Home / Energy & Power / Environment / Geotechnical Services for Offshore Wind Market

Geotechnical Services for Offshore Wind Market Size, Share & Industry Analysis, By Service (Cone Penetrating Testing (CPT), Pressuremeter Testing, Dynamic Probe Test (DPSH), Rock Coring, and Others), and Regional Forecast, 2025-2032

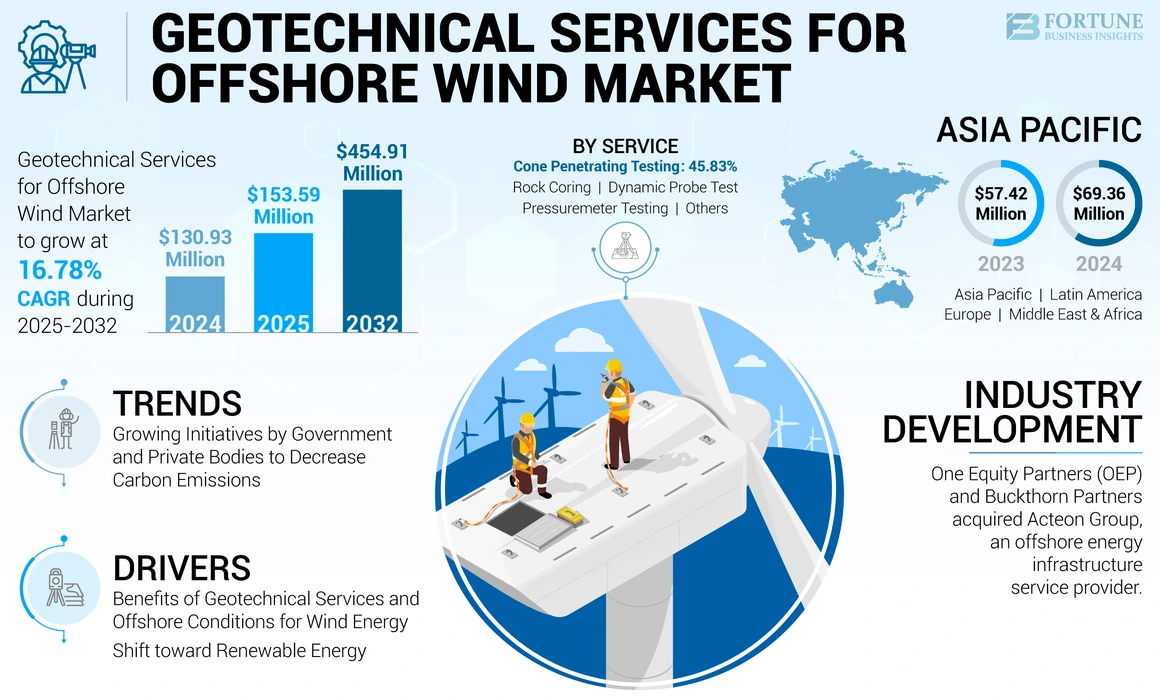

Report Format: PDF | Latest Update: Feb, 2025 | Published Date: Nov, 2024 | Report ID: FBI108863 | Status : PublishedThe global geotechnical services for offshore wind market size was valued at USD 130.93 million in 2024 and is projected to grow from USD 153.59 million in 2025 to USD 454.91 million by 2032, exhibiting a CAGR of 16.78% during the forecast period. Asia Pacific dominated the global market with a share of 52.97% in 2024.

Geotechnical services for offshore wind involve the examination of offshore location, which can be the base for wind-based projects and other platforms. These services constitute a sub-field of geotechnical engineering that deals with offshore examinations of land, project planning, foundation design, construction, and maintenance of structures. It also involves the collection and analysis of data with the help of high-tech equipment.

In modern years, the shift toward renewable projects aimed at reducing the dependence on fossil fuels has been trending due to the amount of energy consumed by end-users. Offshore wind projects are one of the major renewable sources for energy production and the primary factor that drives the demand for geotechnical services for offshore wind. For instance, the Biden administration intends to build 30 GW of offshore wind energy by the end of 2030. The power would be enough to supply over 10 million homes. The turbines would be fastened to the seafloor. It wants to install an additional 15 GW of floating wind turbines by 2035, which would help power 5 million homes.

