E-prescribing Market Size, Share, Trends & Industry Analysis, By Delivery Mode (Web-based, On-premise), By Prescription Type (Controlled substance, Non controlled Substances) By End User (Hospitals, Physician's offices, Pharmacies) and Regional Forecast, 2026-2034

E-prescribing Market Size

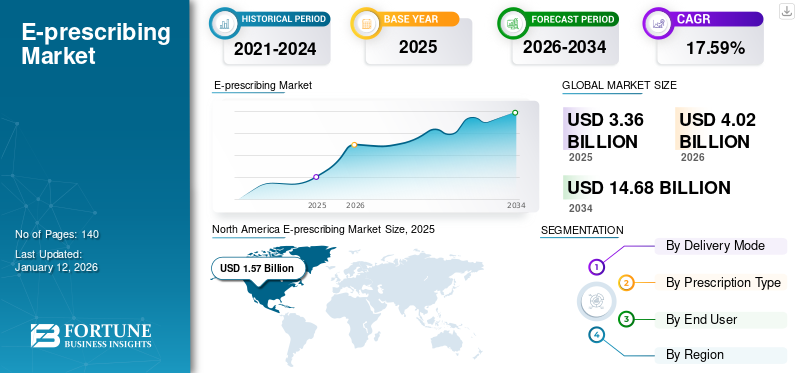

The global e-prescribing market size was USD 3.36 billion in 2025, The market is projected to grow from USD 4.02 billion in 2026 to USD 14.68 billion by 2034, exhibiting a CAGR of 17.59% during the forecast period. North America dominated the e-prescribing market with a market share of 46.82% in 2025.

Electronic prescribing or e-prescribing is a technology framework that enables medical practitioners and other physicians to send computer-based electronic generation and transmission of a medical prescription to a hospital-based or standalone pharmacy. Medical professionals can securely transmit prescriptions to pharmacies via an e-prescribing software program. There are several associated benefits of these solutions, such as improved patient safety and health care quality by checking for drug interactions and reducing medication errors. It is comparatively cheaper and more convenient for doctors and physicians than traditional prescription filling techniques that require ample amount of time. Growing adoption of these systems in various medical facilities will strongly propel their demand in the market during the forecast period.

Global E-prescribing Market Overview:

Market Size:

- 2025: USD 3.36 billion

- 2026: USD 4.02 billion

- CAGR: 17.59%

- Dominant Region (2025): North America (46.82% share)

Key Market Drivers:

- Adoption of Integrated EHR Solutions

- Offers better data access (e.g., med history, pharmacy benefits)

- Reduces prescription errors and documentation burden (Cures Act)

- Focus on Reducing Adverse Drug Events (ADEs)

- Over 90,000 deaths annually in the U.S. due to medical errors

- E-prescriptions help reduce these by offering precise and accessible data

- Government Initiatives and Funding

- Programs like HITECH and ONC funding ($500K for interoperability)

- Policies incentivizing digitization and error minimization

Market Restraints:

- High Cost of Implementation

- Especially in developing economies

- Lack of IT infrastructure and support

Recent Developments:

- Veradigm (Allscripts) partnered with Lash Group to streamline specialty medication access

- Cerner acquired Kantar Health to boost life sciences research

- Surescripts launched a tool for pharmacists to compare out-of-pocket costs in real time

E-PRESCRIBING MARKET TRENDS

Download Free sample to learn more about this report.

E-prescribing Through EHR via Integrated Platform to Boost Product Sales

The incorporation of e-prescribing software in the EHR solutions will significantly drive the market growth. Integrated EHR have several advantages such as laboratory results and orders, clinical notes, and a broad range of clinical decision support that standalone systems do not offer. E-prescribing via integrated EHRs enhances the availability of patient medication histories and pharmacy benefits information, making potentially emergency medication data available immediately. EHR based systems has considerably reduced prescription errors in community-based medical practices, thus boosting product adoption and thereby augmenting market growth during the forecast period. Moreover, increasing initiatives by the government to implement integrated EHR across several hospitals is another significant factor augmenting the market.

