Gypsum Board Market Size, Share & Industry Analysis, By Type (Regular Gypsum Boards, Fire & Moisture Resistant Boards, and Others), By Installation (Screwing into Studs and Gluing to Concrete), By Application (Gypsum Board Partitioning, Ceilings and Wall Coverings, and Others), By End-Use (Residential, Commercial, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

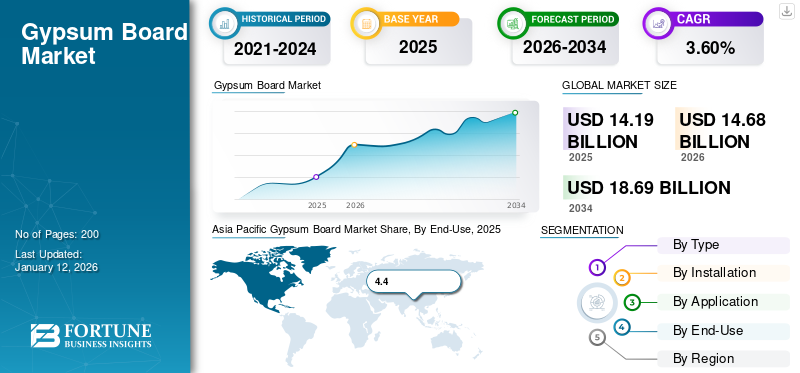

The global gypsum board market size was valued USD 14.19 billion in 2025. The market is projected to grow from USD 14.68 billion in 2026 to USD 18.69 billion by 2034 at a CAGR of 3.60% during the forecast period. Asia Pacific dominated the gypsum board market with a market share of 44% in 2025.

Gypsum board is one of the most consumed gypsum products in the world. It is predominantly used for ceiling and partition wall applications in the construction industry. Several types of these boards are available in the market including regular boards, moisture resistant boards, fire resistant boards, mobile boards, pre-decorated boards, and others. Regular board is the most commonly used type in the global market.

The COVID-19 pandemic negatively impacted the market due to disruptions in supply chain, labor shortages, and construction project delays. However, the market witnessed a gradual recovery as construction activities resumed, driven by increasing demand for commercial and residential buildings. Key players adapted to the changing scenario by implementing safety measures and optimizing operations.

Global Gypsum Board Market Overview

Market Size and Forecast:

- 2025 Value: USD 14.19 billion

- 2026 Value: USD 14.68 billion

- 2034 Forecast Value: USD 18.69 billion

- CAGR (2026–2034): 3.60%

Market Share:

- Asia Pacific: 44% share in 2025

Regional Highlights:

- Asia Pacific: 2026 Market Size: USD 6.45 billion

- North America: Mature market with strong demand from U.S. housing and renovation projects

- Europe: Significant demand from Germany, France, U.K., and Italy

- Latin America: Argentina and Colombia are emerging markets supported by government-backed infrastructure plans

- Middle East & Africa: Growing demand due to construction boom in GCC countries

Gypsum Board Market Trends

Recycling of Gypsum Board to Create Opportunity for Market Growth

Recycling of boards presents a significant opportunity for the market’s growth and has the potential to reshape the industry. This trend is particularly significant in the context of growing environmental concerns over the production of these boards and the implementation of stringent norms, which can hinder the market growth.

Recycled gypsum can be used in a variety of products, including agricultural products, new drywall, cement, composting, and as an additive to other materials. This form of gypsum is an excellent alternative to landfill disposal, which can produce harmful gases, such as hydrogen sulfide. It also promotes sustainable manufacturing practices by decreasing energy consumption and transportation emissions associated with raw gypsum mining.

However, recycling a board from any source remains challenging. But the Gypsum Association member companies are committed to the wise stewardship of shared resources. The association led the development of ‘ASTM C1881 – 20 Standard Guide for Closed-Loop Recycling of Scrap Gypsum Panel Products’ to facilitate the safe recycling of clean scrap.

