Embedded Analytics Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (SMEs and Large Enterprises), By Application (ERP/CRM, Supply Chain Management, Sales and Marketing, Logistics and Delivery, and Others), By End-user (IT & Telecommunications, Retail and Consumer Goods, BFSI, Manufacturing, Healthcare, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

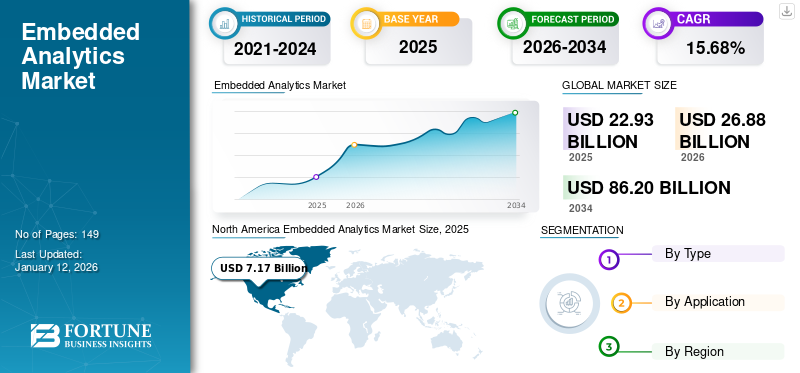

The global embedded analytics market size was valued at USD 22.93 billion in 2025. The market is projected to grow from USD 26.88 billion in 2026 to USD 86.2 billion by 2034, exhibiting a CAGR of 15.68% during the forecast period. North America dominated the global market with a share of 31.26% in 2025.

Embedded analytics refers to the incorporation of data visualizations and analytical competencies into any other software application. It offers actual-time dashboards and reports permitting the user to analyze the data within the software through such platforms. These solutions allow enterprises to build better analytical experiences for their customers, add revenue streams through upsell prospects, and focus on resources to enrich core solutions.

As most enterprises and organizations make use of large amounts of data, they are progressively adopting embedded data analytics in their solutions and services. For instance,

- According to a Sisense Survey of Business Leaders 2022, enterprises anticipate embedded analytics to upsurge up to 4% growth in their business margins, with a predictable median overall business influence of USD 500,000 to USD 1 million from the rise in operational efficiencies and revenue.

Download Free sample to learn more about this report.

COVID-19 IMPACT

Rise in Push to Digital Transformations During Pandemic Propelled Market Development

The COVID-19 pandemic augmented the digital transformation across various business sectors. The shift to online interactions among employees, customers, and supply chains increased digitization plans over the years. Also, to recover the losses companies faced during the pandemic and avoid the mistakes they made, it became necessary for the firms to analyze every piece of data created by the company and design for a better future. Imparting data and analytics into workflow operations is one of the ways that can bring various benefits to the organization’s business growth. Hence, it is necessary for them to integrate analytics in all possible functions of the business and recognize every necessity customer needs.

Thus, adopting these solutions helps businesses to adapt to the digital-first world, personalize the customer's data, securely share information with suppliers and partners, save resources and time when needed most, and augment business development. Hence, key market players advanced their solutions with partnerships, collaborations, and new launches during the pandemic. For instance,

- In June 2020, Tricentis extended the SAP alliance to help customers accomplish faster SAP releases. The company helped enterprises use SAP solutions anywhere they are in their operations to the intelligent enterprise, from upgrading ERP solutions to combining solutions and shifting to SAP S/4HANA.

Thus, the faster push to digitalization propelled the embedded analytics market growth during the pandemic.

Embedded Analytics Market Trends

Implementation of AI and ML Algorithms in Analytics to Enhance Market Progress

Artificial Intelligence (AI) and Machine Learning (ML) algorithms are used to automate various prospects of such analytics, including data analysis, data preparation, and other visualization functions. Applications of analytics powered by AI and ML implementation are minimizing the workforce it takes in any enterprise to analyze and manage data.

