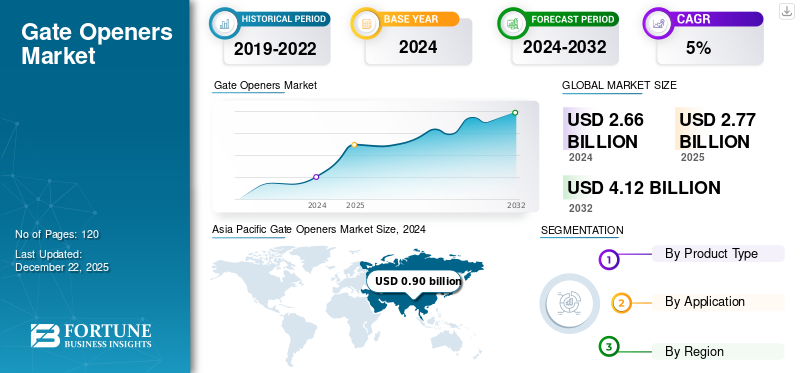

Gate Openers Market Size, Share & Industry Analysis, By Product Type (Linear Ram, Underground, Articulated Ram, Sliding, and Others), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global gate openers market size was valued at USD 2.90 billion in 2025 and is projected to grow from USD 3.04 billion in 2026 to USD 4.60 billion by 2034, exhibiting a CAGR of 5.30% during the forecast period. Asia Pacific dominated the global market with a share of 32.70% in 2025.

Gate openers are automated devices designed to open and close gates for residential, commercial, and industrial properties. These systems enhance convenience, security, and access control by automating the movement of swing, sliding, or other types of gates. Typically powered by electric or solar energy, these devices can be operated through remote controls, keypads, or smart technology integration, providing hands-free access. The market includes various types of systems based on the gate’s design and installation, such as linear ram, articulated arm, underground, and sliding openers.

Download Free sample to learn more about this report.

The gate openers market growth is driven by increased urbanization and infrastructure development, growing demand for home automation solutions, and the increasing disposable income of consumers. The share of the global urban population increased to 56.9% in 2022 from 52.5% in 2012. Over the last few years, urbanization has been most significant in the developing economies, especially in Asia and Oceania, which registered an urban rate increase from 44% in 2012 to 50.6% in 2022. As the urban population increases, there is a growing requirement for controlled gate access to residential buildings, gated communities, and commercial buildings.

In addition, according to the International Monetary Fund (IMF), GDP per capita growth (2023‒2027) is forecasted to rise by 5% to 6% in India, China, the Philippines, and Vietnam and by 3% to 4% in Malaysia and Thailand. The increasing disposable incomes, especially in emerging countries, have led to a significant shift in lifestyle preferences. People are now more interested in investing in home automation systems that improve their convenience and security.

The COVID-19 pandemic had a mixed impact on the market due to the decline in residential and commercial construction projects. Economic fluctuations during the outbreak reduced the demand for non-essential products. However, with more people staying at home due to the stringent lockdown measures, the focus on home security increased. This augmented the demand for the market, especially in the residential segment.

IMPACT OF TECHNOLOGY ON MARKET

Rapid Technological Advancements to Drive the Market Growth

The integration of gate opener systems with smart home technology has significantly impacted the market growth. As smart home technology becomes more widespread globally, homeowners increasingly demand gate openers that can be connected to other home automation hubs, including Amazon Alexa and Google Home. The manufacturers are increasingly combining gate systems with biometric authentication technology to ensure that only authorized individuals can access the property.

Furthermore, solar-powered gate openers are becoming very common as customers demand eco-friendly alternatives to electrically powered systems. Solar-powered gate opener is designed to operate using energy utilized from the sun. This reduces the need for an external power source and lowers electricity costs.

Bluetooth-operated gate opener is another emerging technological trend that offers more flexibility to users. These systems do not need extensive wiring, making installation simpler and less expensive for properties where running wires may be challenging.

GATE OPENERS MARKET TRENDS

Rise in Organized Crime and Burglary to Fuel Market Growth

The rising theft, unauthorized access, and vandalism in residential as well as non-residential settings are expected to augment the market growth. In recent years, burglaries have increased significantly across the world, especially in urban areas. In response, both residential and commercial sectors are actively exploring ways to enhance security at the perimeter level. In the U.S., a burglary is committed every 51 seconds. As per the estimations of the Federal Bureau of Investigation (FBI), 619,811 burglaries happened in 2021 in the U.S. Peru has the highest burglary rate across the world, while Bangladesh has the lowest. In addition, various estimates suggest that one burglary occurs every 1.5 minutes in the European Union (EU). Gate openers, combined with advanced access control systems, offer a robust solution as they allow users to control access to their property without leaving their vehicle or home.

MARKET DYNAMICS

Market Drivers

Growing Demand for Home Automation Solutions to Augment Market Growth

As consumers increasingly seek smart home systems, the demand for automated gates is anticipated to rise during the forecast period. These systems allow automated control of gates, which enhances security and convenience. Automated gates serve as an important component of smart security systems, especially in residential applications. With home automation, gate openers can be combined with other smart devices, including security cameras, alarms, and motion sensors, making a complete security ecosystem.