MARKET DRIVERS

Growing Adoption Rate of Integrated EHR Solutions will Significantly Propel Market Growth

The growing adoption of e-prescription-based EHR solutions across the world is one of the significant factors supporting e-prescribing market growth. The implementation of software in the electronic health record solutions has simplified prescription filling in several ways. The integrated solutions comparatively offer better availability of medical histories than a standalone e-prescribing system. Increasing adoption of integrated EHR solutions will considerably stimulate market growth. This is mainly due to the growing initiatives by governments to implement strategies for reducing administrative and regulatory burdens on health care providers pertaining to the use of integrated e-prescribing EHR solutions. For instance, the introduction of the Cures Act, in the year December 13, 2016, is designed to enhance medical product development and create innovations and advances in medical technology. The implementation of the Cures Act assisted the healthcare IT industry stakeholders in developing recommendations and strategies designed to address key burdens associated with the use of integrated EHR by reducing documentation requirements and improving regulatory flexibility within the Medicare program. Hence, such initiatives will considerably augment the market growth across the forecast period.

Increasing Initiatives to Eliminate Adverse Drug Events (ADEs) and Medical Errors are estimated to drive the Market

Prescription faults among medication errors are the primary causes of concern for medical professionals globally, as they account for more than 70% of medication flaws reported by general practice settings and hospitals. Medication errors can have adverse effects on a patient’s health. Such medication flaws are a common cause of legal and medical malpractice claims against doctors and healthcare professionals. Adverse drug events (ADEs) are among the primary causes of death in the U.S. Various studies reported that every year in the U.S., more than 90,000 deaths occur as a result of medical errors. Hence, the use of e-prescribing solutions allows healthcare providers to access patient medical histories, medication information, and diagnoses that enhance patient safety by eliminating or reducing medical errors. Hence, the increasing rate of medical errors and adverse drug events across the globe will strongly boost the adoption rate of e-prescribing systems.

MARKET RESTRAINT

High Cost Associated with the Implementation and Maintenance of Integrated E-Prescribing Solutions to Limit Market Growth

Despite the increasing usage of e-prescribing systems in clinical applications, certain factors are limiting the adoption of these solutions. One of the major factors restraining the growth of the market is the high cost associated with the implementation and maintenance of an e-prescription integrated EHR. Several developing economies are facing difficulties in the adoption of such solutions due to their high price. Also, the dearth of health care IT support in various developing countries of the world is another important factor restricting market growth.

E-PRESCRIBING MARKET SEGMENTATION ANALYSIS

By Delivery Mode Analysis

To know how our report can help streamline your business, Speak to Analyst

Web-Based E-Prescribing System to Dominate the Global Market

Based on delivery mode type, this market is segmented into web-based and on-premise. The major difference between the web-based and on-premise e-prescribing solution is that on-premise e-prescribing involves hosting the software on in-house servers that are implemented and maintained by an organization, while the web-based or cloud-based is the online implementation of the software in cloud where users get access to it via the internet. The on-premise segment is estimated to witness sluggish growth as compared to web-based solutions. However, the segment will generate a stable e-prescribing market revenue during the analysis period, owing to the increasing adoption of these systems across the globe.

- By delivery mode, the web-based segment is projected to generate USD 2.99 billion in revenue by 2025.

In 2026 the web-based segment is projected to lead the market with a 89.44% share.register a lucrative CAGR during the forecast period. Also, the segment held significant market revenue in 2024 and is estimated to dominate the market throughout the forecast timeframe. Cloud-based systems do not require complex installation processes where technicians need to set up an intense infrastructure to host data. It can all be done through the internet, excluding the need for IT support and minimizing additional costs. Also, increasing adoption rate of integrated EHR owing to its efficiencies in terms of clinical application is another significant factor propelling the growth of this segment.

By Prescription Type Analysis

Non-Controlled Substances to Aid Dominance of the Segment

Based on prescription type, the market is segmented into controlled substance and non-controlled substances. The controlled substance refers to a chemical or drug whose possession, manufacture is regulated by a government, such as illicitly used drugs or prescription medications that are designated by law. E-prescriptions for controlled substances were originally a proposal for the Drug Enforcement Administration (DEA) to revise its regulations for providing practitioners with the option of writing e-prescriptions for controlled substances. These regulations ensure an adequate supply of controlled substances for legitimate scientific, medical, industrial and research purposes. Electronic prescribing of controlled substances, such as opioids, ensures valuable use of drugs and minimizes the risk of drug abuse. Hence, the aforementioned benefits for controlled substances will strongly propel the growth of the segment across the forecast period.

