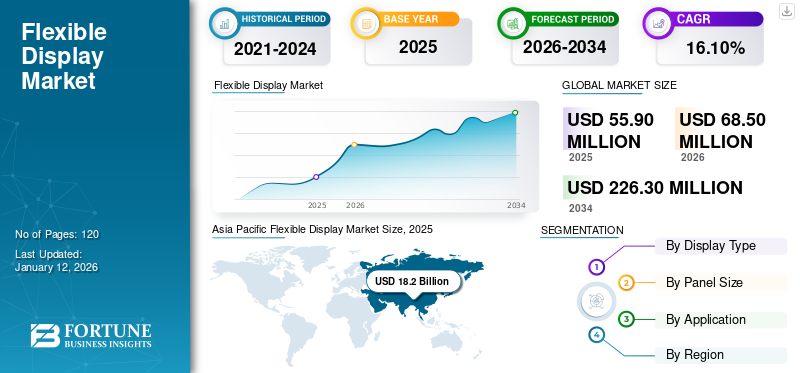

Flexible Display Market Size, Share & Industry Analysis, By Display Type (OLED, LCD, EPD (Electronic Paper Display), and Others (LED)), By Panel Size (Upto 6", 6–20", 20–50") By Application (Smartphones & Tablets, Television & Digital Signage, Automotive & Transportation, E-reader, Smartwatches & Wearables, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global flexible display market size was valued at USD 55.9 billion in 2025 and is projected to grow from USD 68.5 billion in 2026 to USD 226.3 billion by 2034, exhibiting a CAGR of 16.10% during the forecast period. Asia Pacific dominated the global market with a share of 22.39% in 2025.

Flexible displays are designed to be compatible with a variety of flexible form factors such as curvature, bending, folding, or rolling by using flexible materials rather than rigid glass. Such displays are an attractive alternative for consumer electronics manufacturers due to their superior portability, durability, and weight.

Global Flexible Display Market Overview

Market Size:

- 2025 Value: USD 55.9 billion

- 2026 Value: USD 68.5 billion

- 2034 Forecast Value: USD 226.3 billion, with a CAGR of 16.10% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific held a share of 22.39% in 2025, driven by high production and demand in countries like China, South Korea, and Japan

- Fastest-Growing Region: Asia Pacific is the fastest-growing region due to increasing investments and adoption of display technology

- End-User Leader: Smartphones and tablets led the market in 2024, owing to rising adoption of foldable and flexible display devices

Industry Trends:

- OLED Dominance: OLED technology held the largest market share due to its lightweight, thin, and flexible characteristics

- Emergence of E-Paper Displays: Growing traction for energy-efficient and portable applications

- Rise of Foldable Devices: Increasing demand for foldable smartphones and wearable devices accelerates adoption

Driving Factors:

- Rising Demand for Consumer Electronics: Especially foldable smartphones and smart wearables

- Advantages Over Rigid Displays: Including durability, light weight, and design flexibility

- Technological Advancements: In flexible materials and display manufacturing processes

The market growth can be attributed to factors, such as the high demand for advanced smartphones and tablets and the increasing demand for greater picture display quality. The rising trend in the innovation of consumer electronics also contributes to this growth. The technological advancements in the field of display technologies are fostering a growing potential for market share. In addition, these displays tend to be more energy-effective than traditional displays. The focus of organizations is on energy-efficient products because they need less power to operate, which could prolong the life of batteries in devices.

The COVID-19 pandemic had both positive and negative effects on the market. During the first phase of pandemic, lockdown measures imposed in different countries disrupted the supply chain for the manufacturing of phones and displays. However, this market is projected to grow further over the forecast period due to the rapid recovery of consumer electronics markets as a result of strong demand for products, such as smartphones, laptops, and others.

Flexible Display Market Trends

Rising Innovation in Consumer Electronics for Enhanced Display Capabilities to Propel Market Growth

One of the key factors that led to the adoption of connected and innovative display solutions in the consumer electronics sector is the rising trend for smarter homes and buildings and the increasing demand for connectivity technologies. The speed of the replacement cycle of new consumer electronics has been increased by the integration of intelligent sensors into electronic products. Displays are increasingly used to control and communicate with machines.

