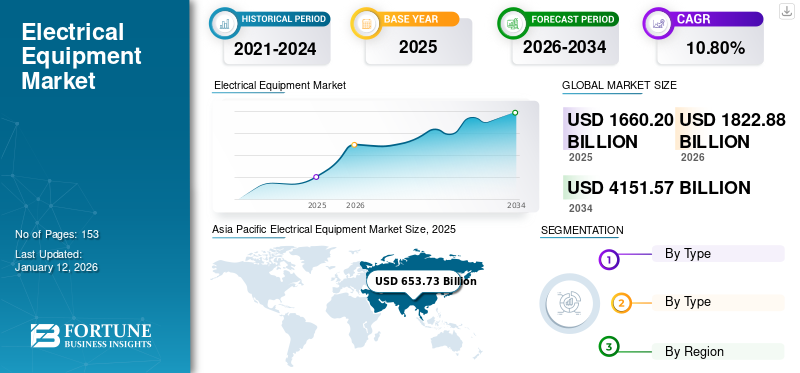

Electrical Equipment Market Size, Share & Industry Analysis, By Type (Electrical Lighting Equipment, Household Appliances, Power Generation, Transmission and Control Equipment, Batteries, and Wires and Cables), By Application (Residential and Non-Residential), and Region Forecast, 2026–2034

Electrical Equipment Market Size

The global electrical equipment market size was valued at USD 1,660.20 billion in 2025. The market is projected to grow from USD 1822.88 billion in 2026 to USD 4151.57 billion by 2034, exhibiting a CAGR of 10.80% during the forecast period. The Asia Pacific dominated the electrical equipment market with a share of 39.40% in 2025.

Electrical equipment is an essential segment of the industrial sector that ingests almost 50% of plant energy, whether in the form of tool applications or large manufacturing facilities. Every pneumatic or advanced electrically driven piece of equipment requires an electric actuation motor for directional movements, which makes electrical equipment a more adopted product in the electrical industry.

With the growing emphasis on the industrial revolution and initiatives such as Industry 4.0, the usage of compressed air has increased significantly. Consumers’ demand for the equipment that offers more technological advancement such as Internet of Things (IoT), real-time monitoring, artificial intelligence, and cost savings. Expansion in industries such as manufacturing, IT, healthcare, and telecommunications increases the need for electrical machinery and equipment. Additionally, increased trade and globalization facilitate the exchange of electric equipment leading to wider market access and increased sales. Moreover, urbanization leads to increased demand for electrical appliances in residential, commercial, and industrial applications.

The COVID-19 pandemic caused major economies worldwide to collapse owing to lockdown situations, a halt in manufacturing, disrupted supply chains, and new variants of the virus causing continuous strains. However, consumers' demand for efficient electric drive solutions in electric vehicles during the pandemic has mitigated some of the impact on the market. Moreover, companies' transitioning from offline sales networks to online shopping platforms and sales sites have generated justifiable revenue from the market.

- For instance, the International Energy Agency (IEA) reported that 2021 sales increased 21% to 2.3 million units in Europe region. In 2020, EU production losses accounted to 4,243,577 units, which represents 22.9% of the total EU production.

Electrical Equipment Market Trends

Regulatory Framework for Energy Efficiency and Uptake of Renewable Energy to Intensify Market Trend

The EV market is expected to grow very rapidly driven by the establishment of a regulatory framework for energy-efficient motors with long life expectancies. Electrical equipment is the primary element that fulfills all the criteria, such as high-efficiency ratio, product purity, reliability, low energy costs, and sustainability for carbon emission-free vehicles. Moreover, global sustainability goals are becoming increasingly stringent, with rising concerns about minimizing carbon emissions and promoting the adoption of renewable energy sources for achieving sustainability targets. These initiatives focus on quickly lowering costs and expanding the global electrical equipment market size during the forecast period.

- For instance, in May 2023, ABB, a leading industrial automation and manufacturing equipment manufacturer, announced the acquisition of Siemens' low voltage motor business NEMA as a decision for business growth strategy and expansion of electric motor range.

Download Free sample to learn more about this report.

Electrical Equipment Market Growth Factors

Increased Concentration on Reducing Operational Expense to Bolster Electric Equipment Demand

Industries nowadays spend about 50% on the energy cost of electrical equipment, whereas maximum expenditure misbalances the operational expense. This condition highlights a gap that can be addressed by the adoption of efficient electric equipment, that incurs minimal operational cost. Another factor driving the adoption of electric equipment in industries is operational efficiency. Users need products that offer cost-effective operation, higher output, less maintenance and easy parts replacement. Many prominent players are focusing on integrating IoT to their equipments providing realtime update on the connected devices for minimal accident and maximum efficiency. This emphasis on efficiency presents an opportunity for market players to capture a major electrical equipment market share in the long term.

