Food Container Market Size, Share & Industry Analysis, By Material (Plastic, Paper & Paperboard, Glass, Metal, and Others), By Product Type (Bottles & Jars, Cups & Tubs, Boxes & Cartons, Trays, and Others), By Application (Fruits & Vegetables, Dairy Products, Spices & Condiments, Frozen Food, Bakery, Snacks & Confectionery, Ready-to-eat Meals, and Others), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

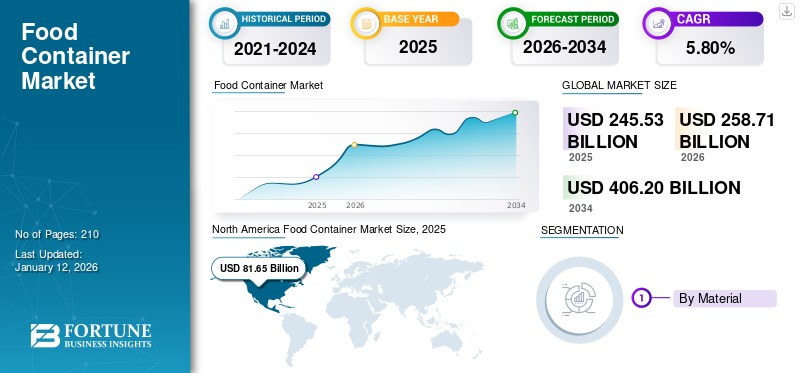

The global food container market size was valued at USD 245.53 billion in 2025 and is projected to be worth USD 258.71 billion in 2026 and reach USD 406.2 billion by 2034, exhibiting a CAGR of 5.80% during the forecast period. North America dominated the food container market with a market share of 33.26% in 2025.

Moreover, the food container market in the U.S. is projected to grow significantly, reaching an estimated value of USD 93.38 billion by 2032, driven by the growing consumption of fruits and vegetables in the country.

A food container is a packaging solution specifically designed for storing, handling, and transporting. The rapidly growing demand for effective packaging solutions for perishable and packaged food products, such as dairy and meat, drives market growth. The massively growing food industry globally also contributes to the market’s share.

The advent of the COVID-19 virus disrupted the supply chain in the market and led to a shutdown of several businesses. However, the rapid growth in online food delivery services globally boosted the market growth during the COVID-19 pandemic.

Global Food Container Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 245.53 billion

- 2026 Market Size: USD 258.71 billion

- 2034 Forecast Market Size: USD 406.2 billion

- CAGR: 5.80% during the forecast period (2026–2034)

Market Share:

- North America dominated with a 33.26% market share in 2025

Regional Insights

- North America: Leading region with a strong food manufacturing base, especially the U.S. (projected to hit USD 93.38 billion by 2032).

- Asia Pacific: Second-largest region. Dominated by rapid growth in online delivery, foodservice outlets, and rising disposable income.

- Europe: Noteworthy growth driven by demand for sustainable packaging and eco-conscious regulations.

- Latin America & Middle East & Africa: Moderate to steady growth, supported by expansion in the food sector and rising consumption trends.

Food Container Market Trends

Rising Utilization of Eco-friendly Containers for Food Packaging Emerges as a Market Trend

The increasing consumer awareness regarding the harmful effects of plastic material on the environment and human health has surged the utilization of sustainable containers for food storage and packaging. On the other hand, as eco-friendly packaging is manufactured from biodegradable and compostable materials, which can easily break down and do not pose any harm to the environment, consumers majorly utilize it. Eco-friendly containers decrease the carbon footprint and are thus utilized by food manufacturers and consumers. The rising utilization of such eco-friendly containers for food packaging not only eliminates food waste but also boosts the food container market growth.

Download Free sample to learn more about this report.

Food Container Market Growth Factors

Significant Benefits Offered by the Containers to the Food Sector Propels Market Growth

Food containers offer a cost-effective packaging solution to the food industry as they keep the food fresh and organized. They help maintain food hygiene, minimize the chances of the development of molds, and prevent bacterial growth. The reusability, durability, and versatility offered by the containers propel their demand in several food packaging applications. The containers can withstand several temperature ranges, further maintaining the freshness of both hot and cold foodstuffs. Moreover, as these containers come with closures or lids, they are widely utilized by the online food delivery sectors, further contributing to the market growth.

