Flight Management and Guidance System Market Size, Share & Industry Analysis, By Component (Hardware (Flight Management Computer, Automatic Flight Control, Aircraft Navigation System, Electronic Flight Instrument System) & Software (Flight Management & Guidance System, Flight Management System software, Autopilot & Flight Director modes, Embedded flight software)), By Platform (Commercial Aircraft (Narrow & Wide-body, General aviation, Rotary wing, Business Jets), Military Aircraft (Fixed & Rotary Wing), UAV (VTOL (Single & Multi Rotor), & Fixed-wing (MALE, HALE)), Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

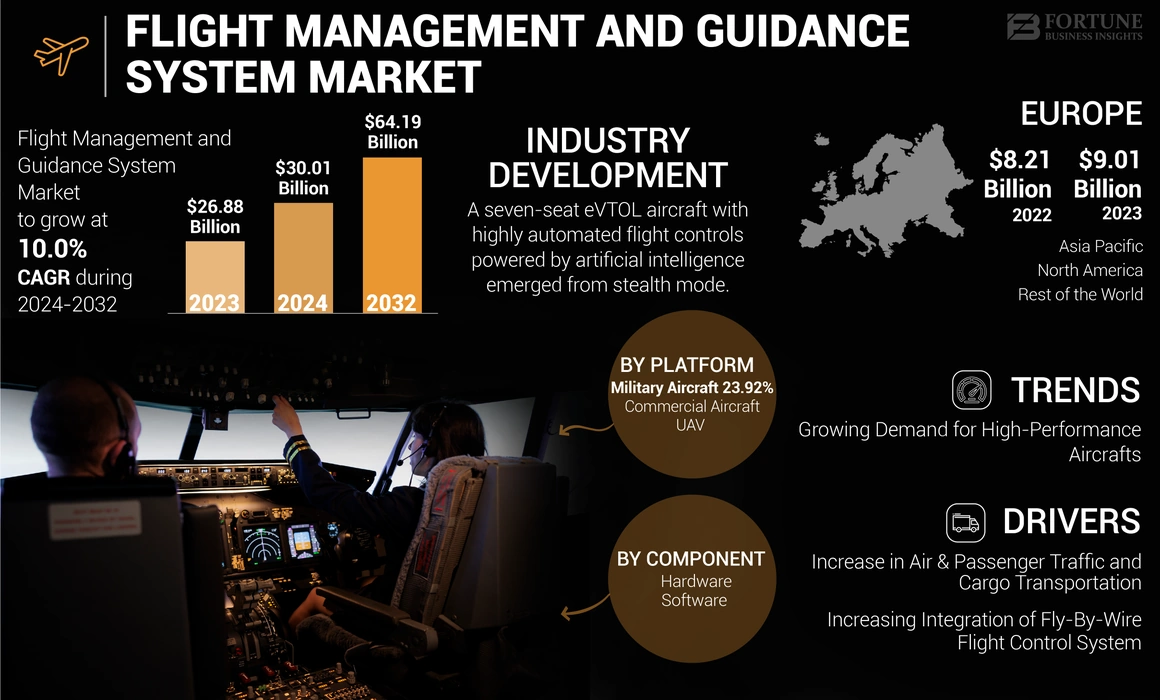

The global flight management and guidance system market size was valued at USD 26.88 billion in 2023. The market is projected to grow from USD 30.01 billion in 2024 to USD 64.19 billion by 2032, exhibiting a CAGR of 10.0% during the forecast period. Europe dominated the flight management and guidance system market with a market share of 33.52% in 2023.

The flight management and guidance system is an advanced avionics system that helps integrate various functions necessary for the control and navigation of an aircraft. The system automates many in-flight tasks, therefore reducing the workload on crews and enabling operational safety and efficiency. Due to rapid industry growth, there is a high competitive rivalry. The aviation industry is undergoing a technological revolution with the rise of autonomous systems, advanced materials, and electric planes. Aeronautical engineers and technicians with expertise in these fields are in high demand to drive innovation and shape the future of aviation.

The COVID-19 pandemic significantly impacted the global flight management and guidance system market. The pandemic led to disruptions in global supply chains, resulting in delays in the production and delivery of flight management and guidance system components and systems. Restrictions on international travel and workforce limitations imposed to curb the spread of the virus further exacerbated these challenges. These disruptions resulted in project delays and affected the overall demand for flight management and guidance systems.

