Europe Cosmetics Market Size, Share & COVID-19 Impact Analysis, By Category (Hair Care, Skin Care, Makeup, and Others), By Gender (Men and Women), By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Channels, and Others), and Regional Forecasts, 2025-2032

KEY MARKET INSIGHTS

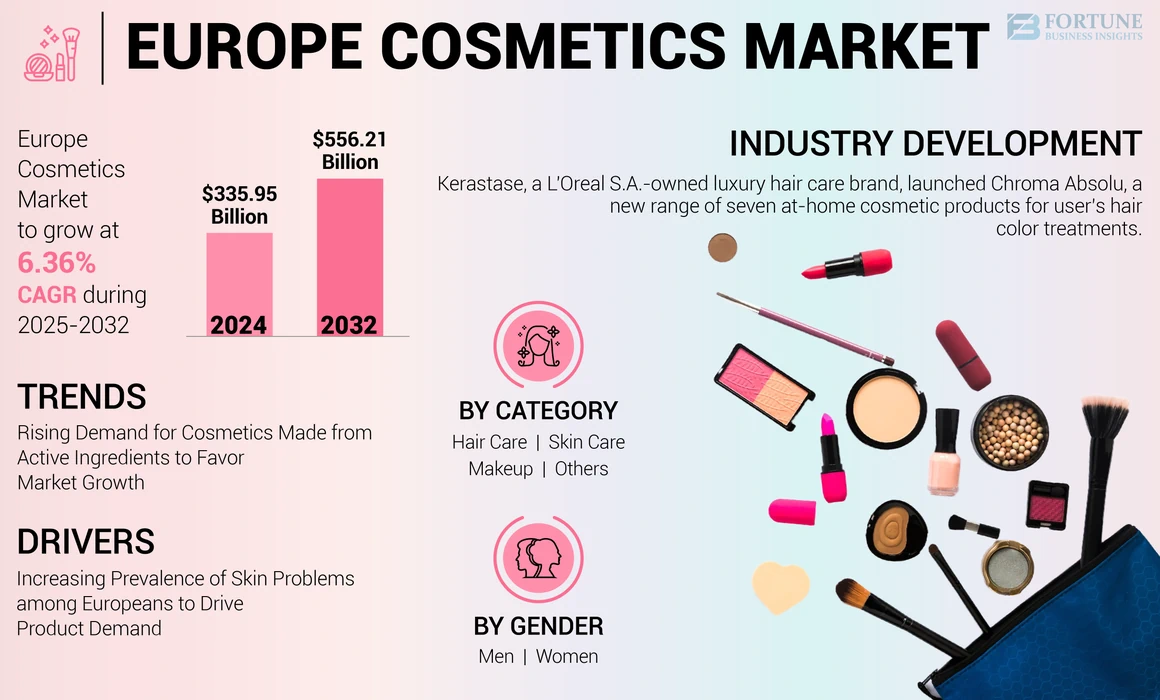

Europe holds the second-largest share of the global cosmetics market. It is projected to record a CAGR of 6.36% during the forecast period of 2025-2032. The global market is projected to grow from USD 335.95 billion in 2024 to USD 556.21 billion by 2032.

The Europeans use luxury cosmetic products to enhance their beauty and self-esteem. Cosmetic products can help improve hair, skin, and face problems such as acne, hair fall, pigmentation, pimples, and others.

According to the Cosmetic Association of Europe, the European market is driven by products from antiperspirants and shampoos to soaps, fragrances, makeup, sunscreens, and different kinds of toothpastes. Cosmetics play an essential role in not only enhancing an individual’s appearance, but also improving their skin health. According to a report by the National Centre for Biotechnology Information (NCBI) in 2021, serums containing vitamin E help repair skin inflammation and offer a smoother acne-free skin surface.

This report on the Europe cosmetics market covers the following countries/regions – Germany, France, Spain, Italy, the U.K., and the Rest of Europe.

LATEST TRENDS

Rising Demand for Cosmetics Made from Active Ingredients to Favor Market Growth

Active ingredients, such as A.H.As (Alpha Hydroxy Acids), BHAs (beta hydroxy acids), hyaluronic acid, niacinamide, and others, are trending in this market. Europeans prefer cosmetics made from these ingredients to improve their skin tone and remove fine lines & wrinkles.

Many key players, such as L’Oréal S.A, the Estee Lauder Companies, and Beiersdorf AG, in the region are extensively using these active ingredients in their cosmetic products to maintain their competitive edge in the market. Cosmetics made from these ingredients are said to be ideal for treating various hair and skin issues such as hair loss, facial acne, dark circles, and scalp skin itching. Growing awareness regarding the health benefits of active ingredient-based cosmetics among Europeans will drive the market growth.

- For instance, the National Library of Medicine data shows men and women aged 18 years and over were randomly selected based on age, sex, and socio-economic status. The survey showed that concern about physical appearance was the highest among women aged above 60 years and younger men.

DRIVING FACTORS

Increasing Prevalence of Skin Problems among Europeans to Drive Product Demand

Sustainable cosmetics are beneficial in treating skin conditions, such as acne, marks, textural issues, and skin irritation. This factor is expected to drive the market growth.