Augmenting Demand for Ready-to-Eat Meals and Convenience Foods Drive Market Growth

The rising trend of online food delivery has uplifted the demand for food containers, further leading to rapid market growth. The convenience and additional benefits offered by online grocery shopping and food delivery have boosted the demand for ready-to-eat meals. The increasing demand for convenience food products also cushions the market growth. The containers offer long-lasting and high-quality food packaging that is capable of protecting food items during transit and delivery. The busy lifestyle and increasing working population have majorly boosted the demand for ready-to-eat meals, which in turn helps the market grow.

RESTRAINING FACTORS

Shifting Consumer Preferences and Fluctuations of Raw Material Costs Hampers Market Growth

The volatility in the raw material costs required for manufacturing food containers is a major factor hampering the market’s growth. The sudden emergence of global crises such as COVID-19, which results in raw material shortages and supply chain disruptions, causes price fluctuations, further limiting the market growth. In addition, the changing consumer preferences, such as the desire for convenience, cost-effective products, sustainability, and innovative packaging, challenge manufacturers to find materials that are cost-effective and suitable for maintaining food quality. Such changing consumer preferences hamper the market growth for food containers.

Food Container Market Segmentation Analysis

By Material Analysis

Significant Benefits of Plastic Material Thrives Segmental Growth

Based on material, the market is segmented into plastic, paper & paperboard, glass, metal, and others. The plastic segment dominated the market in 2026, accounting for 41.05% of the total market share. Unlike other materials, plastic containers are extremely durable and non-hazardous and do not break while being stored or transported. The material can also withstand a broader range of temperatures and ensures that they are suitable for transporting hot as well as cold foodstuffs. The material also offers optimum product visibility and excellent protection from dirt and spills, thus driving the segment’s growth.

Paper and paperboard are the second-leading material segment. The augmenting demand from manufacturers and consumers for sustainable and recyclable food packaging solutions is the major contributor to segmental growth.

By Product Type Analysis

Augmenting Demand for Cups & Tubs for Food Packaging Boosts Segmental Growth

Based on product type, the market is segmented into bottles & jars, cups & tubs, boxes & cartons, trays, and others. The cups & tubs segment dominated the market in 2026, accounting for 35.10% of the total market share. The cups & tubs are durable, lightweight, and leak-proof and are essential in preserving the taste, color, quality & texture of any food product. The rising demand for cups & tubs for storing ready-to-eat meals, frozen food, fruits, and dairy products drives the segmental growth. The tamper-evident design of the cups & tubs boosts their utilization in the food industry, further contributing to the segment’s growth.

Bottles and jars are the second-dominating product type segment in the food container market. The propelling demand for the packaging of spices, snacks, baby food, and other dry food products majorly aids the growth of this segment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Growing Consumption of Fruits & Vegetables Enhances the Segmental Growth

Based on application, the market is segmented into fruits & vegetables, dairy products, spices & condiments, frozen food, bakery, snacks & confectionery, ready-to-eat meals, and others. The fruits & vegetables segment dominated the market in 2026, accounting for 35.78% of the total market share. The containers manufactured for packaging food products are lightweight, odorless, recyclable, stackable, and have required food grade. The packaging of fruits and vegetables in such containers thus ensures that the produce remains fresh and safe to consumers, further boosting the segmental growth. The rising food production and consumption of fruits & vegetables owing to their health benefits also aids the growth of the segment.

Ready-to-eat meals are the second-dominating application segment. As the containers are clean and disinfected, they are in high demand among the working population. The augmenting demand for ready-to-eat meals globally drives the segment’s growth.

REGIONAL INSIGHTS

The market for food containers is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Food Container Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America was the dominating region in the market, with the market size valued at USD 81.65 billion in 2025 and increasing to USD 86.22 billion in 2026. The region’s well-established food manufacturing industry, along with the developed packaging sector, contributes to the global food container market share. The National Restaurant Association estimated that in 2023, there were approximately 749,000 restaurants in the U.S., among which 349,000 were chain restaurant businesses, and 156,715 comprised single-location full-service restaurants and chain and independent establishments. The rising demand for food containers among these restaurants, fast-food chain outlets, and retail sectors also boosts the market growth in the North American region. The US market is projected to reach USD 64.5 billion by 2026.

