The Japan market is projected to reach USD 0.26 billion by 2026, the China market is projected to reach USD 0.35 billion by 2026, and the India market is projected to reach USD 0.24 billion by 2026.

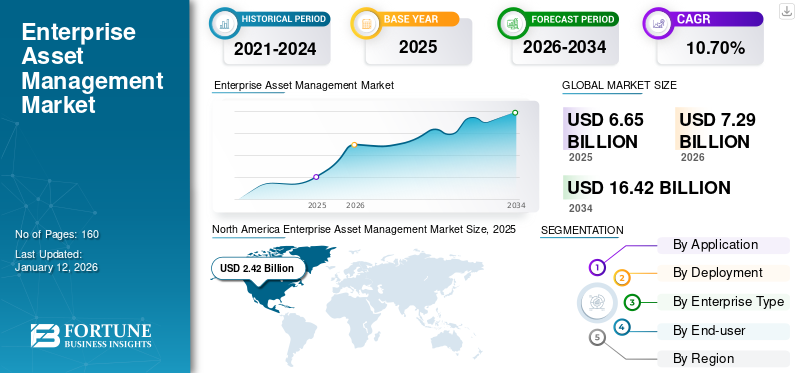

Enterprise Asset Management Market Size, Share & Industry Analysis, By Application (Asset Lifecycle Management, Labor Management, Inventory Management, Predictive Maintenance, Work Order Management, and Others), By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and Small and Medium Enterprises), By End-user (Healthcare, Government, IT & Telecom, BFSI, Manufacturing, Energy & Utility, Transportation, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global enterprise asset management market size was valued at USD 6.65 billion in 2025. The market is projected to grow from USD 7.29 billion in 2026 to USD 16.42 billion by 2034, exhibiting a CAGR of 10.70% during the forecast period. North America dominated the global market with a share of 36.40% in 2025.

An enterprise asset management solution offers the management of physical assets throughout their lifecycle in order to maximize their value, reduce costs, enhance quality and productivity, and protect health, safety, and the environment. Rapid automation and digitalization have fueled the demand for monitoring asset health to maximize its lifespan. As the solution integrates with the systems easily, its adoption across enterprises has gained traction. Furthermore, with the growing complexity of enterprise asset environments, the market is witnessing a significant growth rate.

Global Enterprise Asset Management Market Overview

Market Size:

- 2026 Value: USD 7.29 billion

- 2034 Forecast Value: USD 16.42 billion, with a CAGR of 10.70% from 2026–2034

Market Share:

- Regional Leader: North America, driven by digital transformation across manufacturing and infrastructure

- Fastest-Growing Region: Asia Pacific, led by rapid industrial development and IT integration

- End-User Leader: Manufacturing, due to high asset volume and predictive maintenance adoption

Industry Trends:

- Cloud-Based Platforms: Boosting scalability and integration

- Predictive Maintenance: Enabling proactive asset lifecycle management

- Smart Asset Monitoring: Supported by IoT and analytics

Driving Factors:

- Digital Modernization: Accelerates EAM platform adoption

- Operational Efficiency Needs: Demand to reduce downtime and extend asset lifespan

- Regulatory Pressure: Drives structured asset tracking systems

Some of the solutions offered by the key players are IBM Maximo, IFS Asset Performance Management Software, SAP EAM, MaintainX, Brightly Asset Essentials, and more.

Customers’ buying preferences changed amid the COVID-19 pandemic, with increased demand for hygienic and cleaning products. The adverse effects of the coronavirus affected digital spending across industries globally. As per industry experts, the overall digital technology spending reached USD 3.6 trillion in 2020, experiencing a slight decline of 3.2% due to the COVID-19 pandemic. This reduction in physical interactions among employees and customers led to an increased demand for automated solutions. Small and medium-sized businesses began adopting digital solutions to avoid physical contact amid the pandemic.

Similarly, as the transformation hit enterprises globally, the demand for asset management fueled. Its capability to boost the performance and efficiency of operations propelled its demand amid the pandemic. Thus, post-pandemic, the market experiences a significant boost considering the growing use cases across the industry end-users.

