Dynamic Positioning System Market Size, Share & Industry Analysis, By Sub-System (Power System, Thruster System, and DP Control System), By Sensors (Position Reference Sensors, Wind Sensors, Motion Sensors, and Gyro Compass), By Equipment Type (Class 1, Class 2, and Class 3), By Solution (New Builds and Retro Fits), By Application (Commercial and Military), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

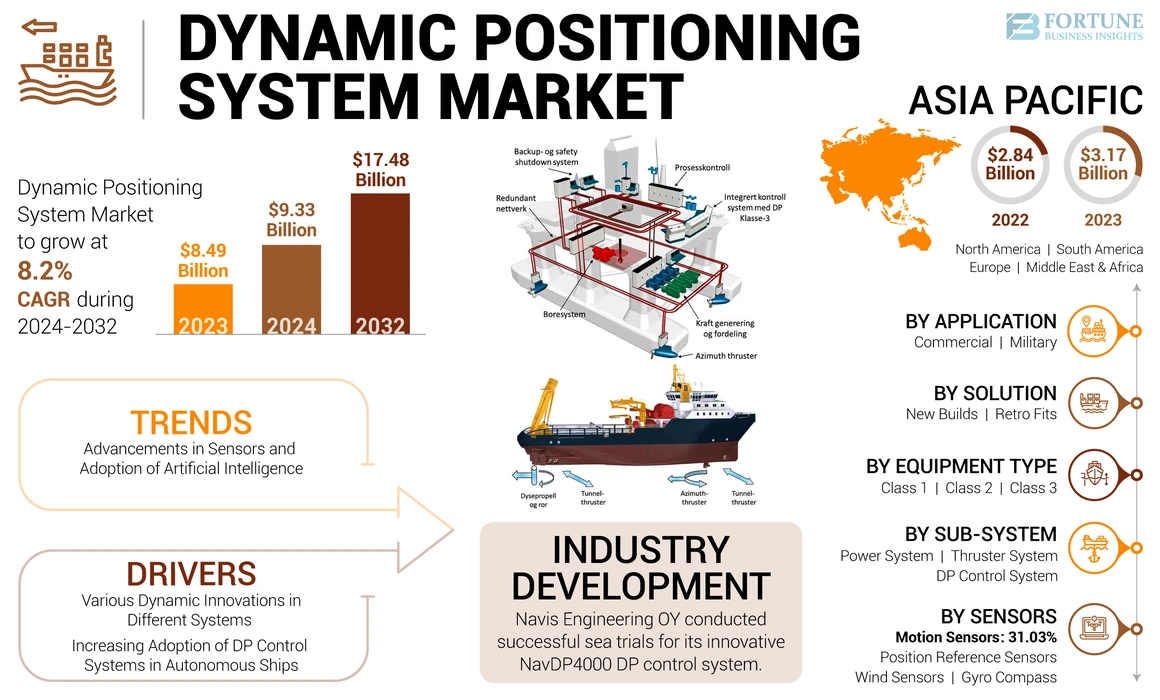

The global dynamic positioning system market size was valued at USD 8.49 billion in 2023. The market is projected to grow from USD 9.33 billion in 2024 to USD 17.48 billion by 2032, exhibiting a CAGR of 8.2% during the forecast period. Asia Pacific dominated the dynamic positioning system market with a market share of 37.34% in 2023.

Dynamic positioning (DP) is a sophisticated computer-controlled system used to automatically maintain a vessel's position and heading without the need for anchors. This technology is particularly critical in offshore operations where traditional anchoring methods are impractical due to deep waters or underwater obstructions.

Dynamic positioning is widely used in various maritime sectors, particularly in the offshore oil and gas industry. It enables vessels, such as drill ships, semi-submersible rigs, and research vessels, to perform tasks, such as drilling, laying pipelines, and conducting scientific research in challenging marine environments. The technology is essential for operations in areas where anchoring is not feasible due to depth or seabed conditions driving the demand for dynamic positioning systems.