Global Flight Management and Guidance System Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 30.01 billion

- 2025 Market Size: USD 33.02 billion

- 2032 Forecast Market Size: USD 64.19 billion

- CAGR: 10.0% from 2025–2032

Market Share:

- Europe dominated the flight management and guidance system market with a 33.52% share in 2023, driven by the presence of leading players such as Airbus, Thales Group, and BAE Systems, alongside growing adoption of autonomous flight control systems and digital avionics.

- By component, hardware accounted for the largest share in 2023, supported by high demand for Flight Management Computers (FMC), Automatic Flight Control Systems (AFCS), and navigation systems that ensure operational safety and fuel efficiency for next-generation aircraft.

Key Country Highlights:

- United States: Dominates the North American market with strong contributions from Boeing, Honeywell, and Collins Aerospace. Growth is driven by increasing UAV and eVTOL integration in both commercial and defense programs.

- France: Home to Airbus and Thales Group, France leads Europe in advanced flight management solutions, supported by stringent EU aviation safety standards and technological advancements in hybrid-electric aircraft.

- China: Rapid air traffic growth and large-scale aircraft procurement under initiatives like the Belt and Road are fueling demand for advanced avionics and digital flight control systems.

- Saudi Arabia: Significant fleet modernization efforts, highlighted by the 2024 order of 105 Airbus A320neo family aircraft, support growth as the country aims to enhance regional air connectivity under Vision 2030.

Flight Management and Guidance System Market Trends

Growing Demand for High-Performance Aircraft Boosts Market Growth

A recent surge in demand for high-performance aircraft with effective and efficient flight control systems is a major driving force in the market. The latest aircraft delivered by major OEMs are well-equipped with the latest technology and support systems for accurate flight control.

These flight control systems improve navigation, ensure optimum fuel saving, and ease operations. Various airlines have started to demand aircraft that can be operated at minimum cost, leading to a rise in demand for appropriate aircraft flight systems integrated with the latest digital technology. In addition, the prevalence of supersonic and hypersonic aircraft for military & commercial purposes is expected to boost the market in the forecast period.

- Europe witnessed flight management and guidance system market growth from USD 8.21 Billion in 2022 to USD 9.01 Billion in 2023.

For instance, in December 2022, a technology demonstration for Russia's future supersonic passenger plane will enter production in 2023, according to reports in state media. It will be built at the Chaplygin Siberian Institute of Aeronautical Sciences (SibNIA), using MiG-29 fighters as a base. The director of the institute, Vladimir Barsuk, announced the plan at a press conference, as reported by Russian news agency TASS.

Download Free sample to learn more about this report.

Flight Management and Guidance System Market Growth Factors

Increase in Air & Passenger Traffic and Cargo Transportation is Driving Market Growth

An increase in the overall air traffic and cargo transportation has contributed to the growth of the market. The adoption of advanced ground support equipment and electric components by airports drives the global market. According to the International Air Transport Association (IATA), 52.2 million metric tons of cargo were transported in 2015 and increased at a CAGR of 4.1% by 2021. IATA’s 20-year air passenger forecast shows that the number of air travelers could double to 8.2 billion by the end of 2037. Thus, in turn, it is expected to drive the growth of the market.

Additionally, growth in the number of aircraft deliveries worldwide is anticipated to fuel market growth. Therefore, as forecasted by IATA, the market is expected to gain traction due to increased post-pandemic passenger traffic, cargo transportation, and aircraft deliveries worldwide.

- For instance, Asia Pacific will show significant growth with 2.35 billion additional passengers from 2017 to 2037. Thus, there will be a total of 3.9 billion air travelers from Asia Pacific in 2037. North America will grow by 2.4% annually and will carry 1.4 billion passengers by 2037.

- Latin America’s air travelers will reach a total of 731 million passengers, an additional 371 million passengers annually, with a CAGR of 3.6%. The total market size of the Middle East & Africa will be 501 million passengers by 2037. An extra 290 million passengers are expected to add a CAGR of 4.4%. By 2037, Africa will witness the addition of an extra 199 million passengers for a total market of 334 million passengers.

