Energy Transition Market Size, Share & Industry Analysis, By Type (Renewable Energy, Electrification, Energy Efficiency, and Others), By Sector (Power & Utility, Transportation, and Others), and Regional Forecast, 2024-2032

Energy Transition Market Size

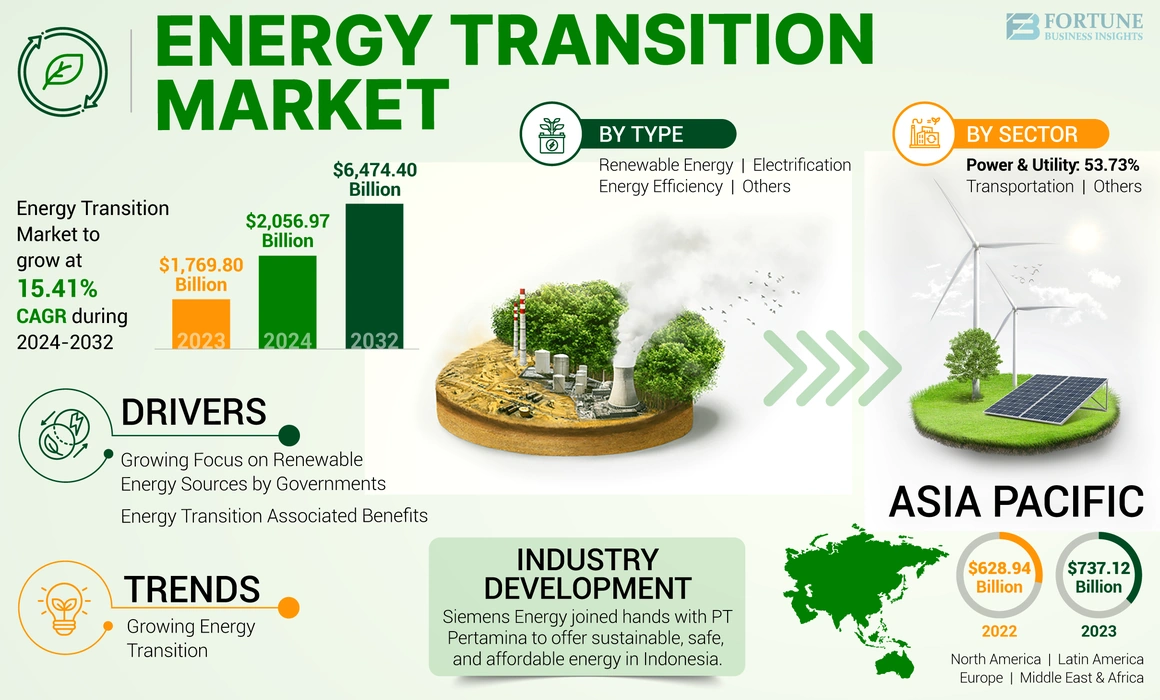

The global energy transition market size was valued at USD 2,056.87 billion in 2024. The market is projected to grow from USD 2,384.50 billion in 2025 to USD 6,474.40 billion by 2032, exhibiting a CAGR of 15.34% during the forecast period.

Energy transition denotes the global efforts of shifting from fossil fuel-based energy sources to the adoption or implementation of low-carbon and renewable energy sources. It involves essential amendments in energy production, distribution, and consumption. The key aspects of energy transition include addressing climate change, lowering greenhouse gas emissions, improving energy security, and supporting sustainable development.

The COVID-19 pandemic restricted global business potential and posed numerous challenges. It caused significant disruption in global energy demand and affected energy-related projects and development. However, the investment efforts in renewable energy sources and electrification continued to support the energy transition, and thus, market growth remained positive during the COVID-19 pandemic period.

Energy Transition Market Trends

Growing Energy Transition is a Latest Trend

The global energy transition market share is expected to grow owing to rising environmental concerns. The Paris Agreement highlighted the need to lower global greenhouse gas emissions and aims to limit the increase in global temperature to 1.5°C above pre-industrial levels, which would significantly reduce climate risks and global warming.

Electricity generation and transportation activities are major contributors to increasing greenhouse gas emissions as they involve the use of fossil fuels. For instance, the U.S. Energy Information Administration states that in 2023, about 4.18 trillion kWh of electricity were produced at utility-scale electricity generation facilities in the U.S., of which 60% of electricity generation was from fossil fuels mainly like coal, natural gas, petroleum, and other gases. Thus, it highlights the need for the adoption of renewable energy sources in order to diminish reliance on fossil fuels in the energy sector, as continued use of fossil fuels will lead to carbon emissions in the environment.

Download Free sample to learn more about this report.

