Energy Efficient Motor Market Size, Share & Industry Analysis, By Efficiency Level (IE1 (Standard Efficiency), IE2 (High Efficiency), IE3 (Premium Efficiency), and IE4 (Super Premium Efficiency)), By Product Type (AC Motor and DC Motor), By Application (Pumps, Fans, Compressor, Refrigeration, Material Handling, Material Processing, and Others), By End-User (Residential, Commercial, Industrial, Agriculture, Transportation, and Others), and Regional Forecast, 2026-2034

Energy Efficient Motor Market Size and Future Outlook

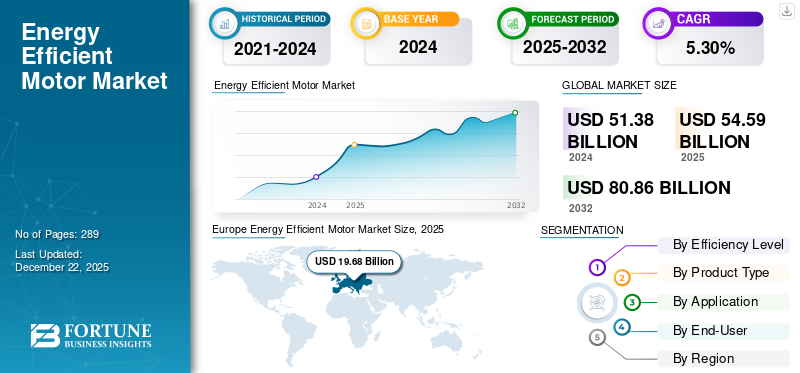

The global energy-efficient motor market size was valued at USD 54.6 billion in 2025 and is projected to grow from USD 57.94 billion in 2026 to USD 87.58 billion by 2034, growing at a CAGR of 5.30% during the forecast period. Europe dominated the energy-efficient motor market with a market share of 36.04% in 2025.

Energy efficient motors play a crucial role in reducing energy consumption, operating & maintenance costs, and reducing greenhouse gas emissions that contribute toward sustainability. The advancements in consumer & power electronics, microprocessors, microcontrollers, electric drive systems, and Digital Signal Processors (DSPs) have led to an increase in energy efficient motor market share in recent years. A significant rise in the energy demand owing to fluctuating prices of conventional fuels and uncertainties in the oil supply is anticipated to boost the demand for these motors in the coming years.

Further, the advancements in these motor designs with the use of a longer core, lower-loss silicon steel, thinner laminations, and thicker wires to reduce resistance are quite popular. Additionally, the smaller air gap between the stator & rotor, the use of copper instead of aluminum bars in the rotors, and superior bearings are expected to drive the energy efficient motor market opportunities in the coming years.

The key companies involved in this type of motor manufacturing are actively working to enhance the motor efficiency. Texas Instruments (TI) is focusing on energy-efficient motor designs, particularly through the use of Gallium Nitride (GaN) technology in its DRV7308 Intelligent Power Module (IPM). In June 2024, the company launched the industry's first 650 V three-phase GaN Intelligent Power Module (IPM) designed for 250 W motor drive applications to address issues during the manufacturing of high-voltage motors for major home appliances and HVAC systems.

MARKET DYNAMICS

MARKET DRIVERS

Increased Energy Efficiency and Sustainability Initiatives Drive Market Growth

Corporate sustainability goals play a crucial role in driving the adoption of energy-efficient motors. Businesses and industrial sectors across the globe are increasingly recognizing the importance of sustainable practices. They are setting ambitious targets to reduce their environmental impact and improve their overall sustainability performance. The energy efficient motors consume less energy, and they reduce the amount of carbon dioxide & other gases released into the atmosphere, offering sustainability. For instance, in October 2024, the new research conducted by ABB stated that nearly all businesses (94%) are investing or planning to invest in sustainability, with a particular emphasis on energy efficiency. Most businesses are aware of the crucial role played by energy efficient motors that can add value to their products & businesses.

Additionally, in June 2022, the energy efficient motors in Türkiye helped small & medium-sized enterprises achieve sustainability goals. According to the inventory conducted in Türkiye associated with electric motors, the industrial sector accounts for around 46% of net electricity consumption, and 70% comes from electric motor-driven systems, the majority of which are inefficient.