Home automation is fundamentally about making life more convenient, and gate opener is a perfect example of this. With automated gate system, homeowners no longer have to open and close their gates manually. This is extremely helpful in bad weather conditions, at night, or when homeowners are in a hurry.

Market Restraints

High Initial Cost Coupled with Limited Awareness in Emerging Economies to Impede Market Growth

One of the major challenges in the market is the high initial cost of acquiring gate openers with advanced features, such as smart connectivity, security integration, and solar-powered systems. The high cost deters some residential and small commercial users from buying this system. Automated gates often need regular maintenance to ensure smooth operation. Issues, such as mechanical wear and tear, malfunctioning sensors, or control systems can increase operational costs.

Automated gates mostly rely on electrical power, and in regions with unreliable power supplies can lead to operational interruptions. Even with backup battery options, prolonged outages can disrupt functionality, limiting adoption in such areas. In developing economies, awareness and adoption of automated gate system is still low. Factors, such as lack of marketing and price sensitivity limit the potential growth of the market in such regions.

Market Opportunities

Increased Urbanization and Infrastructure Development Globally to Offer Ample Growth Opportunities

Rapid urbanization, especially in developing countries, has been one of the major drivers of the market. As cities expand and population density increases, there is a growing need for controlled access to residential complexes, gated communities, industrial zones, and commercial buildings.

Automated gate systems offer an efficient solution to manage the flow of vehicles and people while maintaining security and order. Moreover, the construction of new infrastructure projects, such as shopping malls, business parks, and airports, often includes the installation of automated gate systems.

These large-scale projects require robust access control systems to manage the high volume of traffic and ensure the safety of the premises. As a result, the demand for automated gates in commercial and industrial sectors continues to grow in tandem with infrastructure development.

SEGMENTATION ANALYSIS

By Product Type

Linear Ram to Dominate the Market Due to the Energy Efficiency and Solar Integration

Based on product type, the market is classified into linear ram, underground, articulated ram, sliding, and others.

The linear ram segment is expected to dominate the gate openers market share of 36.51% in 2026 during the forecast period as this gate opener is designed to be compatible with solar energy, making it an energy-efficient and cost-effective solution in regions where environmental awareness is high or electricity costs are high. As more homeowners and enterprises prioritize convenience, automated gate systems with features, such as sensor integration and wireless controls are becoming increasingly popular.

To know how our report can help streamline your business, Speak to Analyst

The sliding segment held 33% of the market share in 2024 and is poised to grow with the highest CAGR during the forecast period owing to the various benefits offered by these gates, such as enhanced security, space efficiency, and aesthetic appeal. Automatic sliding gate systems operate horizontally along a track, which makes them highly ideal for properties with limited space.

By Application Analysis

Increasing Security Concerns Boosted Gate Opener Demand in Commercial Applications

Based on application, the market is segmented into residential, commercial, and industrial.

The commercial segment is poised to account for the market share of 39.47% in 2026 due to increasing security concerns, such as theft, unauthorized access, and vandalism across commercial properties. The increased adoption of automated solutions in the commercial sector is propelling the demand of the market. These systems minimize the requirements for manual operation, enhancing efficiency and minimizing operational costs of commercial buildings.

The residential segment is anticipated to grow at the highest CAGR of 4.70% during the forecast period due to the growing number of gated communities and premium residential developments worldwide. Gated communities are known for their emphasis on safe living and exclusivity, and automated gates are important for providing these.

GATE OPENERS MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, Middle East and Africa, and South America.

ASIA PACIFIC

Asia Pacific Gate Openers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the largest and fastest-growing market, driven by urbanization, increasing disposable income, and the rapid construction of residential and commercial spaces. The regional market value in 2024 was USD 0.95 billion, and in 2026, the market value led the region by USD 1 billion. In countries, such as China and India, the gate opener demand has surged, especially in gated communities and commercial establishments. Meanwhile, North America and Europe hold significant market shares, largely due to the early adoption of home automation and security technologies.

India is projecting to hit USD 0.25 billion and Japan is likely to hold USD 0.11 billion in 2026.

China Dominates Asia Pacific Due to Its Strong Infrastructure Development

The market value in China is expected to be USD 0.33 billion in 2026. China holds the largest market share in the Asia Pacific region due to its strong infrastructure development, urbanization, and large population base. The increasing construction of smart cities and high-rise buildings in China is significantly driving the gate opener demand. India is also emerging as a key market, supported by government initiatives such as the "Smart Cities Mission" and rapid growth in real estate development.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is anticipated to account for the second-highest market size of USD 0.80 billion in 2025, exhibiting the second-fastest growing CAGR of 5.4% during the forecast period. The market growth in North America is majorly attributed to the rapid adoption of home automation systems and rising awareness about security solutions are key factors contributing to this growth. For instance, in states, such as California, there has been a marked increase in electric gate opener demand in luxury residential areas, driven by the growing preference for secure, gated communities.

