Food Flavors Market Size, Share & Industry Analysis By Type (Natural and Synthetic), By Form (Liquid & Gel and Dry), By Flavor (Chocolate, Fruit & Nut, Vanilla, Spices & Savory, and Others), By Application (Bakery, Beverages, Confectionery, Dairy, Convenience Foods, Snacks, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

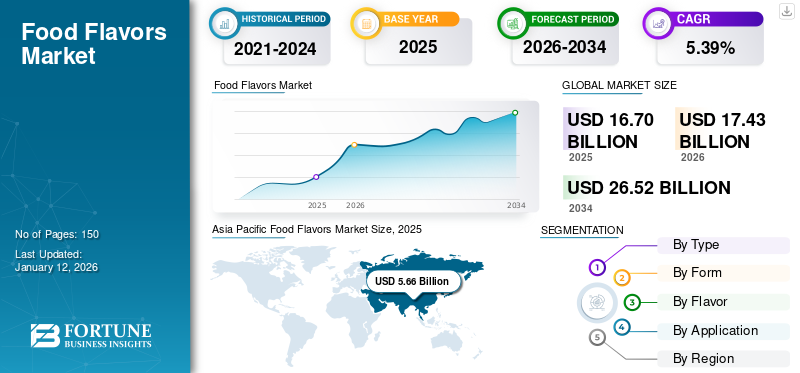

The global food flavors market size was valued at USD 16.70 billion in 2025. The market is projected to grow from USD 17.43 billion in 2026 to USD 26.52 billion by 2034, exhibiting a CAGR of 5.39% during the forecast period. Asia Pacific dominated the food flavors market with a market share of 33.91% in 2025. The market is on an upward trajectory, driven by consumer demand for natural flavor ingredients, innovative flavor profiles, and robust growth in the food and beverage sectors. Companies that adapt to these trends while navigating regulatory challenges will likely find substantial opportunities in this evolving landscape.

The food flavors market refers to an industry involved in the manufacturing, distribution, and sale of substances designed to enhance or alter the flavor of foods and beverages. This market encompasses a wide range of products, including both natural and artificial flavors derived from various sources, such as fruits, vegetables, herbs, and spices. Food flavors are essential for creating distinctive sensory experiences that meet consumer preferences. They play a crucial role in food production and processing, helping preserve freshness and improve taste while also addressing regulatory requirements concerning food additives.

Download Free sample to learn more about this report.

Food Flavors Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 16.7 billion

- 2026 Market Size: USD 17.43 billion

- 2034 Forecast Market Size: USD 26.52 billion

- CAGR: 5.39% from 2026–2034

Market Share:

- Asia Pacific dominated the food flavors market with a 33.91% share in 2025, driven by consumer demand for natural flavor ingredients, innovative flavor profiles, and robust growth in the food and beverage sectors.

- Natural flavors held the largest market share due to their authentic taste and increasing preference for clean-label and organic ingredients.

Key Country Highlights:

- U.S.: Rising demand for flavored functional beverages and ethnic cuisine drives market growth.

- China: Strong consumption of processed foods and growing beverage industry support demand for diverse food flavors.

- India: Increasing disposable income and preference for natural and botanical flavorings aid market expansion.

- Brazil: Economic incentives and demand for convenience foods fuel flavor innovation.

- U.K.: High consumption of organic and clean-label products supports growth in natural flavor segment.

Food Flavors Market Trends

Growing Consumer Inclination Toward Organic and Clean-label Ingredients to Foster Industry Progress

The growing trend of organic foods in various developing countries and adoption of clean-label products are factors that will aid the growth of natural food flavors. According to the Organic Trade Association, the U.S. organic eatable sales reached USD 69.7 billion in 2023, up by 3.4% compared to 2022. Consumers’ inclination toward natural products (chemical-free) and awareness regarding the ingredients on labels is positively impacting the growth of natural flavoring agents. Consumers prefer plant-based and plant-derived ingredients which help them lead a healthier lifestyle. The right amount of awareness regarding natural products among consumers is also a factor that helps in creating demand for organic ingredients in products.

