Enterprise Performance Management Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud), By Business Function (Finance, Human Resource, Sales & Marketing, Supply Chain, IT, and Others), By Industry (BFSI, Retail, Manufacturing, Healthcare, IT & Telecom, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

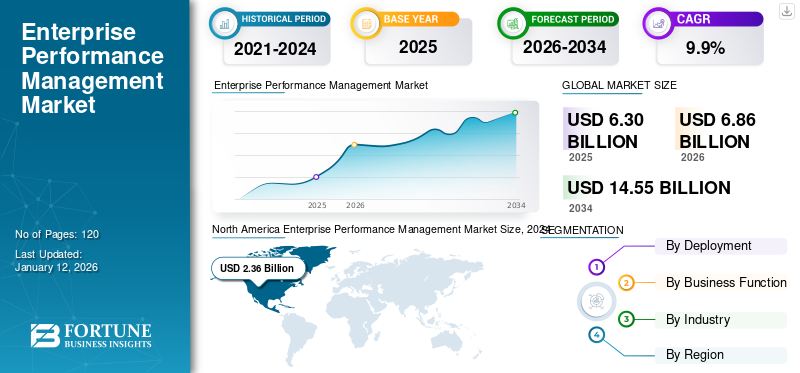

The global enterprise performance management market size was valued at USD 6.30 billion in 2025 and is projected to grow from USD 6.86 billion in 2026 to USD 14.55 billion by 2034, exhibiting a CAGR of 9.9% during the forecast period. North America dominated the global market with a share of 39.90% in 2025.

The enterprise performance management system helps enterprises in forecasting, budgeting, planning, and financial management. It also offers data reporting, analytics, and forecast modelling to make enterprises understand, analyze, and plan tactically for their business. Enterprise performance management system helps enterprises improve the financial and operational performance of the company and drive efficiencies. The increasing need to have a transparent business strategy, overall improvement in performance, growing focus on core business, and increasing data driven decision making among enteprises are driving the market growth.

The COVID-19 pandemic disrupted the global economy in ways that were never predicted. Enterprises had the biggest concerns regarding the budgets, projects, loss of revenue, and availability of funds to finance ongoing operations. Considering the impact of the pandemic and managing cash flow as revenue declines was a big issue for thousands of enterprises. To overcome these challenges, enterprises adopted advanced enterprise performance management solutions to support strategic planning, rolling forecasts, and other financial & operational planning requirements. Also, the capability of EPM helped enterprises assess the immediate impact of the crisis on their business, discover different recovery scenarios for future periods, and help management make more effective decisions about how to respond to such situations.

Enterprise Performance Management Market Trends

Integration of Artificial Intelligence and Machine Learning with Enterprise Performance Management to Aid Market Growth

EPM vendors are integrating various machine learning and artificial intelligence techniques to initiate pilot studies and proof of concepts (POC) for understanding the accurate application of augmented intelligence in use case planning. The POCs are intended to plan for specific areas, including sales predictions, revenue forecasting, supply planning, workforce optimization, and demand sensing.

The AI/ML techniques help address three critical concerns encountered by business users across business functions, including quantity, complexity, and accessibility issues that make transactions time-consuming. Data becomes more complicated and complex when the volume increases. For this, a costly and time-consuming update is required for EPM systems to receive information from various data sources. To overcome this challenge, AI/ML techniques are used as this technique allow systems to self-adapt. Due to the increasing usage of the Internet of Things (IoT) and Big Data technologies, the data volume is increasing among enterprises. Automation is required to handle this huge amount of data as it helps in deriving actionable insights in a timely and cost-effective manner. AI/ML techniques help in automating repetitive and mundane tasks. AI/ML handles challenges regarding data accessibility in two ways: by making it simpler to discover and use information in the system and by making the information more available to employees throughout the company.

Integration of AI & ML techniques within the EPM system helps in performing predictions, detecting patterns, and analyzing huge amounts of market intelligence that can be used for creating operational scenarios and finding groundbreaking paths. AI-based EPM solutions help companies with their corporate growth plans by providing accurate, dependable, and adaptable planning & performance management systems.