Increasing Integration of Fly-By-Wire Flight Control System to Accentuate Market Growth

Recently, there has been an increase in the integration of fly-by-wire control systems in aircraft. Fly-by-wire is acting as a replacement for traditional mechanical and hydro-mechanical systems. The system stabilizes the aircraft and adjusts the flight characteristics without pilot involvement while preventing the pilot from operating outside the aircraft's safe operating range.

Since fly-by-wire is electronic, it is much lighter and less bulky than mechanical control, allowing for increased fuel efficiency and flexibility in aircraft design, even on aircraft old fly, and hence is preferable by the OEMs and airlines.

Fly-by-wire is currently used in most aircraft and is expected to boost the market in the forecast period, owing to growth in demand and integration for the system.

- For instance, in October 2022, BAE Systems and Supernal, two major flight control system manufacturers, unveiled an agreement to design and develop Supernal's vertical take-off and landing (eVTOL) computer control system.

In support of Supernal, BAE Systems will help define the architecture of a light electric flight system for its autonomous aircraft. The electric flight control system will safely and efficiently control the aircraft during flight.

RESTRAINING FACTORS

Stringent Regulations Surrounding Flight Control Systems to Limit Market Growth

Despite the numerous advantages of the aircraft flight control system, strict regulations are a major setback for the market's growth. Getting the flight control system approved by the regulatory authorities takes time and costs, with safety and operability being the major reasons.

The regulatory authorities have become extremely cautious of the issue after the MCAS (Maneuvering Characteristics Augmentation System) fatal flight crash cases in Boeing 737 Max 8 aircraft. Since the plane crashes happened due to the MCAS flight control system, the processes have become more stringent, which is expected to limit the flight management and guidance system market growth.

Flight control systems must adhere to stringent safety regulations to ensure that aircraft operate safely in all conditions. Compliance with these regulations is essential to prevent accidents and ensure passenger and crew safety. Aviation authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have specific certification processes that flight control systems must undergo to demonstrate compliance with airworthiness standards.

Flight Management and Guidance System Market Segmentation Analysis

By Component Analysis

Safety and Enhanced Efficiency of Flight Operations to Ensure Market Growth for Hardware Segment

By component, the market is divided into hardware and software segments.

The hardware segment accounted for a dominant share in the market in 2023 and is expected to grow at the highest CAGR in the forecast period. The hardware segment is further divided into types of hardware being readily used in the aviation industry. Flight Management Computer (FMC), Automatic Flight Control or Automatic Flight Guidance System (AFCS or AFGS), Aircraft Navigation System, Electronic Flight Instrument System (EFIS), and others are further classifications of hardware components in the flight management and guidance system market share.

Furthermore, the incorporation of advanced navigation performance, Global Positioning System (GPS) capabilities, and the ability to predict accurate flight profiles for primary and alternate destinations have made FMCs indispensable for modern aircraft operations. These systems also facilitate automated flight by incorporating navigation databases that include departure, enroute, arrival, and approach procedures, ensuring safe and efficient flight operations.

The software segment is expected to grow at a significant CAGR, owing to the growing number of autopilot applications being highly used in new-age aircraft. The rising demand for flight management software for scheduling, crew roster, training, document control, safety management, and quotations will boost the segment growth.

By Platform Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Aircraft Deliveries to Propel Commercial Aircraft Segment Growth

Based on platform, the market is categorized into commercial aircraft, military aircraft, and UAV.

The commercial aircraft segment accounted for a dominant share of the market in 2023 and is expected to grow at the highest CAGR in the forecast period. The commercial aircraft segment is further segmented into narrow-body, wide-body, general aviation, rotary wing, and business jets. Growth in the number of aircraft deliveries, growing global passenger air traffic, and growing net worth of individuals is expected to drive the growth of the segment in the forecast period.

- For instance, in May 2024, Saudi Arabia's national airline ordered more than 100 new Airbus jets, reflecting the kingdom's ambitious drive to lure more tourists. The Saudia Group, which represents the Saudia airline and its budget carrier Flyadeal, announced that it placed an order for 105 aircraft from the French aerospace giant's A320neo family of jets, including 12 A320neos and 93 A321neos. The backlog of Airbus aircraft orders is now at 144 of the A320neo family planes.

