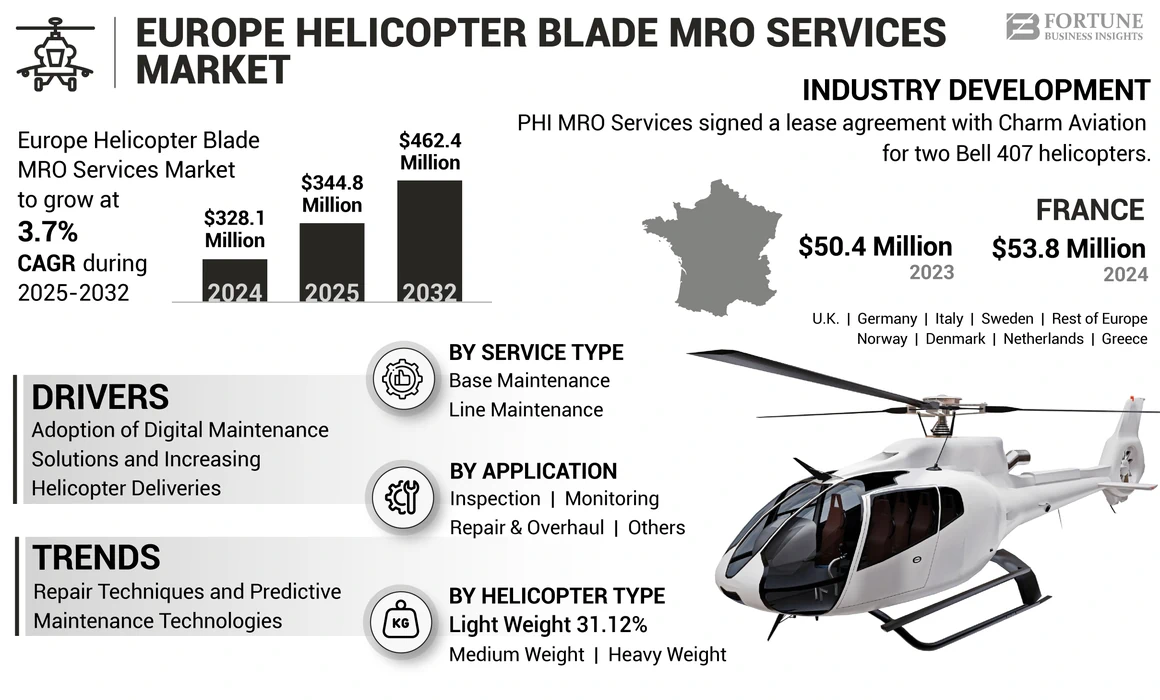

Europe Helicopter Blade MRO Services Market Size, Share & Industry Analysis, By Service Type (Base Maintenance and Line Maintenance), By Helicopter Type (Light Weight, Medium Weight, and Heavy Weight), By Application (Inspection, Monitoring, Repair & Overhaul, and Others), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

The Europe helicopter blade MRO services market size was valued at USD 328.1 million in 2023. The market is projected to grow from USD 344.8 million in 2024 to USD 462.4 million by 2032, exhibiting a CAGR of 3.7% over the forecast period.

Helicopter blade MRO services comprise a range of processes aimed at ensuring the reliability, operational efficiency, and airworthiness of helicopter rotor blades. These services include thorough inspections, monitoring & testing, repairs, and other activities to address issues, such as degradation, corrosion, leading-edge replacement, or non-compliance with industry standards. By utilizing advanced techniques and tools, helicopter blade MRO service providers enhance blade functionality and safety, ultimately extending the lifespan of rotor systems and ensuring optimal aircraft performance.

The European market for helicopter blade MRO services is anticipated to grow significantly in upcoming years owing to a combination of technological advancements, digitalization of MRO processes and solutions, military modernization programs, and regulatory developments. For instance, in 2023, military modernization programs such as Poland’s Acquisition of 96 Boeing AH-64E Apache helicopters and regulatory developments such as EASA Standards for Electric and Hybrid Helicopters 2023, are driving the market. Additionally, technological advancements, such as the EU-funded MORPHO Project, aim to develop smart aeronautical parts with embedded sensors for real-time monitoring and maintenance. These developments and ongoing initiatives are anticipated to drive market growth during the forecast period.