According to surveyed data presented by the National Library of Medicine, National Centre for Biotechnology Information (NCBI), in March 2022, nearly 94 million Europeans complained about uncomfortable skin sensations, such as itching, dryness, or burning. The report further stated that the most frequent skin conditions among Europeans were fungal skin infections at 8.9%, atopic dermatitis or eczema (caused by skin rashes and pimples) at 5.5%, and acne conditions at 5.4%.

RESTRAINING FACTORS

Health Complications Due to Overuse of Skincare Cosmetics to Hamper Market Growth

Excessive usage of makeup products could cause skin pores to enlarge, pimples, rashes, wrinkles, fine lines, and other problems. In addition, repetitive use of hair coloring products and dyes can cause dry scalp, excessive hair loss, hair thinning, and other severe conditions to the users’ hair. These aspects could weaken consumers’ demand for such products and restrain the European cosmetics market growth.

For instance, according to the Food & Drug Administration (FDA) report published in February 2022, cosmetic products can trigger allergic reactions in the skin, causing severe skin damage such as deep pigmentation, loss in skin elasticity, and eczema.

Download Free sample to learn more about this report.

KEY INDUSTRY PLAYERS

The key manufacturers that have captured a sizable Europe cosmetics market share are adopting business strategies, such as acquisitions & mergers, joint ventures, new product development, and partnership & business expansions, to enhance their business portfolios & production capacity and strengthen their market position in Europe. For instance, Europe-based cosmetics company flânerie skincare announced the launch of a new skincare range to expand its product portfolio. The new range is said to be infused with active ingredients and enriching formulas to restore the skin's ideal pH level.

LIST OF KEY COMPANIES PROFILED:

- L'Oréal S.A. (France)

- Unilever plc (U.K.)

- The Procter & Gamble Company (U.S.)

- The Estée Lauder Companies Inc. (U.S.)

- Beiersdorf AG (Germany)

- Shiseido Co., Ltd. (Japan)

- Coty Inc. (U.S.)

- Kao Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Amorepacific Corporation (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- November 2022: Kerastase, a L'Oreal S.A.-owned luxury hair care brand, launched Chroma Absolu, a new range of seven at-home cosmetic products for user’s hair color treatments.

- April 2021: The Kao Corporation, a Japanese chemicals & cosmetics manufacturing company, launched a luxury hair care brand, 'ORIBE', through its subsidiary company Kao Salon Japan. By establishing such a brand, the company aimed to enhance its consumer base in Japan while expanding its brand portfolio in the salon business and strengthening its global presence.

REPORT COVERAGE

The market research report provides a detailed market analysis. The report also provides a detailed market outlook and forecasts based on different product segments. The report is segmented based on category, gender, distribution channel, and country/region. It focuses on critical aspects, such as overview of the cost structure of cosmetics, the European industry’s supply chain, and rise in adoption of active ingredients in this industry.

In addition, the report provides detailed information on new product launches, key industry developments such as mergers, partnerships, & acquisitions, and the impact of COVID-19 on the market. Besides this, it also offers insights into fundamental industry dynamics, trends, and outlooks. In addition to the abovementioned factors, the report encompasses several factors that have effectively contributed to the market's growth in recent years

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.36% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Category, By Gender, By Distribution Channel, and Country/Sub-Region |

|

By Categories |

|

|

By Gender |

|

|

By Country/ Sub-Region |

|

Frequently Asked Questions

According to Fortune Business Insights, the Europe cosmetics market is projected to grow from USD 335.95 billion in 2024 to USD 556.21 billion by 2032

Recording a CAGR of 4.0%, the market will exhibit steady growth during the forecast period of 2023-2030.

Key growth drivers include the rising prevalence of skin-related issues, growing awareness of personal grooming, and the increased use of active ingredients like niacinamide, hyaluronic acid, and AHAs in cosmetic formulations. Additionally, consumer preference for sustainable and dermatologically beneficial products further accelerates demand.

The leading countries in the European cosmetics market include Germany, France, Italy, Spain, and the U.K. These nations have high consumer spending on beauty and personal care products, well-established beauty brands, and a growing inclination toward premium and organic cosmetics.

A major trend is the rising demand for active ingredient-based cosmetics, including serums and creams formulated with Vitamin C, niacinamide, and retinol. Theres also a strong push towards vegan, cruelty-free, and eco-friendly cosmetics, and an increasing focus on inclusive beauty targeting diverse skin tones and concerns.

Prominent companies include LOreal S.A. (France), Beiersdorf AG (Germany), Unilever plc (U.K.), The Estée Lauder Companies (U.S.), and Shiseido Co., Ltd. (Japan). These brands invest in R&D, acquisitions, and product innovation to maintain competitiveness and meet evolving consumer demands.

Challenges include the risk of skin complications from excessive product use, increasing regulatory scrutiny, and growing consumer concerns over chemical formulations. Health risks like skin allergies, pigmentation, and sensitivity due to overuse of skincare products may hinder market growth.

Trending active ingredients include Alpha Hydroxy Acids (AHAs), Beta Hydroxy Acids (BHAs), hyaluronic acid, niacinamide, and Vitamin E. These components are widely used for their skin-enhancing properties, such as reducing wrinkles, evening out skin tone, and treating acne.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us