Hazardous Area Equipment Market Size, Share & Industry Analysis, By Product (Cable Glands and Accessories, Measurement Devices, Control Panel Products, Alarm Systems, Gas Detector, Fire Detector, Motors, and Lighting Products), By Industry (Oil & Gas, Chemical & Pharmaceuticals, Food & Beverages, Energy & Power, Mining, and Others), and Regional Forecast, 2026-2034

Hazardous Area Equipment Market Size

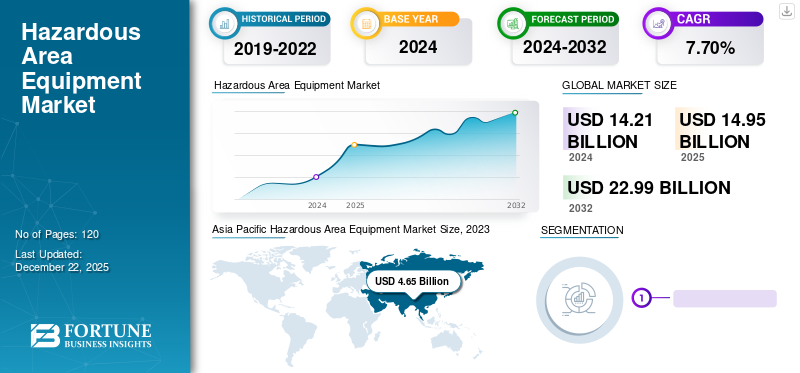

The global hazardous area equipment market size was valued at USD 14.96 billion in 2025 and is projected to grow from USD 15.79 billion in 2026 to USD 26.60 billion by 2034, registering a CAGR of 6.70% over the forecast period. Asia Pacific dominated the hazardous area equipment market with a market share of 35.10% in 2025.

Hazardous area equipment is an electronic and electrical device that is designed and certified to operate safely in environments where an explosive atmosphere may exist due to the presence of flammable vapors and flammable gas. Cable glands, measurement devices, industrial controls, sensors, and lighting fixtures are some products used in the market. It is extensively used for the oil & gas sector. Furthermore, it finds application in chemical & pharmaceuticals, food & beverages, mining, and power industries, among others.

Rapid industrialization and the expansion of the manufacturing sector, especially in developing countries. The rising demand for the equipment for safety measures fuels the growth of the market. Moreover, stringent government regulations for installing such products in hazardous areas are set to fuel the growth of the market. Besides, the integration of the Internet of Things (IoT) and Industry 4.0 technologies in such equipment enhances monitoring, diagnostics, and predictive maintenance, driving the growth of the market. The adoption of advanced technologies, such as LED lighting and smart sensors, over traditional solutions is a significant factor. These technologies offer better performance, energy efficiency, and longer lifespans, making them attractive options for hazardous environments, further driving the market expansion.

Download Free sample to learn more about this report.

Global Hazardous Area Equipment Market Overview

Market Size & Growth

- 2025 Value: USD 14.96 billion

- 2026 Projection: USD 15.79 billion

- 2034 Forecast: USD 26.60 billion

- CAGR (2026–2034): 6.70%

Market Definition

Hazardous area equipment includes electrical and electronic devices specifically designed to operate safely in environments with explosive atmospheres due to flammable gases or vapors. Key products include:

- Cable glands

- Industrial controls

- Sensors

- Lighting fixtures

- Measurement and alarm systems

Growth Drivers

- Industrial Expansion: Rapid industrialization, especially in developing countries

- Safety Regulations: Stringent government mandates across hazardous industries

- Tech Integration: Use of IoT and Industry 4.0 for predictive maintenance, remote monitoring

- Advanced Technology: Adoption of LED lighting, smart sensors, and explosion-proof control systems

Market Segmentation

By Product

- Top Segment: Cable Glands & Accessories (24.3% share in 2025)

- Steady Growth: Measurement devices, control panels

- Moderate Growth: Alarm systems, gas & fire detectors

- Decent Growth: Motors and lighting, driven by new plant construction

By Industry

- Top Industry: Oil & Gas (expected to reach USD 4.77 billion in 2025)

