Electric Construction Equipment Market Size, Share & Industry Analysis, By Type (Excavators, Loaders, Cranes, Dozers, and Others), By Battery Type (Lithium Ion, Lead Acid, and Others), By Application (Construction, Mining, Material Handling, and Others), and Regional Forecast, 2026–2034

Electric Construction Equipment Market Size

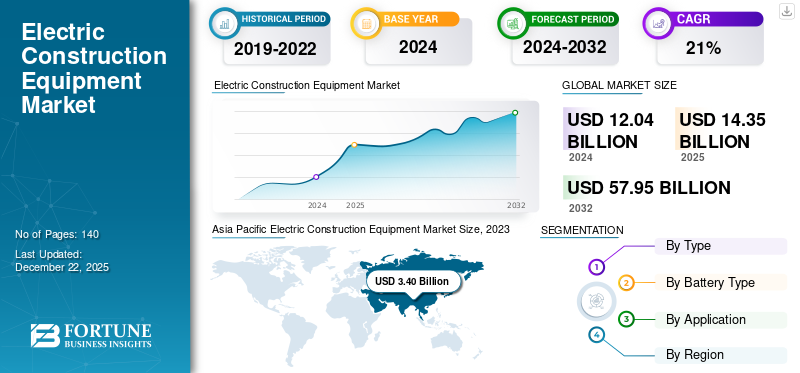

The global electric construction equipment market size was valued at USD 14.35 billion in 2025 and is projected to grow from USD 17.23 billion in 2026 to USD 90.68 billion by 2034, registering a CAGR of 23.10% over the forecast period. Asia Pacific dominated the electric construction equipment market with a market share of 35.40% in 2025.

Electric powered construction equipment refers to machinery powered by electric motors and batteries instead of traditional internal combustion engines such as gasoline or diesel powered. The market includes a wide range of equipment such as excavators, loaders, cranes, dozers, and specialized machinery such as trenchers and compactors which are used in construction, mining, material handling, and various other industrial applications.

The global market for electric construction equipment is experiencing significant growth due to a combination of regulatory, economic, and technological factors. Governments worldwide are enforcing stringent environmental regulations aimed at reducing greenhouse gas emissions and minimizing air pollution, particularly in urban areas. These regulations are compelling construction companies to adopt cleaner technologies, including electric machinery.

The COVID-19 pandemic initially disrupted supply chains and delayed construction projects, impacting the demand for electric powered construction equipment. However, the pandemic also accelerated sustainability trends and heightened interest in green technologies. This would potentially boost the long-term adoption of electric equipment as economies recover and prioritize environmental goals.

Electric Construction Equipment Market Trends

Advancements in Battery Technology is a Significant Trend in Global Market

Over the past few years, there have been notable developments in batteries used to power construction equipment. One of the most significant advancements in battery technology has been the improvement in energy density. Higher energy density allows batteries to store more energy in a smaller, lighter package, which is crucial for construction equipment that requires long operational periods and high power output.

Developments in battery technology have led to faster charging solutions, significantly reducing downtime for electric construction equipment. This has been particularly beneficial for applications where equipment uptime is critical, such as in large-scale construction projects or continuous mining operations. Moreover, modern batteries are designed to be more durable and have a longer lifespan, even under harsh operating conditions.

Advancements in manufacturing processes and economies of scale have led to significant reductions in battery costs. Thus, as the cost of lithium ion batteries continues to decline, electric powered construction equipment is becoming more affordable and competitive with traditional diesel-powered equipment. The advancements in battery technology are a critical trend driving the growth and adoption of electric construction equipment.

Download Free sample to learn more about this report.

Electric Construction Equipment Market Growth Factors

Environmental Regulations and Sustainability Goals to Drive Market Growth

One of the most significant drivers of the electric construction machines market is the increasing stringency of environmental regulations aimed at reducing greenhouse gas emissions and air pollution. Governments globally are implementing policies and standards that limit the use of diesel-powered machinery in favor of cleaner alternatives. These regulations are particularly stringent in urban areas and regions with high pollution levels, where the impact of emissions from construction activities is more pronounced. Compliance with these regulations necessitates the adoption of electric construction machines, which produces zero tailpipe emissions.

Many construction companies and contractors are setting ambitious sustainability goals to reduce their carbon footprints and improve their environmental performance. The shift toward electric powered construction equipment is a key strategy in achieving these goals. Further, many governments and environmental organizations are offering incentives, subsidies, and grants to encourage product adoption. These financial incentives can significantly offset the higher upfront costs of electric machinery, making it more accessible to construction companies. The combination of stringent environmental regulations and the growing emphasis on sustainability goals is driving the electric construction equipment market growth.

RESTRAINING FACTORS

Limited Availability of Charging Infrastructure to Hamper Growth Potential

One of the primary challenges for the electric powered construction machines is the insufficient number of charging stations, especially in remote or less-developed areas where many construction projects take place.