The non-controlled substances segment is estimated to account for 92.84% of the market in 2026 witness stable growth across the forecast period. The segment also held significant market revenue during the analysis period. High growth is attributable to the increasing adoption of e-prescription technology across various medical facilities to ensure proper management of drug usage. Moreover, the increasing prevalence of chronic disorders across the globe is another significant factor boosting the demand for e-prescription solutions and thereby augmenting e-prescribing market growth.

By End User Analysis

Higher Adoption of Integrated Solutions by Hospitals to Enable Dominance of the Segment

The end user segment is classified into physicians’ offices, hospitals, and pharmacies. The emergence of physicians’ offices in developed and emerging countries is attracting a large patient pool suffering from chronic and acute conditions. The patient pool mainly comprises patients suffering from conditions that can be treated in outpatient settings and do not require hospital stay. A growing number of physicians’ offices, along with adequate reimbursement policies provided by these settings, are some of the major factors responsible for higher adoption of such solutions in these facilities.

- By end user, the hospitals segment is expected to hold a 49.5% share in 2025.

The hospitals segment is projected to hold the maximum market share of 49.03% in 2026. in the e-prescribing market during the forecast period. This segment is estimated to witness substantial growth, owing to the increasing adoption of e-prescription integrated EHR solutions in the hospital settings. A rise in a number of multi-specialty hospitals implementing such technology to streamline workflow will strongly propel market expansion. The Health Information Technology for Economic and Clinical Health Act (HITECH) creates incentives related to health care information technology. It mandates the use of integrated EHR solutions across several hospital facilities in the U.S. Moreover, the increasing number of EHR vendors offering integrated solutions for acute care in the hospital settings will further accelerate the growth of the segment.

REGIONAL ANALYSIS

North America E-prescribing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market of e-prescribing is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The market size in North America stood at USD USD 1.57 billion in 2025. The U.S. is projected to witness lucrative growth due to factors such as increasing digitalization in the healthcare sector, coupled with favorable government policies, and a flexible regulatory scenario. The U.S. market is projected to reach USD 1.77 billion by 2026.

Moreover, increasing private and public funding pertaining to integrated EHR adoption will further propel regional growth in the forecast period. For instance, in June 2019, the Office of the National Coordinator for Health Information Technology (ONC) released the Cooperative Agreement Notice of Funding Opportunity (NOFO). The purpose of this program is to enable development in the technical standards essential to attain interoperability among healthcare IT systems. The program has been funded up to USD 500,000 in the initial year. Hence, such factors are responsible for the positive growth of this market in North America.

In Asia Pacific, the market is projected to grow at a lucrative rate, owing to the increasing number of vendors penetrating into emerging Asian economies. The Japan market is projected to reach USD 0.25 billion by 2026, the China market is projected to reach USD 0.21 billion by 2026, and the India market is projected to reach USD 0.12 billion by 2026.

- The e-prescribing market in Japan is expected to reach USD 205.9 million by 2025.

- China is projected to witness a strong CAGR of 23.90% during the forecast period.

The market in Europe is forecasted to hold substantial market share by the end of 2026. High growth is due to the presence of major electronic prescribing vendors operating in the European market. Moreover, the increasing adoption rate of healthcare IT across several European countries will further propel industry growth. The UK market is projected to reach USD 0.35 billion by 2026, while the Germany market is projected to reach USD 0.13 billion by 2026.

- Europe is anticipated to grow at a CAGR of 20.7% during the forecast period.

Latin America and Middle East & Africa are projected to witness a stable CAGR in the electronic prescribing market, owing to the increasing awareness among the population pertaining to the associated benefits of these solutions in a healthcare facility. Additionally, the growing prevalence of chronic ailments that require proper management in a medical facility is another significant factor boosting product adoption.

KEY INDUSTRY PLAYERS

Core Focus on Inorganic Strategic Partnerships by Epic Systems Corporation, to Propel Their e-Prescribing Market Position.