The positive impact of COVID-19 pandemic on geotechnical services for the offshore wind market can be attributed to the increased emphasis on renewable energy and sustainable practices. The pandemic heightened global awareness of environmental issues, leading to a growing focus on clean energy solutions such as offshore wind. This heightened interest helped drive investments in geotechnical services, which play a crucial role in assessing the seabed conditions for offshore wind projects. As nations prioritize renewable energy transitions post-pandemic, the demand for geotechnical services in the offshore wind sector may experience an upswing.

Geotechnical Services for Offshore Wind Market Trends

Rising Initiatives by Governments and Private Bodies to Reduce Carbon Emissions is a Key Market Trend

There have been substantial offshore project developments in recent years due to the shift toward renewable energy and the government’s commitment to reduce carbon emissions. Governments worldwide increasingly promote renewable energy sources as part of their climate action plans. This emphasis on clean energy aligns with the expansion of offshore wind projects, necessitating comprehensive geotechnical assessments. The growing commitment to carbon reduction creates a favorable market environment for geotechnical services, as they play a dynamic role in safeguarding the success and sustainability of offshore wind developments.

For instance, on April 7, 2022, the government published its British Energy Security Strategy (BESS), outlining how the U.K. would accelerate its transition from oil and gas toward renewable energy sources. The BESS accelerates the government’s plan for a more independent and secure energy system, ending its reliance on expensive fossil fuels and moving toward a future in which all its energy comes from cheaper and low-carbon sources.

The Wind Energy Technologies Office of the U.S. Department of Energy funds research nationwide to permit the deployment of offshore wind technologies that can capture wind resources off the U.S. coasts and convert the captured wind into electricity. In addition, it will cut 78 million metric tons in carbon emissions. The federal government in the U.S. aims to deploy 30 GW of new offshore wind energy by 2030. This target will cut 78 million metric tons in carbon emissions, support power 10 million homes, and offer 77,000 jobs across the U.S.

The 2013 energy agreement stipulated that by the end of 2023, 4.5 GW of offshore wind farms would be operational in the Netherlands. This was achieved with an adequate capacity of 4.7 GW in 2023. It was completed on time, on budget, and almost without subsidies. This is an important milestone for the Dutch and European wind industry.

Geotechnical Services for Offshore Wind Market Growth Factors

Advantageous Properties of Offshore Conditions and Geotechnical Services for Wind Energy is Driving Market Growth

Generating clean energy from an offshore wind farm delivers major advantages that are enormously attractive for investors and owners, which drives the demand for geotechnical services for offshore projects, especially wind farms. Rising investment in wind energy is an additional factor for offshore wind geotechnical services market growth. According to the BloombergNEF’s 1H 2024 Renewable Energy Investment Tracker, offshore wind investment reached a new high in 2023. The record comes in spite of soaring costs and interest rates that forced some companies to cancel or delay projects in the previous year. Global investment in offshore wind energy touched a record USD 76.7 billion, a spike of 79%.

In addition, an offshore wind farm has a higher cost than other installations as it conveys advanced-technology foundation works in the sea and technicians with higher skills for its installation. Geotechnical services for offshore wind maintain standards and deliver accurate data through high-tech analysis, an important step for new offshore wind projects that boost geotechnical services. As many projects are ongoing in multiple regions due to the clean energy requirement, the geotechnical services for offshore wind market is expected to rise over the forecast period.

The growth of offshore wind projects will boost the product demand. Offshore wind projects are one of the major renewable sources for energy production and the primary factor that drives geotechnical services. For instance, the Biden administration desires to boost offshore wind energy by adding 30 GW by 2030. This will power over 10 million homes.

Shift toward Renewable Energy is Boosting the Offshore Geotechnical Services Market

Offshore wind provides advantages such as generating up to double the energy of onshore wind farms. These wind projects have a high capacity to generate power. Offshore wind farms guarantee renewable energy generation in markets with a high population density. They save millions of tons of CO2 over the lifetime of the facility. The geotechnical services for offshore wind market is expected to grow during the forecast period as many projects are ongoing in multiple regions due to the clean energy requirement and the shift toward renewable energy. The offshore wind market witnessed USD 9.8 billion in new investment in 2022, more than triple the figure a year ago, with USD 4.4 billion going into port infrastructure, development, and supply chain transmission, indicating that the resource is observed as a more important part of the renewable energy mix.

For example, in January 2022, Fugro signed a new contract with Energinet to determine the cable routes for the Energy Island project in the North Sea. Energy Island operates as an offshore power station, distributing up to 10 GW of offshore wind to Denmark and other neighboring markets. Fugro will perform geophysical, geotechnical services, and laboratory tests to provide valuable information on ground encounters along the cable route from Danish landing sites to future artificial island locations. These emerging trends will influence the global geotechnical services for offshore wind market growth during the forecast period.

