Europe Photo Products Market Size, Share & COVID-19 Impact Analysis, By Type (Photobooks and Other Photo Products), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

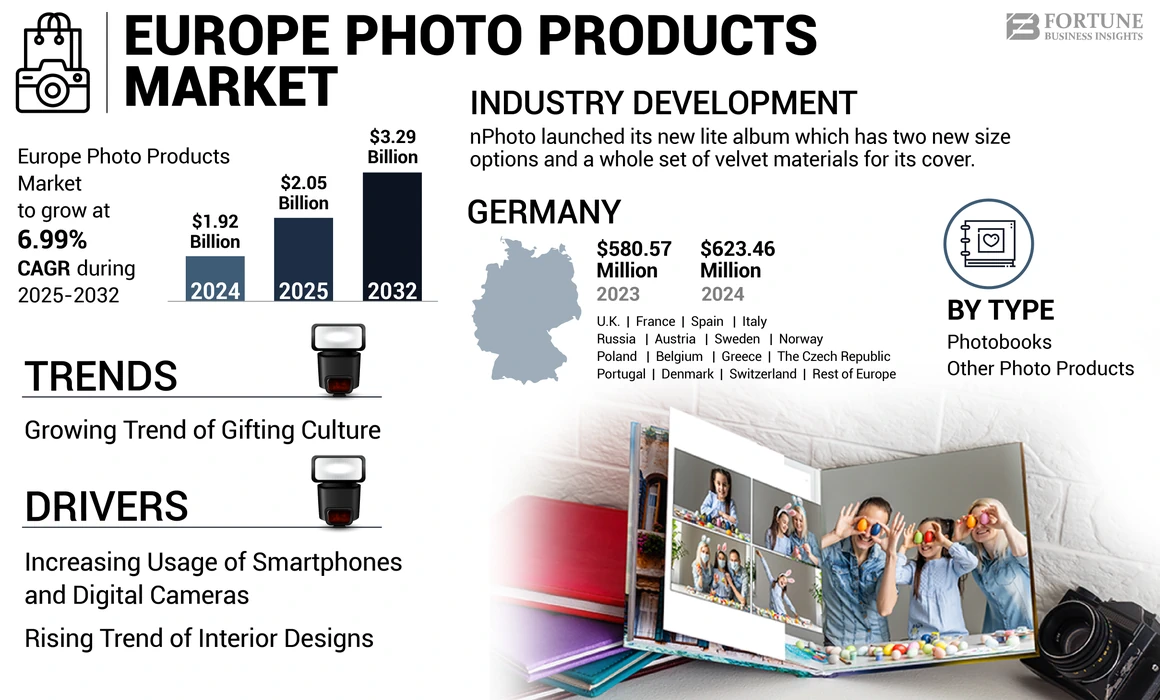

The Europe photo products market size was valued at USD 1.92 billion in 2024. The market is projected to grow from USD 2.05 billion in 2025 to USD 3.29 billion by 2032, growing at a CAGR of 6.99% during the forecast period.

The photo products are made using papers, hardcovers, cardboard and other decorative items. Various photobook and photo products manufacturers such as CEWE, Photobox group, and smart photo group, make customized photobooks and photo products with extensive options in terms of formats, sizes, and designs catering to various occasions according to the consumer requirements and preferences.

The demand for photo products is increasing owing to the rise in individuals' interest in preserving memories of their special moments of weddings, travel, festivals, and others. The rising married couples’ demand for premium wedding photography services, including the provision of lay flat and flush mount wedding albums by photographers, is mainly driving the photobooks’ market growth in Europe.

Furthermore, increasing trends of creating fashioned albums of pre-wedding engagements and elopements are favoring the demand for photobooks in European countries. Moreover, the increasing usage of photobooks among wildlife, still life, and editorial photographers to showcase their work as a publication is further boosting the market growth. The increasing number of business organizations creating photo-printed yearbooks and magazines as a part of their business processes is also expected to fuel the Europe photo products market growth.