In addition, the cost of installing and maintaining charging infrastructure can be prohibitive. Setting up charging stations, especially fast chargers suitable for heavy construction equipment, requires substantial investment in electrical grid upgrades, transformers, and other supporting infrastructure. For many construction companies, especially smaller firms, these costs can be a significant barrier to adopting electric equipment. The limited charging infrastructure poses a significant restraint on the global electric powered construction equipment market growth.

Addressing these challenges will require substantial investments in infrastructure development, technological advancements in fast charging and mobile solutions, and greater standardization across the industry.

Electric Construction Equipment Market Segmentation Analysis

By Type Analysis

Excavators Segment Dominates Market Due to their Versatility in Construction Activities

Based on type, the market is divided into excavators, dozers, loaders, cranes, and others.

The excavators segment accounting for 39.47% of the global market share in 2026. This dominance can be attributed to their versatility and extensive use in various construction activities, including digging, grading, and demolition. The rising demand for sustainable and efficient construction practices is further driving the adoption of electric excavators.

Loaders also represent a significant segment of the global market. They are widely used for material handling, earthmoving, and loading operations in construction and mining activities. The shift toward electric loaders are majorly driven by their ability to operate in enclosed spaces without emitting harmful fumes, making them ideal for urban construction and indoor applications.

The electric cranes segment is growing steadily as construction projects increasingly prioritize safety and environmental sustainability. The segment held 18% of the market share in 2024. Electric cranes are favored for their precision, quieter operation, and lower maintenance costs compared to traditional diesel-powered cranes.

Electric dozers are gaining traction in the market due to their role in heavy-duty earthmoving and grading applications. The transition to electric dozers is fueled by the need to reduce emissions and operational costs in large-scale construction and mining projects.

The others segment includes a variety of specialized electric construction equipment such as trenchers, compactors, and concrete mixers. This segment is expected to witness moderate growth as the construction industry players explore electric alternatives for various niche applications.

To know how our report can help streamline your business, Speak to Analyst

By Battery Type Analysis

Lithium Ion Segment Leads Global Market Owing to its Superior Properties

On the basis of battery type, the market is subdivided into lead acid, lithium ion, and others.

The lithium ion segment dominated by battery type, holding 72.14% of the market share in 2026. The preference for lithium-ion batteries is driven by their superior energy density, longer lifespan, and faster charging capabilities compared to other battery types.

Lead acid batteries represent a significant electric powered construction equipment market share and is set to exhibit a CAGR of 19.5% during the forecast period. Despite their lower energy density and shorter lifespan compared to lithium-ion batteries, lead acid batteries are still widely used due to their lower cost and established recycling infrastructure. They are commonly found in applications where cost considerations outweigh the need for high performance, such as in smaller or less demanding construction equipment.

The others segment includes alternative battery technologies such as nickel-metal hydride (NiMH), solid-state batteries, and flow batteries. While these battery types currently hold a smaller market share, the segment is expected to grow due to ongoing research and development efforts aimed at improving their performance and cost-effectiveness.

By Application Analysis

Construction Segment Holds Majority Market Share Due to Rising Urbanization

Based on application, the market is categorized into construction, material handling, mining, and others.

The construction segment captured 53.51% of the global market share in 2026. The growing emphasis on sustainable and eco-friendly construction practices is driving the adoption of electric equipment in this segment. Urbanization, infrastructure development, and the implementation of green building standards are key factors contributing to the demand for electric construction machines.

The mining segment is likely to account for a significant share by 12% in 2025, of the electric construction machines market. The shift toward electric mining equipment is driven by the need to reduce carbon emissions and improve energy efficiency in mining operations.

The material handling segment is witnessing steady growth in the electric powered construction equipment market. This segment includes equipment used for lifting, moving, and transporting materials in various industrial and construction settings.

The others segment encompasses a range of specialized applications, including agricultural construction, forestry, and waste management. Although this segment holds a smaller market share compared to construction, mining, and material handling, it is expected to experience moderate growth.

REGIONAL INSIGHTS

By geography, the market report’s scope comprises five major regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South America.

Asia Pacific

Among these five regions, Asia Pacific holds the highest market share and will dominate the market over the forecast period due to increasing investments in infrastructure development and the rising awareness about the environmental benefits of electric equipment. Asia Pacific recorded USD 5.08 billion in 2025. China, being a major manufacturing hub, leads the market in this region with substantial government support and initiatives aimed at reducing carbon emissions. The presence of key manufacturers and the increasing adoption of advanced technologies also contribute to the electric construction equipment market growth. India and Japan are other prominent markets in the region, driven by urbanization and industrialization.