Airbus SE, Leonardo S.p.A., CHC Group LLC, Bristow Group Inc., and Babcock International Group plc are ranked highest as they provide better helicopter blade MRO services experience, quick turnaround time, and reduced downtime for helicopters.

MARKET DYNAMICS

Market Drivers

High Adoption of Digital Maintenance Solutions and Increasing Helicopter Deliveries to Boost Market Growth

The Europe helicopter blade MRO services market growth is anticipated to be robust, driven by the high adoption of digital maintenance solutions and increasing helicopter deliveries. The integration of advanced technologies such as robotics, sensor systems, and machine learning is enhancing maintenance operations, reducing downtime, and improving efficiency. These technologies enable predictive maintenance, allowing for timely interventions before failures occur, thereby ensuring operational readiness and safety. Additionally, these technologies allow for real-time monitoring and data analysis, further reducing downtime and improving operational efficiency.

For instance, companies such as Standard Aero are leveraging these technologies to optimize maintenance schedules and reduce operational costs. Airbus SAS, at the forefront of this digital transformation is leveraging its extensive experience in aerospace technology to implement modern maintenance practices that align with regulatory standards and enhance service delivery. For instance, in October 2024, reports such as data-driven defense and AI-driven aircraft predictive maintenance highlighted that many MRO providers are implementing. AI-driven predictive maintenance tools analyze real-time data from helicopter sensors, enabling proactive maintenance scheduling and reducing operational downtime.

The adoption of digital maintenance solutions is transforming the helicopter MRO landscape. Companies such as Airbus have integrated advanced analytics and predictive maintenance technologies to enhance operational efficiency and reduce downtime. For instance, in August 2023, Airbus announced the implementation of its Skywise platform, which utilizes data analytics to streamline maintenance processes and improve fleet management.

Europe specifically benefits from this trend as countries ramp up their helicopter fleets to meet operational demands. For instance, Airbus delivered over 600 helicopters for EMS applications in Europe alone, which directly correlates with an increased need for MRO services. For instance, in August 2023, Airbus announced plans to expand its MRO capabilities in Europe to accommodate the growing fleet size and complexity of maintenance requirements. This expansion includes the establishment of new service centers equipped with cutting-edge technology for enhanced blade inspections and repairs.

These trends indicate a shift toward more efficient and cost-effective maintenance solutions, aligning with the industry's focus on operational readiness.

Market Restraints

High Equipment Costs and Budget Constraints to Hinder Investments and Market Growth

Despite the growth potential, several investment challenges are hindering market expansion. The high cost of advanced maintenance equipment and technology is a major barrier for MRO providers. High initial investments are required for state-of-the-art tools, robotics, and digital maintenance systems, which can strain budgets, especially for smaller operators. The costs associated with acquiring advanced maintenance equipment can be prohibitively high for many operators. For instance, in July 2024, it was reported that many MRO providers are struggling with the financial burden of upgrading their facilities to meet new technological advanced standards.

Operators, especially in the defense sector, often face fluctuating budgets that limit their ability to invest in necessary MRO services. The ongoing economic pressures, exacerbated by global events, have led many organizations to prioritize immediate operational needs over long-term investments in MRO capabilities. As a result, budget constraints are forcing operators to delay essential upgrades and maintenance.

Many operators face budgetary limitations that restrict their ability to invest in comprehensive MRO programs. These budget constraints can lead to deferred maintenance or inadequate service levels, ultimately compromising safety and operational efficiency. According to the European Helicopter Association, the financial pressures on operators have intensified due to rising operational costs and economic uncertainties, making it challenging for them to allocate sufficient funds for MRO services. These factors collectively pose significant challenges to investment in the helicopter MRO market.

