Electrolyzers Market Size, Share & Industry Analysis, By Type (PEM Electrolyzer, Traditional Alkaline Electrolyzer, and Others), By Application (Power Plants, Steel Plant, Electronics and Photovoltaics, Industrial Gases, Energy Storage or Fueling for FCEV, Power to Gas, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

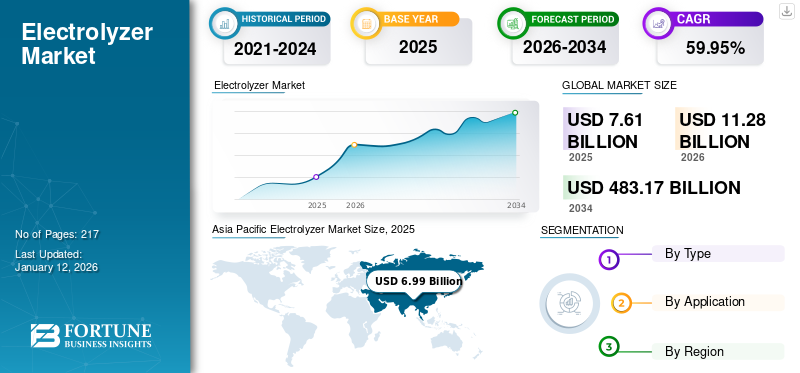

The global electrolyzers market size was valued at USD 7.61 billion in 2025. It is projected to be worth USD 11.28 billion in 2026 and reach USD 483.17 billion by 2034, exhibiting a CAGR of 59.95% during the forecast period. Asia Pacific dominated the electrolyzers market with a market share of 93.40% in 2025.

The market growth is fueled by rising green hydrogen demand, supportive clean energy policies, and increasing fuel cell vehicle adoption. Technological advancements in electrolyzers, strategic collaborations, and growing investments in Asia Pacific’s power generation further drive expansion across industrial and mobility sectors.

The market is undergoing considerable expansion, fueled by the rising need for clean energy options and the international movement toward decarbonization. Electrolyzers play a crucial role in generating green hydrogen by separating water into hydrogen and oxygen through the use of electricity derived from renewable resources.

With nations globally pledging to reduce carbon emissions, there is an increasing transition toward renewable energy sources. Green hydrogen, generated through electrolyzers fueled by renewable energy, is becoming an essential element in reaching these decarbonization objectives.

Additional key companies in the market include Air Liquide S.A., Air Products and Chemicals Inc., ITM Power plc, Linde plc, McPhy Energy S.A., Siemens AG, Titanium Tantalum Products Limited, and Toshiba Corporation.

MARKET DYNAMICS

ELECTROLYZERS MARKET GROWTH FACTORS

Growing Demand for Green Hydrogen to Accelerate Market Growth

As industries and governments worldwide focus on reducing carbon emissions, the demand for green hydrogen produced through electrolysis using renewable energy continues to rise. This shift is crucial for achieving climate goals and transitioning to cleaner energy sources. Numerous governments are establishing supportive measures, including subsidies and tax breaks, to encourage clean energy technologies, such as hydrogen generation. This regulatory assistance is crucial for speeding up the uptake of electrolyzers.

The rising adoption of hydrogen in industries such as chemicals, refining, and steel production is boosting the need for electrolyzers as crucial instruments for hydrogen generation. Sectors are progressively acknowledging the importance of electrolyzers in their strategies for decarbonization.

Electrolyzers are additionally being employed for energy storage, allowing the transformation of surplus renewable energy into hydrogen, which can subsequently be stored and utilized later. This feature improves grid stability and reliability, further aiding market expansion.

In October 2024, AM Green secured the largest electrolyzer order in India with John Cockerill Hydrogen for one of the globe's largest green ammonia initiatives.

In August 2024, AM Green reached a Final Investment Decision (FID) for this initial million-ton green ammonia venture that will utilize 1.3 GW of electrolyzers. John Cockerill Hydrogen is set to provide sophisticated pressurized alkaline electrolyzers featuring a capacity of 640 MW in phase 1, ensuring economical green hydrogen production due to continuous renewable energy generated from a mix of wind and solar power, complemented by pumped hydro storage.