As such, the recycling of the board could drive innovation, open new market segments, and enhance the overall value proposition of products.

In a nutshell, government support and preference toward environmentally safe products will create a strong demand for recycled gypsum in the future.

Download Free sample to learn more about this report.

Gypsum Board Market Growth Factors

Expansion of Building & Construction Industry in Emerging Economies to Drive Market Growth

The expansion of the building & construction industry, particularly in emerging economies, is a significant driver of the market’s growth. This growth is fueled by factors, such as increased urbanization, high infrastructure investments, technological advancements, and the demand for sustainable construction practices.

Emerging economies, such as China, India, and Latin America are expected to be key drivers of the market’s growth due to rapid urbanization and infrastructure development. In addition, the adoption of sustainable practices, prefab construction methods, digital transformation, and development of smart cities are shaping the construction industry's trajectory globally.

The construction industry's growth, fueled by urbanization and population growth, is significantly increasing the demand for boards made up of gypsum. Their versatility, fire resistance, sound insulation, and durability make them a preferred choice in modern construction practices. Technological advancements and product innovations are also pivotal in driving the market, with manufacturers producing boards with enhanced qualities, such as improved strength, moisture resistance, and lighter weight.

Government policies and regulations promoting energy conservation and sustainable building practices will also contribute to the market's growth. Asia Pacific is the largest region in the gypsum board market due to a booming construction industry, rapid urbanization in countries, such as India and Thailand, and growing preference for modern building materials in residential and commercial construction.

This region’s growth underscores the pivotal role of the construction sector in driving economic development and meeting the evolving needs of a growing population.

RESTRAINING FACTORS

Environmental Impact & Health Risks to Restrict Market Growth

Rising environmental concerns and the implementation of stringent norms can hinder the growth of the market due to the negative environmental impacts of gypsum board waste. When this waste is dumped into landfills, it converts the sulfate in the gypsum into toxic hydrogen sulfide, which is released into the environment. The paper in the plasterboard decomposes into methane gas, a harmful greenhouse gas.

The gypsum board market growth in regions, such as Latin America and the Middle East & Africa is hindered by continuous political and social conflicts, coupled with economic instability. The International Energy Conservation Code (IECC), the International Green Construction Code (IGCC), and other environmental regulations are forcing the market players to look for greener options.

Environmental issues, such as natural disasters, air & water pollution, and climate change can negatively impact insurance costs, property values, and affect consumer preferences. Therefore, consumers are shifting their preference toward eco-friendly products. Thus, this factor will directly impact the market’s growth during the forecast period.

In summary, while rising environmental concerns and the implementation of strict regulations can pose challenges to the growth of certain industries, such as the real estate market, there are strategies that can be employed to mitigate these challenges and promote sustainable development.

Gypsum Board Market Segmentation Analysis

By Type Analysis

Regular Gypsum Boards Led Market Growth Due to Their Cost-Effective and Versatile Nature

Based on type, the market is segmented into regular gypsum boards, fire & moisture-resistant boards, and others.

The regular gypsum boards segment held the with a share of 56.54% in 2026, These cost-effective and versatile products are widely used in a variety of residential, commercial, and industrial applications. Ability to offer protection against fire and ease of installation have made these boards an ideal material in building and construction applications. As a result, the regular board has dominated the global market during the historical period and is poised to maintain its dominance throughout the assessment period. However, the market is becoming increasingly competitive as manufacturers are focusing on improving the strength, fire resistance, and moisture resilience of their regular gypsum board offerings to meet evolving customer demands.

Driven by stringent building codes and growing safety awareness, the demand for fire and moisture-resistant boards is on the rise. These specialized products are gaining traction in high-value sectors, such as healthcare, education, and commercial real estate, where enhanced fire protection and moisture control are critical. In addition to the regular and fire/moisture-resistant boards, the market is also witnessing increased demand for other specialty products, such as sound-insulating boards, impact-resistant boards, and boards with enhanced thermal properties. These niche segments cater to the evolving needs of discerning customers, particularly in the commercial and industrial sectors.