Cost-Saving Ability of the Motor to Propel Market Growth

Energy-efficient motors consume less electricity as compared to standard motors, leading to a considerable reduction in energy bills. Over time, the lower operational costs can offset the initial higher investment in energy-efficient technology. This is particularly important for industries with high energy demands, where even small efficiency improvements can transform into significant financial savings.

The revised regulation for more efficient motors in the EU is expected to increase annual energy savings from 46 TWh in 2020 to 106 TWh by 2030, which is equivalent to the electricity consumption of the Netherlands. This will avoid 40 million tons of CO2 emissions annually and reduce energy bills by approximately USD 21.65 billion per year, leading to a reduction in greenhouse gas emissions.

Additionally, energy-efficient motors also have a longer lifespan and require less maintenance, further reducing costs associated with repairs and downtime. The overall reduction in operating expenses enhances profitability, making energy-efficient motors a better option for businesses aiming to improve their bottom line while also benefiting from the environmental advantages of reduced energy consumption.

MARKET RESTRAINTS

Lack of Government Mandates in Many Countries Restrains Market Growth

Governments of the U.S., China, the European Union, and many other high-economic nations have formulated regulations for the compulsory adoption of motors with energy efficiency. These efforts have been taken to reduce carbon emissions by lowering the consumption of electricity.

Many countries in Africa, Asia-Pacific, and South America still do not have any regulations mandating the efficiency levels for electric motors. The lack of government regulations pose a significant challenge to the energy-efficient motor market. Without regulatory requirements or incentives to encourage the use of these motors, businesses and consumers may prioritize short-term cost savings over long-term energy efficiency benefits. This results in a continued reliance on less efficient motor technologies, leading to higher energy consumption, increased greenhouse gas emissions, and higher operating costs, further limiting the energy efficient motor market expansion.

MARKET OPPORTUNITIES

Advancements in Material Design & Technologies Drive Energy Efficient Motor Market Development

The use of advanced materials and integration of smart technologies such as Artificial Intelligence (AI) and Variable Frequency Drives (VFDs) lowers the energy consumption and cost of overall motors. For instance, the development of higher efficiency class motors, namely IE4, which represents super premium efficiency, and IE5, which indicates ultra-premium efficiency, is becoming quite popular. In addition, the advancements in materials with the use of lower-loss silicon steel reduce core losses.

The use of thicker wires and thinner laminations minimizes the resistance losses and lowers the eddy current losses. Replacing aluminum bars present in the rotor with copper bars offers excellent connectivity & reduces losses. Furthermore, improved winding design lowers copper losses, which is a major factor leading to electrical inefficiency. For instance, concentrated windings, also known as tooth coil windings, comprise positioning the winding coils directly around the stator teeth.

MARKET CHALLENGES

Lack of Awareness Poses Significant Challenges for Emerging Industry Players

The lack of awareness among end-users regarding the adoption of energy-efficient motors and their long-term benefits, which lead to energy savings, hinders market expansion. The high upfront cost deters businesses that prioritize immediate saving over long-term efficiency goals. The standardization of energy-efficient motors can assist in overcoming these challenges by disseminating and promoting energy efficiency technologies, providing definitions and measurements of performance, and establishing minimum energy performance requirements. For instance, IEC has formed the Advisory Committee on Energy Efficiency (ACEE) to help IEC technical committees in adopting energy efficient solutions in their standardization activity in order to boost energy efficient technologies through their standards.

ENERGY EFFICIENT MOTOR MARKET TRENDS

Growing Demand from Industrial Sector Drives the Energy Efficient Motor Market Trends

The industrial sector is boosting the demand for energy efficient motors as industries aim to enhance efficiency, lower operating expenses, and adhere to environmental regulations. Electric motors are commonly utilized in industrial machines and equipment for functions such as pumping, compressing, and handling materials. As automation and Industry 4.0 technologies progress, there is an increasing demand for these motors that can drive smart and interconnected manufacturing systems.