Global Dynamic Positioning System Market Overview

Market Size:

- 2023 Value: USD 8.49 billion

- 2024 Value: USD 9.33 billion

- 2032 Forecast Value: USD 17.48 billion, with a CAGR of 8.2% from 2024–2032

Market Share:

- Asia Pacific held the highest market share in 2023 at 37.34%

- By equipment, Class 2 dominated in 2023 and is expected to grow fastest during 2024–2032

- By component, command and control systems are projected to hold a 23% share by 2025

Key Country Highlights:

- Japan: Market expected to reach USD 851.6 million by 2025

- China: Forecast to grow at a CAGR of 4.56% during the forecast period

- Europe: Estimated to grow at a CAGR of 4.5%, driven by tech advancement and maritime regulations

The COVID-19 pandemic significantly impacted the DPS market, influencing both its growth trajectory and operational dynamics. Significant disruptions in global supply chains were caused by the pandemic, which affected the availability of components required for manufacturing and installing dynamic positioning systems. Companies were hesitant to invest in new technologies, including these systems, due to economic uncertainty during the pandemic. The overall demand for DPS solutions was impacted as operators often postponed capital expenditures.

Lockdowns and health protocols resulted in limitations for numerous maritime operations, causing decreased activity in industries heavily dependent on dynamic positioning, including offshore drilling and marine transportation. This decline in operational activities subsequently impacted the market's growth.

Dynamic Positioning System Market Trends

Advancements in Sensors and the Adoption of Artificial Intelligence in Systems Catalyze Market Growth

The dynamic positioning system (DPS) market is experiencing significant advancements driven by technological innovations and evolving industry demands. Advancements in sensors, such as Global Navigation Satellite Systems (GNSS), Inertial Navigation Systems (INS), Radar Sensors, and so on, drive the market growth for precision applications. Asia Pacific witnessed dynamic positioning system market growth from USD 2.84 Billion in 2022 to USD 3.17 Billion in 2023.

For instance, in April 2024, Wartsila, a technology company, is introducing a major new product that commits to providing enhanced operational performance and greater efficiency for operators of offshore vessels, ferries, and tugs. The company's most recent release consists of a top-quality thruster and propulsion control solution bundle that integrates Wartsila WST-E embedded electric steerable thruster and WST-R retractable thrusters. This bundle also features an upgraded remote propulsion control system with a refined user interface known as ProTouch, designed to improve the precision and dependability of dynamic positioning (DP) operations.

AI algorithms integrated into DPS enable predictive modeling and dynamic control adjustments, leading to optimized vessel positioning in varying environmental conditions and improving operational efficiency and safety.

Download Free sample to learn more about this report.

Dynamic Positioning System Market Growth Factors

Various Dynamic Innovations in Different Systems to Fuel Market Growth

A dynamic positioning system is at the forefront of technological innovations, with advancements in systems and sustainability initiatives driving its evolution. As the maritime and offshore industries continue to embrace digitalization and automation, these technologies will play a pivotal role in enhancing the efficiency, safety, and environmental sustainability of dynamic positioning operations, such as

Sensor Fusion Technique: Sensor fusion combines data from multiple sensors to provide a comprehensive view of the vessel's environment. This approach improves the robustness and reliability of DP systems, allowing for better decision-making and control.

Energy-Efficient Propulsion Systems: Advancements in electric propulsion and hybrid solutions are transforming dynamic positioning capabilities. These technologies contribute to improved maneuverability, reduced environmental impact, and enhanced system redundancy, making them vital for modern DPS applications.

For instance, in April 2022, Kongsberg Maritime secured a USD 20 million contract to provide integrated equipment packages for two additional newbuild offshore wind commissioning service operation vessels. These vessels are designed with a technological foundation supported by Kongsberg Maritime's comprehensive integrated equipment solution. The solution encompasses permanent magnet azimuth thrusters, generators, electrical systems, a fully integrated bridge with navigation, dynamic positioning (DP), and automation systems, as well as deck machinery equipment and control systems.