By Installation Analysis

Screwing into Studs Installation Led Market Growth Due to Its Rising Demand in Residential Sector

Based on installation, the market is segmented into screwing into studs, gluing to concrete, and others.

The screwing into studs installation segment held the largest share contributing 91.01% globally in 2026. This installation method remains the most widely adopted technique in the market, particularly in the residential sector. This approach is favored for its ease of installation, structural integrity, and ability to accommodate modifications or renovations.

The gluing to concrete installation segment is gaining traction, especially in the commercial and industrial construction segments, driven by the rise of prefabricated and modular building practices in emerging countries. This technique offers benefits, such as faster installation, improved thermal insulation, and enhanced sound absorption.

By Application Analysis

Ceilings & Wall Coverings Segment to Showcase Fastest Growth Owing to Aesthetic Appeal

Based on application, the market is segmented into gypsum board partitioning, ceilings & wall coverings, and others.

The ceilings & wall coverings segment held the largest share of the global market and is expected to be the fastest growing segment during the forecast period. The demand for boards as ceiling and wall coverings is significant in the market, driven by their aesthetic appeal, thermal insulation properties, and ease of installation. The market for boards used in ceiling and wall coverings is anticipated to grow with a share of 45.98% in 2026, in tandem with increasing emphasis on interior design and energy-efficient construction practices.

The board partitioning segment continues to hold a significant share of the market as these versatile and cost-effective products are extensively used for creating flexible interior spaces in both residential and commercial settings. The market for board partitioning is expected to grow consistently, driven by the ongoing demand for efficient space utilization and adaptability.

By End-Use Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Segment Accounted for Largest Market Share Due to Ongoing Urbanization

Based on end-use, the market is segmented into residential, commercial, and others.

The residential sector remains the largest end-use segment contributing 50.68% globally in 2026 in the market, driven by the ongoing urbanization and widespread development of residential spaces. The residential sector is expected to maintain its dominance as the demand for cost-effective and efficient construction materials continues to grow.

The commercial sector, including office building, retail spaces, and healthcare facilities, is another key driver. The commercial segment is anticipated to grow at a faster pace as customers in this segment prioritize safety, sustainability, and aesthetic considerations.

Emerging end-use sectors, such as infrastructure development, industrial applications, and specialized construction projects also present attractive opportunities for market players. The market for boards in the niche end-use segments is relatively smaller but offers potential for growth as the construction industry evolves.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Gypsum Board Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific was valued at USD 6.45 billion in 2026. The region is anticipated to record high sales revenue owing to the huge consumption of boards among leading Asia Pacific economies, including China, Japan, and India. China accounted for nearly half of the regional consumption in 2023 and is poised to maintain its dominance during the forecast period. The humongous demand in the region is attributed to the huge commercial building and construction projects and increasing adoption of boards made with gypsum in residential building activities. The Japan market is projected to reach USD 0.86 billion by 2026, the China market is projected to reach USD 3.74 billion by 2026, and the India market is projected to reach USD 0.24 billion by 2026.

North America

Asia Pacific Gypsum Board Market Share, By End-Use, 2025

To get more information on the regional analysis of this market, Download Free sample

North America market is a mature market with steady demand driven by the rise in residential and commercial construction activities, particularly in the U.S. The U.S. is the largest consumer of these boards due to new housing and renovation projects. Canada’s market is smaller but growing, supported by infrastructure development projects. The U.S. market is projected to reach USD 3.34 billion by 2026.

Europe

Europe holds a significant gypsum board market share, with Germany, France, the U.K., and Italy being the major consumers. Demand in this region is fueled by robust infrastructure development, rise renovation projects, and growing construction activities. The UK market is projected to reach USD 0.45 billion by 2026, while the Germany market is projected to reach USD 0.78 billion by 2026.

