High Voltage Motor Sleeve Bearing Market Size, Share & COVID-19 Impact Analysis, By Type (Below 100 mm, D 100 - 200 mm, D 200 - 400 mm, D 400 - 600 mm, and Above 600 mm), By Application (Below Frame 355 mm, Frame 355 - 560 mm, and Above Frame 560 mm), and Regional Forecast, 2026-2036

High Voltage Motor Sleeve Bearing Market Size

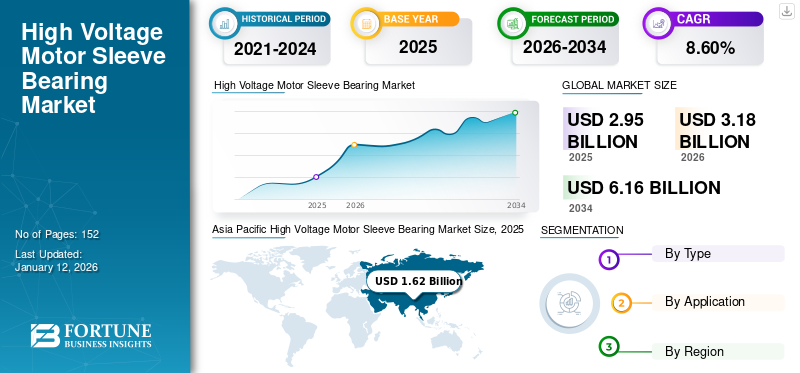

The global high voltage motor sleeve bearing market size was valued at USD 2.95 billion in 2025 and is projected to grow from USD 3.18 billion in 2026 to USD 6.16 billion by 2034, exhibiting a CAGR of 8.60% during the forecast period. The North America dominated global market with a share of 21.00% in 2025.

High voltage motor sleeve bearings are the necessary components on both sides of the motor, allowing for alignment of the axial shaft and lubrication with hydrodynamic lubrication. These are made of hard or ionized materials offering high lifespan or infinite life. Also, it bears a heavy axial or radial load and requires less or no maintenance. The products are offered across the industry in different sizes from below 100 mm to above 600 mm for other applications per frame sizes.

Global High Voltage Motor Sleeve Bearing Market Overview

Market Size:

- 2025 Value: USD 2.95 billion

- 2026 Value: USD 3.18 billion

- 2034 Forecast Value: USD 6.16 billion

- CAGR (2026–2034): 8.60%

Market Share:

- Regional Leader: North America held approximately 21.00% market share in 2025

- Fastest-Growing Region: Asia Pacific, driven by infrastructure and manufacturing growth

- Top Application Segment: Below Frame 355 mm motors, with strong demand in industrial automation and EVs

Industry Trends:

- Renewable Energy Expansion: Increased investments in wind, solar, and clean energy infrastructure boost demand

- Infrastructure Upgrades: Modernization of power generation, transmission, and industrial facilities

- Electrification & Urbanization: Rapid urban growth and electrification in Asia and Africa drive market expansion

- Product Innovation: Development of maintenance-free, high-efficiency, and advanced material sleeve bearings

Driving Factors:

- Rising Electricity Demand: Urbanization and industrialization increase need for high voltage motors and bearings

- EV & Automation Growth: Surge in electric vehicle production and industrial automation fuels demand for small and mid-size bearings

- Government Initiatives: Support for smart infrastructure, FDI, and energy sector development

- Replacement & Upgrades: Ongoing replacement of old motors and retrofitting with high-performance sleeve bearings

However, the widespread pandemic disruptions in the global supply chain sector with halted import-export economies globally have shaken. Thus, major agro-based economies such as India, Mexico, China, South Africa, Canada, and others have noted a rise in domestic electricity demand. This boosted the demand for new energy infrastructure development across geographies. Also, the renewable infrastructure development investments and sustainability trends across geographies raise the valuation of the high voltage motor sleeve bearing market over the forecast period.

COVID-19 IMPACT

Reduced Demand and Pricing Volatility to Create Short-Term Disruptions across the Market

The COVID-19 pandemic caused an unsettling impact on the global production sector, with volatility across material prices and inadequate or reduced demand. This caused a downturn in the machinery and manufacturing sector due to reduced demand and the high cost of operations across immensely populated countries such as India, China, and others. However, the post-pandemic resurrected supply-demand and restructuring of product portfolios by key players have created a good environment for market growth.

LATEST TRENDS

Download Free sample to learn more about this report.

Growing Renewable Energy Sector and Infrastructure Upgrade Investment to Increase Sleeve Bearings Adoption

The increasing infrastructure development across various sectors, such as power generation, manufacturing, oil and gas, and mining, is the latest trend across developing countries. Also, the global push toward achieving carbon neutrality targets for environment sustainment has fast-tracked the clean energy generation activities, which drives high voltage motor sleeve bearing demand.

- For instance, according to a September tracking report by International Energy Agency (IEA), Wind generation in 2021, wind energy generation recorded 273 (TWh) of electricity generation, with an increase of 55% from 2020 and the highest among the renewable energy sector.