Market Dynamics

Market Drivers

Consumer Inclination Toward Botanicals and Floral Flavors to Propel Industry Growth

Floral flavors emerged as one of the major flavor trends as per the 2019 food flavor market trends. Various floral and fruity flavors are added to bakery products which gives them a natural aroma and taste. Fruit flavors are usually paired with botanical flavors to give a natural aroma to edible products. Over the past few years, floral and botanical flavors have grown from a niche sector to a larger one. A few examples of the flavors used in bakery products are lemon-lavender cookies, honey-lavender gelato, lemon-violet granola, blackberry-rose marshmallows, and others. The adoption of floral flavors as a trend is attributed to the consumer’s willingness to spend more on natural food products and ingredients.

Rising Consumer Awareness Regarding Natural Food Flavors to Aid Market Growth

A significant number of consumers are aware of the synthetic ingredients that are used in food products. Rising awareness regarding the usage of natural ingredients and consumers’ inclination toward the consumption of clean-label ingredients may propel the usage of natural food essences. The manufacturers are capitalizing on the growing trend of clean label products by developing products with flavors that are naturally sourced. The usage of natural flavors helps retain the ethnicity of the edible products and provides an authentic taste and flavor. In recent years, synthetic flavors, such as pyridine, benzophenone, styrene, and ethyl acrylate have been identified to be carcinogenic. Various natural flavors are replacing these synthetic ones. The majority of natural flavorings act as a preservative, which will reduce the usage of artificial preservatives.

Market Restraints

Stringent Regulations to Restrict Market Growth

The food industry has to abide by various rules and norms imposed by regulatory agencies. The regulatory standards vary from one country to the other, but the common goal is to maintain the quality of the flavors. Such regulations ensure proper labeling of the ingredients and right usage of the flavorful essences in eatables. These norms and regulations imposed by various regulatory bodies can restrain the market growth as they might delay the launch or development of new products, thereby leading to product recalls. Therefore, the stringent regulations imposed by multiple nations may negatively impact the global food flavors market growth.

Market Opportunities

Interest in Exotic and Diverse Flavors to Ensure Success for Market in the Future

Consumers are increasingly exploring global cuisines, leading to heightened interest in exotic flavors from regions, such as South America, Asia, and Africa. Trending ingredients include spicy, smoky, and tangy flavors, with specific interest in Korean and African cuisines, which are gaining popularity among consumers looking for adventurous taste experiences.

Market Challenge

Volatility in Raw Material Prices to Pose Challenge for Market Growth

The prices of raw materials for making food flavors, especially plant-based ingredients, are highly susceptible to fluctuations due to seasonality and weather conditions. This volatility can impact production costs and ultimately affect pricing strategies and profit margins for manufacturers. Economic downturns or shifts in consumer spending habits can further exacerbate these issues.

Impact of COVID-19

The COVID-19 pandemic severely disrupted global supply chains, leading to increased costs and limited availability of raw materials. Thus, the reduced availability of raw materials led to decreased production of food flavoring agents. Also, lockdowns and business closures halted production and affected sales channels, particularly in the foodservice sector. Thus, the demand for food flavorings faced multiple challenges, leading to decreased sales.

Segmentation Analysis

By Type

Natural Flavors Hold Largest Market Share Owing to Their Authentic Taste and Flavor

In terms of type, the market has been segmented into natural and synthetic.

The natural flavor segment holds the largest market share owing to the influence of various regional cuisines. Natural extracts from various plants provide the ethnicity of a regional dish, unlike synthetic flavors. Various food chains are adopting these natural flavors to provide authentic taste. Additionally, the young generation prefers to use various botanicals and adaptogens in their culinary dishes. This is due to awareness regarding the harmful effects of consuming synthetic flavors. Prolonged usage and consumption of artificial flavoring agents can lead to various health issues, such as skin rashes and cancer. Many manufacturers are engaged in the production of natural food flavoring agents as the innovative usage of naturally-sourced raw materials will create growth opportunities for food manufacturers.