Energy Transition Market Growth Factors

Growing Focus on Renewable Energy Sources by Governments Promotes Market Growth

Governments globally are focusing on renewable energy sources to enhance their energy mix and provide sustainable and clean energy. In 2023, at the United Nations Climate Change Conference (COP28), governments set a goal to triple global renewable power capacity by 2030. Policies such as the European Union’s Green Deal Industrial Plan, India’s Production Linked Incentives (PLI), and the Inflation Reduction Act (IRA) in the U.S. have been developed to support renewable energy sources and facilitate the energy transition.

Solar and wind energy are one of the most deployed renewable energy sources. In solar energy production, China, the U.S., and India are the top countries globally. Similarly, wind energy production is led by China, the U.S., and Germany.

Energy Transition Associated Benefits to Support Market Growth

Energy transition presents a number of benefits to the environment, governments, the private sector, and all energy users, as energy is fundamental to all activities. Energy efficiency is one of the major components of energy transition. Since residential and commercial buildings are the leading users of energy, and thus, achieving energy efficiency in these setups is crucial. It provides benefits such as cost savings, improved energy consumption, lower energy wastage, and optimum utilization of resources.

The energy transition is also evident in the transportation sector, where internal combustion engine vehicles are being replaced by Battery Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs). OEMs are highly focused on and investing in electric vehicle technologies, while governments are supporting the transition by providing subsidies and incentives for purchasing electric vehicles. These aspects are anticipated to support global energy transition market growth.

RESTRAINING FACTORS

High Initial Investments Requirement is Inhibiting Market Expansion

Although energy transition is essential to limit rising global temperature, it demands long-term financial commitment in order to achieve desired goals. Improvements in power grids, installation of solar and wind farms, and the development of new technologies require huge capital investments. As a result, energy transition efforts are observed to be concentrated in some regions while low-income economies are deprived of such developments. Further, growing energy needs are expected to put strain on reliable and sustainable energy supply.

Energy Transition Market Segmentation Analysis

By Type Analysis

Electrification in Transportation and Buildings Sector to Support Market Growth

Based on type, the market is divided into renewable energy, electrification, energy efficiency, and others.

Electrification is anticipated to capture 41.24% of the market share in 2025 owing to the development of electrification technologies. Globally, prominent efforts are being made in order to achieve electrification in the transportation and buildings sector. Electrification is one of the most important approaches for lowering CO2 emissions in the Net Zero Emissions by 2050 Scenario, where adopting electric transport and installing heat pumps are crucial for emissions.

Renewable energy is another leading segment owing to its significance in achieving energy transition. The segment is exhibited to capture a CAGR of 15.44% during the forecast period. Efforts are being undertaken globally by governments and energy producers in order to install and increase renewable energy capacities. China, the U.S., and India are some of the prominent countries in the installation of solar and wind energy.

By Sector Analysis

Power & Utility Sector Dominate Due to Their Huge Adoption of Renewable Energy Sources

Based on sector, the market is segmented into power & utility, transportation, and others.

The power & utility sector led the market share by 53.8% in 2024. The power & utility sector, highly dependent on fossil fuels, is shifting focus and investments toward renewable energy sources for power generation. Generation capacity has notably expanded in recent years owing to policy support and cost reductions primarily in solar photovoltaics and wind power.

According to the IEA, in 2023, solar photovoltaic energy made up three-quarters of renewable capacity additions globally. The development of the solar PV supply chain is facilitating the manufacturing essential to meet the demands of the growing industry. Added manufacturing capacity in the U.S., India, and the EU is likely to help diversify the solar PV supply chain; however, China remains dominant in solar energy.

Transportation is the second-leading segment owing to emphasis on electrification pushed by government initiatives, high investments, and research & development efforts by OEMs and other stakeholders. Many countries have also planned to phase out ICE-based vehicles, partly or fully, in the forthcoming years.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The global energy transition market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Energy Transition Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to be the leading region globally, with China and India, serving as major contributors. The regional market value in 2024 was USD 865.84 billion, and in 2023, the market value led the region by USD 737.12 billion. According to the India Brand Equity Foundation (IBEF), as of 2024, India ranks fourth in wind power capacity, solar power capacity, and renewable energy installed capacity. By 2030, the country is aiming to install approximately 450 Gigawatt (GW) of renewable energy capacity, with about 280 GW expected from solar energy. Government initiatives and efforts by market players are essential for the development and growth of the market. The market in China is expected to hit USD 617.59 billion in 2025, whereas India is likely to reach USD 109.05 billion and Japan is projected to hit USD 116.87 billion in 2025.