- Steady Growth: Food & Beverages, due to safety needs in combustible environments

- Moderate Growth: Chemical & Pharmaceuticals

- Decent Growth: Energy & Power, Mining

- Others: Pulp and paper sector also contributing due to regulatory compliance

Regional Highlights

Asia Pacific

- 2023 Size: USD 4.65 billion

- Driven by industrialization, oil & gas investment, and mining sector growth

- Notable growth in China (CAGR 8.3%) due to oil & gas and manufacturing expansion

Europe

- Stable growth from petrochemical, oil & gas, and mining industries

- Key countries: Germany, France, Italy

North America

- Growth driven by industrial safety mandates and key players’ presence

South America & Middle East & Africa

- Moderate growth fueled by infrastructure investment and industrialization

The COVID-19 pandemic had a mixed impact on the global hazardous area equipment market due to increasing safety awareness and rising demand from the oil and gas sector. The economic slowdown resulted in reduced capital expenditures by companies, particularly in non-essential sectors.

Hazardous Area Equipment Market Trends

Key Players Introduce IoT and AI-Based Solutions for Enhanced Safety and Efficiency

ABB Ltd, WERMA Signaltechnik GmbH Co KG, Siemens AG, Honeywell International, Patlite Corporation, and Rockwell Automation, among others, are few of the leading companies engaged in the introduction of new technological advancements such as the Internet of Things (IoT) and Artificial Intelligence based technologies. Such solutions allow real-time monitoring, data collection, and remote control capabilities, improving operational efficiency and safety in hazardous environments. Hazardous area equipment is increasingly incorporating advanced sensors and analytical capability to monitor various parameters such as temperature, pressure, vibration, and gas levels. A rise in advancements in technology is the latest trend in the global market.

Hazardous Area Equipment Market Growth Factors

Global Investments and Industry Growth Boost Market for Specialized Safety Equipment in Hazardous Environments

The growth of industries such as oil and gas exploration, petrochemical processing, and mining activities, which often operate in hazardous environments, is driving the demand for such equipment. As these industries expand globally, the need for specialized equipment designed for potentially explosive atmospheres increases. The oil and gas industry is a significant consumer of such equipment, and increasing investments in exploration activities, both onshore and offshore, contribute to the market growth. In addition, government investment in expanding oil & gas infrastructure, which subsequently leads to a rise in the demand for such products, fuels the growth of the market. For instance, in February 2024, the Indian government planned to invest around USD 67 billion for the expansion of the natural gas supply chain for the next 5 to 6 years. These factors collectively fuel the global hazardous area equipment market growth.

RESTRAINING FACTORS

Substantial Initial Capital Investment to Impede Market Growth

Hazardous area equipment is typically more expensive than standard equipment owing to the specialized design, materials, and certifications required to ensure safe operation in potentially explosive environments. The cost required for such equipment such as cable glands and accessories, control panel products, gas detectors, and smoke detectors, among others, ranges from USD 1,000 to USD 12,000. In addition, a shortage of skilled personnel, particularly in remote or underdeveloped regions, can pose challenges for companies operating in hazardous environments.

Hazardous Area Equipment Market Segmentation Analysis

By Product Analysis

Cable Glands and Accessories Segment Dominate Due to Increasing Industrial Infrastructure Development

Based on product, the market is segmented into cable glands and accessories, measurement devices, control panel products, alarm systems, gas detector, fire detector, motors, and lighting products.

The cable glands and accessories segment accounting for 24.45% of the global market share in 2026. The increased adoption of automation across industries such as oil and gas, manufacturing, mining, and energy drives the demand for cable glands and accessories. These components are vital for ensuring safe and reliable electrical connections in automated systems. This segment gained 24% of the market share in 2024.

Control panel products and measurement devices segments are projected to witness steady growth during the forecast period. This is owing to their features such as explosion-proof control panels. In addition, these products are widely adopted in the oil and gas, petrochemical, and mining industries, driving market growth.