RESTRAINING FACTORS

High Cost of Offshore Geotechnical Services May Hinder Market Growth

Offshore geotechnical services include various services, such as offshore geotechnical site investigations, geotechnical design, foundation design and installation analysis, leg penetration analyses, cable route analysis, and planning involving complex activities, procedures, and surveys that cost high per location. The high cost of offshore geotechnical investigations is the primary factor hindering the market growth.

In addition, the cost of different types of machinery and offshore equipment is high due to the complex tools and technique procedures. The offshore geotechnical surveying needs advanced software, sensors, and complex data acquisition systems. The cost of advanced technology used in geotechnical monitoring and instrumentation solutions is a major market restraint.

The budget and cost of services may vary depending on the offshore location and the complexity of the tools, which also negatively impacts the geotechnical services for offshore wind market share.

Geotechnical Services for Offshore Wind Market Segmentation Analysis

By Service Analysis

High Efficiency and Cost-Effectiveness to Boost Cone Penetrating Testing (CPT) Segment Growth

By service, the market is segmented into Cone Penetrating Testing (CPT), pressuremeter testing, Dynamic Probe Test (DPSH), rock coring, and others.

The Cone Penetrating Testing (CPT) segment will dominate the market during the forecast period. CPT dominates offshore wind projects due to its efficiency, cost-effectiveness, and real-time and high-quality data. Offshore wind farms need an in-depth knowledge of seabed conditions to guarantee the safe and efficient installation of wind turbines and related infrastructure. CPT plays a crucial role in offshore wind development by offering valuable geotechnical data for designing and installing wind turbine foundations.

The dynamic probe test segment involves the use of dynamic cone penetration tests or similar methods to assess the seabed conditions. This segment is crucial in providing real-time data on soil characteristics, strength, and stratigraphy at different depths. Rise of deep-sea excavations and discoveries has increased the steady demand for dynamic probe test.

Rock coring is triggered when a valid stone is found. Soil sampling is sometimes interchanged with borehole CPT to obtain samples for laboratory testing and CPT probing in the same borehole. With the specificity of rock coring required only when all the tests are done, limits the growth of the segment in geotechnical services for offshore wind.

REGIONAL INSIGHTS

Based on region, the global geotechnical services for offshore wind market is studied across North America, Asia Pacific, Europe, and the rest of the world.

Asia Pacific is the leading region due to the involvement of key countries and their achievements in construction projects for geotechnical services catering to offshore wind. Major countries such as China, Japan, and Vietnam continuously add offshore projects to the offshore wind market and boost the requirement for geotechnical services in the region. In 2021, Fugro, a geotechnical services provider, won an offshore geotechnical contract as part of the consortium with Vietsovpetro and PTSC G&S from La Gan Wind, owned by Copenhagen Infrastructure Partners, Asiapetro, and Novasia for the La Gan offshore wind project in Vietnam.

Several European countries, such as Germany, the U.K., and the Netherlands, actively participate in offshore operations. The U.K. has most of the offshore geotechnical operations driven by the ongoing projects of offshore wind farms, leading the charge toward a net zero, nature-positive future. The U.K. aims to deploy up to 50 GW by 2030, with up to 5 GW coming from floating offshore wind supported by specialist geotechnical services for offshore wind.

North America is expected to grow due to rising activities such as construction, mining, and others, and the government’s focus on minimizing the carbon footprint and adopting clean energy through offshore wind. In addition, commercial wind farms are progressing in the Atlantic Ocean, with the first expected to come online over the coming years. Large areas of the Pacific Ocean are now open to offshore wind turbine development after a federal auction in 2022. Community groups in New York City and beyond are taking steps to guarantee that residents hardest hit by fossil fuel pollution are the first to fill the clean energy jobs that will come.

The rest of the world, which includes Latin America, is beginning to explore its offshore wind potential, with projects in the development phase. Geotechnical services are gaining importance as feasibility studies progress and the market growth is influenced by the regulatory frameworks established by governments and their commitment to supporting renewable energy goals.

Although still in the early stages, some countries in the Middle East & Africa are exploring offshore wind potential. Geotechnical services are becoming increasingly crucial, especially in the initial stages of project development. In Kenya, state generator KenGen has announced plans to build a 1GW wind farm in Marsabit County with an initial capacity of 200MW in October 2023. This area is close to the Lake Turkana project and is expected to have a similarly high capacity factor. Independent Power Producers (IPPs) are expected to add 150MW by 2027. Plans are underway to expand the Kipeto and Lake Turkana Power projects.