Increasing Industrial Applications to Drive Market Growth

Industries such as steel, chemicals, and transportation are increasingly focusing on decarbonization to meet carbon neutrality targets. The shift toward green hydrogen, produced via electrolyzers, is becoming a preferred solution for these sectors. As companies strive to align with environmental, social, and governance (ESG) goals, the adoption of electrolyzers is expected to rise sharply.

The need for hydrogen-powered automobiles and fuel-cell electric vehicles (FCEVs) is rising. With manufacturers pouring resources into hydrogen infrastructure and favorable regulations being put in place, the transportation industry is anticipated to experience considerable expansion in the utilization of electrolyzers.

In June 2023, Ohmium International (“Ohmium”), a leading green hydrogen company that designs, manufactures, and deploys advanced Proton Exchange Membrane (PEM) electrolyzers, announced that its India-based subsidiary has been selected as the PEM electrolyzer partner of NTPC Renewable Energy Limited (REL), the renewable energy subsidiary of NTPC, India’s largest power utility with more than 70 gigawatts (GW) installed generation capacity. The agreement is valid for a period of two years, through to May 2025. This green hydrogen opportunity is the largest-ever PEM electrolyzer deal in India and one of the largest globally.

Ohmium’s patented electrolyzers are expected to be deployed in up to 400 megawatts (MW) of projects across a diverse range of industrial and commercial applications, including ammonia, transportation, and power, among others. Ohmium’s technology is expected to help NTPC deploy 5 GW of renewable energy for green hydrogen and ammonia production (forming part of NTPC’s ambitious goal to deliver 60 GW of renewable energy capacity by 2032). The company’s interlocking modular electrolyzers provide a dense and dynamic solution that integrates with renewable energy resources and produces green hydrogen at a very competitive cost.

ELECTROLYZERS MARKET RESTRAINTS

Competition from Alternative Hydrogen Production Methods to Restrain Market Growth

Biomass gasification is receiving increased interest as a potential substitute for hydrogen generation. It can attain high efficiencies and reduce energy needs compared to water electrolysis. As this technology develops, it could pose a significant threat to the electrolyzers market growth.

Continuous advancements in thermochemical processes and solar-driven hydrogen production techniques are improving their effectiveness and lowering expenses. Such progress may render these options more competitive with electrolyzers, especially as they grow in scalability and commercial feasibility.

The absence of infrastructure for distributing and storing hydrogen makes the adoption of electrolyzers more challenging. In contrast, alternative techniques such as SMR take advantage of current fossil fuel infrastructure, whereas electrolyzers necessitate fresh investments in renewable energy sources and hydrogen infrastructure to operate effectively on a large scale.

In conclusion, although electrolyzers provide an eco-friendly approach to generating green hydrogen, competition from well-established fossil fuel-based methods, progress in alternative technologies, economic considerations, regulatory landscapes, and infrastructure obstacles greatly limit their potential for market growth. Tackling these competitive challenges will be essential for the future development of the electrolyzers market.

ELECTROLYZERS MARKET OPPORTUNITIES

Expansion of Hydrogen Infrastructure to Create Opportunity for Market Growth

The combination of electrolyzers with renewable energy sources such as solar and wind is crucial for establishing a sustainable hydrogen economy.

As the capacity for renewable energy grows, electrolyzers have the ability to transform surplus electricity into hydrogen, offering a means for energy storage and balancing the grid. This collaboration improves the feasibility of both renewable energy and electrolyzer technologies.

The development of hydrogen infrastructure, such as storage facilities, distribution networks, and refueling stations, is essential for facilitating the broad adoption of electrolyzers. The increasing awareness of hydrogen's potential as a clean fuel option is leading to investments in these infrastructures, which, in turn, boosts the demand for electrolyzers.

In October 2024, GreenH Electrolysis, a partnership between H2B2 Electrolysis Technologies and GR Promoter Group, officially launched its inaugural 1 MW Proton Exchange Membrane (PEM) electrolyzer at its production facility located in Jhajjar, Haryana. The 1 MW PEM electrolyzer is planned to be set up at the hydrogen production and refueling site in Jind, Haryana, aiding India’s initial hydrogen-powered train as part of the Indian Railways’ “Hydrogen for Heritage” program.