Market Opportunities

Advanced MRO Solutions and Fleet Modernization Presents Significant Growth Opportunities

The European helicopter blade Maintenance, Repair, and Overhaul (MRO) services market is poised for significant growth, driven by advanced MRO solutions and fleet modernization. The integration of IoT, machine learning, and predictive maintenance technologies is revolutionizing helicopter MRO services. These innovations enable real-time data collection and analysis, allowing for proactive maintenance scheduling that minimizes downtime and enhances operational efficiency.

Companies such as Airbus SAS are leading the charge by implementing advanced MRO solutions that replace traditional processes with more efficient, technology-driven approaches. For instance, in September 2024, Airbus announced a new digital platform aimed at streamlining MRO operations, significantly improving turnaround times and reducing costs. As helicopter fleets age, there is an increasing demand for modernized maintenance practices to ensure safety and compliance with stringent regulations.

The modernization of fleets involves upgrading existing helicopters with state-of-the-art systems, which require specialized MRO services. This trend presents a lucrative opportunity for MRO providers to offer tailored solutions that meet operators' evolving needs. Additionally, the European Helicopter Association reported in August 2024 that the rising number of helicopters used for Emergency Medical Services (EMS) is driving demand for specialized MRO services tailored to modernized fleets.

EUROPE HELICOPTER BLADE MRO SERVICES MARKET TRENDS

Repair Techniques and Predictive Maintenance Technologies to Drive Market Trends

Modern repair techniques involve sophisticated inspection methods, such as Non-Destructive Testing (NDT) and composite material repair. These methods allow for thorough assessments of rotor blades, identifying issues such as fatigue cracking and erosion before they lead to failures. For instance, in August 2024, Airbus SAS announced the implementation of advanced NDT techniques at its MRO facilities, enhancing the reliability of inspections and repairs for its helicopter fleets. This investment underscores the importance of adopting modern repair techniques to ensure operational safety.

Specialized activities such as blade balancing are critical for optimizing helicopter performance. These techniques help reduce vibrations, which can lead to longer blade life and improved fuel efficiency. For instance, in September 2024, Standard Aero signed a contract with Corendon Airlines to provide comprehensive blade balancing services, showcasing the growing demand for specialized repair techniques that enhance operational efficiency.

The integration of IoT devices and sensors in helicopters allows for continuous monitoring of blade conditions. Predictive maintenance technologies analyze real-time data to forecast potential failures, enabling proactive maintenance scheduling. Helicopter blade MRO services providers are increasingly adopting predictive maintenance technologies to improve service delivery. This trend is expected to significantly reduce downtime, allowing operators to maintain higher levels of operational readiness.

Download Free sample to learn more about this report.

IMPACT OF RUSSIA-UKRAINE WAR

Disruptions in Supply Chains, Demand for MRO Services, and Shift in Operational Focus Influence the Market

The ongoing Russia-Ukraine war has influenced the European market for helicopter blade MRO services, with a comprehensive impact stemming from geopolitical tensions and skirmishes, economic sanctions, and supply chain disruptions.

Amid EU and NATO Sanctions against Russia, the country has been facing supply chain disruptions related to aircraft and helicopter parts and raw materials. For instance, in March 2022, EU sanctions prohibited aviation trade and the sale of components, disrupting the supply chain for many European MRO service providers. This led to increased maintenance costs and requirements for alternative suppliers of key materials such as titanium, nickel, and aluminum, which were previously sourced from Russia.

The war also influenced the shift in operational focus areas, owing to which many service providers are investing in advanced technologies such as data analytics, digital twins, and advanced predictive maintenance tools to enhance service delivery and reduce downtime. For instance, in October 2024, many MRO providers began implementing AI-driven predictive maintenance tools to analyze real-time data from helicopter sensors, enabling proactive maintenance scheduling. This technological shift is critical as operators seek to optimize their fleets amidst rising operational demands.

The conflict has also intensified regulatory scrutiny within Europe. The European Union Aviation Safety Agency (EASA) has established stringent guidelines for MRO providers, particularly concerning safety and compliance standards. In September 2024, Airbus announced enhancements to its MRO capabilities, specifically targeting aging helicopter fleets while ensuring compliance with EASA regulations. Adapting to these evolving regulations is crucial for MRO providers aiming to maintain their market positions.