COVID-19 IMPACT

Complete Closure of Retail Outlets and Factories Due to the COVID-19 Pandemic Adversely Impacted the Market Growth

The COVID-19 pandemic and the related lockdown were challenging for the industry, mainly due to the closure of retail stores all across Europe. The pandemic impacted the volume of photobook and other photo product sales due to the reduction in holiday plans of tourists in European cities. In addition, the decline in the number of wedding events and parties due to the lockdown impacted the sales of the product in Europe. According to Eurostat, a European government agency, in 2020, a decline of 26.32% was registered in the number of marriages in Europe compared to 2019. The pandemic also affected the supply chain for photobook and photo product manufacturers in Europe due to the implementation of lockdowns across the region, closure of international and national borders, lack of availability of labor, and other factors.

Europe Photo Products Market Trends

Growing Trend of Gifting Culture to Boost the Market Growth

The growing popularity of the product, encompassing custom photo books, calendars, and personalized items, is propelled by profound sentimental value, establishing it as the preferred option for gifting. These products empower individuals to infuse their gifts with a personal touch, converting them into meaningful and popular souvenirs for recipients. As the trend shifts toward more thoughtful and unique gifts, a growing number of people are opting for personalized offerings. These products present a unique opportunity to develop customized gifts that stand out, underscoring the thoughtful effort and consideration invested in selecting a present. Furthermore, the provision of corporate gifts such as welcome kits, festival hampers, and gifts for appraisal and promotion events in the commercial sector is contributing to a heightened demand for photo-based gifts, including greeting cards, calendars, diaries, coffee mugs, and photo frames.

Download Free sample to learn more about this report.

Europe Photo Products Market Growth Factors

Increasing Usage of Smartphones and Digital Cameras to Drive the Market Growth

The positive growth in the adoption of smartphones and digital cameras within a significant portion of the population has a favorable impact on the demand for the product. This is attributed to the rising advancements in technology, the increasing need for communication & connectivity, the professional use of high-quality cameras, the favorable emphasis on image quality, and the rising trend of social media across the region. The increased usage of these devices contributes to a higher availability of photos, thereby fostering the adoption of the product. Manufacturers in the digital camera and smartphone industry, including Apple Inc., Samsung, Kodak, Fuji cam, Sony, Nikon, Canon, One Plus, and Arri consistently introduce innovative products to drive the adoption of digital camera-based devices, including smartphones and various types of digital cameras such as SLR, DSLR, and others. These new offerings from manufacturers are expected to enhance the demand for smartphone adoption, thereby influencing the demand for the product during the forecast period.

Rising Trend of Interior Designs to Bolster the Market Growth

The escalating prominence of interior design significantly drives the growth of this market. As individuals place greater emphasis on enhancing the aesthetic appeal of their living spaces, the demand for personalized products, such as wall decorations, photo albums, and customized items, experiences a notable surge. The increasing interest in interior decor trends, especially customized products, supports the market growth and reflects a broader cultural shift toward making visually attractive and personalized living spaces. Moreover, factors such as rising disposable income, urbanization, and higher employment opportunities in European countries have further influenced the demand for the product, which is poised to further drive the market growth. In addition, innovative offerings such as augmented reality (AR) photo frames or personalized 3D-printed sculptures have attracted a large number of individuals, which further fueled the growth of the European market.

RESTRAINING FACTORS

Cloud Storage Advancements May Limit the Product Demand

Advancements in cloud storage technology have introduced a more sophisticated and widely adopted approach to manage personal photos. This has prompted individuals to favor the convenience of digitally storing their photos in the cloud rather than investing in traditional physical products including albums and printed pictures. The accessibility offered by cloud storage allows users to effortlessly view, share, and organize their digital photos across various devices, eliminating the necessity for physical prints, which further results in restraining the market growth. The prevalence of cloud storage providers, including Amazon, Microsoft Azure, OVH Cloud, DigitalOcean, CloudSigma, SAP, Fuga Cloud, and Rackspace Technology in European countries, increases the availability of such alternative products, potentially impacting the traditional Europe photo printing and photo product market and negatively.

Europe Photo Products Market Segmentation Analysis

By Type Analysis

The Photobooks Segment Dominates Owing to the Rise in Interest of Individual Towards Preserving Memories

Based on type, this European market is categorized into photobooks and other photo products.

The photobooks segment dominates the Europe photo products market share owing to the growing number of domestic tourists and shifting consumer preference from producing travel scrapbooks to photobooks to preserve their special vacation moments is favoring the product demand in Europe.