Alarm systems, gas detectors, and fire detector segments are projected to exhibit moderate growth during the forecast period. This is owing to rapid industrialization and government investment in expanding industrial infrastructure. Subsequently, the demand for such equipment will drive the market growth.

The motors and lighting products segment is anticipated to exhibit decent growth during the forecast period. This is owing to increasing construction of new industrial manufacturing plants and rising adoption from sectors such as oil and gas and petrochemicals, which contributes positively in the global hazardous area equipment market share.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Oil & Gas Industry Holds Leading Position Owing to Rising Product Demand in Oil & Gas Plants

Based on industry, the market is segmented into oil & gas, chemical & pharmaceuticals, food & beverages, energy & power, mining, and others. The others segment includes the pulp and paper sector.

The oil & gas segment holding 32.24% of the global market share in 2026 and is projected to witness substantial growth during the forecast period. It is due to the presence of flammable hydrocarbons and explosive atmosphere in upstream and downstream operations. In addition, the rising demand from the oil & gas sector fuels the growth of the market. This segment is poised to capture 32% of the market share in 2025.

The food and beverages sector segment is set to grow steadily during the forecast period owing to the rising adoption of such equipment to maintain safety, compliance, reliability, and efficiency. The presence of combustible dust and flammable gases, which mandates the usage of such equipment to ensure safety in industrial operations, fuels the market growth.

The chemical and pharmaceutical segment is anticipated to exhibit moderate growth during the forecast period. These industries deal with various flammable and combustible materials, making such equipment essential for safe operations. This segment is expected to document a considerable CAGR of 6.80% during the forecast period (2025-2032).

The energy & power and mining sectors are set to record decent growth during the forecast period. This is due to the rising demand for control panels, cable glands, and flameproof control panels from the energy and mining sectors.

The others segment, which includes pulp and paper, is anticipated to grow moderately during the forecast period. This is credited to government safety regulations and standards and increased awareness about industrial safety practices across the pulp and paper sector.

REGIONAL INSIGHTS

Geographically, the market is studied across Asia Pacific, Europe, North America, South America, and the Middle East & Africa.

Asia Pacific Hazardous Area Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific recorded USD 5.25 billion in 2025, driven by urbanization, industrialization, and increasing investment in the oil & gas, mining, and petrochemical sectors. In addition, the growing petrochemical and mining sector, which results in a surging demand for hazardous area equipment, fuels the market growth. For instance, according to Mining Technology, investment in the mining sector in Asia Pacific grew by 5% in 2024 as compared to 2023. The China market is expected to reach USD 1.76 billion by 2026. The Japan market is projected to reach USD 0.85 billion, and the India market is expected to reach USD 0.57 billion by 2026.

China to Witness Substantial Growth Propelled by Expansion of Oil & Gas and Petrochemical Sector

China is a major producer and consumer of oil and gas, driving the demand for hazardous area equipment in upstream, midstream, and downstream operations. In addition, the robust manufacturing sector, including the automotive, electronics, and machinery sectors, propel the demand for hazardous area equipment. The Chinese market is foreseen to hold USD 1.63 billion in 2025. Moreover, China has domestic manufacturers of such products. These companies provide such products for the local market and are also expanding their presence across the globe.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the third largest market anticipated to be worth USD 3.31 billion in 2025. Europe is projected to grow steadily during the forecast period, owing to rising demand for such products from the petrochemical, oil and gas, and mining sectors. The U.K. market continues to grow, expected to reach USD 0.34 billion in 2025. In addition, growth in the mining and manufacturing sectors across Germany, France, and Italy, among others, drives the growth of the regional hazardous area equipment market share. The UK market is expected to reach USD 0.37 billion, while Germany is projected to reach USD 0.86 billion by 2026.

North America

North America is the second largest market anticipated to be valued at USD 4.26 billion in 2025, exhibiting a considerable CAGR of 6.50% during the forecast period (2025-2032). North America is set to experience decent growth during the forecast period, owing to increasing industrial safety regulations and the need for advanced safety equipment in hazardous applications. In addition, the strong presence of major players such as Rockwell Automation Inc., ABB Ltd, and Siemens AG, among others, drives the growth of the market. The U.S. market is expected to reach USD 3.16 billion by 2026.