SEGMENTATION ANALYSIS

By Service Type

Line Maintenance Segment Dominated Owing to Rising Emphasis on High Operational Efficiency

The market is segmented based on service type into base maintenance and line maintenance.

The line maintenance segment dominated the Europe helicopter blade MRO services market with the largest market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period. This growth is driven by the emphasis on high operational efficiency for ensuring helicopters remain operationally ready, minimizing downtime, and maximizing availability, which is particularly crucial in emergency services and commercial operations where quick turnaround times are important. Additionally, as the number of helicopters in service rises, so does the need for regular line maintenance to ensure safety and compliance with aviation regulations.

For instance, in January 2024, Airbus announced a new line maintenance contract with a major European airline to support its fleet of helicopters, enhancing operational efficiency and service availability. Similarly, in March 2024, Heli-One expanded its line maintenance services across Europe, partnering with several operators to streamline maintenance processes and reduce aircraft downtime.

The base maintenance segment is estimated to grow at the second-highest CAGR in the forecast period. The increasing number of helicopters necessitates comprehensive base maintenance to ensure regulatory compliance. The adoption of modern techniques and digital solutions in base maintenance operations enhances efficiency and effectiveness, driving growth in this segment.

For instance, in July 2024, Safran Helicopter Engines announced plans to construct new facilities near Hamburg to enhance its MRO capacity. This expansion is aimed at supporting increased demand from military operators in Germany and surrounding regions, reinforcing the importance of base maintenance services.

For instance, in February 2024, Sabena Technics completed the acquisition of Héli-Union, strengthening its base maintenance capabilities for military helicopters across Europe. This acquisition allows Sabena to provide comprehensive MRO services for a significant portion of the French military helicopter fleet. In April 2024, Standard Aero announced an expansion of its base maintenance facilities in the U.K. to meet growing demand from both civilian and military helicopter operators.

By Helicopter Type

Medium Weight Helicopters Lead Due to their Increased Demand for Various Applications

Based on helicopter type, the market is segmented into light weight, medium weight, and heavy weight.

The medium weight segment dominated the Europe helicopter blade MRO services market share in 2023 and is anticipated to grow at a moderate rate during the forecast period. Increased demand for medium weight helicopters for various applications, such as search and rescue, offshore oil and gas exploration, and transportation, is driving the segment’s growth. Additionally, continuous innovations in helicopter design, avionics, and materials are reducing maintenance cycles and enhancing the operational efficiency of medium-weight helicopters, making them more appealing to operators.

For instance, in March 2024, a consortium led by the Danish aerospace firm Skyways announced plans to develop lightweight eVTOLs for urban air taxi services, reflecting the growing trend toward lightweight helicopter applications in urban environments.

Light weight segment was the second-largest in the helicopter blade MRO services market in 2023. Demand for lightweight helicopters in Helicopter Emergency Medical Services (HEMS) due to their agility and ability to access remote areas and the growing interest in urban air mobility solutions are some of the factors driving market growth. For instance, in April 2024, French startup Volocopter partnered with local authorities to introduce lightweight air taxi services in Paris, further highlighting the rapid growth of this segment driven by technological advancements and changing consumer preferences.

The NATO Next Generation Rotorcraft Capability (NGRC) program, launched in November 2020 by France, Germany, Greece, Italy, and the U.K., aims to integrate next-generation medium-lift helicopters by mid-2030. This initiative is expected to replace around 1,000 helicopters with advanced designs that incorporate electric or hybrid power.

To know how our report can help streamline your business, Speak to Analyst

By Application

Repair & Overhaul Segment to Highest CAGR Owing to Increased Demand for Regular Maintenance Requirements

By application, the market is categorized into inspection, monitoring, repair & overhaul, and others.

Repair & overhaul segment dominated in the Europe helicopter blade MRO services market in 2023. Many existing helicopters are aging, necessitating more frequent repairs to ensure safety and compliance with regulatory standards. This trend is particularly prevalent in military and commercial sectors where operational readiness is paramount. Aging helicopter fleet, stringent safety regulations, the adoption of advanced technologies and digital techniques for maintenance operations, and the growing number of helicopter deliveries for various applications are factors influencing the segmental growth in 2023 and during the forecast period.