Enterprise Asset Management Market Trends

Integration of Artificial Intelligence with EAM Software to Augment Market Growth

Vendors are integrating artificial intelligence to enhance asset management software. Implementation of AI capabilities, along with natural language processing (NLP), deep learning, machine learning (ML), and more, enables asset analysis at every stage of the lifecycle. It provides insights and estimates for future operations in real-time, helping enterprises handle and guide outgoing operations with the right measurements throughout the process. AI-enabled chatbots can reduce waiting time by engaging and filtering conversations with machines and humans. The data captured through these conversations is then sent into the analytics engine, which helps in optimizing the management process. Considering the growth opportunities, various companies are innovating with these technologies. For instance,

- In March 2020, business and technology service provider Microdesk introduced an advanced bi-directional synchronization asset management solution by combining IBM Maximo and Autodesk Revit. The new version is integrated with artificial intelligence technology to employ conversation capabilities.

Thus, integration of AI technology is expected to boost enterprise asset management market share.

Download Free sample to learn more about this report.

Enterprise Asset Management Market Growth Factors

Rapid Migration to Cloud-based Technologies to Drive Market Growth

Industry leaders are shifting toward cloud-based solutions, considering their capabilities and unique offerings. Several reasons drive this transition, including security, cost-effectiveness, user experience, smart manufacturing, and industrial IoT technologies. The growing technology is propelling the adoption of cloud-based enterprise asset management. Key factors contributing to the cloud-based solution growth include ease of deployment along with affordability. Furthermore, globalization and standardization are expected to surge the demand for cloud-based software and services. Thus, companies are strategically introducing new cloud-based asset management solutions to expand their business. For instance,

- In March 2022, Aptean, an enterprise solution provider, launched a cloud-based enterprise asset management solution for manufacturing industry applications. The product’s modern interface and real-time offering are key factors contributing to its success.

Thus, with the growing cloud-based solution, the adoption of EAM is expected to grow.

RESTRAINING FACTORS

Increasing Data Security Threats to Hamper Market Growth

The chances of security threats are likely to increase with the rapid adoption of automation technology. The increasing number of connected devices and machines heightens the risk of cyber-attacks. In addition, unlike traditional technologies, EAMs are directly connected through the cellular network, which increases the chance of direct attack. The advancements and newness of the technology are forcing providers to adopt updated security solutions. Attackers are expected to gain the advantage of such security gaps with new advanced attacks. Thus, the increasing implementation of enterprise asset management solutions is expected to intensify potential threats, hampering the EAM market growth.

Enterprise Asset Management Market Segmentation Analysis

By Application Analysis

Growing Reliability and Safety to Propel Asset Lifecycle Management Demand

On the basis of application, the market is segmented into asset lifecycle management, labor management, inventory management, predictive maintenance, work order management, and others.

Asset lifecycle management is poised to gain maximum revenue share during the forecast period. Enterprises with limited budgets are shifting toward asset lifecycle management solutions to improve performance and ensure safety. Furthermore, its ability to offer more than the return on investment is expected to boost enterprise asset management market growth.

The Others (Risk Scoring, etc.) segment is expected to lead the market, contributing 32.92% globally in 2026.

By Deployment Analysis

On-Premise Deployment Dominates Market Share, Favored for Data Security and Accessibility

On the basis of deployment, the market is segmented into cloud and on-premises.

On-premise deployment is touted to hold a major market share of 58.66% in 2026 owing to the flexibility and security it offers when retrieving data. Enterprises are opting for on-premises deployment due to the high volume of data that needs to be accessed promptly.

The demand for cloud-based enterprise asset management solutions is expected to show the highest growth during the forecast period. These solutions enable businesses to manage information securely, efficiently, remotely, and in a consolidated manner. Moreover, the installation cost of cloud deployment is lower compared to traditional deployment methods.

By Enterprise Type Analysis

Large Enterprises Dominate the Market Owing to Workforce Management

Based on enterprise type, the market is segmented into large enterprises and small and medium enterprises.

Large enterprises dominate the segment share of 65.84% in 2026 owing to the presence of a huge workforce, large documentaries, and extensive consumer records. The solution facilitates faster analysis of the workforce, asset lifecycle, labor efficiency, inventory, and more.

The small and medium-sized enterprises segment is poised for substantial growth in the forecast period. Increasing competition is compelling SMEs to adopt automated processes and tools to manage enterprise operations and asset management efficiently.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Manufacturing Segment Captured the Largest Share due to Growing Automation

By end-user, the market is categorized into healthcare, government, IT & telecom, BFSI, manufacturing, energy & utility, transportation, and others.

