Geotechnical Services Market Size, Share and Industry Analysis, By Type (Underground City Space, Slope and Excavation, and Ground and Foundation), By End-user (Municipal, Bridge and Tunnel, Oil & Gas, Mining, Marine, Building Construction, and Others), and Regional Forecast, 2026-2034

Geotechnical Services Market Size

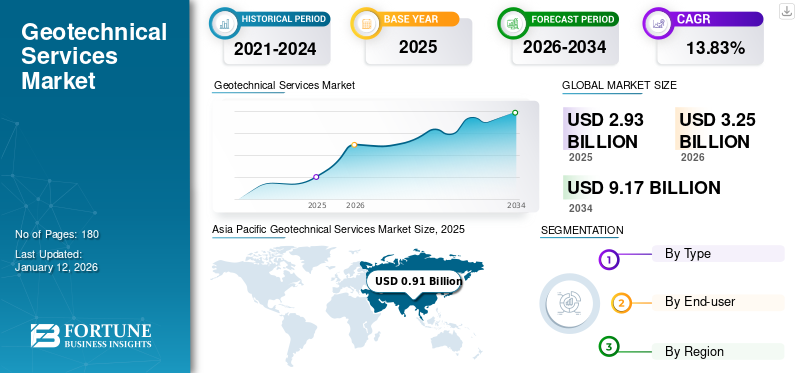

The global geotechnical services market size was valued at USD 2.93 billion in 2025. The market is projected to grow from USD 3.25 billion in 2026 to USD 9.17 billion by 2034, exhibiting a CAGR of 13.83% during the forecast period. Asia Pacific dominated the geotechnical services industry with a market share of 31.06% in 2025. The Geotechnical services market in the U.S. is projected to grow significantly, reaching an estimated value of USD 872.12 million by 2032.

Geotechnical engineering is a civil engineering branch that involves the study of materials present below the earth’s surface. Geotechnical services are used in planning infrastructures, such as bridges & tunnels and other onshore and offshore constructions. The services also include mathematical calculations, gauging load-bearing capacity, and deformation in man-made structures. The growing construction & infrastructure industry globally is a major factor driving the growth of the market.

The COVID-19 pandemic became a global health threat in December 2019. Its impact on numerous sectors, such as manufacturing, construction, hospitality, and others, have been explicit and unprecedented. The construction & infrastructure were primarily affected owing to lockdowns announced in several countries, which created supply chain disruptions and unavailability of the workforce issues. In March 2020, Boston became the first city in the U.S. to shut down all construction work to curb the COVID-19 outbreak. This had a negative impact on the growth of geotechnical services.

Furthermore, several oil & gas, mining, and renewable projects were also suspended due to the COVID-19 pandemic. In April 2020, Ørsted, a Denmark-based company, said at least five of its projects off the U.S. East Coast could be delayed due to the impacts of the COVID-19 pandemic. The company said the projects with a total generation capacity of about 3 GW could fall victim to a slowed permitting process caused by shutdowns due to COVID-19.

Geotechnical Services Market Trends

High Growth in Offshore E&P Activities to Drive Market Growth

The shift toward renewable energy is leading to the development of offshore renewable energy. According to the International Energy Agency, in 2022, wind electricity generation surged by a record 265 TWh, reaching more than 2,100 TWh. This was the second-highest growth among all the renewable power technologies. This is leading to the increased demand for these services, thereby driving the geotechnical services market growth.

For instance, in March 2024, the first geotechnical seabed surveys for TotalEnergies and SSE Renewables’ 500 MW Seagreen 1A offshore wind farm in Scotland were completed. Phase 2 of the geotechnical works is anticipated to start later in 2024 and is anticipated to take approximately two weeks to complete.

Download Free sample to learn more about this report.

Geotechnical Services Market Growth Factors

Rising demand for Geotechnical Services from Offshore Wind is Driving Market Growth

There is a considerable shift toward renewable energy, especially offshore wind. According to the Global Wind Energy Council’s (GWEC) Global Wind Energy Report 2023, alongside net-zero targets, many nations are aiming for specific offshore wind goals, with at least 16 governments setting or enhancing them since 2022. This comprises the Canadian province of Nova Scotia (5 GW by 2030) and subnational jurisdictions, such as the Australian state of Victoria (9 GW by 2040). These developments are consequently increasing the demand for geotechnical services.

There's been a notable increase in the development of offshore wind farms worldwide, driven by renewable energy targets, technological advancements, and declining costs. As these projects expand into deeper waters and more challenging seabed conditions, the need for comprehensive geotechnical assessments becomes paramount.

For instance, in February 2024, Kim Heng, a Singapore-based offshore vessel operator and marine engineering services provider, inked an agreement with an undisclosed offshore wind farm developer in Korea. The agreement was facilitated via its subsidiary Adira Renewables and Soiltech Engineering Korea (STE) for around four years. As part of the agreement, Kim Heng will supply a geotechnical drilling vessel and partner with STE to offer offshore geotechnical investigation services.

