Heating Equipment Market Size, Share & Industry Analysis, By Product Type (Boilers, Heat Pumps, Furnaces, and Unit Heaters), By Fuel Type (Oil, Natural Gas, Electricity, Biomass, and Others), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026– 2034

Heating Equipment Market Size and Future Outlook

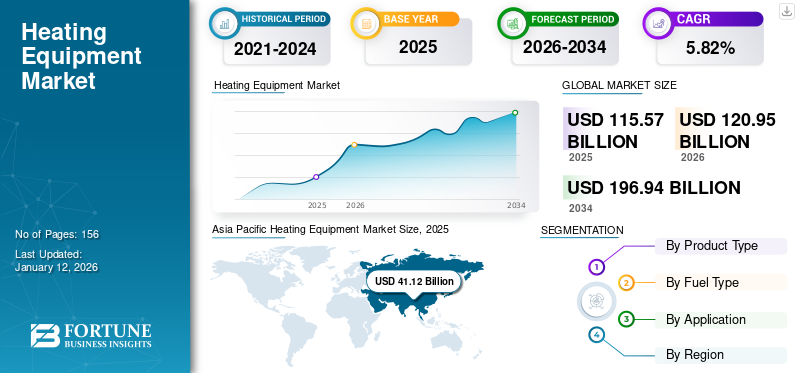

The global heating equipment market size was valued at USD 115.57 billion in 2025 and is projected to grow from USD 120.95 billion in 2026 to USD 196.94 billion by 2034, exhibiting a CAGR of 6.3% during the forecast period. The Asia Pacific dominated global market with a share of 35.6% in 2025.

Heating equipment is a mechanical device used for regulating required temperatures, including boilers, unit heaters, furnaces, and geothermal heat pumps. The global heating equipment market presents a complex, dynamic landscape marked by an intriguing interplay of technological innovations and the unpredictable nature of international trade affairs. The industry is witnessing a gradual shift toward more sustainable and energy-efficient solutions, driven by stringent environmental regulations and evolving consumer preferences. According to a recent press release by the International Energy Agency (IEA), heating accounts for nearly half of the energy consumption, underscoring a vast potential for innovation and growth in the heating equipment sector. For instance, Singapore started construction of a new vaccine production facility in 2022 and is expected to be completed by 2026. The investment totaled about USD 467 million for the project named Tuas Biomedical Park New Vaccine Production Facility.

The heating equipment market is highly fragmented, with a significant number of players. These players include Carrier, Johnson Controls Plc., Midea Group, Mitsubishi Electric Corporation, and Siemens AG. Their dominance is owed to their wide range of product offerings, heavy investment in innovative technologies, and energy-efficient product launches that meet end-user needs.

The COVID-19 pandemic had a significant impact on the heating industry due to temporary lockdowns, halts at manufacturing plants, and disruptions in the supply chain. Limited capital availability and contracted investment in the expansion of manufacturing facilities post-pandemic impacted the market demand across regions. The pandemic caused a major decline in the market due to financial pressure and a complex, dynamic landscape marked by an intriguing interplay of technological innovations and the unpredictable nature of global trade affairs.

IMPACT OF INDUSTRY 4.0

Adoption of Connected and Efficient Heating Solutions Drives Industry 4.0 Advancements

The global trajectory of heating equipment is intricately linked to its ability to harness technological innovation, navigate the complexities of Industry 4.0, and adapt to the ever-changing geopolitical trade landscape. This ultimately paves the way for a more efficient, sustainable, and connected heating solution ecosystem. Industry 4.0 capabilities enable end users to remotely monitor and identify possible risks, which help schedule predictive maintenance of heating equipment and flow systems.

HEATING EQUIPMENT MARKET TRENDS

Trend of Green Buildings and Hybrid Heat Pumps to Proliferate Market

Globally, energy consumption in buildings accounted for almost 30% of global final energy demand in 2022, along with 26% of emissions and 8% of direct emissions from gas heating and cooking. The current trend of zero-energy buildings in the construction sector is to strive for the market in the coming years. Also, this idea of green buildings is supported by the adoption of hybrid heat pumps and various government institutions' promotions, including 26 nations in ‘Energy in Building and Communities’, and EBCs have planned aligned programs to support the same. Also, commercial building owners are aggressively installing modern community heating solutions and hybrid heat pumps for personal heating, which use eco-friendly refrigerants. Sustainable initiatives for energy-efficient heating solutions, including boilers, heat pumps, and furnaces, are gaining market demand.