Thus, the integration of artificial intelligence and machine learning is expected to drive enterprise performance management market share during the forecast period.

Download Free sample to learn more about this report.

Enterprise Performance Management Market Growth Factors

Increasing Adoption of Cloud-based EPM Solution is Propelling Market Growth

Cloud-based EPM systems can offer clear benefits in scalability, significantly reducing IT overhead costs and allowing access to a variety of devices via the web. It is especially important to assess the benefits in terms of service-level agreements, security, and cost per user to ensure service is delivered with the greatest possible degree of efficiency. Cloud EPM solutions provide organizations with numerous functionalities and business benefits that help enterprises mitigate risk and maximize performance.

Cloud EPM solutions are expected to provide more business automation, and cloud EPM software providers are infusing their solutions with advanced software technologies, such as artificial intelligence (AI), introducing new tools for automation and analysis, thereby enabling them to perform automated data collection, business budgeting, and more. Enterprises are opting for cloud EPM solutions as moving to the cloud results in reduced or eliminated infrastructure investments as well as lowered total cost of ownership. Cloud-based EPM simplifies compliance by integrating governance and risk management into financial processes, reducing both the time and cost associated with regulatory requirements.

Therefore, the increasing adoption of cloud EPM solutions is propelling enterprise performance management market growth.

RESTRAINING FACTORS

High Cost of Enterprise Performance Management (EPM) System to Hinder Market Expansion

With the integration of extra components related to performance management, the operational process becomes complicated, and difficulties arise in the installation of the solution. Due to difficulties in the installation process, enterprises need experienced and knowledgeable professionals, and this increases the total cost for the business as well as the system cost. The EPM solution needs regular maintenance inspection to ensure its stability and functioning, and due to this, additional maintenance costs are integrated into the system cost, thereby restricting market growth.

Enterprise Performance Management Market Segmentation Analysis

By Deployment Analysis

Increasing Adoption of Cloud EPM to Provide Unified User Experience to Aid Cloud Segment Growth

By deployment, the market is segmented into on-premise and cloud.

The Cloud segment is expected to lead the market,contributing 71.47% globally in 2026. and is expected to register the highest CAGR during the forecast period. Cloud EPM offers real-time insights using appealing visual dashboards and advanced reporting capabilities, which makes it easier for finance leaders to make decisions and drive segment growth. Cloud EPM uses predictive analytics to provide more precise and agile planning processes. This leads financial leaders to rapidly adapt to market changes and redevelop business strategies with financial goals. It offers a unified platform that decreases both direct and indirect costs, contributing to a lower total cost of ownership.

The on-premise segment is estimated to grow steadily as on-premises solutions involve infrastructure setup, installation, and configuration expertise that increases the total costs. Also, the maintenance costs for on-premise solutions are higher due to the client providing upgrades, backup, and redundancies costs.

By Business Function Analysis

Increasing Adoption of EPM for Decision Making is Driving the Finance Segment Growth

By business function, the market is divided into finance, human resource, sales & marketing, supply chain, and IT and others.

The Finance segment will account for 34.43% market share in 2026 and is estimated to showcase the highest CAGR during the forecast period. The finance function empowers choices over the organization, requiring more profound, clearer knowledge of operations, clients, markets, and the external environment. EPM exhibit a range of activities and practices that offer the reference points required for delivering insights based on internal, external, financial, non-financial, structured, and unstructured data and information. Thereby, propelling the segment growth.

The human resource segment is estimated to grow steadily, as human resources use EPM for planning, defining goals, and comparing them continuously with the data stream and for forecasting the budget for planning.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Adoption of EPM for Mitigating Risk to Aid the BFSI Segment Growth

By industry, the market is segmented into BFSI, manufacturing, retail, healthcare, IT & telecom, and others.

The BFSI dominated the market in 2024. EPM leverages transactional data, including debt capital market (DCM) transactions, letters of credit, deposits, loans, trading desks, and EPM framework, empowers clients to evaluate and report on execution while at the same time monitoring the budget, investments, and impact of transformational programs the bank sanctions in various areas of the business. This makes EPM software a great tool as it helps banks mitigate risk, accomplish stronger financial performance, and deliver profitability.