High Growth in the Construction Industry is Fueling Market Growth

There has been exceptional growth in construction activities across residential, commercial, infrastructural, industrial, and utility sectors in developing economies. Several countries, such as India, China, Indonesia, Qatar, Thailand, and Brazil, have extensive ongoing construction activities, and a high number of construction projects are set to go underway. With India and China looking to strengthen their infrastructural base, government aid and subsidies are set to attract high investment in the construction industry. For instance, Cengrs Geotechnica secured a contract of around USD 72.90 thousand (INR 53.9 lakhs) for the geotechnical soil investigation of the upcoming 28.50 km elevated metro line. This line is set to connect HUDA Millennium City Centre with DLF Cybercity. Also, Sri Lanka, India, and Thailand are promoting their tourism. Therefore, the construction of hotels, resorts, parks, & other commercial buildings is increasing rapidly. The geotechnical survey helps to know the site conditions and design & construction recommendations for the roadway design, bridge design, and construction personnel.

RESTRAINING FACTORS

Higher Cost of Geotechnical Services to Hinder Market Growth

The cost of geotechnical equipment rises with range, resolution, accuracy, precision, and repeatability. Advanced sensors, software, and complex data acquisition systems increase the cost of geotechnical solutions. Further, the cost of hardware and software used in geotechnical instrumentation and monitoring solutions and associated services depends primarily on the complexity of structures. Thus, the high price of geotechnical services acts as a restraining factor for market growth. In addition, consulting and inspection costs are high for complex projects.

For instance, Universal Engineering Sciences, one of the major national engineering and consulting companies having expertise in geotechnical engineering, building code adherence, threshold inspections, and environmental consulting, has been awarded a USD 5 million contract with the Florida Department of Transportation to serve as geotechnical experts on transportation projects for District 2, in Northeast Florida, over the next 4 to 5 years.

Geotechnical Services Market Segmentation Analysis

By Type Analysis

Underground City Space Segment to Dominate Due to Growing Use in Underground Tunnel Construction

Based on type, the market is divided into underground city space, slope and excavation, and ground and foundation. The underground city space segment accounted for a dominant marekt with a share of 52.19% in 2026. This type of service is majorly used to construct underground tunnels for rail and metro, water & gas pipeline construction, and other public service facilities. The demand for rail, metro, and other public service facilities is growing at a rapid pace. Thus, the need for underground city space service is high. For instance, in October 2023, the Chennai Metro Rail Limited (CMRL) inked its second contract with TATA Projects Limited for the construction of five underground stations at the cost of ~USD 220 million.

Ground and foundation is also one of the major segments and is likely to contribute considerably throughout the forecast period. This service is used before the construction of buildings, defense activities, and municipal activities, among others.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Municipal Segment Leads Market with Amplified Demand from Government Buildings and Other Sites for Geotechnical Services

Based on end-user, the market is segmented into municipal, bridge and tunnel, oil & gas, mining, marine, building construction, and others.

The municipal segment held a dominant geotechnical services market share of 39.54% in 2026 and uses these services for utility pipeline construction, dam construction, government buildings, power plant construction, and airports, among others. Rapid urbanization is leading to increased demand for infrastructure development in cities and municipalities. Geotechnical services are essential for assessing soil conditions and geological factors to ensure the stability and durability of infrastructure projects such as roads, bridges, tunnels, buildings, and underground utilities.

Mining is another major segment of this market and is projected to contribute significantly during the forecast period. Geotechnical engineering has become an integral part of mine operations. Recently, most mining companies have developed in-house geotechnical expertise at corporate and mine levels and hire consultants to undertake mining project studies or solve specific ground engineering problems. This important change was brought about by strict mine safety regulations and the mining community’s gradual recognition of the value of active ground engineering in optimizing mine design and managing geotechnical risks.

In the marine sector, geotechnical services are also used to understand the earth's surface at the ocean or river floors. Marine geotechnical services involve analyzing sea-bed and under-sea-bed materials for constructing offshore structures such as wind turbines, anchored floating structures, and even piers and jetty. For instance, in 2023, Hartshead Resources awarded a contract to Swiss-based offshore geotechnical data acquisition company Geoquip Marine Operations. The contract aims to survey the Somerville and Anning gas fields pipeline. Geoquip plans to utilize the Geoquip Seehorn, a class 2 dynamic positioning integrated geotechnical survey vessel, to carry out the survey.

REGIONAL INSIGHTS

Geographically, the global geotechnical services market has been studied across North America, Asia Pacific, Europe, and the Middle East & Africa, and Latin America.

Asia Pacific Geotechnical Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held a leading share of the global market in 2024 and is expected to experience substantial growth during the forecast period. Asia Pacific dominated the market with a valuation of USD 0.91 billion in 2025 and USD 1.04 billion in 2026. China, India, and Southeast Asian countries are projected to be lucrative markets owing to government regulations supporting renewable power generation resources. For instance, in 2023, WSP was engaged by Alinta to carry out the geotechnical site investigation for the Oven Mountain Pumped Hydro Energy Storage Project in the New England Renewable Energy Zone in New South Wales. Additionally, high investment in the construction & infrastructure sector provides a further boost to the growth of the market. The Japan market is projected to reach USD 0.13 billion by 2026, the China market is projected to reach USD 0.35 billion by 2026, and the India market is projected to reach USD 0.20 billion by 2026.