- For instance, in March 2024, Philips Corporation, a globally renowned consumer goods manufacturer, announced the launch of three commercial units of air-to-water (A2W) heat pumps using environment-friendly refrigerants. Commercial models that employ compact design and environmentally friendly refrigerants have been launched in the European market.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Demand for Energy-Efficient Solutions, Backed by Government Initiatives, Flourishes Market Growth

The global push for sustainable and energy-efficient heating systems is propelled by the burgeoning population and stricter energy regulations supported by policy measures and consumer demand. The choice of heating solution is complicated due to a range of variables, such as building use, consumer persona, and infrastructure. However, the industry's electrification, promoting the use of low—or zero-carbon power equipment, drives the progressive growth of sustainable heating solutions. This makes eco-friendly heating solutions accessible to more end users across developed and emerging economies. Oil & gas, chemicals, pharmaceuticals, power plants, food & beverages, packaging, textile, and rubber are a few of the prominent sectors catering to the rising demand for heating appliances. Furthermore, the government's initiatives and efforts to promote energy-efficient products through tax credits are further stimulating the heating equipment market size in the long term.

- For instance, in September 2023, Johnson Controls launched an air-to-water inverter scroll modular heat pump utilizing GWP R-454B refrigerant that cuts climate impact by 80% compared to traditional R-410 Refrigerant. The R-454B refrigerant is compliant with current and upcoming regulations by the U.S. Environmental Protection Agency (EPA) through the American Innovation and Manufacturing (AIM) Act.

Market Restraints

High Maintenance Costs and Shortage of Skilled Technicians are Hindering Market Growth

Modern commercial and residential spaces, which are highly airtight and compact, complicate traditional heating solutions, which require additional space and high installation and commissioning costs. Further, skilled technicians are needed to examine complex and automated heating systems. Owing to all these, the cost of operating and maintaining such systems is high, causing a hindrance to the market's growth.

Market Opportunities

Technological Advancements Across Heating Systems are Expected to Trigger Market Growth

Product innovation is a key trend gaining popularity in the heating equipment market. Many prominent players in the global heating market currently focus on the marketing and development of novel equipment that caters to increased demand and gains a competitive edge. Additionally, several building professionals are utilizing an automation system that includes the Internet of Things (IoT), smart thermostats, AI, and others. This subsequently creates opportunities and drives the global heating equipment market growth.

- For instance, in October 2024, Connect M Technology Solutions, Inc. announced its groundbreaking AI-powered heat pump with the Advance Heating and Refrigeration Institute (AHRI) cold climate certification.

SEGMENTATION ANALYSIS

By Product Type

Lower Operational Cost, and Maintenance Solidifies Boilers Dominance in Product Segment

By product type, the market is classified into boilers, heat pumps, furnaces, and unit heaters.

Across the product type segment, boilers dominate the market share owing to their lower operational costs and maintenance. Boilers are in demand from commercial buildings, including hotels, offices, and hospitals, for space heating and water supply. The rising application of greenhouse heating to provide warmth to plants and crop yields is further boosting the market demand for boilers. However, boilers are experiencing a significant decline in market share in the forecast period due to their lower energy efficiency compared to newer technologies such as hybrid and electric heat pumps.

The heat pump segment is witnessing the highest CAGR due to its superior energy savings, where a single unit provides up to four units of heat energy. The segment is witnessing a shift in product type adoption driven by accelerating environmental concerns and strict energy regulations. Heat pumps are expected to experience the highest growth rate during the forecast period across end users, including residential and commercial. The rising trend toward the electrification of heat and government support is expected to influence the growth of heat pumps across industries. Heat pumps carry several economic benefits and efficiently deploy heat to several end-use industries.

Furnaces is anticipated to capture 62.54% of the market share in 2026 and unit heaters are expected to experience steady growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Fuel Type

Heavy Dependency and Rising Demand for District Heating Proliferate Natural Gas Dominance

The fuel type category is classified into oil, natural gas, electricity, biomass, and others (coal, etc).

Natural gas is expected to gain the largest share among fuel types due to its heavy usage in district heating solutions and industrial processing units where temperature control is critical. Europe, North America, and China's heavy reliance on conventional gas and oil-based boilers supports the high-value market. Moreover, natural gas is cost-efficient for end users and reduces carbon emissions. Despite being the current frontrunner, the market faces a decline due to fluctuating prices.

At the same time, the electricity segment is projected to grow with the highest CAGR of 7.16% during the forecast period, driven by the increasing adoption of electric water heating solutions, which are perceived as cleaner and more efficient heating solutions.

Oil segment is expected to capture 39.54% of the market share in 2026 of the global market.

