Helicopter Meteorological Software Market Size, Share & COVID-19 Impact Analysis, By Type (Helicopter and Heliports/Helipads), By Application (Emergency Medical Services, Corporate Services, Search & Rescue, Oil & Gas, Homeland, Security, Transportation, and Others), By Offering (Electronic Flight Display (EFD) Software, Application Based Software, PC/Desktop Software, and Mobile Software), and Regional Forecast, 2025–2032

KEY MARKET INSIGHTS

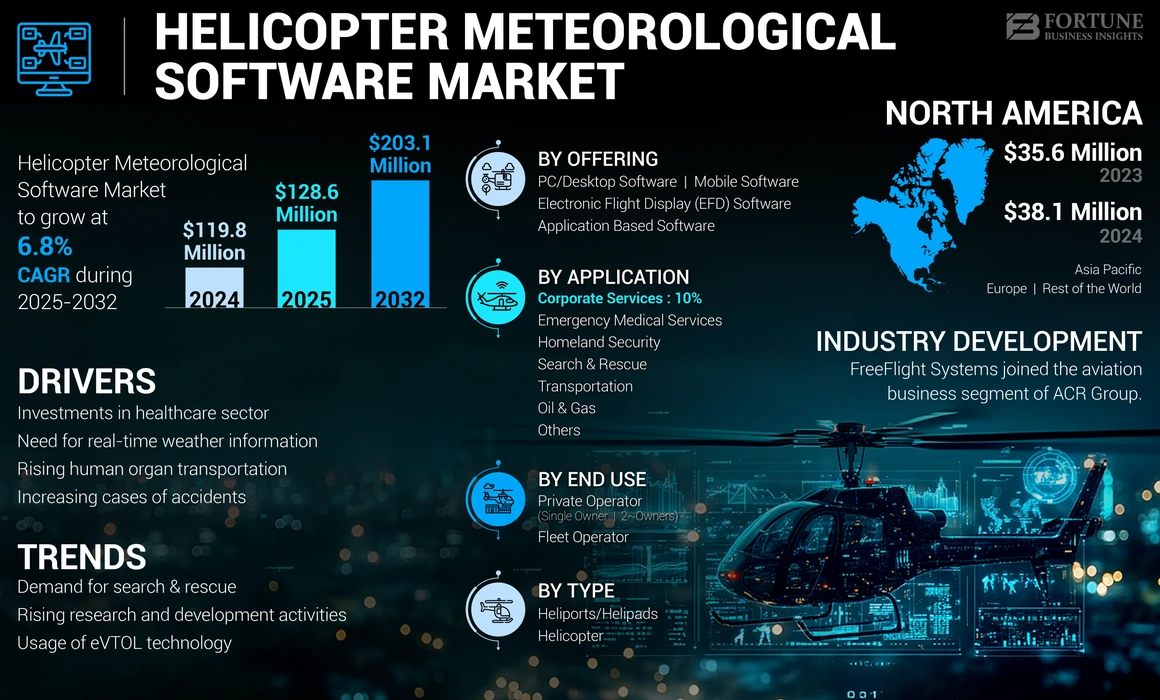

The global helicopter meteorological software market size was valued at USD 119.8 million in 2024. The market is projected to grow from USD 128.6 million in 2025 to USD 203.1 million by 2032, exhibiting a CAGR of 6.8% during the forecast period. North America dominated the helicopter meteorological software market with a market share of 31.8% in 2024.

Meteorological software gets climate data through meteorological radars, climate radars, sensors, flying airships, and helicopters. Radars give data such as temperature, wind speed, mugginess, wind course, climate, and other natural conditions. The collected data at that point is handled within the program. It is utilized to get ready reports such as Meteorological Aerodrome Reports (METARs), Terminal Aerodrome Estimates (TAFs), and wind aloft that are utilized within the flying industry.