These algorithms help to uplift user interactions with data management and analytics by helping to generate or deliver data fabric proficiencies, smart organization data catalogues, self-service data preparation, AI-driven data cleansing, and many more. They help in automation, optimization, and future predictions. Hence, organizations have started demanding more from AI-powered systems, and AI will progress even more to becoming a more scalable and responsible technology. Hence, various market players are enhancing their offerings with advanced mechanisms, such as machine learning and artificial intelligence. For instance,

- In October 2023, Zuar announced an alliance with ThoughtSpot to modernize AI-driven analytics. Zuar and ThoughtSpot help joint customers eliminate the barriers that enterprises face while delivering an up-to-date data experience. The partnership helps users resolve problems with data by unifying embedded analytics and a data-wrangling platform with the AI-powered search experience solution of ThoughtSpot.

Such advancements with the use of AI and machine learning capabilities enhance the market progress.

Embedded Analytics Market Growth Factors

Rising Demand for Customized Analytics Solutions to Drive Market Growth

Enterprises are required to develop customized operator interfaces that transform beyond the framed graphs to make data reachable and actionable for consumers. Hence, to keep up with the pace of rising diversity in data consumers, these embedded applications have grown more interactive and polished.

Customized analytics solutions allow businesses to tailor them to their specific requirements. They help enterprises choose to display data from their own internal and external sources or unification of both. These solutions enable them to set the dimensions and metrics as per their business necessities, allowing them to focus on information relevant to their business.

Customized visualizations help businesses choose from the best and communicate their insights. Also, if the data is not consistent, up-to-date, and accurate, it can harm the complete business value, strategy, and success opportunities. For instance,

- According to industry experts, poor-quality data can cause enterprises and organizations approximately USD 12.9 million losses every year.

Hence, the demand for and usage of customized analytics embedded tools and platforms is increasing in the market.

RESTRAINING FACTORS

Lack of Skilled Professionals Can Limit Embedded Analytics’ Capabilities, Hampering Market Progress

Implementing and working with such analytics would require skilled individuals with expertise in software development, data analysis, and visualizations. Shortages of qualified data analysts and data scientists can hinder the adoption of such solutions, especially across small- and medium-sized enterprises.

Users can be hesitant to adapt to new tools and work operations, particularly if they are unfamiliar and are not equipped with data analysis concepts. It can impact the business operations that work heavily on data operations. Poor user experience can lead to lower adoption rates of these analytic tools and would also impact the investment value in the market.

Without skilled professionals to develop and configure these solutions, the functionalities of these solutions may be limited. It can lead to dissatisfaction and frustration, further restraining the adoption of these solutions.

Such situations would cause organizations to struggle to find skilled professionals to manage and implement such analytics, resulting in delays in project timelines. It certainly would slow down the pace of innovation and limit the potential of these tools, eventually impacting the user experience.

Embedded Analytics Market Segmentation Analysis

By Deployment Analysis

Real-time Reporting and Analysis Upsurges the Cloud Segment Growth

Based on deployment, the market is segmented into cloud and on-premise.

The cloud segment holds the highest embedded analytics market share of 63.52% in 2026 and is anticipated to grow with a leading CAGR during the forecast period. The increasing demand for real-time data insights across various industries drives the demand for cloud-based solutions in the market. Major players are focusing on advancing their cloud-driven offerings with a keen emphasis on user experience and integration competencies. For instance,

- In October 2023, SAP released the S/4HANA Cloud, a private cloud edition. The new system is of intelligence support and navigates the business, making use of embedded analytics, prediction, simulation, and decision support to operate live businesses.

On-premise deployment provides enterprises with control over their data, assuring that it remains within their firewalls and is subject to their internal security policies. As it is particularly important for organizations to secure their sensitive data or compliance necessities, various organizations and enterprises also prefer on-premise deployment.

By Enterprise Type Analysis

Business Tailored Features of Embedded Analytics Platform to Increase Adoption Among SMEs

By enterprise type, the market is bifurcated into SMEs (Small And Medium-sized Enterprises) and large enterprises.

The SMEs segment is estimated to grow with the highest CAGR during the study period. As these analytics solutions offer benefits, such as customization as per enterprise demands and help to increase operational proficiency, the adoption of such analytics solutions is increasing. It also enables improved collaboration and integration of these tools in their existing applications. Various market players are introducing new solutions for the promotion of such solutions among SMEs. For instance,

- In April 2022, ICICI Bank announced the launch of a new digital ecosystem for small, medium-sized, and micro enterprises, including users of other banks. It is fortified with high-tech technology and embedded analytics; the new type of InstaBIZ application offers various reminders based on the consumer profile.