By Application

Growing Application of Heating Equipment in Industrial Processes Drives Market Demand

The application segment is trifurcated into residential, commercial, and industrial.

The industrial category dominates the market share owing to the growing application across manufacturing and process solutions, where precise temperature control for processing is critical. Segments including textile, packaging, automotive, aerospace, agriculture, and metal manufacturing are the major contributors to the industrial segment.

The commercial segment is gaining the highest CAGR of 6.15% during the forecast period, owing to the increasing adoption of community and district heating units in developed countries where centralized temperature control is important.

The residential segment is expected to expand its market share by 49.39% in 2026, due to the growing adoption of heat pumps among consumers for personal space heating.

HEATING EQUIPMENT MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Heating Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The heating equipment market in the Asia Pacific region held the market size of USD 43.34 billion in 2026, and USD 41.12 billion in 2025, is experiencing rapid growth, primarily driven by the hefty usage of heating furnaces and boilers in industrial processes and industrial expansion in emerging countries such as India, Indonesia, and the rest of Asia Pacific. The region's strong manufacturing base, particularly in China, Japan, India, and SEA, fueled the demand for advanced heating solutions. Government initiatives and increasing demand for heating equipment across residential and commercial applications further boost the market demand. High demand for district heating in the commercial HVAC industry is also driving demand.

- For instance, in February 2024, the Indian government inaugurated 40 greenfield plants for bulk drugs and medical device manufacturing. The focus of the Indian government to expand its pharmaceutical manufacturing across the country is projected to boost the market demand for heating appliances.

China is estimated to hold the highest market share due to the presence of manufacturers in the automotive HVAC equipment industry and the establishment of numerous new manufacturing clusters in the country, which is propelling the growth of the HVAC sector. Also, the country's potential to attain huge consumer demand and cost-competitive product offerings drives market growth during the forecast period. The market in China is estimated to be USD 23.28 billion in 2026. The market in India is expected to gain USD 7.30 billion and Japan to acquire USD 7.65 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is projected to be the third-largest region with a market value of USD 27.76 billion in 2026, and operates within a technologically advanced and highly efficient product landscape, driven by the strong demand for carbon emission-free, sustainable heating solutions that comply with the U.S. plan to reduce greenhouse gas emissions to 50-52% by 2030. The market is booming due to the demand for smart heating systems enabled by Internet of Things (IoT) technology. IoT-based heating systems provide greater flexibility and smart controls for end-users, positively impacting the market demand. Heat pumps are gaining market traction across residential and commercial space and water heating industries due to extreme climatic conditions.

The U.S. heating market is growing dynamically, driven by the strong presence of prominent players such as Daikin, Panasonic, Johnson Controls, Carrier, Midea, and others in the region. Emphasizing local manufacturing is also aiding the market's growth. The U.S. market is projected to hit USD 19.61 billion in 2026.

South America

The region's economic landscape is shaped by fluctuating foreign investments, currency volatility, and government-led subsidies and incentives to use electric and home appliances. The South American heating equipment market is undergoing a notable transformation, reflecting the region’s commitment to renewable energy and reduced carbon footprint.

Europe

Europe is anticipated to be the second-largest region with a market value of USD 35.10 billion in 2026, with the second-fastest CAGR of 5.93% during the forecast period. Strong industrial automation, eco-design homes, and stringent sustainability regulations characterize the heating equipment market in Europe. These factors drive the demand for heating equipment that offers long-term life, electric, energy-efficient, and sustainable solutions. The region's established industrial base and R&D infrastructure fuel the demand and development of innovative yet efficient heating solutions. The U.K. market size is estimated to be USD 4.67 billion in 2026. Germany’s market size is anticipated to be valued at USD 8.92 billion and France is likely to acquire USD 6.40 billion in 2026.

Middle East & Africa

The Middle East & Africa is the fourth-largest region anticipated to acquire USD 8.49 billion in 2026 of the global market. The growing investments in the development of sustainable infrastructure and the heavy dominance of the global oil ecosystem in the GCC countries have led to the region's moderate growth. Furthermore, Africa’s increasing investment by private players and sustainable policies will pave the way for the development of the heating equipment market through the forecast period. The GCC countries are projected to hit USD 4.75 billion in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Focus on Integrating Advanced Heating Equipment into Product Portfolio to Strengthen Market Presence

Prominent market players such as Daikin Industries, Ltd., Carrier, Mitsubishi, Panasonic Holdings Corporation, Robert Bosch, and others invest heavily in heat pump technology, which offers higher efficiency compared to traditional heating systems. Additionally, the integration of the Internet of Things (IoT) has revolutionized many industries, including the heating equipment industry. By utilizing sensors and connectivity, IoT-enabled heating solutions can collect data on temperature, heating performance, and efficiency. All these features strengthen the prominent players' market presence and expand the heating equipment market share during the forecast period.