Furthermore, many countries invest heavily in upgrading infrastructure across power generation, transmission, and distribution infrastructure.

Also, upgrading involves installing new motors and replacing or refurbishing existing engines with newer high-voltage motors equipped with sleeve bearings that enable smooth functioning.

DRIVING FACTORS

Urbanization Growth and Demand for Electricity to Surge Demand across Industry

Rapid urbanization across Asian countries, such as India, Malaysia, Singapore, and many others, has bolstered the infrastructure development of commercial spaces, such as railway terminals, airport terminals, super and hypermarkets, and others, which need low-speed motor drive systems.

- According to the United Nations World Urban Population Report, growth in urbanization and continual population rise is expected to add around 2.5 billion by 2050 to the world’s urban population, with increased concentration across Asia and Africa.

Additionally, the government has plotted infrastructure plans to fulfill the urban development needs with the smart ecosystem and energy requirements across the logistics and passenger moving industry is driving demand for high voltage electric motors across the transportation and logistics sector. Thus, the growing population and rising infrastructure development across the renewable industry fulfill the increasing electricity demand and are estimated to compel demand across electricity generation motors and will consequently uplift the market growth over the forecast period.

RESTRAINING FACTORS

Increasing Adoption of Advanced Frictionless Bearing Driving Shafts is Impeding the Market

Global bearing dynamics have changed a lot with the growing applications of frictionless drive systems and geared motors bearings market has grown significantly, with heavy load application bearing offering maintenance free capabilities hindering the market of sleeve bearings.

Technological advancement in bearing technology and alternative presence, such as rolling element bearings and magnetic bearings, can restrain the high voltage motor sleeve bearing revenue. These bearings approach her performance capabilities such as higher loads, low friction, and maintenance-free, making them more capable for certain applications.

For instance, In May 2023, SKF world’s leading Bearing Manufacturer, increased their technical and manufacturing capabilities to address the growing demand for magnetic bearings with an investment of USD 4.71 million to a new manufacturing site in Morocco.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Small Bearing Offerings and Increased Product Development to Strengthen the Market

Based on type, the market segment is classified into different sizes offered such as below 100 mm, D 100 - 200 mm, D 200 - 400 mm, D 400 - 600 mm, and above 600 mm.

The smaller bearing size range is below 100 mm and the D 100-200 mm segments are projected to grow exponentially with a share of 41.19% in 2026 across type segments. Introducing highly efficient and maintenance-free bearings enhances operational time, and reduced maintenance cost is considered a crucial factor in expanding the market size over the forecast period.

Additionally, governance across geographies pushing electrification as an alternative to highly pollutant crude oil is raising the adoption of electric vehicles. Thus, initiating the EV revolution across geographies has increased the demand for high-voltage electric motors in the automobile sector. Moreover, industrial facility operators are also working toward inculcating a high level of automation at their facilities to increase production efficiency and quality which is also identified as a critical factor with a positive impact on market growth.

- For instance, according to EV Sales Volume Database, EV sales rose by 55%, reaching 10.5 million with a growing market share of 13%.

By Application Analysis

Smaller Frame Sizes up to 355 mm to Intense Growth Owing to Small Motors Demand

Based on application, the market is subdivided into smaller frame sizes ranging from below frame 355 mm, frame 355 - 560 mm, and above frame 560 mm. The market is projected to grow in segment of below frame 355 mm is projected to grow with contribution of 42.45% globally in 2026

Globally increased demand for electric motors across the industrial sector bolstered the demand for high voltage motor sleeve bearings. Also, the wide application of electric motors across the electric vehicle industry is growing the need for high voltage motor sleeve bearings across smaller electric motors of frame sizes below 355mm. Adopting industrial automation and industry-oriented development programs such as Industry 4.0 and IoT is revolutionizing development across the electric sector. Thus, demand for electric motors across the EV and industrial sectors progressively bolstered the high voltage motor sleeve bearing market share.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific High Voltage Motor Sleeve Bearing Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The market value of Asia Pacific was USD 1.76 billion in 2034 and is likely to observe an impressive CAGR during the forecast period. Economic stability and growth of China, India, and other countries within the ASEAN region led to the development of the Asia Pacific market.

The regional market is expected to increase exponentially, owing to heavy integration of automation into industrial electrical motors. Also, the support from governments in the different countries is trying to increase the manufacturing base of the foreign entities in their domestic manufacturing clusters to emerge as an important market contributor. The governments provide numerous tax subsidiaries, sketching favorable policies for foreign direct investments (FDI) initiatives. These factors also encourage application industry market participants to set up operational facilities in the said region. The perfect blend of demand-side availability and supply-side demand collectively drives the regional market growth. The Japan market is projected to reach USD 0.21 billion by 2026, the China market is projected to reach USD 1.21 billion by 2026, and the India market is projected to reach USD 0.13 billion by 2026.

India’s Fast Pace of Infrastructure Development

The government’s commitment to substantiate growth in the energy sector is anticipated to encourage regional growth prospects. Also, a heavy concentration of the laboring population in the region’s developing economies and, subsequently availability of labor at relatively lower wages is attracting numerous global market players to these markets to establish their manufacturing facilities.