These displays are starting to emerge due to the fast adoption of new technologies, which highlights the need for an enterprise-wide change in consumer electronics. For instance, in May 2023, Tianma, a global manufacturer of panel displays, showed a wide variety of new technologies and solutions during Display Week 2023. The company showcased around 50 display demo units, including new prototypes and the latest introduced products.

Download Free sample to learn more about this report.

Flexible Display Market Growth Factors

Increasing Usage of Technologically Advanced Smartphones and Tablets for Flexible Display to Aid Market Growth

The need for flexible display is increasing exponentially as a result of the rapid adoption of advanced display technologies. Compared to traditional CRT technologies, the technological advancement of these displays provides increased contrast, greater resolution, and lower energy consumption.

The creation and introduction of new products with premium features and attractive designs has been driven by an increased level of market competitiveness. Companies such as Samsung Electronics Co., Ltd. and LG Display Co., Ltd. have driven the display market into a new age with the introduction of products based on technologies, including OLED and Q-dot. For instance, in December 2023, Samsung Display announced that they started mass production of a new 31.5-inch quantum dot-OLED monitor with ultra-high definition resolution. To achieve this resolution, the company processed enhanced inkjet printing technology to the quantum dot light-emitting layer.

RESTRAINING FACTORS

High R&D Costs and Complex Manufacturing Process to Hinder the Market Expansion

The development cost for the flexible display is higher as it requires technologically advanced materials. The production of flexible screens is a complex process with multiple stages. Other rival display technologies now provide the ability to design better and the need for fewer production steps. Flexible display technology must match the performance of rigid display technologies, currently used for this market. Thus, these factors are hindering the flexible display market growth.

Flexible Display Market Segmentation Analysis

By Display Type Analysis

Adoption of OLEDs to Increase Market Demand for Enhancing Display Capabilities Drives Segment Expansion

Based on the display type, the market is segmented into OLED, LCD, EPD (Electronic Paper Display), and others.

The OLED segment is projected to dominate the market with a share of 36.32% in 2026. Due to its simplicity of design, improved image quality, and limited flexibility, this kind of display is becoming increasingly popular. OLED screens do not use backlighting, and they can be thinned and shaped in different ways. For large screens, such as televisions and computer monitors, OLED display technologies are currently costly. However, for economies of scale in this segment, they still benefit from it.

The EPD (Electronic Paper Display) segment is anticipated to register the highest CAGR during the forecast period, owing to the rising adoption of flexible display-based e-readers. EPDs are soft, thin, and resilient. EPDs also provide low power dissipation and design autonomy.

By Panel Size Analysis

Ease of Accessibility and Cost-effectiveness for Upto 6” Panel Size Display to Drive Upto 6” Segment Growth

Based on panel size, the market is categorized into upto 6", above 50", 20-50", and 6-20".

The up to 6-inch segment is expected to lead the market, accounting for 34.07% of the total market share in 2026. The segment growth is due to its smaller size and easy-to-carry features. Additionally, it is cost-effective for both manufacturers and consumers.

The 20-50” segment is anticipated to register the highest CAGR during the forecast period. The rise of automotive display technologies used for better user experiences has created the demand for this segment in the market. Moreover, the growth of the segment can be accredited to the manufacturers launching innovative products. In September 2022, LG Electronics introduced the LG OLED Flex (model LX3), the 42-inch OLED screen that can bend.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Smartphone & Tablets Segment to Dominate Owing to its Enhanced Functionality

Based on application, the market is categorized into smartphones & tablets, television & digital signage, automotive & transportation, e-reader, smartwatches & wearables, and others.

The smartphones & tablets segment is anticipated to hold a significant market share of 26.74% in 2026. Flexible displays can enhance customers' ability to perform multifarious tasks on cellular devices, such as tablets. This improves the aesthetics and functionality of these devices. The display is a visual output surface created to resist being bent, folded, and twisted in smartphones. In addition, smartphones and tablets are easy to carry and economical.