Key Industry Players

Fugro is Leading the Market Owing to its Expertise in Geotechnical Services

Fugro delivers solutions using an integrated approach that incorporates the acquisition and analysis of geo-data. The company has expertise in site characterization and asset integrity. The company operates in 61 countries and gathers geotechnical and survey data on offshore and onshore oil fields. The company has divided its business into marine, geoscience, and land divisions. Due to a diversified product portfolio and an integrated acquisition approach, the company holds the maximum share of the market.

- In October 2023, Fugro announced its latest project, a state-of-the-art geotechnical testing laboratory in Kaohsiung, Taiwan. This facility is a significant step in strengthening Fugro's expertise in providing advanced geotechnical testing services, particularly in the offshore wind and wider energy and infrastructure sectors.

LIST OF TOP GEOTECHNICAL SERVICES FOR OFFSHORE WIND COMPANIES:

- Fugro (Netherlands)

- Helms Geomarine (Malaysia)

- EGS Survey (Singapore)

- Acteon (U.K.)

- Geoquip Marine (Switzerland)

- Horizon Geosciences (UAE)

- Sarathy Geotech & Engineering Services Pvt. Ltd (India)

- Gardline Limited (England)

- Geoxyz (Belgium)

- Coastal Marine Construction & Engineering Ltd. (COMACOE) (India)

- JAVA Offshore (Indonesia)

- ABL Group (Norway)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Private equity investors Buckthorn Partners and One Equity Partners (OEP) acquired offshore energy infrastructure service provider Acteon Group. The investors would focus on developing Acteon's capabilities in exploration, foundation, anchoring, decommissioning, and advisory services to support and diversify business activities in the offshore renewable oil and gas sector.

- April 2024: Geoquip signed a contract to provide offshore geotechnical services for developing an LNG port off the coast of Jamaica at Old Harbor Bay. The MV Surveyor, which then completed an extensive survey of the coast of Chile in the Pacific Ocean, was mobilized to Jamaica within two weeks of signing the contract. MV Investigator completed a 63-hole program on-site in four weeks.

- June 2023: Hartshead Resources NL (HHR), the oil and gas services provider, awarded Geoquip Marine Operations an agreement to perform a geotechnical survey for field developments in the Southern North Sea.

- April 2023: Thistle Wind Partners (TWP) announced that it would complete its Front-End Engineering Designs phase for the two ScotWind projects by mid-2024. The company also shared plans for a second round of geotechnical and geophysical studies for the following year to collect the FEED information of ships and equipment around the offshore wind farms.

- April 2023: Benthic and TerraSond geo-services brands in Acteon’s Data and Robotics division, were awarded a joint geotechnical and geophysical survey project scope by the Renantis and BlueFloat Energy Partnership. The project has been assigned for its Broadshore and Bellrock wind farms northeast of Aberdeen in Scotland.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

REPORT SCOPE & SEGMENTATION

ATTRIBUTE | DETAILS |

Study Period | 2019-2032 |

Base Year | 2024 |

Forecast Period | 2025-2032 |

Historical Period | 2019-2023 |

Growth Rate | CAGR of 16.78% from 2025 to 2032 |

Unit | Value (USD Million) |

Segmentation | By Service

|

By Region

|

Frequently Asked Questions

How much was the global geotechnical services for offshore wind market worth in 2024?

A study by Fortune Business Insights estimates that the global market size stood at USD 130.93 million in 2024.

At what CAGR is the global geotechnical services for offshore wind market projected to grow during the forecast period?

The global market is projected to grow at a CAGR of 16.78% during the forecast period.

How big was Asia Pacific’s market size in 2024?

Asia Pacific’s market size stood at USD 69.36 million in 2024.

Which service segment is expected to lead the global market?

Based on service, the Cone Penetrating Testing (CPT) service segment is anticipated to dominate the global market.

How much will the global market be worth by 2032?

The global market size is expected to reach USD 454.91 million by 2032.

What are the key market drivers?

The shift toward renewable energy and various benefits of offshore conditions and geotechnical services for wind energy are key factors driving the market.

Who are the top players actively operating across the market?

Fugro, Gardline Limited, and Acteon are some of the top players actively operating across the market.

- Global

- 2024

- 2019-2023

- 139