- For instance, in December 2023, Airbus SAS expanded its MRO services in Europe by securing contracts with various military and commercial operators to provide comprehensive blade maintenance solutions. This move is expected to enhance their service offerings significantly.

- For instance, in November 2023, Safran signed a contract with ITP Aero to implement engine condition monitoring systems at their facilities in Ajalvir (Madrid) and Albacete, Spain. This contract focuses on predictive maintenance using big data analysis, which will improve the efficiency of helicopter operations.

The inspection segment is estimated to be the second-largest segment in the Europe helicopter blade MRO services market in 2023 and is anticipated to grow at the highest rate during the forecast period. Regular inspections are vital for identifying potential issues before they lead to failures, ensuring the safety of operations. This is increasingly important due to the aging helicopter fleets in operations. Compliance with aviation regulations mandates frequent inspections, driving demand for this service.

- For instance, in January 2024, Leonardo announced an initiative focused on enhancing inspection protocols using advanced technologies such as AI and machine learning to improve accuracy and reduce inspection times. In March 2024, Airbus Helicopters launched a new inspection service package aimed at optimizing operational efficiency for operators across Europe, highlighting the industry’s growing focus on proactive maintenance strategies.

The monitoring segment is estimated to grow at the second-highest rate during the forecast period. Predictive maintenance technologies allow operators to monitor helicopter performance in real-time, helping them preemptively address issues. As older helicopters are updated with modern monitoring systems, the demand for monitoring services is expected to grow significantly.

- For instance, in February 2024, Heli-One introduced a new monitoring system that integrates IoT technology to provide real-time data analytics for helicopter performance, enhancing operational decision-making. In April 2024, Bell Helicopter announced a partnership with Google Cloud to develop advanced monitoring solutions that leverage big data analytics to improve maintenance scheduling and reduce costs.