The automotive & transportation segment is expected to grow at the highest CAGR during the forecast period significantly. Flexible displays are used in vehicle displays, such as instrument clusters and head-ups. This is due to these displays can be mounted on rigid surfaces, which makes them suitable for use in automobiles. With the help of wider visibility angles to allow a better view of the driver and passengers in the cabin, the safety features of the vehicle will be enhanced. The use of these displays has been greatly increased due to the rapidly growing demand for automatic transmission in the automotive and transportation sectors.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific Flexible Display Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held a major market share in 2025 and is expected to experience the highest growth rate during the forecast period. The growing demand for compact and lightweight electronic devices is reflected in regional growth. Moreover, it is expected that the growth of the region's market will be positively affected by the proliferation of mobile phones and an increase in the adoption of new technologies, such as 3D displays and augmented reality. The Japan market is projected to reach USD 6.1 billion by 2026, the China market is projected to reach USD 6.5 billion by 2026, and the India market is projected to reach USD 4.1 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

The Middle East & Africa is expected to register the second-highest growth rate in the market during the forecast period. Several display materials companies have been early investors in enhanced display technologies that are driving growth and contributing to the expansion of the market in the region.

North America

North America has also shown a considerable flexible display market share. The demand in the region is driven by the rising innovative display products, increased government spending, and improved infrastructure. The U.S. market is projected to reach USD 11.1 billion by 2026.

Europe

The UK market is projected to reach USD 4.1 billion by 2026, while the Germany market is projected to reach USD 2.9 billion by 2026.

Key Industry Players

Growing Adoption of Merger & Acquisition Strategies By Key Players to Propel Market Growth

The key players operating in the market are providing enhanced flexible displays to increase efficiency during tasks. The growing focus of these key players in acquiring small and local businesses to expand their reach. Moreover, strategic partnerships, mergers & acquisitions, and investments contribute to the increasing demand for the product.

List of Top Flexible Display Companies

- BOE Technology Group Co., Ltd. (China)

- LG Display Co., Ltd. (South Korea)

- Samsung Electronics (South Korea)

- Royole Corporation (China)

- Microtips (U.S.)

- E INK HOLDINGS INC. (Taiwan)

- SHARP CORPORATION (Japan)

- FlexEnable (U.K.)

- Innolux Corporation (Taiwan)

- AUO Corporation (Taiwan)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Samsung showed a new generation of products that can be folded outward and inward at CES 2024. In addition, new monitor-sized OLEDs, both foldable and slidable, have been revealed.

- November 2023: Vivo introduced the new flagship phone from VivoX100, which is a flexible OLED made by BOE and Visionox.

- July 2023: A team of scientists at the Department of Materials Engineering, Indian Institute of Science (IISc) developed a super flexible semiconductor composite material that can be used for next-generation applications in flexible or curved displays.

- April 2023: Researchers at the University of Chicago developed a flexible OLED display technology that could be used in the future for smart wearables, electronic equipment, and other flexible form factors.

- September 2021: PragmatIC Semiconductor, a player in flexible electronics and Ynvisible Interactive Inc., a player in the Internet of Things (IoT) market, entered into a supply agreement and partnership for 3 years. They offer deliverables and services of up to 2.0 million U.S. dollars, dedicated to fully integrated flexible display modules.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Display Type

By Panel Size

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 226.3 billion by 2034.

In 2025, the market value stood at USD 55.9 billion.

The market is projected to grow at a CAGR of 16.10%.

In 2025, the smartphones & tablets segment led the market.

Increasing usage of technologically advanced smartphones and tablets for flexible display to aid market growth.

BOE Technology Group Co., Ltd., LG Display Co., Ltd., Samsung Electronics, Royole Corporation, Microtips, E INK HOLDINGS INC., SHARP CORPORATION, FlexEnable, Innolux Corporation, and AUO Corporation are the top players in the global market.

In 2025, Asia Pacific recorded the largest market share.

The EPD (Electronic Paper Display) type segment is expected to exhibit the highest growth rate during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us