Latin America’s key markets are Brazil and Mexico due to a strong rise in residential and commercial construction. Argentina and Colombia are emerging markets with high growth potential. Demand for the product in this region is supported by government initiatives and infrastructure development projects.

Middle East & Africa

In the Middle East & Africa region, increasing construction activities, especially in the GCC countries, are driving the product demand. Infrastructure development and a growing tourism sector are also contributing to the regional market’s growth.

KEY INDUSTRY PLAYERS

Product Innovations and Technological Advancements are Key Strategic Initiatives Adopted by Market Players

The market is fairly fragmented with a mix of both large manufacturers and specialized companies. The leading manufacturers are actively pursuing strategies, such as capacity expansion, product innovations, acquisitions & mergers, sustainability initiatives, market expansion into emerging regions, strategic partnerships with construction firms, and digital transformation. These initiatives aim to meet the growing demand, introduce advanced products, promote eco-friendly practices, penetrate new markets, and enhance operational efficiencies.

List of Top Gypsum Board Companies:

- Cabot Gypsum (Canada)

- Eagle Materials Inc. (U.S.)

- Fletcher Building (New Zealand)

- KNAUF (Germany)

- Mada Gypsum Company (Kingdom of Saudi Arabia)

- National Gypsum Company (U.S)

- Saint-Gobain (France)

- Taishan Gypsum Co., Ltd.s (China)

- Beijing New Building Materials Public Limited Company (BNBM) (China)

- YOSHINO GYPSUM CO. LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 - Saint-Gobain Gyproc became the first company in India to produce low-carbon plasters, reducing the global warming potential by 40% over their lifetime. Gypsum plaster is the most effective alternative to traditional cement plaster, offering superior finish. Fewer cracks, zero cement, significant water & energy savings, and increased productivity are boosting its adoption.

- October 2023 - Saint-Gobain announced the remaining acquisition of assets and equity interest of Seven Hills Paperboard LLC which also includes a gypsum paper board liner manufacturing facility from its joint venture partner WestRock. The acquisition provided Saint-Gobain with greater control over the supply of critical raw materials and components necessary to manufacture boards and related products. April 2023 - Saint-Gobain began producing plasterboard in Norway using a 100% decarbonized process. Switching from natural gas to hydroelectric power enabled decarbonization of the industrial process, reducing CO2 emission by 23,000 tons annually. Modernization of the plant, better heat recovery, and process efficiency led to a 30% reduction in energy use.

- February 2022 - Following the acquisition, Knauf rebrandeds the SG Boral Building Products Pty Limited as Knauf Gypsum Pty Ltd. USG boral was a major producer of gypsum board and related building products, with strong presence in the APAC region. This move is seen as a strategic acquisition by Knuaf to expand its global footprint and strengthen its position in key growth markets.

- January 2020 - Saint-Gobain announced that it had planned to acquire Continental Building Products, a major producer of gypsum wallboard and finishing products in North America. The acquisition significantly increased Saint-Gobain’s presence and share in the North American gypsum market, making it one of the largest players in the region.

REPORT COVERAGE

The report provides a comprehensive market analysis and emphasizes on crucial aspects, such as leading companies, types, installations, applications, and end-uses. Also, it provides quantitative data regarding the volume & value, market analysis, research methodology for market data, and insights into market trends, and highlights vital industry developments and competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Mn Sq. Mtr) |

|

Growth Rate |

CAGR of 3.60% during 2026-2034 |

|

Segmentation |

By Type

|

|

By Installation

|

|

|

By Application

|

|

|

By End-Use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 14.68 billion in 2026 and is projected to reach USD 18.69 billion by 2034.

Asia Pacific held the highest share of the market in 2025.

Recording a CAGR of 3.60%, the market will exhibit rapid growth during the forecast period of 2026-2034.

In 2025, the regular gypsum boards segment led the market.

Versatility and Ease in Operations is one of the factors driving this market.

North America held the highest market share in 2018.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us