The large enterprises segment accounts for the highest revenue share of 56.34% in 2026. As large enterprises have to deal with higher volumes of data, these types of enterprises prefer the usage and implementation of such solutions. It provides large enterprises with deeper insights into their large amounts of data. Also, it helps to optimize such large sets of data with enhanced democratization and better data accessibility for better decision-making.

By Application Analysis

Accurate and Precise Data-driven Insights for Supply Chain Management Fuels Segment Growth

The various applications of the market include ERP/CRM, supply chain management, sales and marketing, logistics and delivery, and others (production planning and performance management).

The supply chain management segment accounted for the maximum market revenue share of 33.99% in 2026. Using these analytics solutions in the supply chain helps users to combine all of their previous order data with an actual-time market study to build a better and more precise demand prediction, much more effectively than human supply chain planners. More perfect demand forecasting means enterprises can avoid overspending on procurement and save costs while still attaining the customers' demands. For instance,

- In June 2023, GEODIS, in partnership with Yellowfin, announced the launch of a SaaS-embedded analytics tool for supply chain analytics. The new tool provides customers of GEODIS in the Americas across various business units, such as retail, e-commerce, transportation, customs brokerage, and warehousing.

The ERP/CRM segment is estimated to grow with the highest CAGR during the forecast period. The seamless integration of data analysis tools within the ERP platform helps businesses derive better insights and make improved data-driven decisions in the context of their daily functionalities. Thereby augmenting the adoption of these solutions in ERP and Customer Relationship Management (CRM) solutions.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Higher Usage of Embedded Analytics in IT and Telecom Sector to Boost Segment Growth

Based on end-user, the market is segmented into IT & telecommunications, retail and consumer goods, BFSI, manufacturing, healthcare, and others (government and security).

The IT and telecommunications segment accounted for the largest market share of 27.29% in 2026. IT analytics links the opening between insights, data, and accomplishment; thus, IT firms achieve the most out of it and make use of it to their benefit and stay competitive in the market. It helps telecom firms understand their customers in a better way by studying their usage of various services, billing preferences, purchase history, location data, and more. Thus, the usage of such analytics is more, thereby driving market growth.

As per Fortune Business Insights, the retail and consumer goods segment is anticipated to grow with a leading CAGR during the forecast period. In the retail industry, these solutions play a key role in determining essential insights associated with sales, customers, operations, and inventory. Thus, helping them create better strategies for their sales and marketing activities.

REGIONAL INSIGHTS

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Embedded Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 7.17 billion in 2025 and USD 8.28 billion in 2026. The region holds prominence in advanced technologies and solutions, such as ERP, CRM, or other advanced technologies, such as NLP, artificial intelligence, machine learning, and many others. The U.S. has a larger presence of key market players, such as Tableau Software LLC, Oracle, Microsoft, and Qlik, contributing to the progress of the region’s market share. The U.S. market is projected to reach USD 5.9 billion by 2026. For instance,

- According to an industry expert’s survey, the U.S. accounts for the highest percentage, i.e. 30% of enterprises with a preference to use such analytics in their business operations.

Also, the region has the maximum number of investors, with investments, partnerships, and collaborations in the region. For instance,

- In June 2023, MicroStrategy expanded its partnership with Microsoft to incorporate enhanced analytics capabilities of MicroStrategy with Azure OpenAI service to support businesses in harnessing the complete potential of their data.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

According to Fortune Business Insights’ analysis, Asia Pacific is estimated to progress with a leading CAGR during the forecast period. The rising technological investments across various countries of the region, such as India, Singapore, Japan, and others, is contributing to the region's market progress. Various players are forming alliances and collaborations to introduce such analytics across different applications, such as predictive analysis, supply chain management, BFSI, and many more. The Japan market is projected to reach USD 1.41 billion by 2026, the China market is projected to reach USD 2.13 billion by 2026, and the India market is projected to reach USD 1 billion by 2026. For instance,

- In September 2022, ThoughtSpot announced an investment of USD 150 million in India to empower innovation for the modern data stack. The company also plans to extend its operations in the coming five years to boost product competencies and partner incorporations to support every company in gaining a competitive advantage in the data decade.