To know how our report can help streamline your business, Speak to Analyst

On the other hand, the synthetic flavors segment recorded a moderate CAGR and a substantial share of 46.01% in 2026, owing to the decreased consumer preference for these artificial flavor additives. The production of these essences is cost-effective, which is the reason for manufacturers to adopt them in their food products.

By Form

Versatility and Ease of Use to Fuel Growth of Liquid Segment

In terms of form, the market has been divided into liquid & gel and dry.

The liquid & gel segment is expected to hold a major global food flavors market share of 80.90% in 2026. Liquid flavors can be easily mixed and distributed, making them ideal for diverse food applications. This adaptability contributes significantly to their market dominance. The rise of functional beverages and ready-to-eat meals has spurred the demand for liquid flavors that enhance taste without compromising nutritional value. This trend is particularly strong in regions, such as North America and Asia Pacific, where health-conscious consumers seek flavorful yet healthy options.

Dry flavors offer advantages, such as longer shelf life, stability, and ease of storage compared to liquid flavors. This segment is gaining traction in applications, such as snack foods and dry mixes, where moisture control is crucial. This segment is anticipated to grow at a CAGR of 4.10% during the forecast period (2025-2032).

By Flavor

Vanilla Segment Holds Largest Market Share Owing to Versatility Across Applications

In terms of flavor, the market has been divided into chocolate, fruit & nut, vanilla, spices & savory, and others.

The vanilla segment is expected to hold a majority market share of 30.06% in 2026, as this flavor is widely used in various food products, particularly in the bakery and confectionery sectors. It enhances the flavor of cakes, cookies, chocolates, ice creams, and beverages, contributing to its high demand across multiple categories. This versatility allows vanilla to maintain a strong presence in diverse culinary applications. Natural vanilla extract is often linked with higher quality and purity compared to its synthetic alternatives. Consumers perceive products containing real vanilla as premium offerings, which influences their purchasing decisions and drives demand for vanilla-flavored items.

The spices & savory segment is expected to experience significant CAGR of 5.73% during the forecast period (2025-2032) in the global market. The globalization of food culture has led to an increased acceptance of ethnic cuisines, which often feature bold spices and savory elements. As consumers seek to replicate these flavors at home or in dining establishments, the demand for spices and savory flavors is expected to rise significantly.

By Application

Beverage Sector to Hold Largest Market Share Owing to Increased Popularity of Flavored Drinks

In terms of application, the market has been segregated into bakery, beverages, confectionery, dairy, convenience foods, snacks, and others.

Beverages dominated the application segment and is expected to hold the share of 35.92% in 2026. The dominance of beverages can be attributed to the large usage of flavors in beverages such as functional beverages, alcoholic drinks, carbonated drinks, and others. Moreover, the growing popularity of innovative flavors across the beverage industry has significantly contributed to the growth of this market globally. Functional beverages are rapidly becoming popular due to the growing knowledge regarding their health benefits among consumers. A wide range of natural flavors have found extensive applications in these functional beverages. The growing demand for plant-based beverages has also increased the utilization of natural flavors across the beverage industry. Various synthetic flavors, such as chocolate, fruit, and floral flavors are becoming popular in developing markets of Asia Pacific and the Middle East due to the increasing discretionary incomes of consumers.

The dairy, confectionery, and bakery segments are expected to witness prominent growth over the forecast period. Various flavors, such as natural spices and fruits are widely utilized in dairy beverages and other dairy products. The growing popularity of cocoa and fruit flavors across bakery and confectionery industries is anticipated to drive the growth of this segment in the coming years. The bakery segment is expected to grow at a CAGR of 5.08% during the forecast period (2025-2032).

