Europe Olive Oil Market Size, Share & COVID-19 Impact Analysis, By Type (Refined/Pure, Virgin, and Others), By End-user (Household/Retail, Foodservice/HoReCa, Food Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

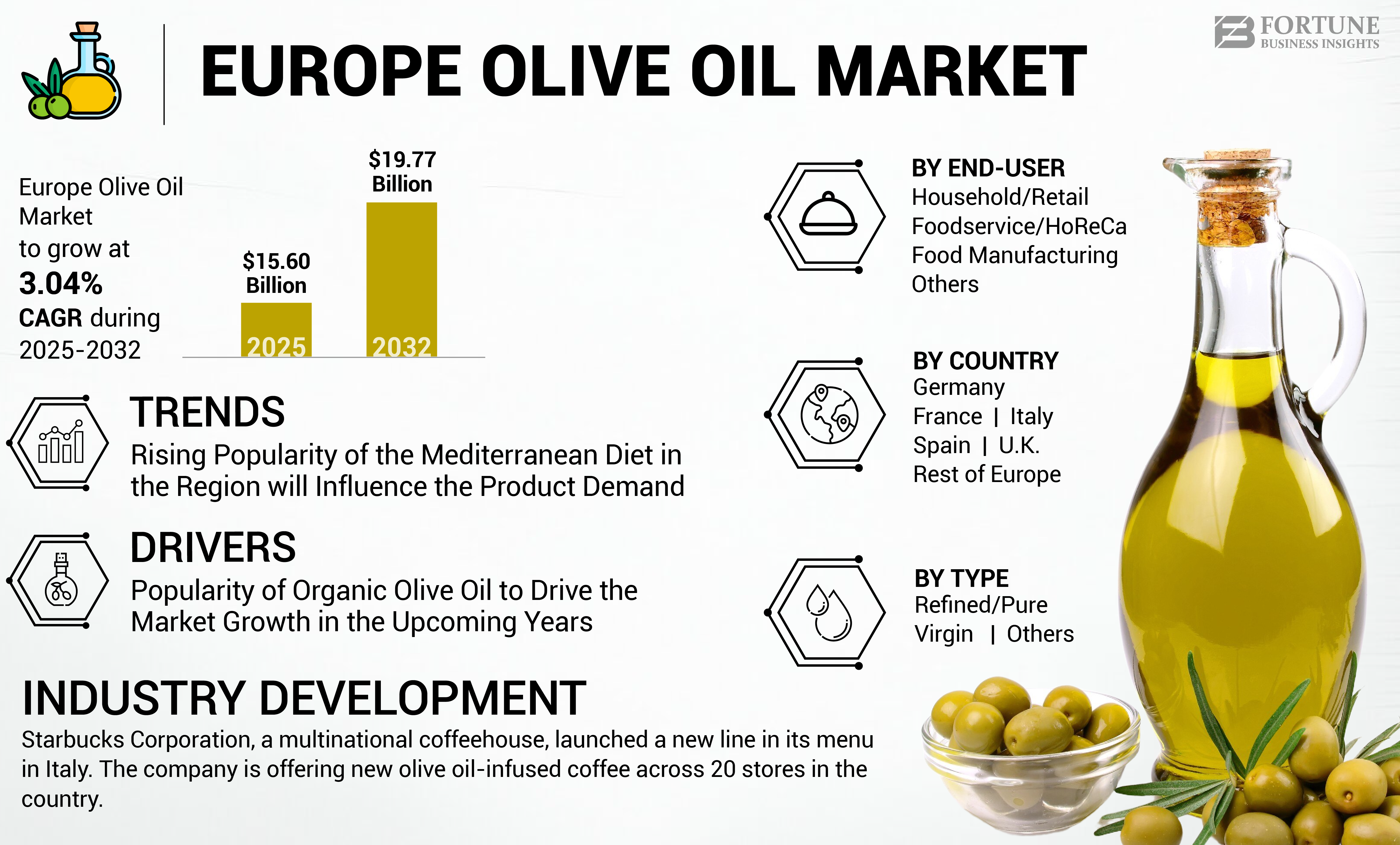

Europe is the largest region in the global olive oil market. The Europe olive oil market size is projected to grow at a CAGR of 3.04% during the forecast period. The global olive oil market size is projected to grow from USD 15.60 billion in 2025 to USD 19.77 billion by 2032.

Europe is one of the largest producers of olive fruit oil in the global space. Spain, Italy, Greece, and Portugal, which are prominent regional producers, contribute nearly 63%, 17%, 14%, and 5%, respectively, to the region’s total olive oil production annually. The increasing product production across the region will drive the product sales in the coming years. According to the International Olive Council, the production volume of olive oil in Europe has increased from 1,920 thousand tons in 2019/20 to 2,272 thousand tons in 2021/22.

Our report on the Europe olive oil market covers the following countries – Germany, France, Italy, Spain, the U.K., and the Rest of European countries.

Europe Olive Oil Market LATEST TRENDS

Rising Popularity of the Mediterranean Diet in the Region will Influence the Product Demand

The Mediterranean diet practice is strongly increasing across European countries, including Belgium, Greece, Iceland, and Spain. The product is a primary source of added fat in this particular diet. European Commission is bringing several projects such as MedDiet, Mediterranean Diet Virtual Museum, and MedEat Research to promote the diet practice and consumption of refined olive fruit oil. Different organizations are also joining hands with the EU commission, including the Mediterranean Diet Foundation in Barcelona and the International Foundation of Mediterranean Diet in London to promote this particular diet across the region. This trend will positively influence the product consumption in the near future.

