Geospatial Analytics Market Size, Share & Industry Analysis, By Component (Solution & Services), By Solution (Data Integration & ETL, Geocoding & Reverse Geocoding, Thematic Mapping & Spatial Analysis), By Deployment (On-Premises & Cloud), By Enterprise Type (Large, Small and Medium Enterprises), By Application (Disaster Management & Risk Reduction, Public Safety and Medicine Delivery, Surveying, Climate Change), By End-user (Defense and Internal Security, Retail & Logistics, Government, BFSI, Energy & Utilities, Agriculture), Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

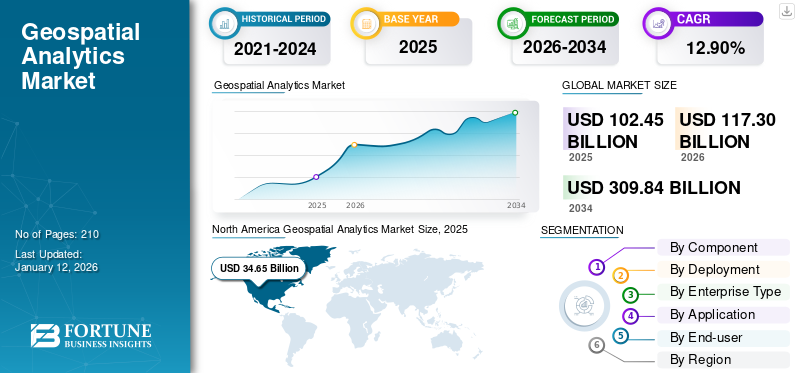

The global geospatial analytics market size was valued at USD 102.45 billion in 2025. The market is projected to grow from USD 117.30 billion in 2026 to USD 309.84 billion by 2034, exhibiting a CAGR of 12.90% during the forecast period. North America held the largest wearable technology market share, accounting for 33.80% of the global market. Additionally, the U.S. geospatial analytics market is projected to grow significantly, reaching an estimated value of USD 39.29 billion by 2032.

Geospatial data analytics gathers, manipulates, and visualizes different types of geospatial data generated from GPS, location sensors, drones, satellite imagery, and smartphones. Geospatial data analysis helps organizations study large volumes of demographic, topographic, and environmental datasets, and make data-driven decisions.

Global Geospatial Analytics Market Overview

Market Size:

- 2025 Value: USD 102.45 billion

- 2026 Value: USD 117.30 billion

- 2034 Forecast Value: USD 309.84 billion

- CAGR: 12.90% from 2026–2034

Market Share:

- Regional Leader: North America held a significant market share in 2025, driven by early adoption of geospatial analytics technologies and substantial investments in infrastructure.

Industry Trends:

- Cloud Deployment Dominance: The cloud deployment model is expected to showcase rapid growth and hold a dominant market share during the forecast period, owing to its capability to access large sets of data.

- Large Enterprises Leading Adoption: Large enterprises are estimated to gain the maximum market share and are likely to record the highest CAGR during the forecast period, supported by increased IT spending and early adoption of advanced technologies.

- Surveying Applications Leading: The surveying application segment accounted for the largest market share in 2023, with businesses investing heavily in location-based solutions to gain insights and understand customer preferences.

Driving Factors:

- Urbanization and Technological Advancements: Increasing urbanization and the proliferation of advanced technologies, such as IoT, AI, and ML, are major contributors to market growth.

- 5G Technology Adoption: Widespread adoption of 5G technology across the globe is enhancing the capabilities of geospatial analytics.

- Supply Chain Optimization: The Growing importance of supply chain optimization is driving the demand for geospatial analytics solutions.

- Government Initiatives: Governments and universities are liberalizing the geospatial sector to minimize and resolve various problems arising from rapid urbanization.

The significant growth of the market is majorly attributed to the increasing urbanization, proliferation of advanced technologies, such as Internet of Things (IoT), Artificial Intelligence (AI), and Machine Learning (ML), widespread adoption of 5G technology across the globe, and growing importance of supply chain optimization. Many governments and universities are liberalizing the geospatial sector for minimizing and resolving various problems arising from rapid urbanization. For instance,

- In June 2023, Yale University established the Center for Geospatial Solutions (YCGS) to bolster its research, training, and engagement infrastructure in geospatial science, data, and analysis. This initiative aims to leverage geospatial methods to address global challenges, such as climate-induced human displacement and improve economic forecasting. According to Yale Provost Scott Strobel, YCGS will support the university community's mission across various fields, such as economics, public health, and environmental science.