Food Flavors Market Regional Outlook

Asia Pacific

Asia Pacific Food Flavors Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, Asia Pacific attained a majority share of 33.91% in the global food flavors market with a valuation of USD 5.66 billion and previously USD 5.42 billion in 2024. The region's market is growing at a rapid pace due to the large-scale consumption of processed edible products and beverages. Asia Pacific is an emerging region that consists of a large population and working professionals. The region has a different opinion on dairy products as consumers have a unique preference compared to that of Europeans and Americans. The Asians are willing to try new products by using a basic ingredient, which can be used to produce a wide range of exotic products, such as beverages and yogurts.

Population dynamics is one of the major macro-economic factors, which supports the market growth. In addition, investments from various multinationals, especially from major nations, such as China, India, and Japan, will create opportunities for various mid-tier companies. The market in China is expected to ht USD 2.72 billion in 2026. The rise in the number of working women and a busy lifestyle is leading to the consumption of various ready-to-eat/drink products. Moreover, the consumption of confectionery and baked products in the region is also expected to hold high growth potential for the market. This is owing to a large consumer base for bakery goods. India is estimated to capture a share valued at USD 0.95 billion in 2026, while Jpan is poised to be valued at USD 0.65 billion in the same year.

North America

North America is expected to hold the second-largest market share with a valuation of USD 4.99 billion in 2026, exhibiting a CAGR of 5.15% during the study eriod (2025-2032). This is owing to the consumption of various cuisines in the region. The rising migrant population has led to the consumption of authentic ethnic food products, resulting in the opening of various international restaurants in the region. Consumers in the U.S. have a liking for Japanese and Indian food. Retailers and restaurants cash in on the popularity of Japanese ingredients and foods, such as matcha, sushi, and ramen. Japanese eatable products utilize various flavors, such as umami. The usage of umami in Japanese cuisine lingers the taste of the whole food product. This will help this the market grow in North America. The U.S. market is set to reach USD 4.28 billion in 2026.

Europe

Europe is the third largest market, projected to be valued at USD 3.66 billion in 2026. The changing consumer demands are shaping the dairy industry across the globe in the form of the potential of dairy farmers to react to the changes and dairy entrepreneurs’ strategies for increasing their profits. The U.K. market continues to grow, anticipated to reach a valuation of USD 0.65 billion in 2026. The dairy market in Europe is influenced by a combination of factors that vary from country to country within the region. The overall demand for dairy products in Europe is driven by its large and diverse population. Moreover, economic conditions, including disposable income levels, further affect the dairy food industry in the region. This factor is expected to push the demand for food flavors from the dairy industry in the coming years. In Europe, Russia holds the largest food flavor market share owing to the presence of a large population base. The U.K. holds the second-largest market share as the consumption of organic products is growing rapidly. One of the three products sold in the U.K. is claimed to be organic, and this supports the growth of natural food flavors in the country. Germany is set to be worth USD 0.54 billion in 2026, while France is expected to be valued at USD 0.66 billion in 2025.

South America

The fast-paced lifestyle of consumers is leading to increased consumption of convenience and Ready-To-Eat (RTE) meals in the region. Products, such as instant soups, sauces, and snacks are gaining popularity due to their ease of preparation and quick consumption, driving the need for flavors that enhance these foods. Moreover, the relatively low labor costs in Brazil are attracting investments from food companies looking to expand their operations. This economic landscape fosters competition and innovation within the food flavor market, further driving the product demand.

Middle East & Africa

The Middle East & Africa is the fourth largest market, witnessing a robust expansion in the food & beverage sector, particularly in packaged and processed foods segment. This region is anticpated to reach a valuation of USD 1.61 billion in 2026. This growth is fueled by urbanization, changing lifestyles, and an increase in disposable income, leading to higher consumption of flavored products. The demand for innovative flavors in beverages, bakery items, and snacks is particularly strong. This trend will significantly drive the demand for a variety of food flavors that enhance the taste of these products. The UAE market is expected to be valued at USD 0.32 billion in 2025.

