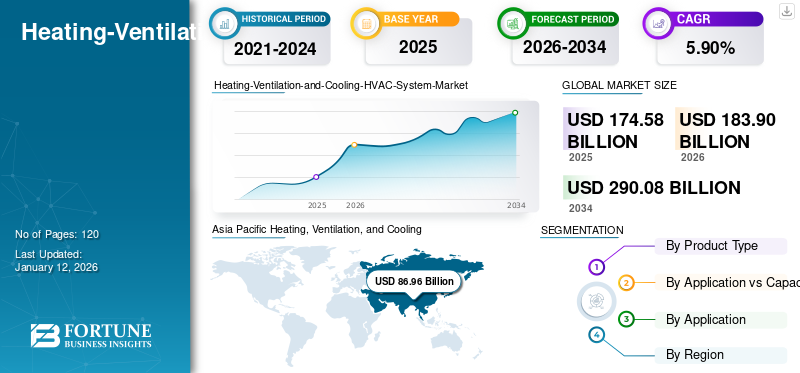

Heating, Ventilation, and Cooling (HVAC) System Market Size, Share & Industry Analysis, By Application vs Capacity (Residential, Commercial, and Industrial), By Product Type (Heating Equipment, Cooling Equipment, and Ventilation Equipment), By Application (Commercial, Residential, and Industrial), and Regional Forecast, 2026 – 2034

HVAC Industry Analysis

The global Heating, Ventilation, and Cooling (HVAC) system market size was valued at USD 174.58 billion in 2025 and is projected to grow from USD 183.9 billion in 2026 to USD 290.08 billion by 2034, exhibiting a CAGR of 5.90% during the forecast period. Asia Pacific dominated the HVAC industry with a market share of 49.80% in 2025.

HVAC systems include several equipment that control temperature, air quality, humidity, and others in closed spaces. HVAC systems help in maintaining healthy air quality and adequate ventilation for energy consumers across industries. Rising trends for smart homes, government incentives, and increasing capital expenditure in the construction sector are set to bolster the demand for Heating, Ventilation, and Cooling (HVAC) systems across geographies. In addition, climate change and sustainable practices are increasing the adoption of smart HVAC systems at residential and commercial properties. Green building certifications, including Leadership in Energy and Environment Design (LEED), are further boosting the energy-efficient Heating, Ventilation, and Cooling (HVAC) system market share. Increasing development of residential and commercial properties are all supporting the market growth of HVAC systems across industries. For instance, according to the U.S. Census Bureau and Department of Housing and Urban Development Authority, residential sales in June 2024 accounted for about 617,000 units.

Poor air quality and regulatory influence are prominent factors that are poised to surge the demand for HVAC systems. These systems with good indoor air quality also allow control over humidity in varying environments. Urbanization and wide application across commercial buildings are all contributing to the growth of the market. Several government associations have implemented stringent standards in relation to refrigerant and energy efficiency.

The COVID-19 pandemic has slowed down the economic impact on the market share across diverse industry applications. Delayed availability of raw materials, halt at manufacturing facilities, and cross border trade tensions during the post pandemic period have all impacted the demand for HVAC system across regions.

HVAC Industry Trends

Growing Popularity of Software Automation and Smart HVAC Systems in Commercial and Residential Applications

Adoption of software platforms and tools enhances client communication, ensuring eco-friendly and energy-efficient HVAC systems. The growing popularity of smart buildings and building automation systems is boosting the demand of Heating, Ventilation, and Cooling (HVAC) systems, along with condition tracking and effective communication with end-users. Commercial buildings are focused on reducing energy costs with durable systems, which is surging the demand for HVAC systems. Extreme climatic conditions are further supporting the demand for these systems in older properties. Modern commercial and residential infrastructures prefer ductless systems due to limited space availability and optimized energy solutions.

Download Free sample to learn more about this report.

HVAC Industry Growth Factors

Growing Construction Sector to Propel Market Growth

Rise in industrialization and rapid urbanization across developing countries are significantly increasing demand for commercial and residential buildings. According to the U.S. Department of Energy, HVAC equipment accounts for about 40% of the total commercial buildings’ energy consumption. Moreover, considerable growth in climate-controlled solutions is generating strong demand for Heating, Ventilation, and Cooling (HVAC) systems. Government regulatory standards and policies are further surging the demand for HVAC systems to minimize energy consumption.

