GPS Market Size, Share & Industry Analysis, By Deployment (Standalone Trackers, Automotive Navigation Systems, Wearable GPS Devices, Smartphones and Tablets, and Others), By Application (Road, Aviation, Marine, Location Based Services, Surveying & Mapping, and Others), and Regional Forecast, 2026–2034

GPS Market Size

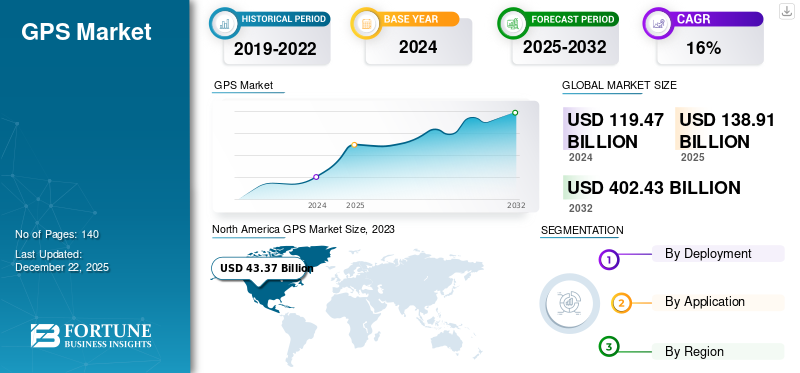

The global GPS market size was valued at USD 138.91 billion in 2025. The market is projected to grow from USD 161.78 billion in 2026 to USD 506.01 billion by 2034, exhibiting a CAGR of 15.3% during the forecast period. North America dominated the GPS market with a market share of 42.6% in 2025.

Global positioning systems refer to the development and deployment of technology that enables precise location determination using satellite signals. This technology includes a range of applications, from standalone trackers to automotive navigation systems and wearable GPS devices. Factors such as the widespread adoption of smartphones and wearable devices, increasing demand for location-based services and real time navigation systems, and automotive innovations positively drive the market. Moreover, technological advancements and government support play a crucial role in accelerating market progress.

The COVID-19 pandemic had both positive and negative impacts on the market. Factors such as supply chain disruptions and decreased demand in certain sectors, such as automotive and aviation, negatively impacted market growth. However, in sectors such as healthcare and logistics, the need for efficient tracking and management boosted demand for GPS-enabled devices and services. In the post-pandemic period, factors such as increased investments in smart cities and the expanding e-commerce market have showcased to significant growth rate.

IMPACT OF GENERATIVE AI

Incorporating Generative AI into GPS Products Helps End Users Gain a More Personalized and Effective Experience

Generative AI has been showcasing significant applications in the global positioning system market. Various aspects of the market, such as route optimization and predictive maintenance, are being enhanced by the use of generative AI. With the large volumes of data generated, gen AI models can optimize routes, leading to minimized fuel consumption and reduced travel time. In addition, these models can also analyze user behavior and preferences to provide personalized navigation experiences.

As per industry experts, AI-based global positioning system (GPS) devices that provide personalized experiences are anticipated to grow by 25% yearly by the end of 2025.

Market players have also been harnessing the capabilities of generative AI and developing products that best suit end users. For instance, December 2023, TomTom, specializing in in-car global positioning system navigation, introduced a gen AI-based driving assistant in collaboration with Microsoft. Powered by Microsoft's Azure OpenAI tool, the new tool is designed to perform tasks in and around the car, enabling drivers to take their eyes off the road and hands off the steering wheel.

As the technology continues to evolve, it will positively impact the GPS during the forecast period.

GPS Market Trends

Increasing Adoption of Global Positioning System in Emerging Markets to Accelerate Market Growth

The industry is witnessing increasing adoption of global positioning system in emerging markets, especially in Asia Pacific countries. Factors such as infrastructure development, urbanization, and expansion of mobile networks are driving regional growth. In addition, the rising demand for smartphones and wearables global positioning system devices is contributing to the growth across the region.

As per industry experts, the Asia Pacific region showcases a promising future for the smart wearables market, driven by the positive responses from emerging economies such as China, India, and Japan.

In addition, several market players are developing products particularly aimed at catering to emerging markets across Asia Pacific. For instance,

June 2024: Iridium Communications Inc. announced the commercial availability of its Satellite Time and Location service, an alternative positioning, navigation, and timing solution. The company aimed to cater to the increased commercial demand across Asia Pacific and European regions.

Download Free sample to learn more about this report.