- The military aircraft segment is expected to hold a 23.92% share in 2023.

The UAV segment is expected to grow at a significant CAGR owing to the growing number of UAVs and Evtol aircraft being operated worldwide, and their exponentially increasing numbers, and technological advancements.

REGIONAL INSIGHTS

The global market is segmented into regions such as North America, Europe, Asia Pacific, and the Rest of the World.

Europe Flight Management and Guidance System Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The European market accounted for USD 9.01 billion along with dominating market share and is estimated to grow at a significant CAGR throughout the forecast period. However, the European market is expected to grow at a moderate rate due to increasing demand, technological advancements, and a positive outlook for the industry.

North America held a significant share of market in 2023. North American market size is projected to grow at a high CAGR during the forecast period. The U.S. holds the maximum number of companies operating in flight management and guidance systems.

The market in Asia Pacific is projected to grow at the highest CAGR during the forecast period. Digitalization and technological advancements in this region are enhancing the aviation industry. Thus, higher growth in the regional valuation is expected during the forecast period.

The Rest of the World market is expected to experience growth in the flight management and guidance system market due to the growing economies in the region.

KEY INDUSTRY PLAYERS

Key Players Adapt Strategies to Ensure Market Survival by Expanding Service Portfolio

The flight management and guidance system market is consolidated with several global players operating in this industry. It is observed that key players offer quality and advanced systems and introduce cutting-edge technology. Most of the players involved in the market are focusing on designing advanced aircraft components and systems for various applications of flight management and guidance systems.

The top 5 players in the industry: The Boeing Company, General Electric, Raytheon Technologies Corporation, Airbus S.A.S., and Honeywell International Inc.

List of Top Flight Management and Guidance System Companies:

- Airbus (The Netherlands)

- Boeing (U.S.)

- BAE Systems (U.S.)

- Collins Aerospace (U.S.)

- General Electric Company (U.S.)

- Garmin Ltd. (Switzerland)

- Thales Group (France)

- Honeywell International (U.S.)

- Lockheed Martin Corporation (U.S.)

- Teledyne Technologies (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Safran proposes to acquire Collins Aerospace's advanced actuation and flight control capabilities, which are vital for commercial and military aircraft and helicopters. The company has around 3,700 employees across eight facilities in Europe and Asia, as well as MRO and engineering capabilities. Sales of approximately $1.5 billion and an EBITDA of $130 million are expected in 2024.

- December 2023: A seven-seat eVTOL aircraft with highly automated flight controls powered by artificial intelligence emerged from stealth mode. The design of its AI-powered eVTOL aircraft not yet revealed, but the company revealed that it will use Honeywell's compact fly-by-wire flight control system.

- June 2023: Thales' FlytRise flight control system was selected by SkyDrive to equip its future three-seat zero-emission eVTOL aircraft. Thales proven and certifiable solutions will support SkyDrive's ambitions and secure the wings of tomorrow's urban mobility.

- September 2023: The next-generation vehicle management computer from BAE Systems was successfully tested on the F-35 Lighting II aircraft. The test demonstrated a technological upgrade for all three F-35 variants, which will boost computer performance and address aging-related issues. Testing occurred at Naval Air Station Patuxent and Edwards Air Force Base.

- September 2023: The Sweden-based manufacturer of regional electric aircraft Heart Aerospace tapped aerospace titan Honeywell to install its compact fly-by-wire flight control system on its 30-passenger ES-30.

REPORT COVERAGE

The report provides detailed information on the competitive market landscape and focuses on leading companies, product types, and leading product applications. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the above-mentioned factors, it contains several factors that have contributed to the sizing of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 10.0% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

|

|

By Platform

|

|

|

By Region

|

Frequently Asked Questions

The global flight management and guidance system market was valued at USD 26.88 billion in 2023 and is projected to record a valuation of USD 64.19 billion by 2032.

The global flight management and guidance system market is projected to record a CAGR of 10.0% during the forecast period.

The commercial aircraft segment is the fastest growing segment in this market.

The Boeing Company, General Electric, Raytheon Technologies Corporation, Airbus S.A.S., and Honeywell International Inc. are the leading players in the global market.

Europe topped the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us