The helicopter meteorological software installed in helicopters and heliports provides real-time information to air traffic controllers and pilots for efficient helicopter operations. Passenger safety is an important aspect of the aviation sector; aircraft operators always ensure the safety and comfort of their passengers, and helicopter meteorological software provides safety for all flights. Numerous operators and airlines are retrofitting old helicopters with the software and purchasing new helicopters equipped with the latest meteorological software, thereby driving the growth of the market over the forecast period.

GLOBAL HELICOPTER METEOROLOGICAL SOFTWARE MARKET OVERVIEW

Market Size & Forecast:

- 2024 Market Size: USD 119.8 million

- 2025 Market Size: USD 128.6 million

- 2032 Forecast Market Size: USD 203.1 million

- CAGR: 6.8% from 2025–2032

Market Share:

- North America dominated the helicopter meteorological software market with a 31.8% share in 2024, driven by the presence of key players, robust helicopter operations, and integration of advanced avionics systems across the U.S. and Canada.

- By offering, the Electronic Flight Display (EFD) software segment held the largest market share in 2024, supported by rapid advancements in cockpit display systems and demand for real-time atmospheric data.

Key Country Highlights:

- United States: Adoption is driven by strong demand for EMS helicopters, defense-related fleet modernization, and FAA mandates for enhanced flight safety and situational awareness.

- Germany: Focus on upgrading heliports with real-time weather software and integrating AI-based aviation systems to improve rescue and commercial operations.

- India: Rapid expansion of civil helicopter fleets for emergency medical services and infrastructure monitoring is creating demand for mobile-accessible meteorological software.

- Japan: Demand is fueled by frequent natural disasters requiring real-time weather updates for helicopter-based emergency responses and disaster recovery missions.

COVID-19 IMPACT

Challenges and Opportunities of COVID-19's Divergent Impact on the Market

The COVID-19 pandemic presented both challenges and opportunities for the market. Since the COVID-19 outbreak in December 2019, the disease has spread all over the world, leading to a complete halt in all aviation-related operations. A disrupted supply chain led to a scarcity of raw materials, impacting helicopter production and deliveries worldwide. As meteorological software is a principal component of a helicopter, the market experienced a decline in demand during the pandemic.

However, the pandemic also created opportunities for companies to invest in R&D, enabling the launch of advanced meteorological software to compete in this market. This, in turn, is expected to boost the global helicopter meteorological software market growth over the forecast period.

Helicopter Meteorological Software Market Trends

Integration of Artificial Intelligence in Meteorological Software to Positively Grow the Market

In recent years, there have been numerous advances in technology in the competition to provide the best and most accurate software to operators and helicopter manufacturers. Artificial Intelligence (AI) ensures accuracy in magnitude and speed predictions and facilitates better judgment for the pilot. Therefore, artificial intelligence is the most prominent trend in helicopter meteorological software. Numerous service airlines have started using AI-enabled software in aircraft for better meteorological assessments. For instance,

- In September 2022, Lufthansa, a global airline, unveiled increased on-time flights by using wind forecasting by Google Clouds. BISE winds, cold and dry winds in the northeastern to southwestern part of Switzerland over the Swiss plateau, hindered operations in Zurich Airport, which has now gained over 30% accuracy in meteorological predictions due to the integration of Google Cloud’s software.

Download Free sample to learn more about this report.

Helicopter Meteorological Software Market Growth Factors

Rising Fleet of Helicopters to Catalyze the Market Growth

There has been a surge in helicopter deliveries, leading to growth in the helicopter fleet. Helicopter pilots require real-time atmospheric and weather information to operate helicopters in harsh environments and avoid accidents. Thus, the demand for helicopters is continuously increasing for numerous applications, which, in turn, is creating a need for weather monitoring software.

Growing applications of helicopters in transport, delivery, and medical fields, such as air ambulance, are expected to further grow the market for helicopters as well as the market for meteorological software.