GPS Market Growth Factors

Rising Adoption of Smartphones and Wearables and Favorable Government Initiatives Propels Market Growth

Key market drivers include the rising adoption of smartphones and wearables, favoring government initiatives, technological advancements, and expansion of automobile and fleet management services. The rising adoption of smartphones and wearables equipped with global positioning system capabilities is one of the key drivers of the market. In recent years, end users heavily rely on global positioning systems for navigation and fitness tracking.

As per industry experts, the adoption of wearable devices across firms is anticipated to rise by 463% over the next five years. In addition, smartwatches rank second in terms of generating revenue generation for the market.

Furthermore, favorable government initiatives have been propelling the market in recent years. Several government regulations mandate the use of global positioning systems in various use cases such as disaster management and vehicle tracking.

June 2024: Chhattisgarh Medical Services Corporation Limited installed a global positioning system-based tracking system with the aim of strengthening its supply chain and facilitating the smooth delivery of medicines. CGMSCL, which specializes in collecting and providing quality-tested medical equipment and drugs to government health facilities, mandated the installation of GPS-enabled devices on all 44 of its vehicles.

Thus, these factors have collectively contributed to accelerated market growth in recent years.

RESTRAINING FACTORS

Location Data Vulnerability Concerns are Negatively Impacting the Market Growth

Global positioning systems are vulnerable to hardware and software exploits. Factors such as poor system design, outdated firmware, and weak encryption can expose these systems to unauthorized access, data manipulation, and hacking.

In July 2022, Bitsight reported discovering six severe vulnerabilities in a popular vehicle GPS tracker, MiCODUS MV720. The company advised clients to stop using the tracker as soon as possible, as these attacks could result in supply chain disruption, data breaches, and unlawful tracking.

These instances of unauthorized access to global positioning system data have raised concerns about user privacy, which could negatively impact the global GPS market growth.

In addition, several government regulations, such as the European Union’s GDPR, impose strict rules on how companies collect and use personal data, including global positioning system data. These regulations can hinder product adoption in regions where compliance with data privacy laws is critical.

GPS Market Segmentation Analysis

By Deployment Analysis

Automotive Navigation Systems Segment Led due to Widespread Adoption of Automotive Navigation Systems Among End Users

By deployment, the market is categorized into standalone trackers, automotive navigation systems, wearable GPS devices, smartphones and tablets, and others, including fleet management.

In 2023, automotive navigation systems held the largest share of the market, owing to their widespread adoption across both commercial and consumer vehicles. End users prefer these systems due to features, such as real-time traffic updates, voice commands, and route optimization. In addition, the expanding automotive industry’s inclination toward autonomous and connected vehicles has further boosted demand for GPS systems in recent years. The segment held 27.2% of the market share in 2026.

However, in the coming years, wearable global positioning system devices will grow at the highest CAGR due to factors such as increasing adoption of smart devices among end users such as fitness enthusiasts, rising demand for smartwatches equipped with global positioning system for applications such as child safety, elderly care, and growth of IoT. As wearable technology continues to improve, it is expected that the market will also be impacted positively.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Road Segment Governed the Market due to Increasing Use of Navigation Systems In Vehicles

By application, the market is divided into road, aviation, marine, location-based services, surveying & mapping, and others, including agriculture.

In 2023, road segment dominated the market due to factors such as the increasing use of navigation systems in vehicles, the rise in demand for fleet management solutions, and the growth of delivery services. The use of advanced vehicle tracking systems has helped companies optimize delivery routes, enhance customer satisfaction, and minimize operational costs. The segment is set to hold 27.45% of the market share in 2026.

Location based services will grow at the highest CAGR of 17.80% during the forecast period (2024-2032), particularly due to the expansion of location-based advertising. Companies are using location-based advertising to target end users with personalized ads based on their location. This approach enables companies to generate higher engagement, further driving revenue growth for location-based services.

REGIONAL INSIGHTS

On the basis of geography, the market is studied across the following key regions: South America, North America, the Middle East and Africa, Asia Pacific, and Europe.

North American

North America GPS Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market held the highest global GPS market share with a valuation of USD 59.21 billion in 2025 and USD 69.26 billion in 2026. Factors such as a large presence of market leaders such as Garmin Ltd., and Trimble Inc., have positively impacted the market in recent years. The rising use of global positioning system devices across military and aviation applications, the increasing popularity of automotive navigation, fleet management solutions, and technological advancements have also contributed to this growth. In the coming years, the region is expected to maintain a robust growth due to increasing smart city investments and advancements in mapping technologies. The U.S. market is expected to be valued at USD 50.99 billion in 2026.