- For instance, in July 2023, ABB Inc., a leading technology solution provider, launched its next-generation NEMA motors, offering higher efficiency and reliability even in harsh operating conditions.

RESTRAINING FACTORS

Rising Part Cost and High Sourcing Capex is Hindering the Market Growth

Electrical equipment plays a crucial role in industries, directly impacting productivity on production lines. However, the market faces constraints owing to high assembling costs. Additionally, the material used for electrical equipment manufacturing costs heavily for the capex of manufacturers as the sourcing of raw material and shipping charges rise post-pandemic, leading to a decrease in profit margins. Moreover, rising price competitiveness has led the global demand for electric equipment to a slow, steady path. Many manufacturers are seeking to minimize production to maintain profit margins, which has caused restraint on the market.

- For instance, in August 2023, Mr. Anuj Poddar, MD and CEO of Bajaj Electrical on a financial market interview session has explained the pressure of reduced margins. He stated Bajaj Electrical would be achieving a margin of 10% or even lower owing to pricing pressure of competition across product categories and muted consumer demand.

Electrical Equipment Market Segmentation Analysis

By Type Analysis

Power Generation Segment to Lead owing to Growing Emphasize on Promoting Renewable Energy

Based on type, the market is categorized into electrical lighting equipment, household appliances, power generation, transmission and control equipment, batteries, and wires and cables.

Power generation is likely to hold the highest market share, driven by government policies promoting sustainable power generation and emphasizing the importance of clean energy, accounting for a 37.95% share in 2025. These policies stimulate the market for electrical equipment. Further, many governments across multiple regions are trying to promote renewable energy, energy efficiency, and electrification of rural areas promoting healthy market growth for transmission and control equipment.

Additionally, rising consumer preferences for advance energy saving appliance has expanded the potential demand for household appliance in near term. Also, OEM emphasis on integrating IoT and AI has raised the demand for smart household appliance that can easily be command from anywhere and from any device. Furthermore, continuous innovation in equipment, such as smart meters, smart player grids, energy-efficient appliances, and automation systems, drives demand for electric equipment such as batteries, electrical lighting equipment, and household appliances. Manufactures are continuously and extensively engaged in making substantial investments to develop and manufacture efficient and durable products such as LED lights and other wire cables for efficient electricity transmission.

- For instance, in December 2023, the Association of Home Appliance Manufacturing (AHAM) applauded the U.S. Department of Energy Conservation Standards for making energy-efficient applications of refrigerators and freezers. The standards were introduced to allow home appliance manufacturers to develop more energy-efficient electrical equipment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Dominant Non-Residential Application for Power Need to Bolster Heavy Electrical Equipment Demand

Based on application, the electrical equipment market is bifurcated into residential and non-residential.

The non-residential segment is expected to hold a major share of the market due to the widespread use of heavy electrical equipment such as power generation impeller motors, transformers, and other commercial electrical devices for the generation, transmission, and control of electricity, accounting for a 67.35% share in 2025. Moreover, the pandemic has changed user's lifestyles and hobbies fostering trends such as co-working spaces and the growing need for connected devices and better wifi and network infrastructure in commercial complexes, bolsters the electrical equipment market growth. Additionally, advancements in handheld equipment and modern mobility solutions have gradually expanded the share of residential applications in the long term.

- For instance, in January 2023, a U.S.-based electric motor manufacturer, Infintum, launched its new Aircore mobility, an axial flux and traction motor. The motor is equipped with lighter core material as a PCB stator, which is being replaced with a traditional heavy copper wound stator.

REGIONAL INSIGHTS

By geography, the market is studied across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Asia Pacific Electrical Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Global market is forecasted to grow at a CAGR of 11.7% owing to the increased population in urban tier 1 cities, which spurs commercial construction projects, proving vital for market growth. Infrastructure projects, such as smart cities, transportation networks, and renewable energy systems installation, boost the demand for electric equipment. Furthermore, expansion in industries such as manufacturing, IT, healthcare, and telecommunications is increasing the need for electrical machinery and equipment. Additionally, increased trade and globalization are facilitating the exchange of electric equipment, leading to wider market access and boosting sales.