Technological Advancements to Aid Real-time Data and Bolster Market Growth

Increasing demand for helicopters for a variety of applications, such as search & rescue, oil & gas, emergency medical services, transportation, and others, is driving the growth of the market. Helicopter operations require real-time atmospheric data such as temperature, wind speed, and weather forecasting information to prevent accidents. The rising number of accidents and safety norms described by the Federal Aviation Administration (FAA) are also major reasons for the implementation of real-time data management software. Real-time data tracking assists the pilot in making the required decisions during flights. Moreover, information related to the helicopter system and software is provided by the flight management software installed in the helicopter.

- For instance, in July 2022, Elbit Systems, a meteorological software company, launched a fifth-generation aircraft vision suite for military helicopters. The software integrates an AI-powered mission computer, a Helmet-Mounted Display (HMD) system, and a compiled array of sensors.

RESTRAINING FACTORS

Lack of Weather Analysis Accuracy to Restrict Market Growth

Even with the latest technological advancements and growing helicopter fleets and applications, there isn’t complete precision in weather detection and analysis due to many reasons. The primary reasons for the same can be the variable nature of weather, wind, and other components, which lead to inaccurate readings. Technological advancements have led to nearly accurate analyses but not completely accurate. This, in turn, can cause a hindrance to the market of helicopter meteorological software over the forecast period.

Helicopter Meteorological Software Market Segmentation Analysis

By Type Analysis

Growing Application and Delivery of Helicopters Led to Dominance of Helicopter Segment

Based on type, the market is categorized into helicopter and heliports/helipads.

The helicopter segment accounted for the largest market share and is anticipated to grow at a higher compound annual growth rate, owing to the growing demand and delivery of helicopters for various civil and military applications. Additionally, during the COVID-19 pandemic, the emergence of demand for air ambulances led to a boost in helicopter production globally.

The heliports/helipads segment is predicted to grow at a significant CAGR owing to several technological advancements and applications. Furthermore, there are growing helicopter applications and advancements in aviation infrastructure in developing and developed nations.

By Application Analysis

Emergency Medical Services Dominates the Market Owing to Air Ambulance Application

Based on application, the market is categorized into emergency medical services, corporate services, search & rescue, oil & gas, homeland security, transportation, and others.

The Emergency Medical Services (EMS) segment is anticipated to be the largest segment owing to air ambulance applications, which fueled the demand for helicopters during the pandemic. In the aftermath of the pandemic, air ambulance and emergency medical services are considered relevant and are expected to maintain their dominance owing to surging demand for quick medical services and medical equipment transport.

- For instance, in June 2021, Dunzo, a hyperlocal delivery service provider, announced that it's working with a consortium of industry experts for remotely operated drone-based medicinal and healthcare logistics in Telangana state in partnership with the Government of Telangana.

The oil & gas segment is expected to grow at the highest CAGR over the forecast period owing to increasing oil extraction and transport, which is expected to further aid the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Offering Analysis

Electronic Flight Display Software Segment Dominates Owing to Rapid Technological Developments

Based on offering, the market is divided into Electronic Flight Display (EFD) software, application based software, PC/desktop software, and mobile software.

The Electronic Flight Display (EFD) software segment accounted for the largest market share in 2024 and is anticipated to maintain its dominant position over the forecast period. This position can be attributed to constant technological advancements in aircraft avionics and meteorological software.

The PC/desktop software segment is anticipated to grow at the highest CAGR from 2025-2032, owing to the surge in demand for remote helicopter meteorological software access. In the aftermath of the COVID-19 pandemic, it has been observed that remote access to software is being preferred by operators, thereby ensuring a surge in PC/desktop software. Additionally, the mobile software segment is expected to grow at a significant CAGR due to ease of operations and remote access to meteorological software.

REGIONAL INSIGHTS

By region, the market is analyzed across North America, Europe, Asia Pacific, and the Rest of the World.

North America Helicopter Meteorological Software Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America market was valued at USD 38.1 million in 2024. The region is expected to dominate the helicopter meteorological software market share due to increasing demand for helicopters for various commercial applications and the presence of key market players such as ForeFlight LLC and Collins Aerospace.