The U.S. market size is estimated to be USD 0.52 billion in 2026. The residential sector holds the highest market share in North America. With the growing trend of smart homes, more homeowners are opting for automatic gates that can be controlled via smartphones or integrated with other home security systems. The rising concerns over home safety further accelerate this demand.

Europe

The market in Europe is projected to be the third-largest market with a value of USD 0.65 billion in 2025 and to grow at a moderate CAGR over the forecast period, fueled by the growing adoption of smart technologies and the increasing focus on security solutions. The demand for gate automation systems is particularly strong in Western Europe, where countries, such as Germany, France, and the U.K. are leading the adoption. The market value in U.K. is expected to be USD 0.13 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.16 billion in 2026 and France is likely to hold USD 0.09 billion in 2025.

Middle East & Africa

The Middle East & Africa region is projected to be the fourth-largest market with a value of USD 0.30 billion in 2025. show significant growth during the forecast period due to the region’s expanding construction industry and heightened focus on safety and security are significant growth drivers. The GCC market size is expected to be USD 0.19 billion in 2025. High-income countries in the Gulf Cooperation Council (GCC), such as UAE and Saudi Arabia are leading the automated gate opener demand, while emerging markets in Africa, such as South Africa and Nigeria, are experiencing growing adoption.

South America

South America is anticipated to grow moderately during the forecast period. Brazil and Argentina are the leading contributors to market growth, with a growing demand for automated gate systems due to increasing construction activities and rising disposable incomes.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focused on Strengthening their Market Positions with Continuous Developments

The global market is moderately fragmented and predominantly driven by a few established players, such as ASSA ABLOY, Overhead Door Corporation, Somfy Group, FAAC, Chamberlin, and Nice. Key players in the market are aiming to expand their presence through new acquisitions of small manufacturers operating in other regions. Manufacturers are focused on expanding their presence through acquisitions and collaborations with domestic players in the dominant market, having a huge demand for automated gate systems. Along with expansion strategies, companies are also striving to provide software solutions with AI-assisted systems and Apps, surging their market penetration across geographies. For instance,

- In December 2023, Nice S.p.A, an Italian manufacturer, announced the acquisition of AI-driven company LiveLox. The acquisition aims to enhance the capability of the Nice customer market platform CxONE.

Major Players in the Global Gate Openers Market

To know how our report can help streamline your business, Speak to Analyst

List of Key Companies Profiled:

- ASSA ABLOY AB (Sweden)

- CAME (Italy)

- Chamberlain Group (U.S.)

- FAAC Group (Italy)

- Marantec Groups (Germany)

- NICE S.p.A. (Italy)

- Powertech Automation Inc. (Taiwan)

- PROTECO SRL (Italy)

- SANWA Holdings Corporation (Japan)

- SOMFY Group (France)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Ditec has launched its first smart and connected garage door operator, Ditec AIR, with both local connectivity (via Bluetooth technology on all models) and remote connectivity using Wi-Fi or cellular GSM with optional plug-in models. The new Ditec AIR is also fully compatible with all Ditec TOP Installations.

- March 2024: Liftmaster, a sub-brand of Chamberlain, has launched a new elite strength heavy-duty wall mount garage door opener HD RJO 98032 that is UL certified. The product features Quiet operation, space-saving design, and remote diagnostic capabilities with smartphone capability. The UL certification ensures the opener effortlessly lifts heavy garage doors up to 1,100 pounds.

- January 2024: Liftmaster has launched a new lineup of commercial door operators MAXUM. It offers a comprehensive set of features that include floor-level LCD Display, soft start and stop built-in Wi-Fi connectivity and battery backup. The MAXUM Product lineup is designed to deliver maximum efficiency and productivity. This technology comes in a sleek design with smart capabilities, peak performance, and tailored solutions for unique requirements.

- February 2024: Marantec Group, a global manufacturer of drive and control technology, has announced a collaboration with CEDES Group, a prominent expertise manufacturer of light barrier and optical sensors for the elevator and industrial door sector. The duo will work on the development of an IoT prototype that combines CEDES IoT, sensor technology, and data analysis with Marantec’s product expertise.

- February 2023: Nice, a global manufacturer of smart homes, building automation, and security solutions, has launched SlideDriverII. It is a hydraulic gate operator that utilizes a smart touch 725 controller while offering simple integration with the Hysecurity Installer App.

REPORT COVERAGE

The market research report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimation and forecast based on technology, end-user, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Region

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 2.90 billion in 2025.

The market is expected to reach USD 4.60 billion by 2034.

The market is projected to grow at a compound annual growth rate (CAGR) of 5.30% during the forecast period (2024-2032).

The linear RAM segment is expected to lead the market over the forecast period.

Rising investments in residential infrastructure, increased urbanization, and the rise in organized crime and burglary fuel the market growth.

ASSA ABLOY, Overhead Door Corporation, Somfy Group, and FAAC are the leading companies in this market.

Asia Pacific is the largest shareholder in the market.

The rising theft, unauthorized access, and vandalism in residential as well as non-residential settings are expected to augment the market growth.

Based on application, the commercial sector is projected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us