This electrolyzer is designed to function continuously, generating approximately 430 kg of hydrogen daily at a delivery pressure of 40 bar (g), conforming to ISO 14687 specifications for fuel cell applications. The Jind station will additionally include a 3,000 kg hydrogen storage unit, a hydrogen compressor, and two dispensers with integrated pre-coolers, facilitating effective refueling.

ELECTROLYZERS MARKET CHALLENGES

High Initial Cost to Create Challenge for Market Growth

The lack of a well-developed infrastructure for hydrogen storage, transportation, and distribution creates obstacles to the commercialization of hydrogen produced by electrolyzers. Hydrogen generated electrolytically needs a strong infrastructure that includes storage, transportation, and distribution systems to effectively reach end-users.

The restricted supply of Platinum Group Metals (PGM) presents a challenge as the electrolyzer market grows. Platinum, titanium, and iridium serve as essential materials in Proton Exchange Membrane (PEM) electrolysis. With the expansion of the market and its pursuit of greater scalability, the restricted supply of PGMs creates a challenge.

Download Free sample to learn more about this report.

ELECTROLYZERS MARKET TRENDS

Emerging Applications in Aviation and Maritime Sectors Contribute to Market Growth

Hydrogen can serve as a fuel in adapted gas-turbine engines or be transformed into electrical energy through fuel cells. Airbus views hydrogen as a promising technology for decarbonization and intends to introduce a low-carbon commercial aircraft by 2035. ZeroAvia's hydrogen-electric powertrain combines fuel cell and electric motor technologies to develop an aircraft engine that enhances operating economics while preserving the environment.

Hydrogen can be utilized to produce e-fuels, which are created solely from renewable energy sources. Sustainable Aviation Fuel (SAF) may be generated via a Power-to-Liquid (PTL) method, which depends on green hydrogen generated through electrolysis.

Next Hydrogen Solutions Inc. (Next Hydrogen), is working with Pratt and Whitney Canada to showcase electrolyzers for the aviation sector as part of the INSAT program. Pratt and Whitney Canada plans to demonstrate hydrogen combustion technology on a PW127XT regional turboprop engine within the framework of the Hydrogen Advanced Design Engine Study (HyADES) project.

IMPACT OF COVID-19

The COVID-19 pandemic led to extensive disruptions in supply chains, impacting the accessibility of essential components required for electrolyzer manufacturing. This caused setbacks in production and distribution, hindering the overall growth of the market.

The renewable energy/clean energy sources witnessed growth in the installations but faced multiple challenges, such as labor challenges, various rules and regulations of different countries.

ELECTROLYZERS MARKET SEGMENTATION ANALYSIS

By Type

Traditional Alkaline Electrolyzer Dominates Market Due to Its Affordability, Extended Operational Life, and Adaptability

The market is segmented into PEM electrolyzer, traditional alkaline electrolyzer, and others based on type.

The traditional alkaline electrolyzer is the dominating segment in the market share of 91.93% in 2026. The traditional alkaline electrolyzer sector remains a leading part of the market because of its affordability, extended operational life, adaptability, and well-established technological foundation. As worldwide initiatives to shift toward sustainable energy solutions become more pronounced, the need for alkaline electrolyzers is projected to increase considerably, reinforcing their significance in the hydrogen economy.

The PEM electrolyzer is the second-dominant segment in the market. Recent advancements in PEM technology have increased efficiency, lowered expenses, and boosted performance. Developments such as novel catalysts and enhanced membranes render PEM electrolyzers more appealing for business and industrial uses, promoting their implementation across different industries.

To know how our report can help streamline your business, Speak to Analyst

By Application

Power Plants Segment Leads Owing to Increasing Demand for Sustainable and Renewable Sources of Electricity

The market is divided into power plants, steel plant, electronics and photovoltaics, industrial gases, energy storage or fueling for FCEV, power to gas, and others, based on application.