The Asia Pacific market is anticipated to grow at the highest CAGR during the forecast period owing to increase in the number of OEMs in the region. Additionally, a growing aerospace sector, advancements in technology, and the overall infrastructure development are anticipated to support the rapid market growth of helicopter meteorological software over the forecast period.

Europe accounted for a significant market share in 2024. The region’s large share is due to increased demand for helicopters from developed European countries such as France, the U.K., Italy, and Germany. The rising demand is due to the budding fleet expansion in the region. Additionally, the pandemic has subsequently led to a growth in the number of helicopter operators to facilitate helicopter operations.

The rest of the world consists of Latin America and the Middle East & Africa. Latin America is expected to witness significant growth due to infrastructural developments and various reforms introduced by governments in the region to facilitate smooth aerospace operations.

KEY INDUSTRY PLAYERS

Key Market Players are Focused on Providing Advanced Software in the Market

The global market is consolidated, with several global helicopter meteorological software players operating in this industry. The key players have a variety of product portfolios with a focus on providing the latest and most advanced helicopter meteorological software. The top players in the industry are ForeFlight LLC, Honeywell International Inc., Leonardo S.p.A., and other listed companies.

Other prominent players engaged in the market include HELI EFB GmbH, KONGSBERG Gruppen ASA. Major OEMs have partnerships or acquisitions to sustain their market position.

List of Top Helicopter Meteorological Software Companies:

- All Weather, Inc. (U.S.)

- Automasjon & Data AS (Norway)

- Campbell Scientific (U.S.)

- DTN LLC (U.S.)

- EUROAVIONICS GmbH (Germany)

- ForeFlight LLC (U.S.)

- HELI EFB GmbH (Germany)

- Honeywell International Inc. (U.S.)

- InControl AS (Norway)

- KONGSBERG Gruppen ASA (Norway)

- Leonardo S.p.A. (Italy)

KEY INDUSTRY DEVELOPMENTS:

- March 2023 – The global conglomerate Leonardo S.p.A unveiled market acceptance of Lidar-based technology for advanced weather forecasting. The market acceptance of the two-year-old flagship technology showcases extremely powerful developments. The system was sold through Leonardo Germany GmbH as a highly advanced and reliable weather forecast named SIKRON3D.

- May 2022 – Honeywell International Inc.’s authorized channel partner ABS Jets entered into an agreement with Embraer to provide retrofits to its legacy aircraft. The aircraft is expected to be retrofitted with Honeywell’s IntuVue RDR-7000 advanced weather radar system.

- April 2022 – Air Methods, a U.S.-based air medical transport company, partnered with Skyryse, a transport-tech company, to retrofit over 400 fixed-wing aircraft and single-engine helicopters in Air Methods fleet with Flight OS, a shared mission to protect pilots and patients and further advance safety measures.

- December 2021 – NTSB, the pilot training authority of the U.S., launched a weather simulator for P3D and FSX named CLIMADRIVE. The regulatory bodies have been using such stimulating software for many years, which will now be available to the general public.

- January 2020 – Avidyne Corporation introduced its novel multifunction flight management system, Avidyne HELIOS, for helicopters. This system is designed to integrate seamlessly with the existing helicopter equipment. The new system is an extension of the multifunction FMS line.

REPORT COVERAGE

The report provides detailed information on the market and focuses on leading companies, software types, and leading applications. Besides this, the report offers insights into the market trends, market competition, and highlights key industry developments. In addition to the above factors, it contains several factors that have contributed to the sizing of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.8% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Type

|

|

By Application

|

|

|

By Offering

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights stated that the global market size was USD 119.8 million in 2024.

Registering a CAGR of 6.8%, the market will exhibit rapid growth during the forecast period (2025-2032).

The PC/desktop software segment will dominate this market during the forecast period.

ForeFlight LLC and Leonardo S.p.A are the leading players in the global market.

North America topped the market in terms of shares in 2024.

The U.S. dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us