Ethylene Carbonate Market Size, Share & Industry Analysis, By Grade (Battery Grade, Electronic Grade, and Industrial Grade), By Application (Lithium Battery Electrolyte, Polymers & Resins, Semiconductor, Lubricants, and Others), By End-use (Automotive, Electronics, Industrial, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

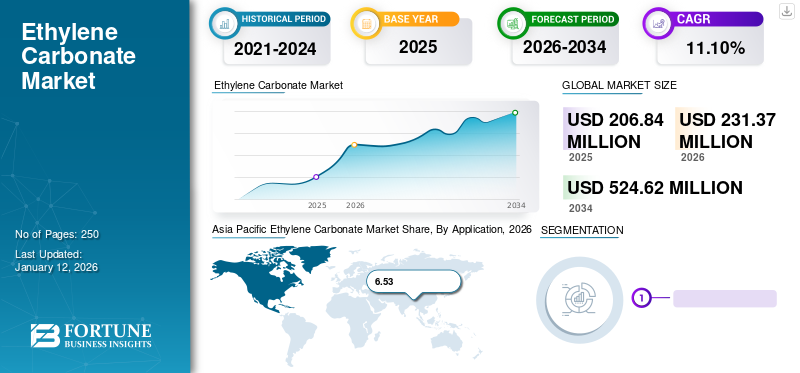

The global ethylene carbonate market size was valued at USD 206.84 million in 2025. The market is expected to grow from USD 231.37 million in 2026 to USD 524.62 million by 2034 at a CAGR of 11.10% during the forecast period. Asia Pacific dominated the ethylene carbonate market with a market share of 63% in 2025.

The efficacy of offering high polarity and high solubility against water has made ethylene carbonate an ideal solvent for various applications. As a polar solvent, it is used to make lubricants, plastics, resins, surface coatings, and others. It is classified as a cyclic carbonate ester of ethylene glycol and carbonic acid. Apart from being an excellent solvent, it is also utilized as an intermediate in chemical synthesis, which created additional demand during the historical period. The product’s long list of applications does not end up with the above-listed applications and continues to lithium-ion batteries and supercapacitors. Moreover, the surging demand for lithium-ion batteries and supercapacitors is projected to drive market growth over the assessment period.

Global Ethylene Carbonate Market Overview

Market Size and Forecast:

- 2025 Market Size: USD 206.84 million

- 2026 Market Size: USD 231.37 million

- 2034 Projected Market Size: USD 524.62 million

- CAGR (2026–2034): 11.10%

Market Share:

- Asia Pacific Market Share (2025): 63%

Regional Highlights:

- Asia Pacific: 2026 Market Size: USD 147.74 million

- North America: Demand driven by growing investment in lithium battery production.

- Europe: EU’s “Fit for 55” program aims to cut emissions by 55% by 2030.

- Latin America and Middle East & Africa: Demand supported by polymers & resins, lubricants, and pharmaceutical applications.

COVID-19 IMPACT

Plant Closures and Delayed Energy Infrastructure Activities Declined Demand for the Product

The COVID-19 outbreak forced people to remain in their homes due to lockdown measures. Amid the lockdown, nearly all industrial production was halted. In addition, the supply-demand equation was severely hampered due to the restrictions on import and export, excluding some necessary items. Automotive, lubricants, polymers & resins are the key industries utilizing most ethylene carbonate produced globally. These industries faced significant declines in their sales, lowering the demand for the product in 2020. However, post-COVID-19, the market recovered quickly on the back of the momentum of electric mobility. Moreover, demand coming from the pharmaceutical and semiconductor industries has assisted the market recovery after the ease of lockdowns.

Ethylene Carbonate Market Trends

Trend of Vehicle Electrification to Drive Market Growth

The electric vehicle industry has observed rapid expansion in the past five years, growing annually at the rate of 50% from the past five years. In response to reducing the carbon emissions from the transportation industry, electric vehicles have emerged as an ideal solution. Momentum toward clean energy has fueled humongous investments in the electrification of the automotive industry. As a result, electric vehicles have witnessed exponential growth in sales with improved efficiency and performance. As per the International Energy Agency, one in every five cars sold in 2023 will be electric. Moreover, a lithium-ion battery is the heart of the electric vehicle, providing the needed energy to drive it. Demand for lithium-ion batteries has grown in line with electric vehicle market growth. As the product is an essential electrolyte in the lithium-ion battery, vehicle electrification is anticipated to drive market growth over the assessment period. Asia Pacific witnessed a ethylene carbonate market growth from USD 103.40 Million in 2023 to USD 116.1 Million in 2024.

Download Free sample to learn more about this report.