Numerous nations in this area have established policies and regulations to increase energy efficiency, lower carbon emissions, and shift toward cleaner technologies. Stringent energy efficiency standards are set by governments in various regions, often mandating minimum efficiency levels for motors in specific applications. Labeling programs highlight energy efficient motors, encouraging consumers to choose more efficient options.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

A global emergency such as the coronavirus or COVID-19 pandemic has significantly restricted various industrial operations across the globe. The result of this crisis has also left the economies of various fast-growing countries in turmoil.

COVID-19 had a negative impact on the energy-efficient motor market as it hampered consumption in many end-use industries due to supply chain disruption of services, technology, and hindrance in activities due to social distancing norms.

However, as countries start to recover from the pandemic, the demand for electric motor technology has increased, which could lead to a rebound in the market. Additionally, the demand for industrial use is expected to increase in the coming years, providing opportunities for growth in the market.

SEGMENTATION ANALYSIS

By Efficiency Level

IE3 (Premium Efficiency) Dominates the Market Due to Its Growing Adoption

Based on energy efficiency, the market is segmented into IE1, IE2, IE3, and IE4.

The IE3 (Premium Efficiency) class motors are anticipated to dominate a major share of the global energy efficiency market, owing to the stringent regulations being set across geographies for the adoption of more and more efficient motors in a variety of applications. The IE3 motors feature enhanced motor design and advanced-quality materials. These materials reduce energy loss during operation. IE3 motors are majorly used in applications where energy savings and environmental impact are crucial. IE3 motors usually offer efficiency ratings of about 89-92%, compared to IE2 motors at 85-89%. These motors can endure harsh operational environments and feature durable materials that enhance reliability and longevity. The segment is likely to attain 53.41% of the market share in 2025.

The IE2 segment is forecasted to record a significant CAGR of 4.88% during the forecast period (2025-2032).

By Product Type

AC Motor Dominates Owing to Its Increasing Applications in HVAC Industry

Based on product type, the market is bifurcated into AC motor and DC motor.

The AC motor is the most dominating and fastest-growing segment compared to DC motors, owing to its wider application across various industries, including HVAC systems, pumps, fans, and compressors. Moreover, the compatibility of AC motors with AC power grids, which is prevalent in most countries worldwide, has resulted in increased installation. The segment is predicted to hold 70.54% of the market share in 2026.

DC motors have a low market share owing to their limited use. They are mostly suitable for applications where speed adjustment is crucial, such as conveyor systems, cranes, and machine tools. The ability to vary speed efficiently and accurately enhances productivity and operational efficiency in these applications. This segment is likely to exhibit a considerable CAGR of 5.14% during the forecast period (2025-2032).

By Application

Pump Segment Dominates Owing to Its Use in Power Generation and Wastewater Management Industry

Based on application, the market is divided into pumps, fans, compressor, refrigeration, material handling, material processing, and others.

The pumps segment holds the dominant share of the market due to its growing requirement in industries such as water and wastewater management, oil and gas, chemicals, power generation, agriculture, and others. North American companies are increasingly prioritizing pumps with high-efficiency motors to minimize electricity usage and comply with environmental regulations. IE (International Efficiency) ratings are used to measure motor efficiency, with higher IE numbers indicating greater efficiency. The segment is poised to attain 23.05% of the market share in 2026.

Similarly, in Europe, the pumps are largely used in water supply systems, industrial processes, HVAC systems, wastewater treatment plants, and cooling systems. In these applications, the aim is to move fluids while minimizing energy consumption by utilizing a motor designed to operate with high efficiency. High-efficiency motors classified as IE3 are often preferred for pump applications due to their superior energy performance.

The material processing segment is estimated to expand with a substantial CAGR of 5.27% during the forecast period (2025-2032).

By End-User

Industrial Segment Leads as Energy Efficient Motors are Highly Used in Machine Tools, Fans, Compressors, and Other Applications

Based on end-user, the market is categorized into residential, commercial, industrial, agriculture, transportation, and others.

