Home / Food & Beverages / Food Processing & Processed Food / Food Intolerance Products Market

Food Intolerance Products Market Size, Share & Industry Analysis, By Product Type (Dairy Alternatives and Lactose-free Products, Bakery Products, Chocolates and Confectionary, Meat Alternatives, Specialized Nutrition, Snacks and Processed Food, and Condiments and Dressings), By Intolerance Type (Dairy and Lactose Intolerance, Sugar Intolerance, Gluten Intolerance, and Meat Intolerance), By Category (Organic and Conventional), and By Distribution Channel (Supermarkets/Hypermarkets, Convenience stores, Online Retail, and Others), and Regional Forecast, 2024-2032

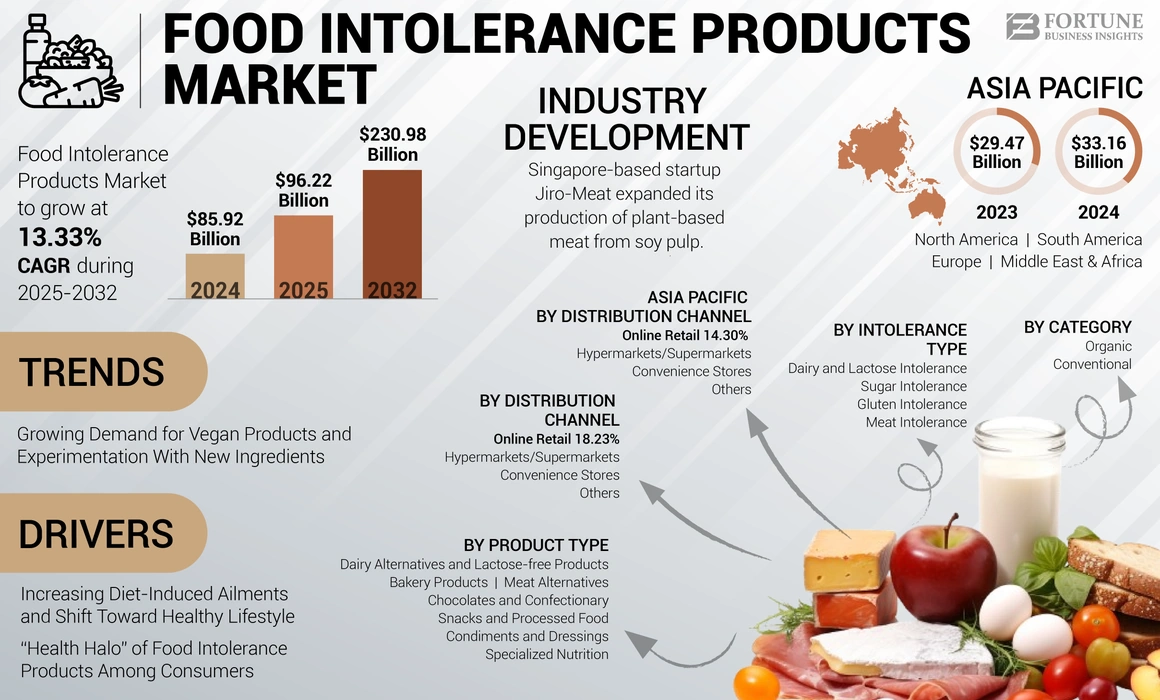

Report Format: PDF | Latest Update: Feb, 2025 | Published Date: Aug, 2024 | Report ID: FBI110038 | Status : PublishedThe global food intolerance products market size was valued at USD 76.93 billion in 2023. The market is projected to grow from USD 85.92 billion in 2024 to USD 230.98 billion by 2032, exhibiting a CAGR of 13.16% during the forecast period. Asia Pacific dominated the food intolerance products market with a market share of 38.31% in 2023.

Food intolerance products were traditionally manufactured for consumers suffering from certain dietary intolerances. As health awareness among consumers increased, more people adopted healthy lifestyles, which included the adoption and consumption of healthy food products. This caused a significant shift in food purchase and consumption patterns, leading to increased demand for food items that are devoid of any allergens and may affect health negatively. Therefore, the market has witnessed an upward trajectory of growth in the last few years, which is expected to continue in the future as well.

The COVID-19 pandemic accelerated the demand for and growth of food intolerance products among consumers globally. An increasing number of consumers shifted toward food products that help boost immunity. They also started adopting a healthier lifestyle.

Food Intolerance Products Market Trends

Growing Demand for Vegan Products and Experimentation with New Ingredients to Support Market Growth

There is a growing number of vegans and flexitarians across the world. Vegans are completely removing animal-based food from their diet and replacing it with plant-derived food, and others are trying to moderate the consumption of animal food. Hence, major manufacturers in the food intolerance category are innovating and expanding their product range to cater to this growing consumer base. Some of the companies are experimenting with new ingredients that can improve the texture and flavor of the finished food product.

Food Intolerance Products Market Growth Factors

Increasing Diet-Induced Ailments and Shift Toward Healthy Lifestyle to Support Market Growth

There are growing incidences of dietary intolerance among the population across the world. An increasing number of people are suffering from celiac disease, diabetes, lactose intolerance, and other allergies. For instance, in the U.S., as per the Boston Children’s Hospital, 1 in 133 people in Boston suffers from celiac disease. Other products, such as sugar-free products, are also growing in popularity. Overconsumption of sugar-based products is associated with an increased risk of type 2 diabetes, heart disease, and obesity. Moreover, the World Health Organization has stated that 422 million people across the globe suffer from diabetes. Hence, the demand for better-for-you products is increasing rapidly among consumers who are suffering from various ailments and also among people who aim to maintain a healthy lifestyle. Therefore, consumers are seeking food alternatives to support a healthy diet, which in turn, will support the global food intolerance products market growth.

“Health Halo” of Food Intolerance Products Among Consumers to Support Market Growth

Food intolerance products are marketed by manufacturers as being better than other traditional foods offered in the market. Such strategies, also known as ‘health halo’, help attract consumers who are health conscious and may or may not have any health ailments for which the products are designed. Moreover, companies are bringing newer product versions for the evolving consumer requirements, which also acts as the major factor supporting and driving the global food intolerance products market share globally.

RESTRAINING FACTORS

High Product Prices to Hamper Market Growth

Prices of free-from food products are higher than those of conventional products available in the market. This results in an economic burden for consumers with budgetary constraints. Moreover, some of the gluten-free baked products contain lower protein content compared to their traditional variants. As the functionality of gluten is difficult to replicate in some products, their structure and texture are affected. Moreover, some of the gluten-free products have limited shelf life compared to traditional versions, thereby impeding the sales of food intolerance products.

Food Intolerance Products Market Segmentation Analysis

By Product Type Analysis

Dairy Alternatives and Lactose-Free Products Lead Market Due to Continuous Innovation

Based on product type, the market is segmented into dairy alternatives and lactose-free products, bakery products, chocolates and confectionary, meat alternatives, specialized nutrition, snacks and processed food, and condiments and dressings.

The dairy alternatives and lactose-free products segment accounted for the highest market share in 2023. The demand for dairy alternatives is growing owing to the increased dangers of global warming induced by animal farms. Moreover, plant-based milk producers are continuously innovating and launching new flavors and versions, aiming for a more dynamic product development compared to the dairy sector where innovation and growth have slowed relatively.

Gluten-free and sugar-free bakery products are becoming significantly popular among consumers. Several manufacturers are expanding their conventional product lines in the gluten and sugar-free categories to support consumers suffering from such food allergies. Gluten substitutes, such as rice, millet, and corn are being used for developing new food products that are less allergenic and healthier.

The popularity of meat substitutes has increased in recent years. With the rise in vegan population, the demand for animal meat-free products is increasing. Thus, alternative meats, which are made of botanical sources, such as soy or peas and resemble meat-like texture, are becoming popular among vegans, vegetarians, and animal meat consumers seeking to experiment with different food products.

Moreover, baby and elderly food products, which are part of the specialized nutrition segment, are also growing in popularity. The increase in the geriatric population in European countries is prompting manufacturers to develop clean-label healthy products for consumers in the region. Parents are spending more on food products that are sugar-free, gluten-free, and healthy for their babies, leading to high growth of this segment.

By Intolerance Type Analysis

Dairy and Lactose Intolerance Segment to Hold Significant Market Share Due to Rise in Veganism

Based on intolerance type, the market is segmented into dairy and lactose intolerance, sugar intolerance, gluten intolerance, and meat intolerance.

Among these, the dairy and lactose intolerance segment will account for the highest market share during the forecast period. Consumers with dairy allergies tend to avoid all types of dairy products. With the rise in veganism, dairy alternatives and lactose-free products are becoming popular, leading to higher growth of the segment. Lactose intolerance is common among Asian and African populations. Hence, several dairy food manufacturers are launching lactose-free variants of milk and milk products for such consumer segments.

There is an increasing consumer awareness and growing focus on the importance of managing celiac disease. The World Health Organization (WHO), along with country-wise regulatory bodies, are playing a crucial role in raising awareness and encouraging consumers to adopt dietary practices that help them combat the risks associated with the disease. This has prompted the demand for gluten-free products and resulted in the growth of the gluten-free food intolerance products market size.

Meat intolerance, specifically red meat, and the rising animal farm-induced global warming are major concerns for consumers worldwide. Hence, the popularity of meat alternatives is growing rapidly, especially in European and North American countries.

There is a growing incidence of diabetes among the young and geriatric populations. In Asia Pacific, this incidence is growing rapidly. Hence, to manage sugar content and also as a precautionary measure, consumers are purchasing sugar-free products, which is supporting the growth of this segment.

By Category Analysis

Conventional Segment Held Significant Market Share Due to Wide Product Availability

Based on category, the market is segmented into organic and conventional. The conventional segment accounted for the largest market share in 2023 as several manufacturers are providing a wide range of products under this category.

The organic segment is expected to register the fastest growth during the forecast period. However, the price of organic products is higher than that of conventional products, which can deter price and budget-conscious consumers from increasing their overall expenditure on food items.

By Distribution Channel Analysis

Hypermarkets/Supermarkets are Widely Adopted Distribution Channels Due to Better Product Availability

Based on distribution channel, the market is segmented into supermarkets/hypermarkets, convenience stores, online retail, and others.

Supermarkets/hypermarkets account for the highest market share among all the distribution channels used by manufacturers to sell their products in the market. A growing number of supermarkets globally are dedicating separate shelf spaces for gluten-free products. Some of the retailers even check the products and ensure that they are gluten-free to confirm that they are properly labeled and safe to consume.

Online retail is expected to be one of the fastest-growing distribution channels and will grow significantly in the future. The adoption of this channel increased during the COVID-19 pandemic, and the sales of products through this channel continue to increase every year. Consumers have the choice to compare prices in brick-and-mortar stores and purchase products based on which option provides better deals.

REGIONAL INSIGHTS

The market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific accounted for the highest market share, reaching a valuation of USD 29.47 billion in 2023. In Asia Pacific, there is a high prevalence of diabetes and lactose intolerance among the population. Hence, the demand for products that suit the dietary preferences of these consumers is increasing in the region. Manufacturers are launching sugar-free and lactose-free variants of their products that are specifically targeted toward these consumer segments. However, the popularity of such products among non-diabetic or health-conscious consumers is still at its early stage. But the region acts as a promising market for reputed manufacturers to expand their presence.

North America accounts for the second-largest food intolerance products market share. As per a study published in Appetite, an international research journal, in the U.S., around 20-30% of the population avoids gluten in their diet. Medical conditions, such as celiac disease and dietary preferences play a pivotal role in promoting the consumption of gluten-free products among consumers. They are continuously seeking flavored gluten-free and sugar-free food items to maintain their diet and also experiment with flavors.

In Europe, the increasing adoption of vegan and keto diets plays a crucial role in supporting the sales of food intolerance products in the region. For instance, in June 2021, Genius Foods launched vegan, gluten-free bakery products, such as loaves, rolls, and brioche buns, which are high in fiber and vitamins. However, the high price of the products can hamper their purchase. For instance, in March 2023, Coeliac UK's Cost of Living Report stated that gluten-free bread costs four times higher than traditional bread. This heightened cost can dampen the market growth. Lack of availability of raw materials, such as rice flour, which is sourced from Asian countries, due to the pandemic and the trade sanction placed by the manufacturing countries also increases the price of the products.

The demand for food intolerance products in South America, the Middle East & Africa is also growing at a fast pace. Growing health-related problems, such as diabetes and celiac disease are one of the major factors influencing the market’s growth in these regions.

KEY INDUSTRY PLAYERS

Key Industry Players Investing in New Product Developments to Expand Market Presence

Some of the major players operating in the market include Conagra Brands Inc., The Kellogg Company, and Hain Celestial Group Inc., among others. There are manufacturing restrictions for major market players operating in both the gluten-free and non-gluten-free food product markets. Separate production lines for each type of product need to be maintained to prevent the mixing of ingredients. Hence, manufacturers may need to invest separately in gluten-free product manufacturing setups, leading to higher production costs. One of the major strategies adopted by the key market players is new product developments, which enable them to provide an expanded range of food offerings from which consumers can choose based on their requirements. Startups competing with global players can attract consumers by providing free samples of food intolerance products.

List of Top Food Intolerance Products Companies:

- Conagra Brands Inc. (U.S.)

- Hain Celestial Group Inc. (U.S.)

- Amy's Kitchen Inc. (U.S.)

- Arla Foods Amba (Denmark)

- General Mills Inc. (U.S.)

- Danone SA (France)

- Reckitt Benckiser Group Plc (U.K.)

- Beyond Meat (U.S.)

- Oatly Group AB (Sweden)

- The Kellogg Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Singapore-based startup Jiro-Meat expanded its production of plant-based meat from soy pulp. The company aims to commercialize the product by the end of 2024.

- May 2024: A U.S.-based brand named Sola launched new bakery offerings with zero sugar, non-GMO ingredients and zero artificial flavors and additives. The product categories launched in the market include kids bread, classic bread in white & multigrain varieties, and rolls.

- January 2024: India-based company Continental Greenbird, launched plant-based meat alternatives in the market. The new product variants include chicken-like nuggets, chicken-like seekh kebab, chicken-like sausage, and mutton-like keema, all of which are made of chickpeas.

- November 2020: Sugar Free, a sweetener manufacturer, launched a sugar-free premium dark chocolate named Sugar Free D’lite chocolates. The company expanded its product offerings in the health alternatives category.

- November 2020: De Villiers Chocolate, a South African company, launched a sugar-free and dairy-free chocolate range for health and environment-conscious consumers. The product is suitable for diabetic consumers and vegan and ketogenic consumers.

REPORT COVERAGE

The report includes quantitative and qualitative insights about the market. It also offers a detailed regional analysis of the market size, statistics, regional forecast, and growth rate for all possible segments. It provides various key insights on the market, an overview of related markets, the competitive landscape, along with key players, recent industry developments, such as mergers, acquisitions, regulatory scenario in critical countries, and key industry trends.

Report Scope & Segmentation

ATTRIBUTE | DETAILS |

Study Period | 2019-2032 |

Base Year | 2023 |

Estimated Year | 2024 |

Forecast Period | 2024-2032 |

Historical Period | 2019-2022 |

Growth Rate | CAGR of 13.16% from 2024 to 2032 |

Unit | Value (USD Billion) |

Segmentation | By Product Type

By Intolerance Type

By Category

By Distribution Channel

By Region

|

Frequently Asked Questions

How much was the global food intolerance products market worth in 2023?

Fortune Business Insights says that the market size was valued at USD 76.93 billion in 2023.

At what CAGR is the food intolerance products market projected to grow during the forecast period of 2024-2032?

Recording a CAGR of 13.16%, the market will exhibit promising growth during the forecast period of 2024-2032.

Which is the leading segment in the market based on intolerance type?

The dairy and lactose intolerance segment is expected to be the leading segment during the forecast period.

Which is the significant factor driving the market?

Increasing diet-induced ailments and shift toward healthy lifestyle will support the growth of the market.

Who are the prominent players in the market?

General Mills and Kelloggs Company are a few of the leading players in the market.

Which region held the largest share of the market?

Asia Pacific dominated the global market in terms of share in 2023.

Which category holds the major market share?

The conventional segment holds the major share of the market.

What is the global market trend?

Growing demand for vegan products and experimentation with new ingredients is the new market trend.

- Global

- 2023

- 2019-2022

- 180