- For instance, According to the data for Promotion of Industry and Internal Trade (DPIIT), the foreign direct investment equity inflows in 2022 reached a USD 52.34 billion increase from USD 51.34 billion the previous year.

North America

The presence of prominent high voltage induction motor manufacturers and significant increase in demand for such motors are prompting a healthy future for the sales of sleeve bearings. The majority of North American high voltage motor sleeve bearing is tailored products and must be manufactured based on the customers' requirements. North America dominated the global market in 2025, with a market size of USD 0.62 billion. Thus, the manufacturers are offering make-to-order and making considerable investments in the research wings to elevate product portfolio diversity and create efficient products. These are some pivotal factors advancing North America's development potential. The U.S. market is projected to reach USD 0.53 billion by 2026.

Europe

In Europe, especially Germany, has pioneered the automotive industry with well-established and state-of-the-art manufacturing clusters for developing automotive vehicles. With the increasing importance of electric cars, the demand for high-voltage motors registered noticeable growth in the EV sector over the recent past. Notably, most regional manufacturers are anticipated to integrate industrial automation and create industry 4.0-related developments. These advancements in manufacturing facilities will subsequently create significant demand for Europe high voltage motor across the region. The UK market is projected to reach USD 2.45 billion by 2026, and the Germany market is projected to reach USD 3.87 billion by 2026.

- For instance, according to the European Commission press corner in December 2022, the EU has invested around USD 66 million in 17 small-scale innovative tech projects with EU innovation funds.

Middle East and Africa

The GCC holds the highest market share in the Middle East and Africa region, owing to the heavy acceptance of plain bearings and its impressive load-carrying capacity in the developed gulf countries. The development of railway, heavy industries, and industrial distribution sectors has been growing progressively, which entails the Africa high voltage motor.

South America

The South American market's key growth factor is consumers' significant shift toward industrial machinery with better performance standards and high-quality products with novel designs. Moreover, Brazil is projected to have the highest market share across Latin America. However, heavy dependency on imported products due to underdeveloped manufacturing facilities could curtail the projected demand prospects.

KEY INDUSTRY PLAYERS

Leading Players Enhanced R&D Initiatives and Advanced Material Offerings to Expand Market

The high share of the established market leaders is due to their diverse product portfolio offerings. Key players of high voltage motor sleeve bearing have recognized capital growth with price/mix from a design innovation perspective with various product offerings and services. Product portfolio expansion makes vigorous and organized efforts to continuously improve its dominant position on the cost curve with parts and onsite services. Also, players adopted a lean strategy to expand their product portfolio with diverse offerings that help to maximize profits with lowering operational expenses.

- For instance, In November 2022, Schaeffler, a leading bearing manufacturer, strengthened its industrial business capabilities by acquiring CERASPIN, which adds up a specialty to a high-quality ceramic components portfolio.

LIST OF TOP HIGH VOLTAGE MOTOR SLEEVE BEARING COMPANIES:

- AB SKF (Sweden)

- Schaeffler AG (Germany)

- Miba AG (Austria)

- The Timken Company (U.S.)

- NTN Corporation (Japan)

- Misumi Group Inc. (Japan)

- Igus GmbH (Germany)

- RENK AG (Germany)

- Hunan Sun Technological Corporation (China)

- Shenke Slide Bearing Corporation (China)

KEY INDUSTRY DEVELOPMENTS:

- February 2025: Igus GmbH, a global manufacturer of sleeve bearings, offers various products that are highly resistant and maintenance-free. These are provided under sustainable polymer-based compounds under the Iglide series.

- January 2025: Spain’s Fersa, a leading bearing manufacturer, penetrated the Indian bearing industry with a major stake in Delux Bearings, a manufacturer of bearings and electromechanical components.

- July 2024: Bearing Corporation, a leader in bearing, launched its brand BCG bearings, and sleeves, focusing on gaining a premium spot in the China market.

REPORT COVERAGE

The research report provides a detailed global market analysis and focuses on key aspects such as leading companies, equipment types, and leading product applications. Besides this, the report offers insights into the market trends and highlights the key industry developments, SWOT analysis, and competitive landscape. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 8.60% from 2026 to 2034 |

|

Segmentation |

By Type, By Application & By Region |

|

By Type |

|

|

By Application |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.18 billion in 2026 and is projected to reach USD 6.16 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 1.62 billion.

The market is expected to grow at a CAGR of 8.60% the market will exhibit steady growth during the forecast period (2026-2034).

Smaller bearing sizes in the type segment of the range below 100mm and D 100 mm-200 mm are expected to be the leading segments during the forecast period.

Growing urbanization and demand for electricity are key factors driving the market.

AB SKF, Schaeffler Group, the Timken Company, NTN Corporation, and Miba AG are the major players in the global market.

The increasing adoption of advanced frictionless bearing driving shafts is impeding the market growth.

The application for frame sizes ranging below 355mm is driving the adoption of these bearings across small industrial motors and the EV industry.

Growing renewable energy sector and infrastructure upgrading investment trends to boost high voltage motor sleeve bearing adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us