In Europe, the Renewable Energy Directive provides the legal framework for implementing clean energy in all sectors of the EU economy, supporting cooperation between EU countries toward this goal. Europe is anticipated to account for the second-highest market size of USD 559.45 billion in 2025, exhibiting the second-fastest growing CAGR of 13.23% during the forecast period. The European Commission has also undertaken the REPowerEU Plan to provide affordable, secure, and sustainable energy, aiming to enhance clean energy by increasing renewable energy installation. The market value in U.K. is expected to be USD 139.36 billion in 2025.

On the other hand, Germany is projecting to hit USD 168.62 billion and France is likely to hold USD 92.52 billion in 2025.

North America holds a prominent share of the global market. The region is anticipated to be the third-largest market with a value of USD 545.14 billion in 2025. The region focuses on adoption of advanced technologies, aided by government efforts and growing research & development of technologies. In the U.S., the Energy Policy Act (EPA) administers energy production, focusing on energy efficiency, renewable energy, and climate change technology to improve the energy sector of the country. These regulations are essential as they advocate the importance of energy transition. The U.S. market size is estimated to be USD 480.76 billion in 2025.

Latin America is also anticipated to observe growth owing to increasing energy demand across the region. Brazil and Mexico are anticipated to influence market growth due to their status as significant economies, attracting investments from both public and private sectors. The region presents lucrative opportunities for market players to expand their business and support market expansion.

The Middle East & Africa is also expected to be the fourth-largest with a value of USD 172.78 billion in 2025 and to grow steadily over the forecast period. There is an ongoing energy transition toward renewables in the Middle East and North Africa. The region’s ambitious energy investment and diversification plans are pushed by the need to meet growing energy demand. These efforts aim to achieve socioeconomic benefits and support decarbonization objectives, which are anticipated to further support energy transition market growth. The GCC market size is estimated to hit USD 82.39 billion in 2025.

KEY INDUSTRY PLAYERS

Key Players Focus on Investments to Improve Power Grid Stability

The market is focused on investments and a strong product portfolio by key players in the market, such as GE Vernova, Ørsted A/S, Siemens, and others. ABB and Korea Electric Power Corporation (KEPCO) signed a Memorandum of Understanding (MoU), which ABB will support to maintain the operation of the power grid on Jeju Island. The collaboration aims to enhance the stability of the Korean power grid and support transitions to green energy.

LIST OF TOP ENERGY TRANSITION COMPANIES:

- GE Vernova (U.S.)

- Iberdrola, S.A. (Spain)

- NextEra Energy, Inc. (U.S.)

- Constellation (U.S.)

- First Solar (U.S.)

- Ørsted A/S (Denmark)

- Dongfang Electric Corporation (China)

- ABB (Switzerland)

- Eaton (Ireland)

- Siemens AG (Germany)

- Danfoss (Denmark)

- Enel X S.r.l. (Italy)

- Ameresco (U.S.)

- Daikin Industries Ltd. (Japan)

- Orion Energy Systems, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2024: Siemens Energy collaborated with PT Pertamina to provide sustainable, safe, and affordable energy in Indonesia. Siemens aims to facilitate a successful energy transition by providing technologies for producing and storing renewable energy in Indonesia.

- August 2024: The U.S. Department of State introduced the Clean Energy Transition Accelerator (CETA) project in Argentina. Under this, the U.S. would provide the government of Argentina with USD 500 thousand in technical assistance through its U.S. Department of Energy’s Pacific Northwest National Laboratory and National Renewable Energy Laboratory. The project aims to lower greenhouse gas emissions and accelerate clean energy transition in Argentina.

- July 2024: Ameresco, Inc. announced the completion of multiple Battery Energy Storage Systems (BESS) construction in collaboration with United Power, Inc. This development is anticipated to enhance energy resilience and security while contributing to sustainability goals.

- June 2024: INEOS and NextEra Energy Resources commenced development of the 310 MW INEOS Hickerson solar project in Texas, aimed to reduce CO2 emissions by 310,000 tons per year. The project is estimated to generate 730,000 megawatt-hours of energy annually, and would be built, owned, and operated by a subsidiary of NextEra Energy.

- April 2024: Ørsted inaugurated Asia Pacific’s largest offshore wind farms. The project has a combined installed capacity of 900 MW and stands as the largest in Taiwan and the entire Asia Pacific region. It denotes a great development toward energy transition in the region.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 15.41% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Sector

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 1,769.80 billion in 2023.

The market is projected to grow at a CAGR of 15.41% over the forecast period.

Asia Pacific’s market value stood at USD 737.12 billion in 2023.

Based on type, the power & utility segment holds a dominating market share.

The global market size is expected to reach USD 6,474.40 billion by 2032.

Growing focus on renewable energy sources by governments globally is a key factor driving market expansion.

Ameresco, Ørsted A/S, and NextEra Energy, Inc. are some of the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us