Europe

The market is growing rapidly in Europe due to new emerging start-ups and small enterprises focusing on digital technologies. The major technologies adopted by European countries include big data and analytics, advanced robotics, and the Internet of Things. Countries, such as Germany, France, and the U.K. are focusing on advancements in ERP platforms, artificial intelligence, and machine learning attributes to the region’s market growth. The UK market is projected to reach USD 1.48 billion by 2026, and the Germany market is projected to reach USD 1.98 billion by 2026.

Middle East & Africa and South America

Various factors, such as the adoption of new technologies and the development of the economy in the Middle East & Africa and South America, led to the development of such analytics solutions in the market. Furthermore, SMEs in these regions are transforming their business operations by embracing digitization. Also, key players, such as SAP, Oracle, and Microsoft, are expanding their business in the MEA region for more business opportunities. For instance,

- According to industry experts, 60% to 80% of ERP revenue across GCC countries is occupied by Microsoft, SAP, and Oracle. Also, the financial sector and government sectors are prominent users of ERP solutions in the region.

Key Industry Players

Growing Emphasis on Worldwide Expansion to Strengthen Market Players’ Business Position

Key players are profound in incorporating new mechanisms across various sectors, such as BFSI, manufacturing, retail, healthcare, IT and Telecom, and others. Modernization of platforms with high-tech mechanisms is one of the extensive approaches that players have been adopting. Likewise, key players purposefully collaborate and form partnerships for expansion into different geographies.

List of Top Embedded Analytics Companies:

- TABLEAU SOFTWARE, LLC (U.S.)

- Qlik (U.S.)

- Reveal (U.S.)

- Toucan (France)

- Oracle (U.S.)

- SAP (Germany)

- MICROSTRATEGY INCORPORATED (U.S.)

- IBM (U.S.)

- Looker (Google) (U.S.)

- Microsoft (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2023: Syspro announced the launch of SYSPRO 8, the ERP software with new features. The product strengthens its predictive capabilities with enhancements to the SYSPRO Embedded Analytics. Its other features include seamless automation, improved warehouse functionality, and enhanced quality control.

- October 2023: Oracle Netsuite announced new upgrades for Netsuite Analytics Warehouse, targeting to offer customers better actionable data insights. The updates enrich the user experience with various features, including embedded analytics within dashboards, frequent data revives, improved financial data analysis, and enhanced consumer access management.

- March 2023: Yellowbrick, in collaboration with Panintelligence, announced a plan to accelerate and streamline embedded analytics for SaaS-based applications. The alliance aims to support the usage of these analytics in a data warehouse over both on-premises and cloud SaaS environments.

- April 2022: Tableau introduced new capabilities to allow developers to extend, embed, and tailor analytics on any project as per their requirements. The embedded analytics proficiencies of Tableau permit data developers to embed analytical experiences into their solutions and applications to enable their customers and users with data-powered insights.

- March 2022: Infragistics announced the launch of the Reveal embedded analytics platform. The modernized architecture streamlines the integration, management, and operations of analytics. It allows users to connect anytime, anywhere, from on-premise devices, desktop or mobile devices or through.

REPORT COVERAGE

The report provides a broad range of analysis of the market and highlights essential aspects such as top market players, product portfolios, and emerging high-tech mechanisms in the market. Moreover, it provides insights into the latest market developments and essential industry expansions. Furthermore, the report unifies various dynamics that have contributed to the market progress in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.68% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 86.2 billion by 2034.

In 2025, the market was valued at USD 22.93 billion.

The market is projected to grow at a CAGR of 15.68% during the forecast period.

Based on end-user, the IT & telecommunications segment captured the highest share in terms of revenue in 2025.

Rising demand for customized analytics solutions to drive market growth.

SAP, Oracle, Reveal, Tableau, and Microsoft, among others, are the top players in the market.

North America dominated the global market with a share of 31.26% in 2025.

By application, the ERP/CRM segment is expected to grow with a leading CAGR during the studied period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us