Competitive Landscape

Key Market Players

The global food flavors market is characterized as moderately consolidated, with a few large players dominating the landscape while numerous smaller companies operate within specific niches. Several factors, including mergers & acquisitions, the need for product diversification, and pursuit of economies of scale, drive this consolidation.

Major Players in the Food Flavors Market

Get comprehensive study about this report by, Download free sample copy

Several key players dominate the global food flavors market, each holding a significant ranking. Givudan S.A., International Flavors & Fragrances (IFF), Firmenich, Symrise AG, and Sensient Technologies Corporation collectively account for a substantial portion of the market. The competitive landscape is characterized by ongoing innovation, with companies investing heavily in research and development to meet the consumer demand for natural and unique flavors.

List of Key Companies Profiled

- Givaudan SA (Switzerland)

- International Flavors and Fragrances (U.S.)

- Symrise AG (Germany)

- Sensient Technologies Corp (U.S.)

- Firmenich (Switzerland)

- Archer-Daniels-Midland Co. (U.S.)

- Kerry Group Plc (Ireland)

- Corbion NV (Netherlands)

- Koninklijke DSM NV (Netherlands)

- BASF SE (Germany)

Key Industry Developments

- October 2024 – Synergy Flavors launched a new line of ‘heat and fire’ flavors aimed at meeting the rising consumer demand for bold and intense taste experiences. The new launch featured a variety of natural flavors and pastes designed for food manufacturers to enhance their product offerings. These flavors are versatile and can be applied across various food products, including ready meals, plant-based meats, and baked goods. This flexibility allows manufacturers to customize the heat levels and flavor profiles of their products according to consumer preferences.

- October 2024 – Givaudan Taste & Wellbeing officially broke ground on a new production facility in Cikarang, Indonesia, as part of its strategic expansion in Southeast Asia. The site will produce a variety of products, including savory, sweet, and snack powders, along with infant nutrition solutions. The company invested USD 58.31 million in the facility. The facility will cover 24,000 square meters within a total land area of 50,000 square meters, allowing for future expansions.

- September 2024 – T. Hasegawa USA, Inc. successfully acquired Abelei Flavors, Inc., a move aimed at enhancing its flavor portfolio and expanding its operational capabilities within North America. The acquisition aligned with T. Hasegawa's goal to broaden its flavor offerings and increase its geographical footprint in North America. The company aims to leverage Abelei's established customer service reputation and technical expertise to serve its clients better.

- January 2024 – Brookside Flavors and Ingredients (BFI) successfully acquired Sterling Food Flavorings, LLC, a manufacturer specializing in flavoring systems for the food & beverage sector. With this acquisition, BFI aims to leverage Sterling's established market presence and expertise to accelerate growth and improve service delivery. This move is expected to enhance BFI's ability to meet the evolving demands of the food & beverage industry.

- March 2023 - International Flavors and Fragrances (IFF), one of the leading companies in food, beverages, biosciences, health, and fragrances, announced a new strategic partnership for the distribution of FermaSure XL in the Brazilian sugar and alcohol markets.

Report Coverage

The report analyzes the market in depth and highlights crucial aspects, such as prominent companies, regional analysis, market segmentation, competitive landscape, product types, distribution channels, and application usage areas. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over the years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.39% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Form

By Flavor

By Application

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 17.43 billion in 2026 and is anticipated to record a valuation of USD 26.52 billion by 2034.

Growing at a CAGR of 5.39%, the market will exhibit steady growth over the forecast period (2026-2034).

The global market is projected to record a significant CAGR of 5.39% during the forecast period of 2026-2034.

The natural food flavor segment is predicted to dominate the market during the forecast period of 2025-2032.

Rising consumer awareness regarding clean-label ingredients and organic food products is likely to drive the product’s demand.

Symrise AG, Archer-Daniels-Midland Co., Givaudan S.A., Sensient Technologies, and others are some of the leading players globally.

Asia Pacific dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us