Restraining Factors

High Service Costs and Limited Skilled Workforce for End-Users May Limit Market Growth

Lack of skilled workforce and emerging technologies such as motion-triggered AC units and smart vents limit the demand for Heating, Ventilation, and Cooling (HVAC) systems. High installation costs for energy-efficient HVAC systems are few of the prominent factors limiting their demand. Initial cost of ownership accounts for heavy capital investment limiting the demand for HVAC systems in Small and medium scale businesses. However, long term gains for end-users might further boost the growth of the HVAC systems market.

HVAC Market Segmentation Analysis

By Product Type Analysis

Heating Equipment to Cater Highest Share Owing to Varying Climate Conditions and Industry Needs

By product type, the market is classified into heating equipment, cooling equipment, and ventilation equipment. Heating equipment includes heat pumps, furnaces, boilers, and unitary heaters. Products considered under cooling equipment include unitary air conditioners, Variable Refrigerant Flow (VRF) systems, chillers, room air conditioner, coolers, and cooling towers. Ventilation equipment includes air-handling units, air filters, dehumidifiers, air purifiers, ventilation fans, and humidifiers. Heating equipment to dominate the market demand with over 50% of the total revenue market share across regions. The heating equipment segment accounted for 49.17% of the total market share in 2026.

Rising demand for decentralized and integrated heating solutions is slated to upsurge the market growth for heating equipment across geographies. Several end-users are adopting carbon-neutral and efficient heating solutions along with intelligent control options. Key participants are collaborating with technology partners to build integrated solutions and offer reliable heating products. Government initiatives toward reduced carbon emissions and supportive subsidies for sustainable heating systems are expected to bolster the demand for heating equipment. The boilers segment is expected to cater the highest share during the study period.

The ventilation equipment segment is set to witness strong growth during the forecast period as a result of increasing demand for centralized systems. Surging demand for energy-efficient and durable systems at commercial and small and medium-scale enterprises is expected to boost the market growth for ventilation equipment.

By Application vs Capacity Analysis

Commercial Segment to Dominate Market Demand Owing to Rising adoption for HVAC Systems

By application vs capacity, the market is classified into residential, commercial, and industrial. The residential segment is further segmented into up to 2 tons and 2 to 5 tons. The commercial segment has further been classified into up to 10 tons, 10 to 25 tons, and above 25 tons. The industrial segment has further been divided into 25 to 50 tons, 50 to 120 tons, and above 120 tons. The commercial segment accounted for the highest market share in 2026, representing 43.69% of the total market share.

Increasing investment and the growing real estate sector for commercial properties are a few of the prominent factors boosting the market demand for Heating, Ventilation, and Cooling (HVAC) systems. Increasing consumer demand for cooling and heating systems due to changing climatic conditions is further boosting the market for HVAC systems across commercial spaces. Supportive government policies and rising capital expenditure are poised to lead to strong market growth of the commercial segment.

The residential segment is set to experience significant growth during the forecast period as a result of the high adoption of indoor temperature control systems.

By Application Analysis

Commercial Segment Leads Driven by Expansion of Urban Areas

By application, the market is segmented into residential, commercial, and industrial. The commercial segment has the highest revenue market share, followed by the residential segment.

Urbanization, rising disposable income, and a healthy indoor environment are all surging the adoption of smart building technologies. Supportive regulatory standards and technological advancements are further driving the Heating, Ventilation, and Cooling (HVAC) system market growth across the commercial segment. Growing number of multi-purpose complexes and commercial properties are expected to bolster the demand for HVAC systems during the forecast period.

The residential segment is anticipated to register the second highest market share during the study period owing to multistoried buildings and a rising preference for energy-efficient climate-controlled solutions. Growing demand for controlled indoor climate conditions are all bolstering the growth of Heating, Ventilation, and Cooling (HVAC) systems in residential buildings and multistoried properties.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market is geographically segmented into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

Asia Pacific Heating, Ventilation, and Cooling (HVAC) System Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market, with the market size valued at USD 86.96 billion in 2025 and increasing to USD 91.99 billion in 2026, driven by rising demand from diverse industry sectors. Developing economies in Asia Pacific, such as India and ASEAN countries, are poised to experience significant investment in real estate projects across the region. Varying climate conditions and increased purchasing power have positively impacted the demand for the product across the region. The Japan market is projected to reach USD 25.49 billion by 2026, the China market is projected to reach USD 37.7 billion by 2026, and the India market is projected to reach USD 16.61 billion by 2026.