Furthermore, amid the COVID-19 pandemic, end-users, such as government authorities, healthcare providers, researchers, and other such agencies, were significantly using the geospatial analysis tools to analyze the data collected across different countries where the COVID-19 strain was widespread. Different geospatial software and data analysis tools were implemented to impose lockdowns and trace patients' close contact information. For instance,

- In 2021, the Government of India’s Department of Science and Technology (DST) announced several guidelines to liberalize geospatial data collection and distribution. This move permitted Indian companies, academic & research organizations, and other private entities to collect geospatial data to find solutions in their respective sectors.

- In March 2020, India’s Esri Global Inc. offered an ArcGIS Online subscription with ArcGIS Hub for six months under its Disaster Response Program. The company also provided a support team to the government and other agencies working on patient tracking and tracing.

Geospatial Analytics Market Trends

Rise of Web-based GIS Platforms Will Transform Market

The web-based GIS platforms utilize web technologies, such as HTML5, JavaScript, and WebGL, to deliver geospatial data and analysis tools directly through web browsers, enabling users to access and analyze spatial information from any location with internet connectivity. Examples of web-based GIS platforms include Esri's ArcGIS Online, Google Maps Platform, and Mapbox, which offer features, such as interactive mapping, spatial analysis, and data visualization. This trend is fueled by the increasing demand for accessible and user-friendly geospatial solutions, enabling organizations to leverage spatial data for decision-making, resource management, and spatial intelligence applications across various sectors, such as urban planning, environmental monitoring, and logistics optimization. Many web GIS platforms enable collaboration by allowing users to share maps and analysis results publicly or privately. For instance,

- ArcGIS Online, a cloud-based mapping software, enables large-scale collaboration with customizable access permission.

As a result, there is a growing emphasis on investing in web-based GIS platforms to support the expanding needs of geospatial analytics in the digital era.

Download Free sample to learn more about this report.

Geospatial Analytics Market Growth Factors

Advancements in Technologies to Fuel Market Growth

The rapid technological advancements in the Internet of Things (IoT) is transforming the traditional way of living into a high-tech lifestyle. Smart homes, pollution control, smart cities, energy saving, and smart transportation have been made possible by the introduction of IoT. This technology uses smart sensors and GPS trackers to generate vast volumes of high-precision data, such as temperature, humidity, noise, radiation, location, proximity, images, and videos. This data can be integrated with geospatial analytics to provide valuable insights into complex queries and research questions.

The rise of Artificial Intelligence (AI) and Machine Learning (ML) is also revolutionizing the market by creating more valuable and precise insights from location-based data. AI-powered image recognition techniques can better interpret satellite images to recognize features, such as roads, wetlands, and changes in them over time. Such analysis is crucial in urban development and natural resource management.

Moreover, the increasing use of cutting-edge wireless technologies, such as 5G across the world is anticipated to provide better connectivity. This, in turn, is expected to enable enhanced tracking, real-time data transmission, and data analytics.

RESTRAINING FACTORS

Lack of Standardization Coupled with Shortage of Skilled Workforce to Limit Market Growth

Geospatial data analytics has witnessed significant growth in the past several years. However, the lack of standardization coupled with shortage of skilled workforce is anticipated to limit the geospatial analytics market growth. GIS specialists spend most of their time on data cleaning before analysis due to the lack of standardization in storing geospatial data. There are quite loose color conventions for geographic information as well as low variety in how elements are defined on the map, thus creating standardization issues.

Shortage of skilled workforce is another major concern anticipated to hinder the market growth. According to a Geospatial World Annual Readership Survey, around 84% of 2,000 surveyed industry professionals acknowledged that there was a skill gap in terms of industry requirements and availability of workforce.

Geospatial Analytics Market Segmentation Analysis

By Component Analysis

Geospatial Analytics Solutions to Gain Dominant Market Share during the Forecast Period Owing to Increased Data Availability

Based on component, the market is divided into solution and services. The solution segment is expected to hold the maximum geospatial analytics market with a share of 69.96% in 2026. The high capabilities of these solutions in addressing the industry-specific functions is likely to fuel their demand. Organizations are able to achieve their business objectives by surveying the demand and supply insights offered by geospatial analytics solutions.

The services segment is anticipated to showcase rapid growth rate during the forecast period. Geospatial analytics technology requires high skills and technical knowledge to properly utilize its solutions. Thus, companies are offering skill training services to the end-users of these solutions.

By Solution Analysis

Demand for Thematic Mapping & Spatial Analysis Solutions to Increase Owing to Proliferation of Smartphones

Based on solution, the market is segmented into data integration & ETL, geocoding & reverse geocoding, thematic mapping & spatial analysis, reporting & visualization, and others.