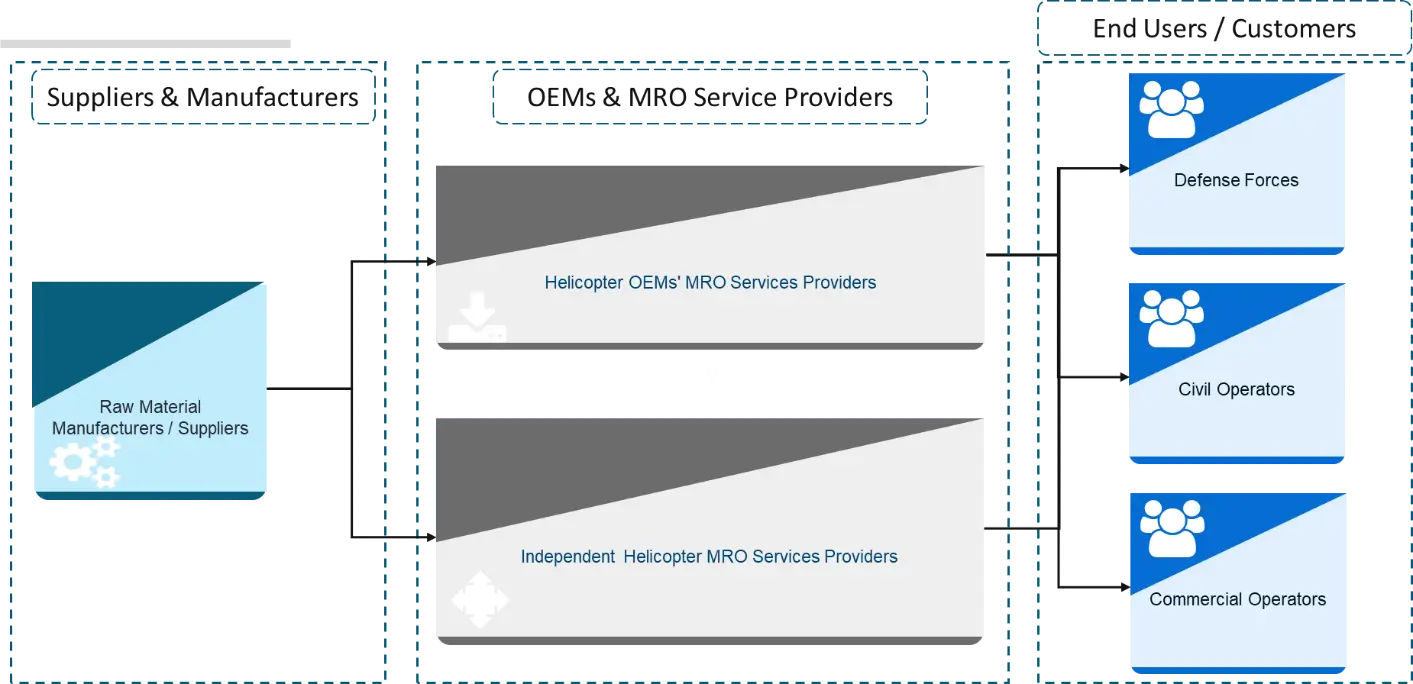

Supply Chain Analysis

Raw material manufacturers and suppliers play a crucial role in the helicopter blade MRO supply chain. Primary materials used in helicopter blades include advanced composites, metals, and coatings that enhance durability and performance.

- Composite Materials

- Metal Suppliers

- Coating Providers

Helicopter OEMs' MRO Services Providers: Original Equipment Manufacturers (OEMs) such as Airbus and Leonardo provide MRO services directly to customers, ensuring maintenance adheres to manufacturer specifications.

- Integrated Services

- Digital Solutions

Independent MRO providers offer flexibility and often competitive pricing compared to OEM services. They cater to a diverse clientele including private operators and governmental agencies.

- Many independent providers focus on niche markets or specific helicopter types, allowing them to develop expertise that can lead to cost savings for clients.

- Collaboration with OEMs: Some independents collaborate with OEMs for parts sourcing or technical support, enhancing the scope of their services.

End-users represent the final link in the supply chain, comprising various sectors:

- Defense Forces: Military operators require robust MRO services due to the critical nature of their operations. They often engage in long-term contracts with both OEMs and independent providers.

- Civil Helicopter Operators: These operators use helicopters for Emergency Medical Services (EMS), search and rescue missions, and tourism. Their demand for reliable MRO services is driven by regulatory requirements for safety.

- Commercial Helicopter Operators: Businesses using helicopters for transportation and logistics seek cost-effective MRO solutions while adhering to high safety standards.

EUROPE HELICOPTER BLADE MRO SERVICES MARKET COUNTRY-LEVEL OUTLOOK

By country, the market is divided into the U.K., Germany, France, Italy, Sweden, Norway, Denmark, Netherlands, Greece, and the rest of Europe.

The rest of Europe accounted for the largest share in 2023 and is likely to remain dominant throughout the forecast period. Increased military investments by Central and Eastern Europe countries due to geopolitical tensions from the Russia-Ukraine War are contributing to the growth of the market. Additionally, the growing civil aviation sector, expansion in tourism and emergency medical services, and stringent EASA regulatory compliance and safety standards are further driving the market during the forecast period.

For instance, according to the Stockholm International Peace Research Institute Report 2022, military spending across Central and Western Europe reached approximately USD 345 billion in 2022. This surge in defense expenditure is driving demand for MRO services as nations work to maintain and upgrade their helicopter fleets.

The market in France held a significant market share in the base year and is estimated to be the fastest-growing country in the forecast period. The presence of some of the largest helicopter MRO services providers with a strong industrial base is a key factor driving market growth in France. Additionally, the French Government’s focus on military helicopter modernization programs and innovation in MRO techniques are further driving growth.

For instance, In November 2023, Airbus announced a strategic partnership with Elbit Systems Ltd to enhance MRO capabilities specifically focused on military helicopters, further solidifying France's position in this sector.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Players Focus on Acquisitions and Service Enhancements to Gain Strong Foothold

The Europe helicopter blade MRO services market is relatively fragmented, with several major key players operating in this industry. Key players are offering services across various applications, catering to civil and military sectors. The top ten players in the industry are Airbus SE, Leonardo S.p.A., CHC Group LLC, Bristow Group Inc., Babcock International Group plc, Petroleum Helicopters International Inc. (PHI Inc.), Heli Air Ltd., Gulf Helicopter Company, NHV Group, and HeliService International GmbH. These companies stand out based on their services portfolio, regional presence, and industry experience.