The Manufacturing segment will account for 28.74% market share in 2026, as EPM provides manufacturers with precise cost and productivity analytics to make “build or buy” decisions. With real-time data insights, manufacturers can protect margins and ensure profitability.

REGIONAL INSIGHTS

Based on geography, the market is studied across South America, the Middle East & Africa, Asia Pacific, Europe, and North America. These regions are further classified into leading countries.

North America Enterprise Performance Management Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.51 billion in 2025 and USD 2.69 billion in 2026. The rising need to make business strategies transparent to all teams, prompt implementation of various marketing strategies among retailers, increasing focus on core businesses, and the need to enrich performance are some of the major factors that propel the market growth in the region. The U.S. market is projected to reach USD 1.69 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow with the highest CAGR during the forecast period owing to the adoption of advanced technologies by enterprises for automating business processes. Industries, including BFSI, retail, and manufacturing, are increasingly deploying the EPM solution for better planning, budgeting, and forecasting and enhancing the collaboration between departments that help enterprises improve customer service. The Japan market is projected to reach USD 0.24 billion by 2026, the China market is projected to reach USD 0.54 billion by 2026, and the India market is projected to reach USD 0.16 billion by 2026.

Europe is witnessing a substantial growth owing to proactive investments made by public and private organizations so as to boost the adoption of cloud in the countries of the region, driving the market growth. EPM solution providers in the region are adopting strategies including partnership, collaboration, mergers and acquisitions, and making investments in research and development to enhance their presence and customer base. The UK market is projected to reach USD 0.25 billion by 2026, while the Germany market is projected to reach USD 0.33 billion by 2026.

South America and the Middle East & Africa are experiencing significant growth as the governments in countries, such as Brazil, Argentina, GCC, and South Africa invest in digital strategies. In addition, the countries are implementing smart technologies to establish a solid foundation in their various end-use sectors, including retail, healthcare, and BFSI, among others.

KEY INDUSTRY PLAYERS

Major Players Adopt Advance Technologies to Strengthen Market Positions to Drive Market Growth

Oracle, SAP, and IB, among others are the leading market players and they are elevating their exsisitng solutions in order to keep pace with changing requirements of the users. Companies are including new technologies such as AI and ML so as to enhance their product portfolio. This set to change their service portfolio in order for them to serve their customers in a better way. In addition, these players are actively taking up partnerships, collaboration, and mergers and acquisitions strategies so as to boost their product offerings in the market.

List of Top Enterprise Performance Management Companies:

- Oracle (U.S.)

- SAP SE (Germany)

- Anaplan (U.S.)

- IBM (U.S.)

- Workday (U.S.)

- Insightsoftware (U.S.)

- Onestream Software (U.S.)

- Workiva (U.S.)

- Planful (U.S.)

- Infor (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In December 2023, KPMG Spain and OneStream entered into a strategic alliance to help enterprises conquer complexity and drive finance transformation in Europe.

- In November 2023, Jedox partnered with Fincons Group to help businesses improve their performance by aligning their operational and financial plans and gaining actionable insights from real-time data.

- In October 2023, Netsuite launched Netsuite Enterprise Performance Management to help finance leaders increase business visibility and enhance decision-making.

- In February 2023, FPT Software entered into a partnership with Anaplan Asia Pacific to deliver cloud-based enterprise performance management to businesses across Southeast Asia.

- In January 2023, OneStream entered into a partnership with Extreme Solutions to provide software and implementation expertise and transform complex financial processes for enterprises in Portugal and across EMEA.

REPORT COVERAGE

The enterprise performance management market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights the competitive landscape. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.9% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Business Function

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 14.55 billion by 2034.

In 2025, the market was valued at USD 6.3 billion.

The market is projected to grow at a CAGR of 9.9% during the forecast period.

The finance segment is expected to lead the market in terms of market share.

Increasing adoption of cloud EPM Solution is propelling market growth.

Oracle, IBM, Infor, SAP SE, and Anaplan are the top players in the market.

North America held the highest market share.

By industry, the manufacturing industry is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us