Increasing Adoption of DP Control Systems in Autonomous Ships for Enhancing Operational Capabilities Drives Market Growth

The integration of dynamic positioning systems in autonomous vessels is transforming maritime operations by enhancing precision, safety, and efficiency. As the technology continues to evolve, it will unlock new possibilities for unmanned maritime activities, driving innovation and sustainability in the industry. The synergy between autonomous shipping technologies and dynamic positioning is reshaping the landscape of maritime operations, making them safer and more efficient.

Autonomous vessels are increasingly utilizing dynamic positioning (DP) systems to optimize their operations, enhancing efficiency, safety, and adaptability in various maritime tasks. The key utilization of dynamic positioning in autonomous vessels, such as precision navigation and positioning, reduced human intervention, integration of advanced sensor technologies, AI and machine learning enhancements, energy optimization, remote operations, and so on, emphasizes the demand for DP systems.

For instance, in February 2023, Volvo Penta expanded the availability of its DP system to include its twin V6 and V8 propulsion packages, making DPS available in the company’s entire range of marine leisure products. This global rollout will provide the broadest coverage of this automated feature in the marine industry and catalyze the global dynamic positioning system market growth.

RESTRAINING FACTORS

High Initial Costs and Unskilled Workforce to Hinder Market Growth

Several factors are restraining the growth of the dynamic positioning system (DPS) market. These challenges can impact both the adoption of new technologies and the operational efficiency of existing systems.

The initial capital investment required for acquiring and installing the DP system is substantial. This high cost can deter operators, particularly in economically challenging times, from investing in new systems or retrofitting existing vessels. Moreover, beyond initial costs, ongoing maintenance, software updates, and compliance with regulatory standards contribute to the total cost of ownership.

In addition, DP systems require trained personnel to operate effectively. The shortage of skilled operators can limit the deployment of these systems and hinder the overall growth of the market. This skill gap is particularly pronounced in regions where maritime training and education programs are lacking.

Dynamic Positioning System Market Segmentation Analysis

By Sub-System Analysis

Increasing Installation of DP Control Systems in New Builds and Retro Fits Boosted Segment Growth

Based on sub-system, the market is divided into power system, thruster system, and DP control system.

DP control system accounted for the largest dynamic positioning system market share in 2023. The system consists of a collection of hardware, software, and systems that work together to keep a vessel in position. The increasing installation of DP systems in new builds and retro fits for vessels is anticipated the segmental growth during the forecast period.

For instance, in March 2022, Vallianz Holdings Limited and Royal IHC signed a memorandum of understanding ("MOU") to work together on the planning and development of a new Service Operation Vessel ("SOV") for supporting offshore windfarm operations and maintenance. The SOV will be equipped with a comprehensive service package, including a DP system, a motion-compensated gangway and crane, an elevator tower, and a daughter craft with step-less boat landing to ensure efficient operations.

The thruster system is estimated to be the fastest-growing segment during the forecast period of 2024-2032. The growth is attributed to advancement in thrusters, auxiliary systems, propellers, azimuth thrusters, tunnel thrusters, or other devices that generate thrust, which plays a major role in anticipating market growth. For instance, in August 2024, Kongsberg Maritime received a Silent-E notation from DNV for its rim-drive azimuth thruster, making it the first of its kind to attain this certification.

By Sensors Analysis

Position Reference Sensors Dominated the Market Due to Their Operational Efficiency

Based on sensors, the market is divided into position reference sensors, wind sensors, motion sensors, and gyro compass.

Position reference sensors dominated the global market in 2023. The growth is attributed to their operational efficiency of measuring a ship's position and movement in a horizontal plane. They are used in a dynamic positioning (DP) system to control the ship's surge and sway automatically.