Europe

Europe is the third largest market anticipated to hold The European market has shown notable growth rate in recent years. The region has been experiencing rising demand for vehicle tracking and navigation systems. The U.K. market continues to expand, projected to reach a market value of USD 10 billion in 2026. Strong governmental support bolsters the adoption of advanced global positioning system technologies across various industries. Moreover, smart infrastructure projects promise a positive outlook for the market in the coming years. Germany is anticipated to be worth USD 8.34 billion in 2026, while France is set to reach USD 6.06 billion in 2025.

Asia Pacific

Asia Pacific is the second largest market set to grow with a valuation of USD 40.42 billion in 2026, exhibiting a CAGR of 24.7% during the forecast period (2026-2034). In the coming years, the Asia Pacific region is expected to grow at the highest CAGR during the study period owing to the higher demand from growing economies such as China and India. The Chinese market is likely to hold USD 9.25 billion in 2026. Moreover, there is an increasing inclination among end users to adopt global positioning system devices across the agriculture, marine, and automotive industries. Factors such as the increasing adoption of wearable devices and accelerated digitalization are expected to drive the regional market share in the coming years. India is foreseen to gain USD 8.54 billion in 2026, while Japan is expected to be valued at USD 8.93 billion in the same year.

Middle East & Africa

The Middle East & Africa is the fourth largest market poised to gain USD 9.77 billion in 2025. The South American and MEA regions are experiencing slower growth than other areas. Limited infrastructure development and lower technology penetration are key factors hindering regional growth. However, as technology adoption increases across these regions, the market is expected to flourish in the coming years. The GCC market is expected to reach a valuation of USD 4.63 billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Market Leaders Focus on Advanced Product Offerings to Improve GPS Ecosystem

The global positioning systems market includes a wide range of market players providing several products and services across industries such as defense, automotive, and logistics. Market players provide products such as fitness wearables, marine global positioning systems, and automotive navigation systems. These players adopt several business strategies, such as developing advanced products, partnering with relevant companies, and raising funding to advance the global positioning system ecosystem.

List of Top GPS Companies:

- Hexagon AB (Sweden)

- Garmin Ltd. (U.S.)

- Trimble Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Texas Instruments Inc. (U.S.)

- Syntony GNSS (France)

- TomTom International BV. (Netherlands)

- MiTAC Holdings Corp. (Taiwan)

- Collins Aerospace (RTX Corporation) (U.S.)

KEY INDUSTRY DEVELOPMENTS:

June 2024: Garmin introduced the Forerunner 165 Series on Global Running Day in India. The watch has an AMOLED display, long battery life, and 19 hours of GPS tracking. The company aimed to meet the needs of professional runners and athletes with advanced training modules and tracking expertise.

May 2024: GPS Renewables, an Indian biofuels technology firm, completed its partnership with SAF One, a Dubai-headquartered sustainable aviation fuels provider, with the aim of propelling SAF in India. With this, the Indian company’s project platforms, ARYA and SAF One, are expected to introduce a new SAF plant in India. The new plant is expected to be capable of developing 20-30 million liters of low-carbon fuel every year by converting lignocellulosic waste feedstock or low-value agricultural by-products.

May 2024: Xona Space Systems, which specializes in satellite-based navigation services, secured over USD 19 million in a Series A funding round from Seraphim Space and Future Ventures. It also saw equal participation from investors such as Industrious Ventures, NGP Capital, Space Capital, Aloniq, and Murata Electronics.

March 2024: u-blox introduced F10 dual-band GNSS platform, which brings together L5 and L1 bands to offers meter-level positioning accuracy and improved multipath resistance. The platform is designed to support urban mobility applications, such as micro-mobility and aftermarket telematics.

May 2021: oneNav, headquartered in California, secured over USD 21 million in a Series B funding round with the aim of making advancements in GPS technology. The round was headed by GV, with equal participation from GSR Ventures and Norwest Venture Partners.

REPORT COVERAGE

The report offers a comprehensive analysis, covering key trends, growth drivers, and challenges shaping the market. In addition, the report highlights recent technological advancements and the leading players, as well as their product/service types and their leading applications. The report aims to help stakeholders navigate through the evolving global positioning system ecosystem.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.3% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 506.01 billion by 2034.

In 2025, the market was valued at USD 138.91 billion.

The market is projected to grow at a CAGR of 15.3% during the forecast period.

By application, the road application segment led the market in 2025.

The rising adoption of smartphones and wearables and favorable government initiatives are the key factors propelling market growth.

Hexagon AB, Garmin Ltd., Trimble Inc., Qualcomm Technologies, Inc., Broadcom Inc., Texas Instruments Inc., Syntony GNSS, TomTom International BV., MiTAC Holdings Corp., and Collins Aerospace (RTX Corporation) are the top players in the market.

North America held the highest market with a share of 42.6% in 2025.

By application, location-based services are expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us