Europe Olive Oil Market Growth FACTORS

Popularity of Organic Olive Oil to Drive the Market Growth in the Upcoming Years

There has been a paradigm shift in the demand for organic foods across the region. The reasons behind this growth are increasing awareness of health, harmful effects of pesticides used during traditional olive production, food safety, and environmental sustainability. According to the Ministry of Agriculture Spain, one out of ten hectares of organically cultivated land in Spain is reserved for olive groves. They cover nearly 222,723 hectares. Furthermore, some regional government authorities are designing supportive laws to increase olive production in organic processes. Thus, the increasing organic and extra virgin olive production will drive the Europe olive oil market growth in the upcoming years.

- In April 2022, the Italian government introduced a new law to promote organic farming, including olive. It is also providing several financial assistance to the farmers to boost organic farming.

RESTRAINING FACTORS

Competition from Counterfeit Oils to Impede the Demand for Olive Oil in the Market

In several European nations, the product is exhibiting strong competition from alternative oils such as canola and sunflower oil. Several northern European countries use other oils across the household, food service, and HoReCa sectors. In several northern European countries, olive fruit oil is considered as a higher-end product with its competing vegetable oils such as canola, soybean, palm, sunflower oil. Therefore, consumers are using the oil for dressing salads, raw vegetables, and in dips instead of using it as a cooking oil. Thus, the strong competition from alternative products in terms of price and availability may lower the demand for the product in the region. Moreover, increasing fluctuations in the product prices due to impact on harvest caused by climatic conditions may impact the market growth of the region negatively.

KEY INDUSTRY PLAYERS

Expanding Sales Footprints and Adding Novel Products in the Portfolio are Emerging as Major Growth Strategies for Industry Players

In terms of the competitive landscape, De Cecco di Filippo SPA, Farchioni Ollii SPA, Deoleo SA, Marmara GmbH, and Casa Anadia are some of the key players in the European market. Owing to the large consumer base, established suppliers network, and geographical footprint, these companies are achieving a competitive advantage in the market space.

Moreover, their diversified product portfolio, strong brand identity, and marketing strategies are also helping to increase their footprint in the regional market. By holding a prominent share in the regional market, these companies are initiating several new trends, educating consumers about olive oil's benefits and supporting the farmers to produce olives sustainably. The vertical integration strategy applied by the companies allows them to achieve sustainability in their supply chain.

List of Top Europe Olive Oil Companies:

- F.lli De Cecco di Filippo S.p.A (Italy)

- Farchioni Olii S.P.A. (Italy)

- Deoleo, S.A, (Spain)

- Olive Line International S.L. (Spain)

- La Española Olive Oil Inc., (Spain)

- Marmara GmbH (Germany)

- Acropolis Olive Oil (U.K.)

- Borges International Group (Spain)

- Casa Anadia (Portugal)

- Casa Agrícola Rui Batel, Lda (Portugal)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: Starbucks Corporation, a multinational coffeehouse, launched a new line in its menu in Italy. The company is offering new olive oil-infused coffee across 20 stores in the country.

- December 2022: A consortium was launched in Germany that is dedicated to educating consumers and training professionals in the food service sector about PGI Tuscan olive oil. A new website has been launched, which features updated information, news, and recipes for PGI Tuscan olive oil.

- October 2020: The European Union initiated a project called “ARTOLIO” as a part of ENI CBC Med program to implement innovative production measures to improve the quality of olive production. This project is funded by approximately USD 3.43 million by European Union under the ENI CBC Med Program.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides qualitative and quantitative insights on the market and a detailed analysis of the market share, size & growth rate for all possible segments. Along with the market forecast, the research report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are overview of the number of procedures, an overview of price analysis of types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Report Scope& Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.04% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type and End-user |

|

By Type |

|

|

By End-User |

|

|

By Country |

|

Frequently Asked Questions

According to Fortune Business Insights, the Europe olive oil market is projected to grow from USD 15.60 billion in 2025 to USD 19.77 billion by 2032.

Growing at a CAGR of 3.04%, the market will exhibit steady growth in the forecast period (2025-2032).

Spain, Italy, Greece, and Portugal dominate olive oil production in Europe. Spain contributes around 63%, followed by Italy (17%), Greece (14%), and Portugal (5%), making them key players in both domestic and global olive oil supply.

Olive oil consumption is rising due to the increasing popularity of the Mediterranean diet, supported by EU-backed health initiatives and awareness campaigns. Additionally, consumers are shifting toward organic and extra virgin olive oils for health and sustainability benefits.

Major trends include a surge in organic olive farming, integration of olive oil in foodservice innovations (like olive oil-infused coffee), and educational campaigns promoting PGI-certified regional oils. These efforts are enhancing consumer trust and market growth.

The market faces challenges such as competition from cheaper vegetable oils (e.g., sunflower, canola), especially in Northern Europe. Additionally, climate-induced production fluctuations and the prevalence of counterfeit oils impact pricing and consumer confidence.

Leading players include Deoleo S.A. (Spain), F.lli De Cecco di Filippo S.p.A. (Italy), Farchioni Olii S.P.A. (Italy), Borges International Group (Spain), and Casa Anadia (Portugal). These companies benefit from established supply chains, brand recognition, and regional presence.

The EU supports production through initiatives like the ARTOLIO project and promotion of organic farming laws, such as Italy’s 2022 law offering financial incentives to organic olive growers. These efforts aim to boost quality and sustainability.

The market is segmented by type (Refined/Pure, Virgin, Others) and end-user (Household/Retail, Foodservice/HoReCa, Food Manufacturing). Regional analysis covers major countries such as Germany, France, Italy, Spain, the U.K., and Rest of Europe.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us