- For instance, in November 2024, Panasonic Holdings Corporation unveiled the ClimaPure XZ and EXTERIOS Z series under its novel R32 heat pumps for the Canadian market. These models offer heating capacities ranging from 10,900 Btu/h to 28,800 Btu/h.

To know how our report can help streamline your business, Speak to Analyst

Carrier, Johnson Controls Plc., Midea Group, Mitsubishi Electric Corporation, Siemens AG, and others are the top 10 players in the heating equipment industry globally, covering around 32% of the market.

Long List of Companies Studied (including but limited to):

- Siemens AG (Germany)

- Johnson Controls Inc (Ireland)

- Midea Group (China)

- Daikin Industries Ltd. (Japan)

- Carrier (U.S.)

- Trane Technologies (Ireland)

- Robert Bosch (Germany)

- Panasonic Holdings Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Danfoss (Denmark)

- Siemens AG (Germany)

- Nortek Air Solutions LLC (U.S.)

- Seeley International (Australia)

- Fujitsu General Limited (Japan)

- Honeywell International Inc (U.S.)

- Emerson Electric (U.S.)

- Johnson Electric Holdings Limited (Hong Kong)

- Lennox International Inc (U.S.)

- LG Electronics (South Korea)

- Hitachi Ltd (Japan)

- AAF International (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Mitsubishi Electric Corporation rereleased water-to-water heat pumps for industrial and commercial applications. These heat pumps are designed for applications requiring high-temperature water of up to 78°C.

- September 2024: Mitsubishi Electric Corporation entered into a partnership with OVO. Through this collaboration, Mitsubishi aims to provide customers with Mitsubishi Electric Ecodan air source heat pumps to heat their homes and save around 35% of home heating bills.

- August 2024: Carrier collaborated with Sibi, a technology platform for supply chains. Through this collaboration, Carrier aims to change the HVAC industry through improved data-driven efficiency and develop a new, enhanced supply chain management system.

- May 2024: Samsung and Lennox announced a joint venture for ductless and variable flow HVAC solutions for outstanding heating and cooling solutions to customers across the U.S. and Canada. The collaboration focused on strong product offerings to the customer network with new product solutions to the market.

- February 2024: Modine, a prominent heating solution in the HVAC industry, announced the launch of MEW, an innovative corrosion-resistant electric heater designed for use in non-hazardous washdown and corrosive environments. The equipment fulfills customer demand across all sectors.

- December 2023: Bradford White Water Heaters released a new Brute XTR commercial boiler and volume water heaters in six different sizes. The sizes range from 399 MBH to 1500 MBH, and they have AHRI certification and high thermal efficiency.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Prominent players of the market have noted the global change and shift in supply chain owing to various reasons such as reciprocal tariffs, geopolitical tensions, bilateral trade agreements, and other tensions. Businesses are strategically locating investments and expansion facilities to mitigate the risk and further boosting the local manufacturing in the priary markets.

- November 2023: Johnson Controls has been granted USD 33 million from the U.S. Department of Energy (DOE) for manufacturing. The grant will increase the production of electric heat pumps by expanding the U.S. heat pump manufacturing facility, which will produce approximately 200,000 electric heat pumps annually.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.3% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

| Segmentation | By Product Type, Fuel Type, Application, and Region |

|

Segmentation |

By Product Type

By Fuel Type

By Application

By Region

|

|

Companies Profiled in the Report |

Johnson Controls Inc (Ireland), Midea Group (China), Carrier (U.S.), Trane Technologies (Ireland), Robert Bosch (Germany), Panasonic Holdings Corporation (Japan), Mitsubishi Electric Corporation (Japan), Danfoss (Denmark), Siemens AG (Germany), and Daikin Industries Ltd (Japan) |

Frequently Asked Questions

The market is projected to record a valuation of USD 196.94 billion by 2034.

In 2025, the market was valued at USD 115.57 billion.

The market is projected to grow at a CAGR of 6.3% during the forecast period of 2026-2034.

The boiler product segment is expected to lead the market.

Increased demand for sustainable heating, backed by government initiatives, is driving market growth.

Johnson Controls Inc., Midea Group, Carrier, Trane Technologies, Robert Bosch, Panasonic Holdings Corporation, Mitsubishi Electric Corporation, Danfoss, Siemens AG, and Daikin Industries Ltd are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By application, the industrial segment is expected to grow with the highest share and CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us