The industrial sector holds the largest energy efficient motor market share due to the high demand for pumps, compressors, fans, machine tools, and other equipment in industries such as oil and gas, chemicals, manufacturing facilities, and others. Also, in North America, industrial machinery depends significantly on electric motors for a range of uses, including conveyor systems, pumps, compressors, and manufacturing devices. As industries evolve and adopt automation, the need for effective and dependable electric motors in the industrial sector keeps increasing. The segment gained 45.14% of the market share in 2026.

In Asia Pacific, the prominence of the industrial sector, owing to the manufacturing & industrial capabilities of China, India, and Japan, along with other emerging economies, is particularly high. Thus, the demand and prevalence of these motors in the industrial segment are high in the Asia Pacific region.

To know how our report can help streamline your business, Speak to Analyst

ENERGY EFFICIENT MOTOR MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America

Technological Advancements in Energy Efficient Motors Drive Market Growth

North America is the second largest market poised to hold USD 18.74 billion in 2026, exhibiting a CAGR of 6.22% during the forecast period (2025-2032). North America's energy efficient motor market is projected to observe significant growth over the forecast period. Government programs significantly contribute to the expansion of the market. For example, the U.S. government is encouraging energy-saving solutions and minimizing GHG (Greenhouse Gas) emissions, anticipated to enhance the expansion of the energy-efficient motor market in the area. Moreover, the U.S. Department of Energy (DOE) is striving to enhance energy efficiency, which is anticipated to boost the demand for energy-efficient motors in the region.

Europe Energy Efficient Motor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Technological developments are also aiding the expansion of the energy efficient motor market in North America. Businesses in the area are investing into research and development to create advanced electric motor technologies that provide enhanced efficiency, performance, and reliability. For instance, improvements in motor design, materials, and manufacturing techniques are allowing the creation of smaller, lighter, and more energy-efficient electric motors suitable for various applications in different industries.

U.S.

Growing Focus on Energy Savings Drives Demand in the Country

The energy efficient motor market in the U.S. is observing growth owing to the increasing focus on energy savings, financial benefits, and regulatory efforts encouraging technologies & innovation. A major factor contributing to the increased demand for energy-efficient motors is the rising awareness among businesses and consumers about the environmental effects of energy usage. Sectors are actively pursuing methods to diminish their carbon footprint and improve their sustainability goals. These motors assist in reducing energy loss via enhanced design and innovative technologies.

Moreover, strict regulations and standards established by governmental organizations have been crucial in driving the need for energy-efficient motors. The U.S. government, understanding the significance of energy savings, has launched programs that promote the use of energy-efficient technologies in various sectors. The Department of Energy (DOE) has placed minimum efficiency standards for motors used in industrial applications. These regulations aim to enhance performance and reduce energy consumption, thereby promoting the adoption of products across various industries. The U.S. market is likely to reach USD 17.15 billion in 2026.

Europe

Clean Energy Initiatives and Growing Focus on Renewable Energy Integration Drive Market Demand

Europe dominated the market with a valuation of USD 19.68 billion in 2025 and USD 20.76 billion in 2026. Europe is anticipated to dominate the global energy efficient motor market share. Currently, Germany, the U.K., and Italy, among others, are key countries contributing substantially to the energy efficient motor market in the region. The U.K. market continues to expand, estimated to reach a market value of USD 4.45 billion in 2026. The France market is anticipated to reach USD 2.64 billion in 2025.

The European Union (EU) has established ambitious goals for decreasing carbon emissions and advancing renewable energy sources in line with its pledge to tackle climate change. To accomplish these objectives, the EU has enacted regulations and directives designed to enhance energy efficiency and minimize the environmental effects of industrial operations. For instance, the EU's Energy Efficiency Directive requires member states to adopt measures aimed at enhancing energy efficiency, such as using energy-efficient electric motors in industrial settings.

In Europe, the primary factors propelling the extensive uptake of energy-efficient motors include stringent regulations imposed by the European Union (EU) that require minimum efficiency standards for motors, along with financial incentives for companies to invest in more efficient models, environmental concerns, and rising energy prices. This has resulted in a notable movement toward superior efficiency classifications such as IE3 and now IE4 for larger motors, especially in industrial & commercial settings.