Additionally, Airbus finalized the acquisition of ZF Luftfahrttechnik in January 2023, which is now operating as Airbus Helicopters Technik GmbH. This acquisition enhanced Airbus's MRO capabilities, particularly for dynamic components used in light and medium helicopters. The integration of ZF Luftfahrttechnik allows Airbus to improve service offerings for military customers, including the German Bundeswehr, by addressing their MRO needs more effectively.

LIST OF KEY HELICOPTER BLADE MRO SERVICES MARKET PLAYERS:

- Airbus SE (France)

- Leonardo S.p.A. (Italy)

- CHC Group LLC (U.S.)

- Bristow Group Inc. (U.S.)

- Babcock International Group plc (U.K.)

- Petroleum Helicopters International Inc. (PHI Inc.) (U.S.)

- Heli Air Ltd. (Austria)

- Gulf Helicopter Company (Qatar)

- NHV Group (Belgium)

- HeliService International GmbH (Germany)

- Heli-Union Industry (France)

- Swedish Maritime Administration (SMA) (Sweden)

- Patria Helicopters AB (Sweden)

- Heli-One Norway AS (Norway)

- Kongsberg Aviation Maintenance Service (Norway)

- Saab AB (Sweden)

- Heli Holland Technics B.V. (Netherlands)

- Hellenic Aerospace Industry (HAI) S.A. (Greece)

- Mecaer Aviation Group (MAG) (Italy)

- Hélicoptères de France (HDF) (France)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – MBDA signed two MoUs with Greek companies MILTECH and ALTUS to develop systems based on the AKERON MP missile, enhancing local capabilities in military aviation. This initiative may indirectly bolster the MRO market for heavyweight helicopters in Greece.

- January 2024 – Sabena Technics acquired Héli-Union, enhancing its position in military helicopter maintenance across Europe. This acquisition could expand the company’s service offerings, particularly for medium-weight helicopters in Greece.

- July 2023 – PHI MRO Services, a leader in maintenance, repair, and overhaul services, announced that it has signed a lease agreement with Charm Aviation for two Bell 407 helicopters. Under the agreement, PHI MRO Services installed floats and air conditioning in the Bell 407 helicopters provided to Charm Aviation.

- March 2022 – Rheinmetall Aviation Services GmbH was awarded a follow-on contract by the Bundeswehr to provide MRO and support services to Germany’s Sikorsky CH-53G transport helicopters. As per the contract, Rheinmetall Aviation Services GmbH had been supporting Bundeswehr (German Air Forces) by conducting pre-flight inspections and operating three service bays.

- August 2021— The US Department of Defense has awarded a contract worth USD 116.5 million for the maintenance and overhaul of the UH-60 Black Hawk main rotor blade. Under the contract, the entire fleet will be modernized over the period.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on important aspects, such as key players, service type, helicopter type, and applications depending on various countries. Moreover, it offers deep insights into the market trends, competitive landscape, market competition, pricing of services, market status, and highlights key industry developments. Additionally, it encompasses several direct and indirect factors that have contributed to the expansion of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 3.7% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Service Type

|

|

By Helicopter Type

|

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

As per the Fortune Business Insights study, Europe’s market size was valued at USD 328.1 million in 2023 and is anticipated to USD 462.4 million by 2032.

The market is likely to grow at a CAGR of 3.7% over the forecast period.

The top ten players in the industry are Airbus SE, Leonardo S.p.A., CHC Group LLC, Bristow Group Inc., Babcock International Group plc, Petroleum Helicopters International Inc. (PHI Inc.), Heli Air Ltd., Gulf Helicopter Company, NHV Group, and HeliService International GmbH.

Rest of the Europe dominated the market in 2023.

France is anticipated to be the fastest-growing country during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us