Manufacturing companies are focusing on investing in energy-efficient HVAC systems in the region to meet changing industry demands. The growing real estate market across the region and the high demand for comfortable living experiences further boost the market demand for HVAC systems. For instance, in February 2022, Carrier launched its AquaFlow Mini VWV X in China for residential properties.

Urbanization and climate change are necessitating climate control solutions, steadily impacting the demand for HVAC products. Owing to regulatory policies and supportive standards, sustainable building practices and manufacturing processes the demand for energy-efficient HVAC systems is expected to surge over the coming years. Moreover, health and air quality awareness among customers is driving the growth of air purification and ventilation technologies in the country.

To know how our report can help streamline your business, Speak to Analyst

North America accounts for the second highest market share globally. Extreme climatic conditions, rising disposable income, and technological advancements are set to upsurge the sales volume of Heating, Ventilation, and Cooling (HVAC) systems in the region. The adoption of favorable climate standards is further supporting the demand for these systems. The HVAC System Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 62.03 billion by 2032, driven by the extensive installation Of pipelines to improve energy infrastructure across regions. The US market is projected to reach USD 44.42 billion by 2026.

Europe’s growing construction expenditures, residential property development, rising disposable income, and increasing government expenses are slated to surge the adoption of Heating, Ventilation, and Cooling (HVAC) systems. Moreover, regulatory policies have been introduced to support energy-efficient climate control solutions with a high preference for eco-friendly refrigerants. The UK market is projected to reach USD 2.19 billion by 2026, while the Germany market is projected to reach USD 7.2 billion by 2026.

Expansion of the real estate sector in arid regions of the Middle East & African countries is leading to a significant increase in sales of heating, ventilation, and air conditioning systems. Rising building construction, compliance with local regulations, and government initiatives are all encouraging the adoption of energy-efficient systems in the region. Latin America is to grow at a steady rate owing to diverse industry requirements across the region.

KEY HVAC INDUSTRY PLAYERS

Key Market Participants are Expanding their Presence Through Investment in R&D Activities

The market is highly fragmented in nature owing to a large number of players at global and regional levels. Key manufacturers are launching new energy-efficient and technology-enabled climate-controlled solutions for end-users. For instance, in January 2024, LG Electronics introduced a Multi F heat pump that offers climate-controlled solutions with versatile installation options. Increasing research and development expenditures, and mergers and acquisitions with domestic market participants to further surge the HVAC market presence.

List of Top Heating, Ventilation, and Cooling (HVAC) System Companies:

- Johnson Controls (Ireland)

- Daikin Industries Ltd. (Japan)

- Lennox International Inc. (U.S.)

- Carrier (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Nortek Global HVAC LLC (U.S.)

- LG Electronics (South Korea)

- Emerson Electric Co. (U.S.)

- Trane Technologies (Ireland)

- Samsung (South Korea)

KEY HVAC INDUSTRY DEVELOPMENTS:

- April 2024: Norwegian startup company named Tequs launched a water-to-water CO2 heat pump for residential and commercial applications. The new heat pump with higher capacities has a large touchscreen user interface for operators.

- March 2024: Aira introduced its new heat pump with smart features and a complete service offering with advanced technology. The new heat pump is operated with the smart app and sleek thermostat.

- May 2023: Delta T Systems introduced a Free Cooling System for industrial and commercial applications. The dry cooler or fluid cooler has been designed to offer energy-efficient cooling for a wide range of industrial and commercial applications with cost-effective and environment-friendly alternative solutions.

- December 2022: Mitsubishi Electric Australia introduced an energy-efficient indoor cooling system. The new s-MEXT provides efficient cooling for IT infrastructures and data centers.

- July 2022: LG launched its new ventilation system for residential buildings with CO2 sensors, HEPA filters, and UV-C technology.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application, Product Type, Application vs Capacity, and Region |

|

Segmentation |

By Product Type

By Application vs Capacity

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 290.08 billion by 2034.

In 2025, the global market was valued at USD 174.58 billion.

The market is projected to grow at a CAGR of 5.90% during the forecast period.

The heating equipment segment leads and accounts for more than 50% of the market share

The growing construction and real estate market is set to boost the demand for HVAC systems, impelling market growth.

Johnson Controls, Daikin Industries Ltd., and Lennox International Inc. are a few of the prominent players in the market.

Asia pacific region dominates the Heating, Ventilation, and Cooling (HVAC) System market.

Commercial application segment dominates by holding the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us