Germany

Growing Adoption of Energy Efficiency Solutions in Industrial Settings

In Germany, the Federal Office for Economic Affairs and Climate Action (BAFA) undertakes various efforts to promote energy efficiency. Initiatives such as the Immediate Climate Action Programme and National Action Plan on Energy Efficiency (NAPE) are driving the adoption of energy efficient solutions in the country. NAPE promotes the use of energy-efficient motors by incorporating measures to encourage the transition to high-efficiency motors via incentives and regulations. It aims to lower energy use across industries by fostering the adoption of more efficient motor technologies. Germany is likely to gain USD 4.94 billion in 2026.

Germany, being one of the prominent countries in Europe focusing on energy efficient solutions, is anticipated to highly support the adoption of IE3 and IE4 level of energy efficient motors.

Asia Pacific

Rapid Industrialization Boosts Market Growth

Asia Pacific is the third largest market anticipated to be worth USD 13.21 billion in 2026. In Asia Pacific, the key factors responsible for the growth of energy efficient motors include rapid industrialization and urbanization, increasing demand for energy-efficient solutions due to rising energy costs, supportive government policies promoting sustainability, significant manufacturing capacity within the region, and a growing focus on reducing carbon footprint across industries.

Many countries in Asia Pacific have implemented policies such as Minimum Energy Performance Standards (MEPS) and incentives to encourage the adoption of energy-efficient motors. Asia Pacific houses a large manufacturing base, facilitating the production and distribution of energy-efficient motors at scale.

Sectors such as manufacturing, construction, infrastructure development, and transportation heavily rely on electric motors, driving demand for energy-efficient options. Growing awareness about climate change and the need to reduce carbon emissions is pushing businesses to adopt more sustainable technologies such as energy-efficient motors. India is likely to hold USD 1.09 billion in 2026, while Japan is foreseen to grow with a value of USD 2.45 billion in the same year.

China’s large manufacturing base, strong government support for energy efficiency initiatives, and significant investments in infrastructure development are supporting the energy efficient motor market growth. Similarly, rapid urbanization, the growing industrial sector, and the focus on renewable energy integration in India are creating demand for energy-efficient motors. The Chinese market is expected to reach a valuation of USD 7.32 billion in 2026.

Latin America

Rise in Demand for Energy Efficiency Standards to Boost Energy Efficient Motors’ Demand

Latin America is the fourth leading region expected to be valued at USD 3.91 billion in 2026. In Latin America, the growing adoption of energy efficient motors is primarily driven by increasing industrialization, government policies promoting energy efficiency standards, rising energy costs, a focus on sustainability, and the need to reduce carbon emissions, especially in major economies such as Brazil, Mexico, and others, with the potential for further growth as more countries implement Minimum Energy Performance Standards (MEPS) for motors.

Implementation of mandatory energy efficiency standards for motors by various Latin American governments is pushing manufacturers to produce more efficient models. Growing focus on environmental protection and reducing greenhouse gas emissions, drives demand for more sustainable industrial practices, including energy efficient motors.

Rapid industrial development across the region created a large market for motors in numerous sectors. However, the upfront cost of these types of motors can be higher compared to standard motors, which stands as a barrier for some businesses. Thus, IE2 (High Efficiency) level motors are observed to dominate the Latin America market landscape, other than IE3 (Premium Efficiency) and IE4 (Super Premium Efficiency) level motors.

Middle East & Africa

Rising Focus on Sustainability Drives Market Growth

The increasing focus on energy efficiency and sustainability is a key driver of the energy efficient motor market in the Middle East & Africa. As sectors aim to lower their carbon emissions and energy usage, the need for energy-saving motors is increasing. Joint initiative to substitute outdated motors with modern, energy-efficient options, the current movement toward energy efficiency, along with governmental policies designed to decrease energy use and encourage green technologies, is anticipated to boost the demand for these motors across multiple applications.