Asia Pacific Electric Construction Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

China holds a significant electric construction equipment market share. The country’s rapid industrialization and urbanization have led to significant infrastructure development, increasing the demand for construction equipment. The Chinese government’s stringent emission regulations and strong support for electric vehicles and equipment are major drivers of market growth. Additionally, China is home to several leading manufacturers of electric powered construction equipment, which enhances the market’s competitive landscape. The government’s focus on reducing carbon footprints and promoting sustainable practices further boosts the adoption of electric construction machines in various sectors, including construction, mining, and material handling. The China market is expected to reach USD 3.17 billion by 2026. The Japan market is projected to reach USD 0.71 billion, and the India market is expected to reach USD 1.15 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America also holds a considerable share of the global market. The region is to be anticipated as the third-largest market with USD 3.30 billion in 2025. The region’s growth is fueled by stringent government regulations on emissions and a strong focus on sustainable construction practices. The U.S. and Canada are the major contributors, with the former being the dominant market. The adoption of electric powered construction equipment in various applications, including construction, mining, and material handling, is rising in the region due to the emphasis on reducing operational costs and enhancing efficiency. The U.S. market is expected to reach USD 2.73 billion by 2026.

Europe

Europe is a significant market for electric construction equipment, driven by the region’s commitment to reducing greenhouse gas emissions and adopting green technologies. The region is anticipated to account for the second-highest market size of USD 4.26 billion in 2025, exhibiting the second-fastest growing CAGR of 21.7% during the forecast period Germany, France, and the U.K. are at the forefront of this transition. The European Union’s regulations and policies to promote electric vehicles and equipment play a crucial role in market growth. The construction sector’s focus on sustainability and the availability of advanced technologies further boost the adoption of electric powered construction equipment in the region. The UK market is expected to reach USD 0.99 billion, while Germany is projected to reach USD 1.75 billion by 2026.

Middle East & Africa

The Middle East & Africa is gradually adopting electric construction equipment, primarily driven by the need to diversify energy sources and reduce dependency on fossil fuels. The region is anticipated to be the fourth-largest region with a value of USD 1.18 billion in 2025. The construction boom in the UAE, Saudi Arabia, and South Africa is creating opportunities for electric equipment. However, the high initial costs and lack of infrastructure for electric charging remain challenges. Government initiatives and international collaborations are expected to support market growth in the coming years. The GCC market size is estimated to be USD 0.74 billion in 2025.

South America

South America is witnessing a steady growth in the market, with Brazil and Argentina being the key markets. The region's focus on sustainable development and the increasing investments in infrastructure projects are driving the demand for electric construction equipment. However, economic instability and limited technological advancements pose challenges to market growth. Nonetheless, international investments and government support for green initiatives are expected to drive the market forward.

KEY INDUSTRY PLAYERS

Key Manufacturers are Committed toward Innovation and Sustainability to Strengthen Industry Position

Key players in the electric powered construction equipment market are characterized by their commitment to innovation and sustainability. They prioritize developing advanced, eco-friendly machinery to reduce carbon emissions and promote green construction practices. These manufacturers often invest heavily in R&D to enhance battery efficiency, durability, and overall performance of electric equipment. Leading companies in this sector also focus on integrating smart technologies for improved operational efficiency and remote monitoring, addressing the evolving demands of the construction industry.

List of Top Electric Construction Equipment Companies:

- Caterpillar Inc. (U.S.)

- Komatsu (Japan)

- AB Volvo (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Deere & Company (U.S.)

- Sany Heavy Industry Co., Ltd. (China)

- JCB (U.K.)

- HD Hyundai Infracore Co., Ltd. (South Korea)

- Kobelco Construction Machinery Co., Ltd. (Japan)

- Liebherr (Switzerland)

- Xuzhou Construction Machinery Group Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Volvo Construction Equipment (Volvo CE) shared plans to introduce the largest electric excavator in Japan, emphasizing the company's commitment to sustainability and innovation in construction machinery. This launch aims to meet the growing demand for eco-friendly equipment in the Japanese construction industry.

- March 2024: Sumitomo Corporation's subsidiary, Sunstate Equipment Co. completed 100% acquisition of Trench Shore Rentals, Inc., a leading U.S. trench safety equipment rental company, with an objective to expand their construction equipment business.

- December 2021: Hitachi developed an electric excavator that can operate for 10 hours on a single charge. The excavator is expected to be a game-changer in the construction industry.

- September 2021: Volvo achieved the target of a 45% reduction in CO2 emissions from their vehicles. The company is heavily investing in electric and hybrid construction equipment.

- March 2021: Caterpillar Inc. launched Cat 794AC, an electric drive articulated truck with improved efficiency and productivity in the construction industry.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Battery Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 90.68 billion by 2034.

In 2025, the market was valued at USD 14.35 billion.

The market is projected to grow at a CAGR of 23.10% during the forecast period.

By type, the excavator segment is leading in terms of market share.

The enforcement of environmental regulations and sustainability goals are the key factors driving the market growth.

Caterpiller Inc., Komatsu, AB Volvo, Hitachi Construction Machinery Co., Ltd., Deere & Company, Sany Heavy Industry Co., Ltd., JCB, HD Hyundai Infracore Co., Ltd., Kobelco Construction Machinery Co., Ltd., Liebherr, and Xuzhou Construction Machinery Group Co., Ltd. are the top players in the market.

Asia Pacific region holds the maximum revenue.

By application, the construction segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us