The power plants is dominating and one of the fastest-growing segment in the market, contributing 24.73% globally in 2026. Ongoing advancements in electrolyzer technology improve efficiency and lower costs, rendering them increasingly feasible for incorporation into power generation systems. These improvements enable power plants to take advantage of surplus renewable energy for hydrogen production, aiding in grid stability and energy management.

Energy storage or fueling for FCEVs is also one of the significant segments in the market. Substantial investments are being made in hydrogen infrastructure worldwide, comprising production plants and distribution systems that aid in utilizing hydrogen as a means of energy storage. The advancement of this infrastructure is essential for enabling the extensive implementation of electrolyzers.

REGIONAL INSIGHTS

The electrolyzers market has been studied geographically across five main regions: North America, Europe, Asia Pacific, and the rest of the world.

North America

Asia Pacific Electrolyzer Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Demand for Hydrogen Gas in Manufacturing and Power Industries to Drive Market Growth

Both the U.S. and Canada have set ambitious objectives for lowering greenhouse gas emissions, identifying hydrogen as a crucial element in reaching these targets. The emphasis on clean energy and decarbonization is driving investments in electrolyzer technology, which is necessary for generating green hydrogen from renewable resources.

There has been a significant rise in investments focused on advancing hydrogen infrastructure throughout North America. This encompasses financial support for initiatives that combine electrolyzers with renewable energy sources, enabling the creation and distribution of green hydrogen.

The increasing requirement for green hydrogen in multiple industries such as manufacturing, transportation (fuel cell electric vehicles), and power generation is propelling the market. As companies seek sustainable options to replace fossil fuels, the demand for effective hydrogen production technologies grows even more vital.

The expansion of the North American electrolyzers market is driven by significant funding from major companies setting up new manufacturing facilities, encouraging governmental regulations, and a rising need for green hydrogen globally.

In April 2024, (“EH2”), a producer of sophisticated, industrial-level hydrogen electrolyzer technology, revealed the site of its initial factory in Devens, Massachusetts. The company has secured a newly built 187,000 ft2 space and is currently recruiting production team members. The Devens factory will possess an annual production capacity of 1. 2GW with the fabrication of EH2’s 100MW green hydrogen electrolyzers starting in Q1 2024.

U.S.

Adoption of Electrolyzers for Refinery Hydro-processing to Drive Market Growth in the U.S.

The use of electrolyzers for hydro-processing in refineries is aiding the expansion of the electrolyzers market share in the U. S. Refineries face mounting pressure to adhere to environmental regulations designed to decrease greenhouse gas emissions. Electrolyzers provide a solution by allowing refineries to generate green hydrogen when energized by renewable energy, assisting them in fulfilling strict regulatory demands and decarbonization plans. This lessens the carbon footprint of the hydrogen supply and minimizes the total emissions related to fuel production. The U.S. market is expected to reach USD 0.44 billion by 2026.

Europe

Major Investments in Hydrogen Infrastructure, such as Refueling Stations and Pipelines, Foster Market Growth

Significant investments in hydrogen infrastructure are occurring throughout Europe, encompassing refueling stations and pipelines. This infrastructure expansion is crucial for facilitating the extensive adoption of electrolyzers and applications of green hydrogen. Germany is currently the dominant player in the European electrolyzers market, followed by France and the U.K. The country’s strong industrial base and commitment to renewable energy make it a key driver of electrolyzer adoption. The UK market is estimated to reach USD 0.05 billion by 2026, and the Germany market is anticipated to reach USD 0.1 billion by 2026.

In October 2024, Danish renewables developer European Energy formally inaugurated its initial green hydrogen facility located close to Esbjerg, signifying its first foray into extensive hydrogen production utilizing renewable energy. Following the finishing of the construction in June 2024 and the start-up phase, the facility is now functioning with the initial electrolyzer provided by the Danish company Stiesdal, European Energy announced on October 28. The company has already made plans to enhance the facility with two electrolyzers, with the next one anticipated to be set up in 2025.

