traditionally, the production of dry ice has involved the sublimation of carbon dioxide (CO2) from the atmosphere, followed by compression and cooling, to form solid pellets. While this process is relatively energy-efficient compared to other cooling methods, it still generates CO2 emissions. To address environmental concerns and reduce their carbon footprint, many manufacturers are exploring alternative sources of CO2 for production. One such source is captured CO2 from industrial processes, such as ethanol production or natural gas processing. By repurposing this captured CO2 for product production, manufacturers can minimize emissions and promote a more sustainable supply chain. Asia Pacific witnessed a dry ice market growth from USD 0.47 billion in 2023 to USD 0.50 billion in 2024.

Download Free sample to learn more about this report.

Dry Ice Market Growth Factors

Rising Cold Chain Logistics Industry Aids to Drive Market Growth

Cold chain logistics involves transporting and storing temperature-sensitive products, such as food, pharmaceuticals, and biologics, in a controlled environment to maintain their quality and integrity. Dry ice plays a crucial role in this process by providing a reliable and cost-effective means of keeping products within the required temperature range during transit. The increasing globalization of trade and growing demand for frozen foods and perishable goods have fueled the expansion of the cold chain logistics industry. With the rise of e-commerce and the increasing popularity of fresh and frozen food delivery services, there is a greater need for efficient and reliable cold chain solutions to ensure the safe and timely delivery of goods to consumers. Moreover, the pharmaceutical industry relies heavily on cold chain logistics for the distribution of temperature-sensitive drugs and vaccines. As the development and distribution of biopharmaceutical products continue to grow, particularly with the rise of personalized medicine and advanced therapies, the demand for dry ice as a cryogenic cooling agent is expected to increase and propel the dry ice market growth.

RESTRAINING FACTORS

Volatility in CO2 Supply and Pricing to Constrain Market

CO2 is a byproduct of various industrial processes, including ethanol production, ammonia production, and natural gas processing. The availability of CO2 feedstock for dry ice production is subject to fluctuations in demand from these industries, and from seasonal variations and supply chain disruptions. For instance, during periods of high demand for CO2 in industrial applications, such as food and beverage processing or wastewater treatment, the supply available for dry ice production may be constrained, thereby leading to shortages and increased prices. Conversely, during periods of reduced industrial activity or plant shutdowns, excess CO2 may be available, leading to oversupply and downward pressure on prices. Furthermore, geopolitical factors, such as trade tensions, sanctions, and export restrictions, can also influence the availability and pricing of CO2 feedstock on the global market. Disruptions to CO2 supply chains, whether due to logistical challenges, regulatory changes, or geopolitical tensions, can create uncertainty for product manufacturers and affect their ability to meet customer demand.

Dry Ice Market Segmentation Analysis

By Type Analysis

Dry Ice Pellets to Remain Dominant Due to Their Higher Use in Various End-use Industries

Based on type, the market segments include dry ice sliced, dry ice pellets, dry ice blocks, and others.

The dry ice pellets segment is projected to dominate the market with a share of 33.71% in 2026. The segment’s growth is associated with the increasing demand from various end-use industries, including healthcare, food and beverage, manufacturing, and logistics. The product pellets are widely used for temperature-sensitive shipments, such as pharmaceuticals, vaccines, perishable foods and beverages, and industrial goods, due to their ability to maintain stable temperatures during transit.

The dry ice sliced segment is anticipated to account for a moderate growth rate during the forecast period due to its use for various purposes across industries, including food processing, pharmaceuticals, and specialty manufacturing. The applications of product slices are in the food industry, where they are utilized for rapid chilling and freezing of food products during processing and packaging. The product slices provide a convenient and cost-effective method for maintaining cold temperatures without the need for traditional refrigeration equipment, making them ideal for preserving the quality and freshness of perishable goods.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Transportation and Storage Segment Dominates owing to High Product Demand from Temperature-controlled Fleets

Based on application, the market is classified into food industry, medical and pharmaceutical, transportation and storage, entertainment industry, plastic, pharmaceutical, and others.

The transportation & storage segment is projected to dominate the market with a share of 35.96% in 2026. This segment encompasses a range of products and services tailored to meet the unique requirements of various industries, including pharmaceuticals, food and beverage, healthcare, logistics, and manufacturing. Moreover, the transportation and storage segment involves the provision of logistics services tailored to the needs of temperature-sensitive products. This includes refrigerated and temperature-controlled transportation fleets equipped with advanced monitoring and tracking systems to ensure compliance with temperature requirements throughout the supply chain.

The product demand from the food industry segment is expected to grow as it finds applications in food processing and manufacturing facilities for the rapid chilling and freezing of food products during production and packaging. By immersing food items in dry ice or using dry ice blasting techniques, manufacturers can achieve quick and uniform cooling, which helps preserve the flavor, texture, and nutritional value of the final products. The food industry segment is expected to hold a 30.9% share in 2024.