Epic Systems Corporation is one of the leading players operating in this market, specializing in interoperable technology, and primarily focuses on the needs of healthcare organizations. The company is known for having various secured contracts with small to large hospitals as compared to any of its competitors in this industry. Its clients include hospital chains such as Duke University Health System, Johns Hopkins Health System, UNC Health Care, Vanderbilt Health System and University of Utah Health Care.

The market is fragmented in nature with the presence of several other companies functioning in the industry. Other significant players include, Cerner Corporation, Surescripts, Allscripts Healthcare Solutions, Inc., athenahealth, Inc., Medical Information Technology, Inc., RelayHealth Corporation, eClinicalworks, NextGen Healthcare., Practice Fusion, Inc. and others.

LIST OF TOP E-PRESCRIBING COMPANIES PROFILED:

- Epic Systems Corporation

- Cerner Corporation

- Allscripts Healthcare, LLC

- Medical Information Technology, Inc. (MEDITECH)

- Athenahealth

- eClinicalWorks

- Surescripts

- Practice Fusion, Inc.

- NextGen Healthcare

- Others

KEY INDUSTRY DEVELOPMENTS

- May 2021 – Veradigm, a prominent provider of data and technology solutions and a business unit of Allscripts Healthcare announced an agreement with Lash Group, a patient support services business. This agreement will facilitate specialty medications, to be available for management within the Veradigm AccelRx™ platform, which streamlines the specialty enrollment process for users of Veradigm, Allscripts and other electronic health record (EHR) software vendors.

- April 2021 – Cerner Corporation announced the acquisition of Kantar Health which is a division of Kantar Group, for USD 375 million in cash. Kantar Health’s rich life sciences expertise will be combined with Cerner’s strong collection of real-world data (RWD) and technology which is expected to increase innovation in life sciences research and improve patient outcomes worldwide.

- June 2020 - Surescripts made an announcement of the availability of its real-time prescription benefit for pharmacy service which will allow pharmacists to access information on out-of-pocket prescription costs. This tool will help pharmacists to easily collaborate with patients and prescribers by choosing an alternative medication which is affordable.

REPORT COVERAGE

The e-prescribing market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, novel product launch and technological overview of these solutions. Besides this, the report offers insights into the market, current trends, and highlights the key industry developments. This, coupled with adoption rate of integrated EHR solutions in key countries. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Delivery Mode

|

|

By Prescription Type

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global e-prescribing market size was USD 3.36 billion in 2025 and is projected to reach USD 14.68 billion by 2034.

Recent trends include the integration of artificial intelligence (AI) and machine learning into e-prescribing systems, the increasing use of mobile applications for prescription management, the exploration of blockchain technology for enhanced security, and the adoption of cloud-based solutions for scalability and accessibility.

The e-prescribing market is projected to exhibit a CAGR of 17.59% during the forecast period from 2026 to 2034, driven by technological advancements and increasing demand for efficient healthcare solutions.

Web-based segment is expected to be the leading segment in this market during the forecast period.

Key drivers include the increasing adoption of integrated Electronic Health Record (EHR) solutions, government initiatives and funding, a focus on reducing adverse drug events, and the growing emphasis on patient safety and healthcare quality.

Leading players in the e-prescribing market include Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare, LLC, Medical Information Technology, Inc. (MEDITECH), Athenahealth, eClinicalWorks, Surescripts, Practice Fusion, Inc., and NextGen Healthcare.

North America dominated the e-prescribing market with a market share of 46.82% in 2025, attributed to the early adoption of advanced healthcare technologies and supportive government policies.

Growing R&D and clinical trials by market players is opening up new application areas for these solutions in the market.

AI and machine learning are being integrated into e-prescribing systems to analyze vast amounts of data, providing insights and recommendations that enhance clinical decision-making. These technologies help identify potential drug interactions, suggest alternative medications, and assist in tailoring prescriptions to individual patient needs.

Mobile-based e-prescribing systems empower patients by providing access to their medication history, reminder notifications for refills, and options to communicate directly with healthcare providers. This shift towards patient-centric solutions is expected to improve medication adherence and health outcomes.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us