Motion sensors are projected to be the fastest-growing segment during the forecast period 2024-2032. Motion sensors play a vital role in the functionality of dynamic positioning systems. They provide real-time data on the vessel's motion, which is essential for calculating the necessary adjustments to maintain its position.

- The motion sensors segment is expected to hold a 31.03% share in 2023.

To know how our report can help streamline your business, Speak to Analyst

By Equipment Type Analysis

Class 2 Segment Dominated the Market By Preventing a Single Fault in an Active System

Based on equipment type, the market is divided into class 1, class 2, and class 3.

The class 2 segment dominated the global market in 2023 and is estimated to be the fastest-growing segment during the forecast period. The growth is attributed to advancements in equipment and enabling redundancy to prevent a single fault in an active system from causing a loss of position or heading. The enhancement in systems anticipates segmental growth.

The class 3 segment analyzes the lucrative growth in upcoming years. With regards to class 2, the adoption of class 3 is also increasing due to the highest redundancy level for a DP system. It is designed to prevent loss of position even in the event of a single failure. The early adoption of these systems in commercial ships catalyzes segmental growth.

By Solution Analysis

Increasing Fleet of New Build Ships Emphasis the Use of DPS System to Improve Stability Operations

Based on solution, the market is classified into new builds and retro fits.

The new builds segment dominated the global dynamic positioning system market in 2023 and is estimated to be the fastest-growing segment during 2024-2032. The growth is attributed to increasing new build ships by OEMs in the commercial and defense sectors, creating lucrative opportunities for the market. For instance, in September 2022, Kongsberg Digital supplied DP simulators to MOL Marine & Engineering for the MOL Dynamic Positioning training center located in Tokyo, Japan. The MOL DPTC has become the first DP training center in Japan to receive accreditation from the Nautical Institute (NI) for offering NI-approved dynamic positioning training courses.

The retro fits segment is expected to register significant growth during the forecast period. The old fleets of ships are being updated in terms of propulsion systems, DPS systems, electrical systems, and various other aspects.

By Application Analysis

Increasing Adoption DPS in Commercial Vessels to Boost Segment Growth

Based on application, the market is segregated into commercial and military.

The commercial segment accounted for the largest market share in 2023 and is projected to be the fastest-growing segment during the forecast period. DP systems are majorly installed in commercial vessels, such as offshore vessels, pipelay, cable lay, trenching, dredging, and others due to their applications in the sea. These vessels are mainly fitted with DP systems to hold their positions and maintain stability during operational conditions. By component, the command and control systems segment is expected to hold a 23% share in 2025.

The military segment is projected to register lucrative growth in the market. The adoption of DP systems in vessels, such as amphibious assault ships, mine sweepers, and other military survey ships is boosting segment growth.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, and Rest of the World.

Asia Pacific Dynamic Positioning System Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share and is poised for significant growth in the market, driven by various factors that enhance its demand and application across multiple sectors. The expansion of seaborne trade in Asia Pacific is a critical factor driving the market. Moreover, there is a notable increase in investments in the offshore shipping sector, particularly in countries, such as China, India, and Japan. These investments are aimed at enhancing the capabilities of naval fleets and ensuring compliance with international maritime regulations, leading to higher demand for DPS.

- The dynamic positioning system market in Japan is expected to reach USD 851.6 million by 2025.

- China is projected to witness a strong CAGR of 4.56% during the forecast period.

Europe is anticipated to grow at a CAGR of 4.5% during the forecast period. It is estimated to be the fastest-growing region, driven by various factors, including technological advancements, rising maritime activities, and increasing defense expenditures. In addition, stringent regulations imposed by the International Maritime Organization (IMO) and other regulatory bodies regarding safety and environmental standards are prompting operators to invest in markets.

North America is a significant player in the global landscape, driven by factors, such as the presence of a large navy industry in both the defense and commercial sectors. The increased preference for automated technology by merchants in this region has resulted increase in the DPS by the commercial naval sector.