The thematic mapping & spatial analysis segment is predicted to showcase rapid growth rate. Businesses are keen on understanding the customer behavior and demand patterns, which will fuel the adoption of these solutions.

The geocoding and reverse geocoding segment is set to gain significant market share. Their ability to provide precise location is driving their use in various applications such as ride-sharing apps, mapping services, and location-based marketing.

By Deployment Analysis

Cloud Deployment to Show Highest Growth Rate Owing to its Ability to Offer Instant Business Insights

Based on deployment, the market is segmented into on-premises and cloud. The cloud segment is expected to showcase rapid growth rate and hold a dominant market with a share of 56.68% in 2026. The capability of the cloud deployment model to access large sets of data will fuel their demand in geospatial analysis. Globally, the adoption of cloud technologies is growing significantly considering its functionalities and offerings.

The on-premises segment is anticipated to grow steadily during the forecast period. The higher security offered by this model to the collected information is driving the adoption of on-premises solutions.

By Enterprise Type Analysis

Large Enterprises to Hold Largest Market Share on Account of Increased IT Spending

Based on enterprise type, the market is bifurcated into large enterprises and SMEs. The large enterprise segment is estimated to gain the maximum market with a share of 61.51% in 2026 and likely to record the highest CAGR during the forecast period. The assigned IT budget at large enterprises supports the implementation of new and advanced technologies. These enterprises are the early adopters of advanced technologies and keen on enhancing their operations and customer services.

The Small and Medium Enterprise (SME) segment is expected to witness steady growth during the forecast period. The lack of financial support and higher risk associated with new technology is hampering the adoption of this technology.

By Application Analysis

Surveying Application to Gain Dominant Market Share Due to Growing Investment in Location-based Solutions

Based on application, the market is segmented into disaster management & risk reduction, public safety & medicine delivery, surveying, climate change adaptation, and others.

The surveying segment accounted for the largest market share in 2023. Businesses are investing heavily in location-based solutions to gain insights and understand the customer preferences. Similarly, the public safety & medicine delivery segment may record rapid growth rate during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

Other applications, such as sales & marketing optimization, supply chain management, among others are anticipated to showcase steady growth. As business are using location-based customer targeting solutions, the demand for these solutions will gain traction.

By End-user Analysis

Defense & Internal Security to Hold Largest Market Share Due to Growing Use of Spatial Data

Based on end-user, the market is segmented into defense & internal security, retail & logistics, government, Banking, Financial Services and Insurance (BFSI), energy & utilities, agriculture, healthcare & life sciences, infrastructure & urban development, and others.

The defense & internal security segment is expected to gain a dominant market share during the forecast period. The implementation of geospatial analytics technology supports the defense and internal security personnel with timely and accurate intelligence.

The healthcare & life sciences segment is expected to grow with the highest CAGR during the forecast period. Geospatial analysis helps in tracking and analyzing disease patterns. In addition, it helps to create various disease maps which help in resource allocation, containment strategies, etc.

The retail & logistics segment is set to record significant growth during the forecast period. During the pandemic crisis, the industry substantially invested in this technology to deliver timely results. Similarly, governments also initiated depending on the technology to track and trace infected patients.

Other industries, such as education, media & entertainment, among others is anticipated to witness steady growth owing to the ability of geospatial analytics solutions to boost customer acquisition by offering targeted campaigns.

REGIONAL INSIGHTS

Geographically, the market share is fragmented into five major regions, including North America, South America, Europe, Middle East & Africa, and Asia Pacific.

North America Geospatial Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 34.65 billion in 2025 and USD 39.07 billion in 2026. As the early adopter of advanced technologies, the region is focused on enhancing its operations and customer experience with personalized location-based solutions. The U.S. market is valued at USD 19.68 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is set to record rapid growth rate during the forecast period owing to the rise in market competition across countries, such as China, India, and Japan, among others. The large regional population is driving the use of location-based services to offer modern day solutions to analyze and target customers. The Japan market is valued at USD 6.19 billion by 2026, the China market is valued at USD 6.77 billion by 2026, and the India market is valued at USD 6 billion by 2026.

In Europe, rapid urbanization and economic development are expected to drive the market growth. In addition, the presence of major players is another factor anticipated to boost the market growth in this region. The UK market is valued at USD 5.72 billion by 2026, while the Germany market is valued at USD 5.6 billion by 2026.

In South America, significant growth in various end-user industries, such as healthcare, consumer electronics, and automotive is anticipated to augment the market growth.