Manufacturing accounted for the largest share of 19.75% in 2026 in the EAM market. The swift pace of industrialization is prompting the manufacturing sector to embrace automation technologies for field operations and processes. Furthermore, manufacturers are transitioning their strategies to prioritize customer-centricity, focusing on delivering cost-effective and value-enhancing services.

Healthcare is witnessing a rapid CAGR in adopting asset management solutions for managing their business operations effectively. These solutions eliminate paperwork from their daily workload, reducing the time required for administration and allowing them to focus on patient care.

Governments are taking active initiatives to facilitate the implementation of asset management across the business. Three standard initiatives address the requirements of the end customers with regard to enterprise management. Similarly, increased digital adoption and complex healthcare guidelines are expected to propel the adoption of enterprise asset management solutions.

REGIONAL INSIGHTS

Based on geography, the market is divided into North America, Asia Pacific, South America, Europe, and the Middle East & Africa.

North America Enterprise Asset Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America is highly anticipated to dominate due to the rising preference for enterprise operations efficacy and constant emphasis on streamlining asset management. The region serves as the hub for technological firms specializing in management solutions. Prominent companies in North America are investing in innovative solutions to serve enterprises efficiently. The U.S. market is projected to reach USD 2.07 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is likely to witness a rapid growth rate during the forecast period. The significant growth in business policies in India, South Korea, Japan, and more to ease enterprise operations is expected to boost the demand for digital technologies. Increased competition has led to a higher demand for efficient asset operation in the region.

Europe

Europe is to witness a significant growth rate during the forecast period. The increase in the number of enterprise asset management solution providers across European countries is expected to boost the market share. In addition, small and medium enterprises are receiving various funds and support from the government, propelling market growth. The UK market is projected to reach USD 0.32 billion by 2026, while the Germany market is projected to reach USD 0.25 billion by 2026.

Middle East & Africa

The Middle East & Africa present unprecedented market opportunities. Market players are expected to expand their geographical presence in the region. Similarly, the rising adoption of digital transformation strategies in South America is expected to boost market growth.

List of Key Companies in Enterprise Asset Management Market

Collaboration with Prominent Industry Players to Boost Market Share of Key Players

Key market players are entering into strategic partnerships and collaborations significantly. These collaborations with advanced technology providers help offer industry-specific solutions. In addition, partnerships with various industry players are growing to meet the increasing need for efficient and environmentally friendly operations. The key players are expanding their presence across countries to achieve global presence and boost sales revenue.

List of Key Companies Profiled:

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- Sage Group Plc. (U.K.)

- Ramco System (India)

- IFS AB (Sweden)

- Hexagon AB (Sweden)

- ServiceNow Inc. (U.S.)

- Hitachi Ltd. (Japan)

- UpKeep Technologies, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: San Francisco-based OpenGoc company launched a GIS-based cloud software for enterprise asset management. It offers solutions such as order management, asset management, infrastructure maintenance and more to over 200 customers in the U.S.

- October 2023: Ireland-based Trane Technologies acquired Nuvolo, an enterprise asset management company, to uplift facilities management, space optimization, and life cycle solutions. This acquisition aimed to gain solution capabilities, client acquisition, and more.

- August 2023: IFS AB announced a strategic collaboration with India-based Tech Mahindra to expand its customer base by delivering workforce productivity and operational excellence. The company delivered solutions and services such as asset management, resource planning, field service management, and more for enterprises across industry verticals.

- July 2023: BlackRock and India-based Reliance Jio announced a strategic collaboration to enhance India’s asset management solutions. Together, the companies invested USD 150 million in the joint venture of digital-first transformation in India.

- April 2023: Hitachi, Ltd. announced a strategic partnership with Equinix Inc. to offer high-end solutions, including enterprise asset management, to accelerate digital transformation. Together, the companies aimed to expand their resources to address social issues using digital solutions and lifecycle management.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key end-user developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Deployment

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 16.42 billion by 2034.

In 2026, the market was valued at USD 7.29 billion.

The market is projected to grow at a CAGR of 10.70% during the forecast period.

By end-user, the manufacturing segment leads and captured the largest market share.

Rapid migration to cloud-based technologies is a key factor driving market growth.

IBM Corporation, SAP SE, Oracle Corporation, Sage Group Plc., Ramco System, IFS AB, and Hexagon AB are the top players in the market.

North America dominated the global market with a share of 36.40% in 2025.

By application, the predictive maintenance segment is expected to grow rapidly during the forecast period.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Information & Technology

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us