REGIONAL INSIGHTS

Regionally, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Dry Ice Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held the largest dry ice market share in 2024 and is anticipated to dominate during the forecast period. The region's growth is associated with rapid industrialization, urbanization, and expansion of cold chain infrastructure. China, India, Japan, and South Korea are witnessing increasing product demand, particularly in the healthcare, food processing, and automotive sectors. In addition, the rise of e-commerce and online grocery delivery services in the region, contributes to the growing product adoption for last-mile delivery of perishable goods. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.16 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America’s growth is associated with the rapid adoption of advanced healthcare technologies and the proliferation of e-commerce. The region's strong presence in pharmaceuticals, food and beverage, and logistics drives significant product demand. The high use of the product in the food industry and construction will aid in propelling sustainable market growth in North America. The U.S. market is projected to reach USD 0.4 billion by 2026.

Europe

The market growth in Europe is associated with increasing stringent regulatory standards and a growing focus on sustainability. The region's strong emphasis on environmental protection drives demand for eco-friendly cooling solutions. Moreover, the pharmaceutical and food industries in Europe rely heavily on cold chain logistics, supporting the growth of the market. The UK market is projected to reach USD 0.06 billion by 2026, while the Germany market is projected to reach USD 0.1 billion by 2026.

Brazil, Mexico, and Argentina are witnessing increasing investments in cold chain logistics, driving product demand as a reliable and cost-effective cooling solution. However, infrastructure challenges and economic volatility in some Latin American countries pose barriers to market expansion.

The Middle East & Africa is anticipated to witness significant growth owing to the expanding healthcare sector and growing investments in cold chain infrastructure.

KEY INDUSTRY PLAYERS

Strategic Planning Adopted by Companies to Strengthen Their Market Share

The competitive landscape of the market depicts a consolidated and competitive nature. Global key players in the market have heavily invested in the research and development of technologies to improve product output. Superior operational efficiency and novel technology development are the strategies used by market leaders for their growth. Additionally, major players are focusing on acquisition and expansion activities to increase their market share.

The major manufacturers in this market are Linde plc, CryoCarb, NEXAIR, Dry Ice UK Ltd., and Central McGowan. Plant expansions, strategic mergers and acquisitions characterize the global market. The market's major businesses have been actively acquiring competitors for better economies of scale.

LIST OF TOP DRY ICE COMPANIES:

- Linde plc (Ireland)

- CryoCarb (U.S.)

- NEXAIR (U.S.)

- Dry Ice UK Ltd. (U.K.)

- Central McGowan (U.S.)

- ASCO CARBON DIOXIDE LTD. (U.S.)

- The Iceman (Canada)

- Polar Ice Ltd. (Ireland)

- Chillistick Ltd. (U.K.)

- Praxair Technology, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023 – Cold Jet launched the IceRocket dry ice blasting machine, an entry-level machine for improving cleaning and maintenance operations to achieve less downtime and more performance. The IceRocket is the latest addition to the Cold Jet line of innovative, high-performance dry ice blasting equipment.

- May 2023 – Holston Gases acquired Superior Dry Ice, which operates in Cartersville, Georgia. Holston Gases will continue to operate from the Superior Dry Ice location at 3439 Hwy 411.

- February 2023 – POET expanded the CO2 and dry ice business in Laddonia. The new facility, located north of the administration building, will allow the company to capture over 200 tons of CO2 per day and manufacture dry ice.

- September 2021 – Cold Jet acquired Aquila Triventek’s dry ice activities, a Danish company that specializes in developing innovative dry ice cleaning, production, and CO2 recovery systems. This acquisition integrated dry ice technologies, innovations, and staff from Triventek with the Cold Jet family and product portfolio. Along with new product offerings and business opportunities, Cold Jet also welcomed Triventek employees, partners, and customers with over 40 years of experience in the industry and a shared view of sustainability.

- October 2021 – Central McGowan introduced a Cobot Welding Package called CRX Fab-Pak at the 2021 ATX/Automation Technology Show in Minneapolis. The new device combines the latest technologies from Lincoln Electric Automation and FANUC into a highly reliable and portable system that is easy to set up, install, and program. The robotic welding machines helped the company improve its market position in the U.S. market.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, applications, and end-use industries. In addition, it offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years. It further includes historical data and forecasts revenue growth at global, regional, and country levels and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.40% during 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was at USD 1.66 billion in 2025 and is expected to record a valuation of USD 3.15 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 0.54 billion.

The market will register a CAGR of 7.40% and exhibit steady growth during the forecast period of 2025-2032.

The transportation and storage segment is the leading application in the market.

Rising demand from the transportation and storage sector is anticipated to drive market growth.

Linde plc, CryoCarb, NEXAIR, Dry Ice UK Ltd., and Central McGowan are a few of the major players in the market.

Asia Pacific dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us