The rising implementation of industrial automation and robotics is another significant factor propelling the market, as motors play a central role in numerous automated systems, including conveyor belts, robotic arms, and machinery on assembly lines. With sectors such as manufacturing, logistics, and packaging adopting automation to enhance efficiency and lower labor expenses, the need for energy efficient motors is increasing. The incorporation of electric motors into robotic systems allows for improved precision, quicker performance, and enhanced energy efficiency, aiding in the overall market expansion. The GC market is projected to stand at USD 0.98 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Product Advancements Present Significant Growth Opportunities for the Market Players

The global energy efficient motor market is characterized by intense competition driven by rapid industrialization, technological innovations, and strategic initiatives worldwide. Major players including Johnson Electric, GE, ABB, Crompton, Siemens, and others, are competing through advanced predictive maintenance technologies, comprehensive service portfolios, and AI-driven solutions.

For instance, in May 2024, ABB Ltd. introduced an AMXE250 motor specially made for electric buses, which works together with the HES580 inverter to provide increased efficiency and sustainable transportation solutions. The motor additionally provides high torque density for enhanced dynamic performance, along with a quieter operation for improved passenger comfort.

List of Key Energy Efficient Motor Companies Profiled:

- Johnson Electric (Hong Kong)

- GE (U.S.)

- ABB (Switzerland)

- Crompton (India)

- Siemens (Germany)

- Rockwell Automation (U.S.)

- Toshiba (Japan)

- Kirloskar (India)

- Mitsubishi (Japan)

- Havells (India)

- Nidec Corporation (Japan)

- Regal Rexnord (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2025: Nidec Corporation introduced the PrecisionFlow™ motor, an extremely efficient Electronically Commutated Motor (ECM) that delivers up to 85 percent efficiency. It enhances performance by as much as 30 percent compared to standard PSC motors.

- May 2024: Nidec Corporation announced the signing of a memorandum of understanding with Taiwan’s Metal Industries Research & Development Centre for cooperation in the technological advancement, production, implementation, etc., of high-efficiency motor system-related products.

- April 2024: ABB India has unveiled IEC Low Voltage IE4 cast iron super premium efficiency motors in 71-132 frame sizes and IE3 Aluminum Motors in 71 – 90 frame sizes for reliable and energy efficient solutions in India. The adaptable design of these motors enables usage in various applications, including pumps and conveyors, among others. These two motors will enable customers to save energy, cut costs, lower emissions, and enhance reliability and productivity.

- September 2023: Regal Rexnord Corporation announced that it has entered into a definitive agreement to sell the Industrial Motors and Generators businesses that comprise the majority of its industrial systems segment to WEG through certain subsidiaries of WEG S.A. for a total consideration of USD 400 million.

- March 2021: Siemens introduced Simotics SD, a motor series that offers efficiency class Super Premium Efficiency (IE4) and helps users achieve enduring efficiency benchmarks, conserve energy, decrease operational expenses, and minimize CO2 emissions. The standard model of Simotics SD is available in the Efficiency class IE4 throughout the full power range from 2.2 to 1,000 kW, with options for 2, 4, and 6 poles starting at 75 kW and 8 poles starting at 55 kW.

Investment Analysis and Opportunities

- In December 2024, the U.S. Department of Energy (DOE) invested $17M in 14 projects to support critical minerals supply chain. The projects focuses manufacturing high-impact components and technologies, including magnets for high-efficiency motors.

- In April 2024, ABB India unveiled its cutting-edge IEC Low Voltage IE4 cast iron super premium efficiency motors in 71-132 frame sizes and IE3 Aluminum Motors in 71 – 90 frame sizes for reliable and energy-efficient solutions in India. The company aims to strengthen its dedication to the "Make in India" initiative and promote self-sufficiency by launching two new motor series. These motors are manufactured in India and are aimed at distributing customers globally.

REPORT COVERAGE

The global energy efficient motor market report provides a detailed market analysis. It focuses on key market aspects such as major market players, leading types, and applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Efficiency Level

By Product Type

By Application

By End-user

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 54.6 billion in 2025.

The market is likely to grow at a CAGR of 5.30% over the forecast period (2025-2032).

Based on application, the industrial segment is expected to lead the market.

Europe's energy efficient motor market size was valued at USD 19.68 billion in 2025.

Growing focus on sustainability initiatives and clean energy transitions is driving market growth.

Some of the top players in the market are Johnson Electric, GE, ABB, Crompton, Siemens, Rockwell Automation, and others.

The global market size is expected to reach USD 87.58 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us