Middle East & Africa

The Middle East & Africa is the fourth largest market set to hold USD 1.35 billion in 2025. South America and the Middle East & Africa are projected to grow moderately during the forecast period. This is credited to rapid industrialization and government investment in the expansion of industrial plants across Brazil and Argentina. The GCC market is anticipated to reach USD 0.78 billion in 2025.

KEY INDUSTRY PLAYERS

Market Players Adopt Product Launches and Acquisitions as Key Strategic Moves to Strengthen Competitive Landscape

Major players such as ABB Ltd, WERMA Signaltechnik GmbH + Co. KG, Siemens AG, Eaton Corporation, Rockwell Automation Inc, Honeywell International Inc, Emerson Electric, Patlite Corporation, R.Stahl AG, and E2S Warning Signals, among others, are engaged in the adoption of product development, product launch, and acquisitions as key strategic moves to gain an edge in the market. For instance, in January 2023, Siemens AG introduced new smoke detectors named FDA261 and FDA262 for industrial manufacturing plants, e-commerce warehouses, and data centers. This device requires a space of 6,700 square meters.

List of Top Hazardous Area Equipment Companies:

- ABB Ltd (Switzerland)

- Eaton Corporation (Ireland)

- Emerson Electric Co. (U.S.)

- E2S Warning Signals (U.K.)

- Honeywell International Inc (U.S.)

- WERMA Signaltechnik GmbH + Co. KG (Germany)

- Patlite Corporation (Japan)

- Rockwell Automation Inc (U.S.)

- R. Stahl AG (Germany)

- Siemens AG (Germany)

KEY INDUSTRY DEVELOPMENT:

- December 2023: Honeywell International Inc launched a new HEICC-23X1T camera for hazardous environments. It has features, such as 30X zoom, True Day/Night vision, 2 MP high resolution camera, and the capability to work under temperature from -400 C to +600 C.

- May 2023: ABB Ltd planned to open a new innovation center at Memphis, U.S. The basic aim of the expansion was to expand its product portfolio of next generation electrification products.

- January 2023: ABB Ltd launched a new range of low-voltage motors, flameproof compressors for industrial plants. It offers advantages such as rising reliability and requires less maintenance. The devices find application in numerous industrial plants including oil & gas, and food & beverages, among others.

- November 2022: Eaton Corporation launched a new ExLin LED lighting products for hazardous work environments. It is a battery powered decentralized LED solution which finds application in numerous sectors such as petrochemical, oil & gas, and chemical plants. It is a cost efficient and safe device used across industrial sectors. It can perform better under low and high temperature capacity from -450 C to +450 C.

- March 2022: DNV GV signed a collaboration agreement with Trainor AS based in Norway, Europe. Trainor AS deals in a wide range of hazardous area equipment. The basic aim of this collaboration was to improve the product portfolio for oil & gas, chemical, pharmaceuticals, and food & beverages sectors.

REPORT COVERAGE

The report provides an in-depth analysis of the industry dynamics and competitive landscape. The report also provides market estimation and forecast based on product, industry, and regions. It provides various key insights, recent industry developments in the market such as mergers, acquisitions, macro, and microeconomic factors, SWOT analysis, and company profiles.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product, Industry, and Region |

|

Segmentation |

By Product

By Industry

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size is projected to grow from USD 15.79 billion in 2026 to USD 26.60 billion by 2034.

The market is projected to grow at a CAGR of 7.70% during the forecast period (2026-2034).

By product, the cable glands and accessories segment led the market in 2025.

Increasing demand from oil & gas sector is a key factor driving the growth of the market.

ABB Ltd, WERMA Signaltechnik GmbH + Co. KG, Siemens AG, Eaton Corporation, Rockwell Automation Inc, Honeywell International Inc, Emerson Electric Co, Patlite Corporation, R.Stahl AG, and E2S Warning Signals are the leading companies in this market.

Asia Pacific holds the major share of the market owing to presence of strong manufacturing sector and rising demand from oil and gas industry.

By industry, the oil & gas segment led the market in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us