Middle East & Africa

The Middle East & Africa is projected to witness healthy growth during the forecast period. UAE, Saudi Arabia, Qatar, and Nigeria are the major countries in the region. Growing investment in public transportation in GCC countries is fueling the growth of the market. Saudi Arabia holds a larger reserve of mineral resources than any other country in the Gulf region. The mining sector occupies a prominent position in Saudi Arabia's program of diversifying its economy away from oil. In 2016, Saudi Arabia announced a plan to raise the value of its mining operations to reach USD 70 billion under Saudi Vision 2030. Furthermore, Saudi Arabia is also investing in construction and infrastructure projects such as NEOM city, which is consequently fueling the demand for geotechnical services. For instance, as of 2022, Keller is one of the geotechnical contractors that has been chosen to take on work on the NEOM Giga project in the Tabuk Province of North West Saudi Arabia.

North America

In North America, increasing oil & gas activities positively influence the growth of the market. According to BP Statistical Review, the region was the second-largest producer of oil and the largest producer of gas in the world in 2018. The U.S. market is projected to reach USD 0.58 billion by 2026.

Key Industry Players

Key Participants are focused on New Contracts to strengthen their Position

The global market is fragmented due to the large number of players operating in the market. Fugro, AECOM, Stantec, and Kiewit Corporation lead the market and accounted for a dominant share in 2023. The major players in the market are adopting several strategies to strengthen their position in the market. Focusing on a geotechnical services contract is one of the ideal methods adopted by companies. For instance, in November 2022, Fugro Quest, a state-of-the-art vessel equipped with advanced deepwater technology, is the latest addition to Fugro's geotechnical fleet. Fugro utilizes this kind of vessel to determine the exact composition of the soil, and the information it provides is essential to determine the optimal location and design of offshore installations such as wind turbines.

The vessel increases personnel and operational safety, and its energy-saving design leads to significantly lower fuel consumption on average than other geotechnical vessels. In addition, its ability to take Hydrogenated Vegetable Oil (HVO) biofuel and remote control and data processing capabilities support sustainable operations.

LIST OF TOP GEOTECHNICAL SERVICES COMPANIES:

- AECOM (U.S.)

- Kiewit Corporation (U.S.)

- Stantec (Canada)

- Fugro (Netherlands)

- WSP (Canada)

- EGS Survey (U.K.)

- Gardline Limited (U.K.)

- Arup (U.K.)

- HDR (U.S.)

- Geosyntec (U.S.)

- Geoquip Marine Group (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Fugro acquired two platform supply vessels, Sea Gull and Sea Goldcrest, which will be utilized as geotechnical assets. The inclusion of these two vessels in its owned fleet will further reinforce Fugro’s ability to address the market demands and shortage of geotechnical capable vessels.

- September 2023: Ulstein Design & Solutions secured a contract with Fugro to modify and convert two platform supply vessels into geotechnical vessels. The vessels will be redesigned with geotechnical drill towers along with important equipment, and one will also adjust the accommodation capacity with six new cabins.

- August 2023: Hartshead Resources and its joint venture partner Rockrose Energy, part of the Viaro Group, signed a contract with Gardline to carry out a geophysical pipeline survey of the Anning and Somerville fields in the UK North Sea. According to the contracts, Gardline will carry out a geophysical survey to confirm seabed and underground soil conditions. This would help complete the project and effectively install the pipeline from two fields.

- February 2022: Inmarsat provided geotechnical services provider Geoquip Marine with dedicated Fleet Xpress bandwidth for the company's vessel charter contracts. Four Geoquip-integrated geotechnical survey vessels have implemented Fleet Xpress Charterer Network services exclusively for charterers and connectivity for the crew. According to the contract, Fleet Xpress allows multiple networks to be connected to ships through one antenna, and activation does not require new hardware or installation work on the ship. The ships are currently operating offshore on the US East Coast, Taiwan, and Europe.

- July 2020: The DP2 geotechnical vessel Greatship Rachna, equipped with EGS's EGSA-25 geotechnical twin drilling platform, operated continuously for ten months in Taiwanese waters for three geotechnical campaigns for two different clients. The first study focused on Ørsted's offshore wind Greater Changhua farms, where EGS acquired over 1,000 million borehole CPT data for foundation design in Q3 of 2019.

REPORT COVERAGE

The geotechnical services market research report includes a detailed industry analysis and focuses on key aspects such as leading companies, leading type, and end-user of the services. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.83% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, End-user, and Region |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.93 billion in 2025.

In 2025, the Asia Pacific market size stood at USD 2.93 billion.

The global market is projected to grow at a CAGR of 13.83% in the forecast period.

The underground city space type segment is expected to be the leading segment in this market during the forecast period.

The global market size is anticipated to reach USD 9.17 billion by 2034.

High growth in the construction & infrastructure industry globally boosts the markets development.

Asia Pacific dominated the market share in 2025.

Fugro, AECOM, Stantec, and Kiewit Corporation are eminent players in the global market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us