Asia Pacific is the second-dominating region in the market. The rapid growth in the online food delivery sector in various countries in the region has contributed significantly to market growth. According to industry experts, Asia Pacific accounts for more than half of the global market share for food platforms. The growing fast-food outlets, café, restaurants, and grocery stores in the region also contribute to the market growth. The Japan market is projected to reach USD 12.65 billion by 2026, the China market is projected to reach USD 25.44 billion by 2026, and the India market is projected to reach USD 20.91 billion by 2026.

Europe is the third-leading region and is analyzed to witness noteworthy growth over the forecast period. The augmenting demand for sustainable and eco-friendly packaging solutions for the packaging of foodstuffs drives regional growth. Latin America is estimated to witness steady growth due to the growing food industry. The UK market is projected to reach USD 8.16 billion by 2026, while the Germany market is projected to reach USD 10.83 billion by 2026.

List of Key Companies in the Food Container Market

Major Market Players to Experience Substantial Growth Opportunities with New Product Launches

The global food container market is highly competitive and fragmented. The key players dominating the market are offering innovative packaging solutions in the packaging industry. These key players are continuously focusing on expanding their customer base across regions by integrating innovation into their existing product range.

Major players in the food container industry include Amcor, Berry Global Inc., Ardagh Group, Graphic Packaging International, LLC, Tetra Pak, International Paper, and others. Some of the other players in the market concentrate on providing advanced packaging solutions.

List of Key Companies Profiled:

- Amcor (Switzerland)

- Berry Global Inc. (U.S.)

- Ardagh Group (Luxembourg)

- Graphic Packaging International, LLC (U.S.)

- Tetra Pak (Switzerland)

- International Paper (U.S.)

- Silgan Holdings Inc. (U.S.)

- WestRock (U.S.)

- Crown Holdings Inc. (U.S.)

- Sonoco Products Company (U.S.)

- Stölzle Glass Group (Austria)

- Gerresheimer AG (Germany)

- Huhtamaki (Finland)

- Genpak LLC (U.S.)

- PRINTPACK (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – Novolex announced the launch of its new food packaging containers that are recyclable and manufactured with a minimum of 10% Post-Consumer Recycled (PCR) content. The range consists of several sizes of tamper-evident containers, dessert cups, cake containers, and bakery clamshells.

- February 2023 – Chuk, an initiative of Yash Pakka, announced the launch of compostable delivery containers with the goal of eliminating the utilization of single-use plastic for food delivery, further strengthening its resolution of walking toward a cleaner planet. The 100% compostable delivery containers are designed using bagasse.

- October 2022 – Molded Fiber Glass Tray Company (MFG Tray), declared the acquisition of the product line tooling from Orbis Corporation. The acquisition boosts the company’s industrial product line offerings and increases the production capacities.

- May 2021 – Berry Global announced the launch of CombiLight pot, which is a new, innovative, and circular solution for containers. The food packaging solution launched by Berry is cost-effective, cuts plastic content by 60% compared to other similar solutions, and meets the demand for packaging that is lightweight, strong, and responsible.

- October 2019 – a Novolex brand, Waddington North America (WNA), introduced Blaze, hot food containers, especially for takeout & deliveries. The innovative and new containers are available in various sizes & styles, with convenient hinged and two-piece options.

REPORT COVERAGE

The market research report provides a detailed market analysis and focuses on key aspects, such as top market players, competitive landscape, product/service types, market segmentation, Porter’s five forces analysis, and leading product segments. Besides, the report offers insights into market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to market intelligence and growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Product Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the global market size was valued at USD 245.53 billion in 2025.

The market is projected to record a CAGR of 5.80% during the forecast period.

The market size of North America was valued at USD 81.65 billion in 2025.

Based on material, plastic is the dominating segment and holds the largest market share.

The global market value is expected to reach USD 406.2 billion by 2034.

The key market drivers are the significant benefits offered by the containers to the food sector and the augmenting demand for ready-to-eat meals and convenience foods.

The top players in the market are Amcor, Berry Global Inc., Ardagh Group, Graphic Packaging International, LLC, Tetra Pak, and International Paper, among others.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us