Asia Pacific

Growing Popularity of Fuel Cell Vehicles and Increased Focus on Decarbonization and Lowering Greenhouse Gas Emissions to Drive Market Growth

The Asia Pacific region is among the biggest consumers of hydrogen worldwide, especially for industrial uses such as ammonia and methanol manufacturing. Nations such as China and India are at the forefront of hydrogen usage, which stimulates the need for electrolyzers to generate low-carbon hydrogen.

The growing acceptance of Fuel Cell Electric Vehicles (FCEVs) is driving the demand for electrolyzers. As additional automakers put their resources into hydrogen fuel cell technology, the necessity for effective hydrogen production systems becomes essential. Major firms in the area are forming partnerships, collaborations, and joint ventures to improve their expertise in electrolyzer technology and increase their market presence. This cooperative strategy promotes innovation and speeds up market expansion. The Japan market is forecast to reach USD 0.01 billion by 2026 and the India market is likely to reach USD 0.03 billion by 2026.

In February 2024, Toshiba Energy Systems and Solutions Corporation ("Toshiba") and Bekaert formed a global alliance that encompasses a strategic cooperation agreement and a manufacturing technology license for Membrane Electrode Assemblies (MEA), an essential element for Proton Exchange Membrane (PEM) electrolyzers, which will assist in speeding up progress toward green hydrogen production. This agreement solidifies the recent partnership to utilize the technological, manufacturing, and commercial capabilities of both companies since the signing of a Memorandum of Understanding (MoU) in September 2023.

China

Explosive Growth in Power-to-Gas Demand to Drive Market Growth

The explosive growth in power-to-gas demand is a significant factor driving the growth of the Chinese market. The Chinese energy regulator requires new renewable energy construction to develop matching energy storage solutions, and power-to-gas is a favored option. This emphasis on renewable-plus-storage is a key driver for green hydrogen development. Power-to-gas projects utilize electrolyzers to convert excess renewable energy into hydrogen. This helps integrate fluctuating renewable energy sources such as wind and solar power into the energy system. China market is set to reach USD 10.51 billion by 2026.

Rest of the World

Continuous Innovations in Electrolyzer Technology to Fuel Market Growth

Countries in the region, such as Latin America, are starting to utilize their plentiful renewable resources (such as solar and wind) to generate green hydrogen, establishing themselves as prospective leaders in the hydrogen economy. Industries in developing markets are progressively utilizing hydrogen as a clean energy resource for processes, including ammonia production, refining, and transportation. This industrial requirement is propelling investments in electrolyzer technology to satisfy particular hydrogen demands.

Numerous countries in Latin America and the Middle East & Africa are adopting favorable policies and initiatives to encourage hydrogen production and usage. These consist of subsidies, grants, and regulatory frameworks designed to enhance the growth of hydrogen infrastructure.

In December 2024, Colombian oil and gas company Ecopetrol declared it would invest USD 28.5 million in a new green hydrogen plant at its Cartagena refinery. The firm states that the facility will be the largest in Latin America when it begins operations in 2026, even though it will have merely 5MW of electrolysis capacity.

In November 2022, Masdar, the UAE's leading clean energy organization, along with its consortium partners, Infinity Power Holding and Hassan Allam Utilities, declared that they have entered into a framework agreement with prominent Egyptian state-supported entities concerning the advancement of a 2 gigawatt (GW) green hydrogen initiative in the Suez Canal Economic Zone (SCZONE).

The Masdar-led consortium executed two Memorandums of Understanding (MoUs) in April 2022 with Egyptian organizations pertaining to the establishment of two green hydrogen production facilities in the nation, one located in the SCZONE and the other along the Mediterranean. The consortium aims for an electrolyzer capacity of 4 gigawatts (GW) by 2030, with a production goal of as much as 480,000 tons of green hydrogen annually.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market is Consolidated Major Players Operating with Technological Expertise

The global market is mostly consolidated, with key players operating in the industry. Globally, Siemens, Nel Hydrogen, LONGi and Asahi Kasei are some of the major players. Siemens has expertise in the hydrogen value chain. It provides electrolyzers such as PEM, and also offers service agreements such as basic maintenance to premium service with advanced data analysis, which can be tailored to client's requirements.