Asia Pacific

The Asia Pacific region is a dominant market with the highest share, firmly establishing itself as the manufacturing center of the world, as numerous global companies actively invest in the region and set up manufacturing facilities across developing economies such as India. In 2025, the regional market size reached USD 653.73 billion. China is witnessing the highest growth and share in the Asia Pacific owing to its dominance facilities and manufacturing presence. Rest of Asia Pacific and Japan are already being prominent electric component exporters and India is emerging as a manufacturing powerhouse. The Japan market is projected to reach USD 92.29 billion by 2026, the China market is projected to reach USD 453.27 billion by 2026, and the India market is projected to reach USD 76.99 billion by 2026.

North America

North America is likely to grow progressively as the region boasts a strong ecosystem of research institutions, startups, and established companies driving innovation in electric equipment. Breakthroughs in battery technology, electric vehicle design, and renewable energy generation are making electric equipment more efficient, affordable, and attractive to consumers. The U.S. market is projected to reach USD 430.46 billion by 2026.

Europe

Europe is predicted to grow steadily owing to developed countries across the region being widely regarded as hubs for innovation in renewable energy, electric vehicles, and smart grid technologies. The U.K. and Germany are identified as the two driving engines with decisive market shares in the region. These two countries are expected to play a pivotal role in shaping an optimistic scenario for the market over the forecast period. The UK market is projected to reach USD 112.63 billion by 2026, while the Germany market is projected to reach USD 126.31 billion by 2026.

Middle East & Africa

The Middle East & Africa market will experience slow growth and hold a lesser share in the global market pie. The import-based structure and limited scope of market development outside GCC countries are the main factors limiting current market projections and growth over the forecast period.

Niche opportunities for the development of manufacturing industries, limited presence of global market players in the region, and an underdeveloped distribution channel are factors in Latin America that have led to sluggish growth in the region over the forecast period.

KEY INDUSTRY PLAYERS

Increased Focus on Raising Profit Margins is Driving Heavy Investments

Leading players operating in global markets have identified the supply gap for electric motors in the European region, which requires adherence to more advanced European IE4 standards. Furthermore, foreign entities are investing majorly in market penetration through acquisition strategies, expanding their consumer base and product reach. Key players in the market have been investing heavily in research and development programs aimed at maximizing the operational performance of electric motor drive and industrial electrification systems.

- For instance, in May 2022, G&W Electric, a global supplier of electric power equipment, has announced the completion of a strategic USD 3.6 million investment. This investment will enhance sales and technologies capability through its power suite platform, thereby expanding its market share in energy storage optimization services.

List of Top Electrical Equipment Companies:

- ABB (Switzerland)

- Legrand (France)

- Schneider Electric (France)

- GENERAL ELECTRIC COMPANY (U.S.)

- Hitachi Group (Japan)

- Samsung Corporation (South Korea)

- Siemens AG (Germany)

- Panasonic Holdings Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Havells India Limited (India)

KEY INDUSTRY DEVELOPMENTS:

- March 2022: ABB launched its new range of highly efficient IE5+ SynRM motors, offering more ultra premium energy efficiency. The motors are designed for industrial applications such as mining, paper pulp, and metal industry.

- April 2023: Havells, a prominent leader in electric equipment technology introduced an innovative Solid State Circuit Breaker (SSCB) for their switchgear segment in collaboration with Swedish start-up Blixt.

- May 2023: Siemens, global technology leader in electrification and automation acquired Mass Tech Control’s EV division to expand the eMobility product range for the Indian market.

- July 2023: Electrified Automation, a prominent electric motor & components manufacturer, launched its new motor series EA-193 permanent magnet electric motors. These motors’ usp is balance design offering weight performance for longer life and operational performance.

- July 2023: Schneider electric, announced the launch of 3 Phase modular UPS designed to provide critical loads, offering third party live swap functionality, available in 50-250 KW.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Application, and Region |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 4,151.57 billion by 2034.

In 2025, the market was valued at 1,660.20 billion.

The market is projected to grow at a CAGR of 10.80% during the forecast period.

By type, power generation segment captures the highest market share and lead the market.

Increased concentration on technological advancements is a key factor bolstering market growth.

ABB, Legrand, Schneider Electric, GENERAL ELECTRIC COMPANY, Hitachi Group, Samsung Corporation, Siemens AG, Panasonic Holdings Corporation, Robert Bosch GmbH, Havells India Limited are the top players in the market.

The Asia Pacific dominated the electrical equipment market with a share of 39.40% in 2025.

Non residential application segment is expected to hold a major share during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us