Ethylene Carbonate Market Growth Factors

Lithium Ion Battery and Supercapacitor to Act as a Growth Engine for the Market Expansion

Global lithium-ion batteries and supercapacitors are poised to become the growth engine of demand for the product. As it is a key ingredient in lithium-ion battery electrolytes, the demand for battery-grade ethylene carbonate will usher during the long-term forecast period. Moreover, the product enables a solid electrolyte interface (SEI) to be formed on the surface of graphitic carbons, assisting graphite anode in reversing reactions with lithium ions for hundreds of cycles. As a result, it improves a battery's overall lifespan and offers long range. Owing to its high viscosity and high melting point, it decreases the low-temperature performance and rate capability. Apart from this, the product is highly utilized in making supercapacitors. An electrolytic capacitor offers larger capacitance than other capacitors, making it a crucial ingredient in supercapacitors. Moreover, the rapid expansion of the lithium-ion industry and growing demand for supercapacitors are poised to drive the sales of ethylene carbonate during the forecast period.

RESTRAINING FACTORS

Environmental Concerns Associated With Conventional Production Method May Hamper the Supply Demand Equation during Mid-Term Forecast

Due to increased carbon emissions in China, the Chinese government has taken serious steps to limit it and bring it down in the near future. For instance, as per the fourteenth Five-year plan for the National Economic and Social Development of the People’s Republic of China, carbon dioxide emission per unit of GDP should be reduced by 18%. As a result, many Chinese ethylene carbonate manufacturing companies were forced to close their production plants based on conventional technologies. For instance, in 2019, a Chinese company named Jiangsu Taixing shut its production plant of ethylene carbonate with a production capacity of 31 kilotons. In addition, some of the China-based production plants are operating under low utilization rates owing to environmental pressures and adhering to emission norms. China, the world’s largest ethylene carbonate producer, is currently passing through various changes to meet emission norms. The facts above will hamper the global output for ethylene carbonate, hampering the supply-demand equation during the mid-term forecast.

Ethylene Carbonate Market Segmentation Analysis

By Grade Analysis

Battery Grade Segment to Account for the Largest Share Due to Growing Demand for Lithium Batteries

Based on grade, the market segments include battery grade with a share of 61.59% in 2026, electronic grade, and industrial grade. The battery grade segment is poised to grow at the fastest annual growth rate among other grades, and its market size is set to expand by 2.4 times by the end of the forecast period. This humongous growth is associated with a surging demand for lithium batteries in which the product is utilized as an electrolyte. As a result, battery grade is set to account for the largest share of the global market till 2030.

The electronic grade segment is anticipated to grow in line with the semiconductor market's growth. This grade is utilized in the semiconductor industry for various applications, such as capacitor electrolytes and as a solvent for semiconductor cleaning.

Industrial grade products are used in various applications, such as an acrylic textile processing agent as a solvent for cosmetics and pharmaceutical applications.

By Application Analysis

Lithium Battery Electrolyte Segment to Dominate Owing to High Boiling Point

Based on application, the market is segregated into lithium battery electrolyte with a share of 61.59% in 2026, polymers & resins, semiconductor, lubricants, and others. Various advantages, such as high boiling point and low viscosity, have made the product an essential ingredient in lithium battery electrolyte. As a result, lithium battery electrolyte will dominate the global ethylene carbonate market share till 2030. Owing to the increasing demand for lithium-ion batteries, this segment is poised to remain the dominating segment among other applications.

Polymers & resins utilize the product in various polymer production processes such as polycarbonate resin, acrylic fiber, plastic foam, and others. Such a wide range of applications is expected to drive its demand during the forecast period moderately.

By End-use Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment to Dominate Owing to Growing Demand for Electric Vehicles

By end-use, the market is divided into automotive, electronics, industrial, healthcare, and others. The automotive segment accounted for the largest market share of 59.03% in 2026 and is anticipated to maintain its dominance throughout the assessment period. The high growth can be attributed to surging demand for electric vehicles. As electric vehicles are powered with lithium-ion batteries, their growing demand is expected to increase the sales of lithium-ion batteries, thus fueling the consumption of the product.

- The electonics segment is expected to hold a 18.8% share in 2024.

The electronics segment is projected to grow significantly at a CAGR of 7.6% from 2025 to 2032, creating a market opportunity worth USD 62.3 million. Lithium-ion batteries are crucial in smartphones and various energy storage applications for electronic devices.

The industrial and healthcare segments are set to drive the demand for the product moderately during the forecast period. The growth is primarily driven by increasing demand from various industrial applications such as foundry, polymers, and lubricants.