For instance, in 2024, the HGHH consortium, comprising Hamburger Energiewerke and Luxcara, has given Siemens Energy the task of installing the electrolyzer units. Siemens will provide six units of its latest electrolyzer product, which together form the 100 MW electrolyzer.

LIST OF KEY COMPANIES IN ELECTROLYZERS MARKET

- Nel Hydrogen (Norway)

- Asahi Kasei (Japan)

- Accelera (U.S.)

- Shandong Saikesaisi Hydrogen Energy Co., Ltd. (China)

- Teledyne Energy Systems (U.S.)

- Siemens Energy (Germany)

- LONGi (China)

- Green Hydrogen Systems (Denmark)

- Next Hydrogen (Canada)

- H-Tec Systems (Germany)

- Plug Power Inc (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Nel Hydrogen US, which is a subsidiary of Nel ASA, obtained a purchase order worth about USD 7 million for two containerized PEM electrolyzer units. These two MC500 electrolyzers, each having a capacity of 2.5 megawatts, are meant for hydrogen production at an upcoming steel mill in the U.S.

- October 2024: Accelera by Cummins, the zero-emissions division of Cummins Inc., marked the inauguration of its latest electrolyzer manufacturing facility in Guadalajara, Castilla-La Mancha, Spain. The eco-friendly plant is anticipated to generate 150 highly skilled positions in the area, with the possibility of expanding to 200 jobs as production increases. It will assist in advancing the development, production, and uptake of zero-emission technology in Spain and Europe.

- September 2024: The Japanese technology firm Asahi Kasei entered into a Memorandum of Understanding (MOU) with De Nora, an Italian multinational corporation recognized for its leadership in sustainable technologies, as well as a producer of electrolyzer cells, small-scale electrolyzers, and various components needed for the green hydrogen production process via water electrolysis. The MOU pertains to the collaborative development, investigation, assessment, and marketing of small-scale pressurized alkaline water electrolyzers.

- September 2024: The Hamburg Green Hydrogen Hub (HGHH) is developing a green hydrogen electrolysis facility with a capacity of 100 MW at the previous Moorburg coal site. Siemens Energy will provide and set up six electrolyzer units for this hub. Construction is set to commence in 2025, with complete operation anticipated by 2027, generating 10,000 tons of green hydrogen each year. The agreement encompasses a maintenance contract for 10 years. The stacks of the electrolyzer will be produced at Siemens Energy’s newly established gigafactory in Berlin and will be assembled in Mühlheim and another location in Europe.

- May 2024: Avium, a company specializing in alkaline electrolysis and backed by Tallgrass, has been awarded a USD 5 million grant from the Department of Energy (DOE) for three years. This funding from the DOE will expedite the commercialization of durable and dependable alkaline electrolyzers by integrating Avium’s established low-cost, high-efficiency catalysts with stacks engineered to accommodate Avium’s elevated hydrogen production capacities.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The rising shift toward hydrogen production and government support is resulting in increased investment. For instance, in January 2025, India dedicated a budget of around USD 513.7 million to support the manufacturing capacity of up to 3GW per year of electrolyzers through two tender rounds of 1.5 GW each. Government representatives verified that the USD 255.48 million allocated for the second round of 2024 was the remaining amount after the first round. The USD 510.96 million budget for electrolyzers constituted approximately one-fifth of the USD 2,272.16 million, which New Delhi has allocated for its "national green hydrogen mission.”

REPORT COVERAGE

The global electrolyzers market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering electrolyzers. Besides, it offers insights into market trends and technology developers and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 59.95% from 2026 to 2034 |

|

Unit |

Volume (MW), Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 7.61 billion in 2025.

The market is likely to grow at a CAGR of 59.95% during the forecast period of 2026-2034.

The traditional alkaline electrolyzer segment is expected to lead the market during the forecast period.

The market size of Asia Pacific stood at USD 6.99 billion in 2025.

The growing demand for green hydrogen is projected to accelerate market growth.

Nel Hydrogen, Asahi Kasei, LONGi, and Next Hydrogen, among others, are some of the market's top players.

The global market size is expected to record a valuation of USD 483.17 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us