The market in the Rest of the World is experiencing growth driven by various factors, including increased maritime activities, the expansion of offshore oil and gas exploration, and advancements in technology.

KEY INDUSTRY PLAYERS

Increasing Strategic Partnerships and Collaborations within Key Industry Players Catalyze the Market Growth

In response to the challenges, dynamic positioning system companies are increasingly entering strategic partnerships. Collaborations are being formed to share resources, mitigate risks, and enhance technological capabilities. For instance, recent contracts awarded to companies, such as Praxis Automation, demonstrate a trend toward collective efforts to improve maritime safety and technology integration in response to heightened operational demands due to geopolitical tensions.

List of Top Dynamic Positioning System Companies:

- Kongsberg Gruppen (Norway)

- Wartsila (Finland)

- ABB Group (Switzerland)

- Elcome International LLC (Dubai)

- A.B. Volvo (Sweden)

- Rolls Royce PLC (U.K.)

- Navis Engineering (Finland)

- Praxis Automation Technology B.V. (Netherlands)

- Thrustmaster of Texas (U.S.)

- Royal IHC (Netherlands)

KEY INDUSTRY DEVELOPMENTS

- April 2024 - Royal IHC officially announced the signing of a contract with the Eastern Shipbuilding Group (ESG) to collaborate on the construction of an advanced medium-class hopper dredge for the United States Army Corps of Engineers (USACE). One notable aspect of this hopper dredge is its extensive onboard automation, including the Integrated Forward-Looking Sonar System, Dynamic Positioning, Dynamic Tracking, and Dredging Assist capabilities working in seamless coordination.

- August 2023 - Elcome International, a provider of maritime systems and services based in Dubai, acquired a majority stake in Fabio Fiorucci, an Italian specialist in navigation systems, as part of a broader strategic initiative to broaden its range of offerings in southern Europe. This partnership is anticipated to strengthen Elcome's footprint in the Mediterranean area, supplementing its current activities in Suez, Spain, and Portugal.

- August 2023 - Navis Engineering OY conducted successful sea trials for its innovative NavDP4000 dynamic positioning (DP) control system on Orange Marine’s newly constructed cable laying and repair vessel. This noteworthy achievement represents a significant advancement in sustainable energy solutions and maritime technology, demonstrating Navis Engineering's dedication to advancing innovation and efficiency.

- February 2023 - The unique DP System (DPS) from Volvo Penta, now included in its twin V6 and V8 propulsion packages, expands its availability in the company's entire marine leisure lineup. This update will be launched in global markets, providing the broadest coverage of this automated feature in the marine industry.

- October 2022 - The full skid propulsion units from Thrustmaster form part of the portable dynamic positioning (DP) system designed for submarine cable installation. The portable DP system (PDPS) from Thrustmaster could be used for various barge DP upgrades, including pipe laying, construction, bridge erection, rocket launching or retrieval, and feeding wind turbine components.

REPORT COVERAGE

The market report provides a thorough market analysis. It comprises all major aspects, such as R&D capabilities, supply chain management, competitive landscape, and optimization of the manufacturing capabilities and operating services. Moreover, the report offers insights into the global dynamic positioning system Market trends, market segment, growth analysis, and size and highlights key industry developments. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 8.2% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Sub-System

By Sensors

By Equipment Type

By Solution

By Application

|

Frequently Asked Questions

As per the study by Fortune Business Insights, the market size was USD 8.49 billion in 2023.

The market is likely to grow at a CAGR of 8.2% over the forecast period.

The commercial segment in application leads the market due to the increasing adoption of DP systems in commercial ships.

The market size in Asia Pacific stood at USD 3.17 billion in 2023.

The increasing adoption of DP systems in autonomous ships for enhancing operational capabilities drives market growth.

ABB Group, Elcome International LLC, A.B. Volvo, Kongsberg Gruppen, and Wartsila are the top players in the market.

China is the dominant country in the Market

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us