REGIONAL ETHYLENE CARBONATE MARKET ANALYSIS

Based on region, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Ethylene Carbonate Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The ethylene carbonate market size was dominant in Asia Pacific, with a value of USD 131.23 million in 2025. Sales in the Asia Pacific region are primarily driven as the region is the hub of many industries where the product is utilized. In addition, it is the production hub of lithium-ion batteries, polymers, and electronics. Ethylene carbonate is highly consumed in these three industries and makes up for over half of the regional consumption, making the Asia Pacific the most lucrative market in the world. In Asia Pacific, China held the largest share in 2022 owing to the huge presence of battery production plants. The Japan market is projected to reach USD 15.72 billion by 2026, the China market is projected to reach USD 105.49 billion by 2026, the India market is projected to reach USD 11.52 billion by 2026, and the South Korea market is projected to reach USD 11.52 billion by 2026.

- In Asia Pacific, the polymers & resins segment is estimated to hold a 17.04% market share in 2024.

Asia Pacific Ethylene Carbonate Market Share, By Application, 2026

To get more information on the regional analysis of this market, Download Free sample

North American and European markets are experiencing heavy investment by lithium battery producers, which is expected to fuel the demand for lithium battery electrolytes over the next several years. In addition, government initiatives such as incentives to assist the electric mobility transition are expected to create a progressive environment for lithium battery manufacturers. The U.S. market is projected to reach USD 33.45 billion by 2026.

For instance, the European Union has presented its “Fit for 55” program, which seeks to reduce overall gas emissions by at least 55% by 2030. Similarly, the U.S. government has made a target that by 2030, nearly 50% of the new vehicles sold in the U.S. should be electric. Such initiatives are expected to drive the demand for the product in these regions during the forecast period. The UK market is projected to reach USD 4.08 billion by 2026, while the Germany market is projected to reach USD 10.18 billion by 2026.

Latin America and the Middle East & Africa markets are projected to grow moderately during the assessment period. Industries such as polymer & resins, lubricants, and pharmaceuticals are expected to drive the product demand in these regions mainly.

List of Key Ethylene Carbonate Market Companies

Rapid Capacity Expansion to Become the Key Strategy among Market Giants to Cater to the Growing Product Demand

Shandong Haike Chemical Group, Shandong Shida Shenghua Chemical Group Co. Ltd., Huntsman International LLC, Mitsubishi Chemical Group Corporation, and BASF are identified as key manufacturers in the study of the global market. Companies such as BASF, Huntsman International LLC, and Shandong Shida Shenghua Chemical Group Co. Ltd. have plans to invest millions of dollars to expand their production capacities to meet the increasing demand. In this capacity expansion strategy, battery grade will be a primary focus as its demand is surging from the lithium-ion battery industry.

LIST OF KEY COMPANIES PROFILED IN ETHYLENE CARBONATE MARKET:

- BASF SE (Germany)

- Huntsman International LLC (U.S.)

- Indorama Ventures Public Company Limited (Thailand)

- Lotte Chemical (South Korea)

- Mitsubishi Chemical Group Corporation (Japan)

- Hi-Tech Spring (China)

- Oriental Union Chemical Corporation (OUCC) (Taiwan)

- Shandong Haike Chemical Group (China)

- Shandong Shida Shenghua Chemical Group Co. Ltd. (China)

- Toagosei Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- August 2022: Under its Vision 2030, Indorama Ventures Public Company Limited (IVL) partnered with Capchem Technology USA Inc. to establish a new lithium-ion battery solvents plant on the U.S. Gulf Coast.

- January 2022: Shida Shenghua established a new production facility with an annual production capacity of 120 kilotons. The company will purify 40 kilotons of industrial grade to make battery grade ethylene carbonate in this expansion.

REPORT COVERAGE

An Infographic Representation of Ethylene Carbonate Market

To get information on various segments, share your queries with us

The research report provides detailed market analysis and focuses on crucial aspects such as leading companies, grades, applications, and end-uses. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, and insights into market trends and highlights vital industry developments and competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) and Volume (Kilotons) |

|

Growth Rate |

CAGR of 11.10% from 2026-2034 |

|

Segmentation

|

By Grade

|

|

By Application

|

|

|

By End-use

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global ethylene carbonate market size was valued at USD 231.37 million in 2026 and is projected to grow to USD 524.62 million by 2034, exhibiting a CAGR of 11.10% during the forecast period.

Growing at a CAGR of 11.10%, the market is expected to exhibit rapid growth during the forecast period (2026-2034).

The market is primarily driven by the surging demand for lithium-ion batteries used in electric vehicles and portable electronics, where ethylene carbonate serves as a key electrolyte solvent.

The battery grade segment leads the market due to its critical application in lithium battery electrolytes, with demand expected to grow 2.4x by 2032.

The shift to electric vehicles is boosting demand for battery-grade ethylene carbonate, essential for enhancing battery performance and cycle life.

Asia Pacific dominates the market, holding over 63% share in 2024, driven by strong production and consumption in China for batteries, electronics, and polymers.

Key companies include BASF, Huntsman, Mitsubishi Chemical, Shida Shenghua, and Indorama Ventures, focusing on capacity expansion to meet battery-grade demand.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic