Gas Leak Detector Market Size, Share & Industry Analysis, By Product Type (Electrochemical, Catalytic Bead Sensors, Photo-ionization, Infrared Point, Optical, Ultrasonic, and Others (Semiconductor, Infrared Imaging, Holographic), By Installation (Fixed and Portable), By Application (Residential and Commercial/Industrial (Oil and Gas, Energy and Power, Electronics, Steel, Shipbuilding and Shipping, Firefighting and Rescue, Civil Engineering and Construction, and Others)), and Regional Forecast, 2026-2034

Gas Leak Detector Market Size

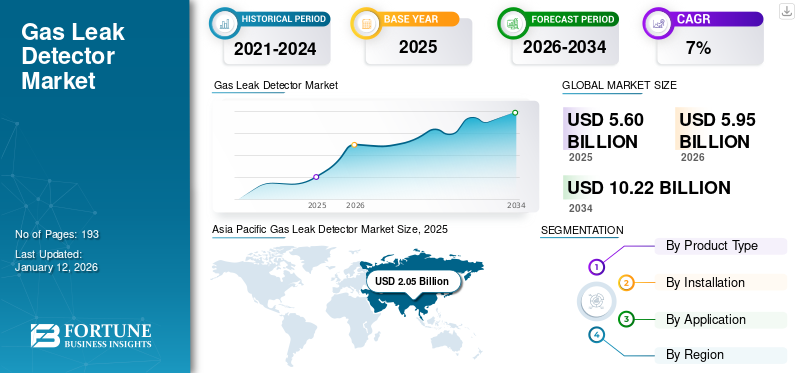

The global gas leak detector market size was valued at USD 5.6 billion in 2025 and is projected to grow from USD 5.95 billion in 2026 to USD 10.22 billion by 2034, exhibiting a CAGR of 7% during the forecast period. Asia Pacific dominated the global market with a share of 36.60% in 2025.

A gas leak detector is a device designed to detect the presence of gas leaks in an environment, typically in residential, commercial, or industrial settings. These detectors are crucial for safety as gas leaks can lead to fire, explosions, and health hazards due to exposure to toxic gases. They work by sensing the presence of certain gases in the air. They use various technologies such as catalytic sensors, infrared sensors, electrochemical sensors, or semiconductor sensors to detect different types of gases, including natural gas, propane, methane, carbon monoxide, and others. When the concentration of gas exceeds a certain threshold, the detector triggers an alarm, alerting occupants of the building or facility to the potential danger. Some detectors may also have features such as automatic shut-off valves or the ability to connect to a monitoring system for remote alerts.

Moreover, gas leak detectors are being used to detect the presence of potentially dangerous gases such as natural gas (methane) or propane. These detectors are typically installed in areas where gas appliances are present, such as kitchens, laundry rooms, utility rooms, or near gas meters. They can be wall-mounted or placed on a flat surface. Moreover, it can be powered by batteries, plug-in power sources, or a combination of both. Battery-powered detectors offer flexibility in placement and continue to operate during power outages.

The global market experienced a slight decline during the COVID-19 pandemic. However, the market ultimately restored after the pandemic due to the crucial significance of detectors across industries. During COVID-19, gas leak detectors had a significant role as the leak detectors for the oxygen supplied to patients via machine by compressed air units that must be completely clean and toxicity-free from pathogens and hazardous gases. These detectors are a key component of the gas processing industry in numerous industrial verticals. Industrial gas leak detectors have dominant applications in the petrochemical and oil & gas sectors and simple spray guns in the automotive industry.

Gas Leak Detector Market Trends

Real Time Monitoring and Integration of Analytics are Trends Enriching Residential Application

In the changing global fuel-based economy market, volatility has been a critical issue owing to the daily fluctuation of oil & gas commodity prices. Users need a reliable solution that minimizes profit earnings amid uncertainty. The industry uses Internet of Things (IoT) and a vast amount of data generated through connected devices for advanced capabilities such as automated predictive maintenance, real-time monitoring, and failure analysis. Communication is a critical element in the digitalization world of IIoT that enables users to capture essential parameters such as pressure, moisture, and temperature that help to develop operational strategies. Moreover, connected detectors enable smart near-infrared spectroscopy to detect methane. It offers the ability to easily monitor any gas leak in residential homes or commercial premises, further contributing towards the gas leak detector market growth.

Download Free sample to learn more about this report.

Gas Leak Detector Market Growth Factors

Growing Adoption of Industry 4.0 for Rising Operational Efficiency to Boost Market

Gas leak detectors are a major tool for industrial safety, whether in the hospitality and residential sector or large manufacturing facilities. Each industry needs safer and cleaner gas to breathe. Also, with the growing industrial revolution such as Industry 4.0, IoT-based gas monitoring systems have increased significantly for the early detection of hazardous gases such as CO, methane, and other dangerous gases. Consumers demand equipment that offers more accurate and precise tools to detect these gases. Another factor for adopting gas leak detectors in the industries is the product's operational efficiency, and users need products that are operational with minimal cost and can provide more output with less utilization of operational resources.

RESTRAINING FACTORS

Economic Losses Owing to Malfunction of Detectors and Rising Cost of Parts is Hindering Market Growth

Gas leak detectors ingest gas from the pipeline, mainly helium, oxygen, and hydrogen; hence, they are not very prone to other types of gases as they are designed specifically for particular gases. Also, the detectors have to face harsh climatic and operating conditions, which impacts the operational capabilities of the detectors, getting lessened, causing malfunction and deteriorating the working life of the equipment. These detectors need a higher cost of replacement, which is the limitation of the fixed gas detectors that are causing economic losses for the manufacturing units or industries, hampering consumer retention rates or organic sales of the detector manufacturers.

Gas Leak Detector Market Segmentation Analysis

By Product Type Analysis

Electrochemical to Dominate the Market Due To Precise Accuracy

On the basis of product type, the market is electrochemical, catalytic bead sensors, photo-ionization, infrared point, optical, ultrasonic, and others (semiconductor, infrared imaging, holographic).

Electrochemical gas detection technology is leading the market with the highest market share & CAGR in the leak detector market. The electrochemical sensors offer high sensitivity and selectivity for detecting specific gases, making them ideal for applications where accurate detection of target gases is crucial, such as detecting toxic gases such as carbon monoxide (CO), hydrogen sulfide (H2S), and oxygen (O2).

Moreover, photo-ionization detection (PID) technology is witnessing major growth due to its ability to detect a wide range of volatile organic compounds (VOCs) and other hazardous gases with high sensitivity and accuracy. The demand for advanced detection technology, such as PID, is driven by increasing concerns about air quality, workplace safety, and environmental protection.

In addition, catalytic bead sensors segment led the market accounting for 28.24% market share in 2026. due to industrial growth, regulatory requirements, technological advancements, and market competition.

By Installation Analysis

Portable Installation Holds Highest Market Share and CAGR Owing to its Flexibility

Based on installation, the market is divided into fixed and portable.

Portable detectors are leading the market share of 66.55% with major CAGR in 2026. It is attributed to their flexibility and versatility in various applications, including leak detection in confined spaces, HVAC systems, pipelines, and residential settings. These detectors are compact, lightweight, and easy to carry, making them ideal for on-the-go gas detection tasks by maintenance personnel, first responders, and field technicians.

Fixed detectors are witnessing significant demand, especially in industrial and commercial applications where continuous monitoring of gas concentrations is essential for ensuring safety and compliance with regulatory standards. These detectors are installed in fixed locations and are designed to provide continuous monitoring of specific gases in confined spaces, manufacturing plants, chemical processing facilities, and other critical infrastructure.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Commercial/Industrial Segment to Lead Market by Complying With Regulatory Standards

Based on application, the market is divided into residential and commercial/industrial.

Moreover, commercial/industrial industry is dominating the market share with 71.26% in 2026. These detectors find widespread use in commercial buildings such as offices, shopping malls, hotels, hospitals, and educational institutions to ensure the safety of occupants and prevent accidents related to gas leaks. The industrial sector represents a significant application area for these detectors, driven by the need to ensure workplace safety and comply with regulatory standards.

Residential sector has anticipated to witness major growth during the forecast period. These detectors are increasingly being adopted in residential settings, particularly in households using natural gas or propane for heating, cooking, and water heating purposes. Residential detectors are typically installed in kitchens, utility rooms, basements, and living spaces to detect leaks of natural gas (methane) or propane, alerting homeowners to potential hazards and enabling timely evacuation and intervention.

REGIONAL INSIGHTS

The market report's scope comprises five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Gas Leak Detector Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.05 billion in 2025 and USD 2.2 billion in 2026. Asia Pacific is experiencing rapid industrialization and urbanization, driving significant demand for detectors across various industries and sectors. Growing manufacturing, construction, and infrastructure development activities require effective gas detection solutions to ensure workplace safety and environmental protection. Increasing awareness about workplace safety, environmental concerns, and the potential risks associated with gas leaks is driving the adoption of gas leak detectors in Asia Pacific. Governments and regulatory bodies are implementing stringent safety regulations and standards to mitigate risks and ensure compliance, further fueling market growth. The Japan market is projected to reach USD 0.46 billion by 2026, the China market is projected to reach USD 1.05 billion by 2026, and the India market is projected to reach USD 0.34 billion by 2026.

The leak detector market in China is highly competitive, with both domestic and international manufacturers offering a wide range of products and solutions tailored to local market needs. Domestic players often focus on providing cost-effective solutions customized for specific industries and applications. In contrast, international players leverage their technological expertise and global presence to penetrate the market.

To know how our report can help streamline your business, Speak to Analyst

North America

North America exhibiting major growth in terms of CAGR. As particularly the U.S. and Canada, has stringent safety regulations governing the use of gas in various industries and residential settings. Compliance with these regulations drives the demand for gas leak detection systems to ensure the safety of workers, consumers, and the environment. There is increasing awareness among consumers and businesses in North America about the risks associated with gas leaks, including fire, explosions, and health hazards such as carbon monoxide poisoning which is further contributing to the increase in gas leak detector market share. The U.S. market is projected to reach USD 1.29 billion by 2026.

Europe

Europe is also witnessing major traction in terms of market share. As this region is home to several prominent players in the detector market, including manufacturers, distributors, and service providers. These companies compete based on product innovation, quality, and brand reputation, driving market growth and competitiveness. These detectors find applications across a wide range of industries and sectors in Europe, including oil and gas, chemicals, manufacturing, utilities, residential buildings, and commercial establishments. Each sector has unique requirements and applications for gas leak detection systems, contributing to market growth in the region. The UK market is projected to reach USD 0.33 billion by 2026, while the Germany market is projected to reach USD 0.3 billion by 2026.

Middle East & Africa

The Middle East & Africa is experiencing rapid industrialization and urbanization, driving significant demand for gas leak detectors across various industries and sectors. Growing manufacturing, construction, and infrastructure development activities require effective gas detection solutions to ensure workplace safety and environmental protection.

South America

South America is expected to experience steady growth, driven by increasing industrialization, urbanization, and regulatory focus on workplace safety and environmental protection. The market size is influenced by factors such as industrial activities, construction projects, and the adoption of safety regulations.

Key Industry Players

Market Players are Adopting Various Business Strategies to Tackle the Supply-Demand Gap

The gas leak detector market consists of a prominent and established players such as PCE Deutschland GmbH, RIKEN KEIKI, NEW COSMOS ELECTRIC CO.,LTD, ABB, Teledyne Technologies, SENSIT TECHNOLOGIES (Halma Plc), Bacharach (MSA Safety), Emerson Electric, Industrial Scientific (Fortive), Drager, Honeywell International. These key major players adopt several market penetration approaches and strategies to sustain their market position through collaborations, mergers & acquisitions establishing partnerships. Moreover, emerging a new production process, setting up a new joint venture, inventing the existing product or developing new product for the product line-up and many others to expand their customer base in the existing and untouched market across all regions.

List of Top Gas Leak Detector Companies:

- New Cosmos Electric Co. Ltd (Japan)

- ABB (Switzerland)

- Emerson Electric Co. (U.S.)

- Honeywell International Inc. (U.S.)

- Teledyne Technologies Inc. (U.S.)

- Fortive Corporation (U.S.)

- Halma Plc. (U.K.)

- Drägerwerk AG & Co. KGaA (Germany)

- PCE Instruments UK Ltd (U.K.)

- MSA Safety Inc (U.S.)

- Riken Keiki Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 - Emerson released the Rosemount™ 9195 Wedge Flow Meter, a fully integrated solution consisting of a wedge primary sensor element, supporting components, and a selectable Rosemount pressure transmitter. The new meter’s unique flexible design is ideal for measuring process fluids with a wide range of demanding characteristics in various heavy industry applications, including metals and mining, oil and gas, renewable fuels, chemicals and petrochemicals, pulp and paper, and others.

- February 2024 - ABB acquired SEAM Group, involved in providing energized asset management and advisory services to clients across commercial as well as industrial building markets. The acquisition complemented ABB’s Electrification Service division, carrying significant further expertise in the areas of preventive, corrective maintenance, predictive, renewables asset management advisory services, and electrical safety.

- January 2024 - Emerson launched the Branson™ Series GMX-Micro, a line of high-precision ultrasonic metal welders comprising features of a new computerized operating system, multiple power levels and configurations, advanced controls, and improved connectivity.

- July 2023 - New Cosmos Electric Co. Ltd established its new wholly-owned subsidiary i.e. Taiwan New Cosmos Electric Co., Ltd. in Hsinchu, Taiwan. Operations which started their operations on July 3 for marketing gas detectors and alarms in Taiwan.

- December 2023 - Honeywell strengthened its building automation capabilities and acquired Carrier Global Corporation’s Global Access Solutions business for USD 4.95 billion in an all-cash transaction. This acquisition enabled Honeywell to become a leading provider of security solutions for the digital age.

REPORT COVERAGE

The global gas leak detectors market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Installation

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 5.6 billion in 2025.

The market is likely to grow at a CAGR of 7% over the forecast period.

The electrochemical segment is expected to lead the market due to its increasing adoption.

The market size in Asia Pacific stood at USD 2.05 billion in 2025.

The portable segment leads the market owing to the rising demand for accurate and real-time detection of gas leakage across confined and isolated locations.

The growing adoption of Industry 4.0 for rising operational efficiency is cited as one of the crucial factors driving market growth.

Some of the top players in the market include Honeywell International, RIKEN KEIKI, and Emerson Electric.

Asia pacific dominated the market in terms of revenue in 2025.

The malfunction of detectors and the rising cost of replacement parts impede product application.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us