In the Middle East & Africa (MEA), high investment in advanced technologies will boost its share in the global market. Similarly, growing preference for personalized services is expected to fuel the adoption of geospatial analytics solutions across the region.

Key Industry Players

Key Players to Focus on Strengthening their Market Position with Continuous Developments

The global market is consolidated by leading players, such as Esri Global, Inc., Trimble Inc., HERE Global B.V., Alphabet Inc. (Google LLC), Oracle Corporation, Precisely Holdings, LLC, Alteryx, Inc., Hexagon AB, Microsoft Corporation, and TomTom International B.V. These key players are expanding their operations by adopting strategies, such as mergers, acquisitions, product launches, collaborations, and partnerships. For instance,

- In December 2021, Esri India launched Indo ArcGIS, a ready-to-use GIS solution for Indian users. Indo ArcGIS comprises disaster management, forest management, land records, and property tax management solutions.

List of Top Geospatial Analytics Companies:

- Esri Global, Inc. (U.S.)

- Trimble Inc. (U.S.)

- HERE Global B.V. (Netherlands)

- Alphabet Inc. (Google LLC) (U.S.)

- Oracle Corporation (U.S.)

- Precisely Holdings, LLC (U.S.)

- Alteryx, Inc. (U.S.)

- Hexagon AB (Sweden)

- Microsoft Corporation (U.S.)

- TomTom International B.V. (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Placer.ai and Esri, a Geographic Information System (GIS) technology provider, partnered to empower customers with enhanced analytics capabilities, integrating consumer behavior analysis. Additionally, the agreement will foster collaborations to unlock further features by synergizing our respective product offerings.

- December 2023: CKS and Esri India Technologies Pvt Ltd teamed up to introduce the 'MMGEIS' program, focusing on students from 8th grade to undergraduates, to position India as a global leader in geospatial technology through skill development and innovation.

- December 2023: In collaboration with Bayanat, the UAE Space Agency revealed the initiation of the operational phase of the Geospatial Analytics Platform during its participation in organizing the Space at COP28 initiatives.

- November 2023: USAID unveiled its inaugural Geospatial Strategy, designed to harness geospatial data and technology for more targeted international program delivery. The strategy foresees a future where geographic methods enhance the effectiveness of USAID's efforts by pinpointing development needs, monitoring program implementation, and evaluating outcomes based on location.

- May 2023: TomTom International BV, a geolocation technology specialist, expanded its partnership with Alteryx, Inc. Through this partnership, Alteryx will use TomTom’s Maps APIs and location data to integrate spatial data into Alteryx’s products and location insights packages, such as Alteryx Designer.

- May 2023: Oracle Corporation announced the launch of Oracle Spatial Studio 23.1, available in the Oracle Cloud Infrastructure (OCI) marketplace and for on-premises deployment. Users can browse, explore, and analyze geographic data stored in and managed by Oracle using a no-code mapping tool.

- May 2023: CAPE Analytics, a property intelligence company, announced an enhanced insurance offering by leveraging Google geospatial data. Google’s geospatial data can help CAPE create appropriate solutions for insurance carriers.

- February 2023: HERE Global B.V. announced a collaboration with Cognizant, an information technology, services, and consulting company, to offer digital customer experience using location data. In this partnership, Cognizant will utilize the HERE location platform’s real-time traffic data, weather, and road attribute data to develop spatial intelligent solutions for its customers.

- July 2022: Athenium Analytics, a climate risk analytics company, launched a comprehensive tornado data set on the Esri ArcGIS Marketplace. This offering, which included the last 25 years of tornado insights from Athenium Analytics, would extend its Bronze partner relationship with Esri.

REPORT COVERAGE

The market report offers qualitative and quantitative insights about the market and a detailed analysis of the size & growth rate of all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, investments, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 - 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 12.90% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Type

By Application

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is estimated to be worth USD 309.84 billion by 2034.

In 2025, the market value stood at USD 102.45 billion.

The market is projected to record a CAGR of 12.90% during the forecast period of 2026 – 2034.

The surveying application segment dominated the market in 2022.

Increasing urbanization and technological advancements, coupled with strong IT spending by businesses, is estimated to augment the market growth.

Some of the top players in the market are Esri Global, Inc., Trimble Inc., HERE Global B.V., Alphabet Inc. (Google LLC), Oracle Corporation, Precisely Holdings, LLC, Alteryx, Inc., Hexagon AB, Microsoft Corporation, TomTom International B.V., and others.

North America dominated the market due to the presence of major market players and increased research & development activities in this region.

By end-user, healthcare & life sciences segment is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us