As per the data published by the European Union (EU), 56% of the European residents made at least one personal trip in 2021. Spain was the most popular tourist destination for international tourists, with 114 million nights spent by tourists in Spanish accommodations, 19% of the total European accommodations in 2021.

The other photo products segment is expected to grow with the highest CAGR during the forecast period. This segment includes calendars, cards, mugs, prints, posters, and others. The rising smartphone adoption and increasing consumer necessity of printing smartphone-clicked photographs in the form of prints, posters, and wall art is accelerating segmental growth. In addition, growing consumer spending on gift-giving products, including photo mugs, calendars, and gift cards during festival celebrations, is favoring segmental revenues across Europe.

COUNTRY INSIGHTS

Europe photo products market is studied across the U.K., Germany, France, Spain, Italy, Russia, Austria, Sweden, Norway, Poland, Belgium, Greece, The Czech Republic, Portugal, Denmark, Switzerland, and the rest of Europe.

Germany dominates the European market owing to the growing consumer spending on gift-giving items during festival seasons, such as Christmas and Halloween, which is expected to increase the demand for photo gift cards and photo mugs, favoring the market growth in the country. Evolving home renovation and remodeling trends and rising household demand for artistic wallpapers and photo posters to provide a personalized touch to their living room spaces are accelerating the market growth.

Market in France is expected to grow with a significant CAGR during the forecast period owing to the increasing number of domestic tourists and their spending on travel photobooks to preserve travel-related memories, which is driving product revenues in the country. Furthermore, evolving outdoor recreation and leisure trends and the growing consumer necessity of creating photobooks to store leisure activity-related photographic information are favoring the French market growth.

List of Key Companies in Europe Photo Products Market

Key Companies to Adopt Innovative Strategies to Gain a Competitive Edge

The European market is highly competitive, and prominent companies, such as CEWE, Photobox Group, Saal Digital, nPhoto, and others, have emphasized on technological innovations, partnerships, and business expansions to gain a strong foothold in the market. They are also focusing on their promotion and marketing strategies to create strong brand awareness.

LIST OF KEY COMPANIES PROFILED:

- allcop Farbbild-Service GmbH & Co. KG (Germany)

- CEWE (Germany)

- EXACOMPTA CLAIREFONTAINE (France)

- Ifolor Group (Switzerland)

- nPhoto (Poland)

- PhotoBox (U.K.)

- Point CZ (Czech Republic)

- Saal Digital (Germany)

- Smartphoto Group (Belgium)

- Cimpress (Ireland)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 - nPhoto, a Poland-based photo printing company, launched its new lite album. According to the company, the new album has two new size options and a whole set of velvet materials for its cover.

- June 2023 - Pixum, a German-based photo products company, launched its new Pixum postcard. According to the company, the photos can be sent from the consumer’s smartphone directly as printed postcards to recipients across Europe.

- September 2022 – Germany-based Pixum launched a limited-edition new advent calendar with 24 small doors filled with sustainable chocolates. The launch helped the company increase its product depth and revenue.

- March 2022 – Orwo, a German-based printing company, partnered with Photobook.AI, a Singapore-based photobook platform, to launch Pixelnet Fotos, a print-on-demand photo products application in Germany.

- January 2022 - Photobox, a U.K.-based photo products company, merged with Albelli, a Netherland-based photo products company. According to the company, the merger is to expand its reach across the European region.

REPORT COVERAGE

An Infographic Representation of Europe Photo Products Market

To get information on various segments, share your queries with us

The research report provides detailed market analysis and focuses on key aspects, such as prominent companies, competitive landscape, and types. Besides this, it offers insights into various market trends and highlights key industry developments. In addition to the above-mentioned factors, the report encompasses several other factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.99% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

Country

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 1.92 billion in 2024 and is projected to reach USD 3.29 billion by 2032.

Ascending at a CAGR of 6.99%, the global market is expected to exhibit steady growth over the forecast period (2025-2032).

In 2024, the Germany market value stood at USD 623.46 million.

Based on type, the photobooks segment leads the market.

The increasing usage of smartphones and digital cameras is poised to drive the market growth.

CEWE, Photobox Group, Saal Digital, nPhoto, and others are the major players in the market.

Germany dominates the market in terms of share.

Technological advancement is the major factor driving the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic