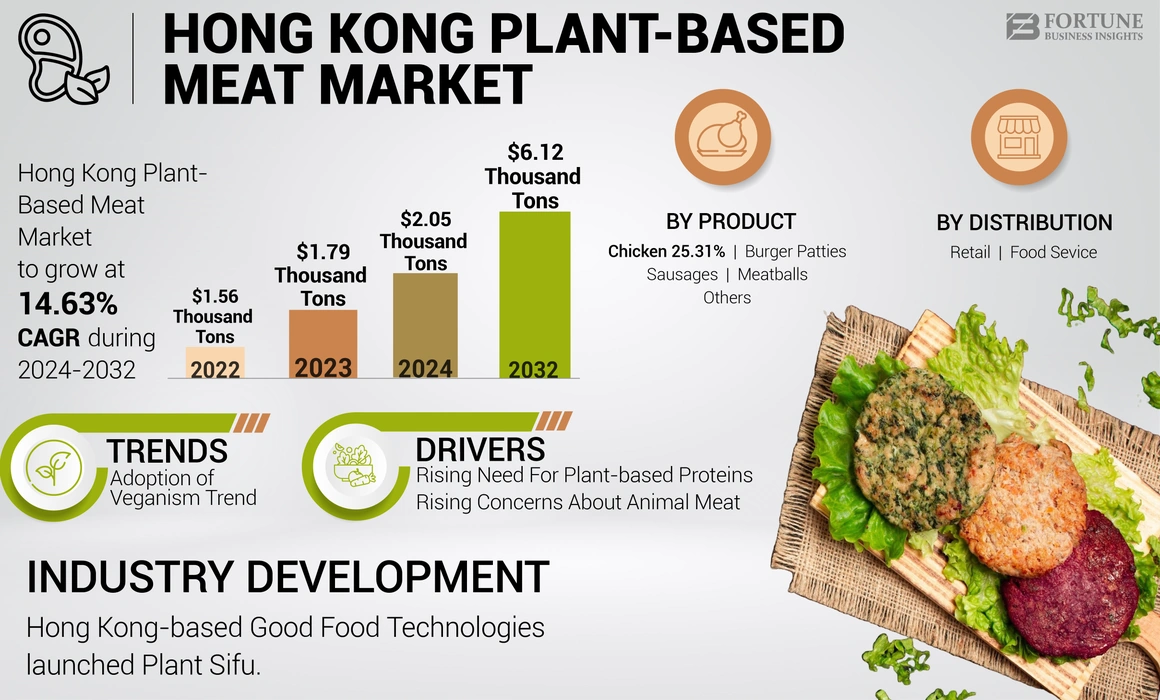

Hong Kong Plant-Based Meat Market Size, Share & Industry Analysis, By Product (Burger Patties, Sausages, Meatballs, Chicken, and Others), By Distribution Channel (Retail and Food Sevice), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

The Hong Kong plant-based meat market size in terms of consumption was 1.79 Thousand Tonnes in 2023. The market is projected to grow from 2.05 Thousand Tonnes in 2024 to 6.12 Thousand Tonnes by 2032, exhibiting a CAGR of 14.63% during the forecast period.

The Hong Kong plant-based meat market is split into different products, such as burger patties, sausages, meatballs, chicken, and others, which are distributed through retail and food service operators. The country is one of the significant consumers of meat globally and thus, has a significant addressable market for meat alternative products. The Hong Kong's plant-based meat market growth is propelled by increasing health awareness, environmental concerns, and a rising population of flexitarians and vegetarians.

Environmental apprehensions, such as deforestation and greenhouse gas emissions, further bolster this trend. Additionally, ethical considerations drives the demand for cruelty-free options—government support, including subsidies for sustainable food initiatives, bolsters market expansion. Celebrities and influencers demand plant-based diets and meat-free diets, amplifying consumer awareness and adoption. Accessibility grows through retail and food service partnerships, diversifying consumer options. For instance, in 2019, Green Monday Holdings announced Cantonese platinum pop star Kay Tse as Chief Kindness Officer to promote sustainable food consumption.

The spread of the COVID-19 pandemic drastically changed the world markets and significantly affected different industries, including the Hong Kong plant-based meat industry. Restrictions on international travel and trade disruptions led to delays in importing raw materials and ingredients for vegan meat production and overall food production. This affected manufacturing schedules and product availability. Lockdown measures, reduced transportation capacity, and stringent health protocols disrupted logistics and distribution networks in the food service industry, thus hindering the timely delivery of vegan meat products to consumers.

The COVID-19 pandemic presented significant challenges for meat alternative market in Hong Kong, impacting supply chains, production capabilities, consumer behavior, food service demand, market expansion efforts, and consumer education initiatives. Adaptation to the evolving market conditions, resilience, and innovation will be crucial for manufacturers and stakeholders in navigating the challenges posed by the pandemic and sustaining growth in the plant-based meat market in Hong Kong.

Hong Kong Plant-Based Meat Market Overview & Key Metrics

Market Size & Forecast:

- 2023 Market Size: 1.79 Thousand Tonnes

- 2024 Market Size: 2.05 Thousand Tonnes

- 2032 Forecast Market Size: 6.12 Thousand Tonnes

- CAGR: 14.63% from 2024–2032

Market Share:

- The Hong Kong plant-based meat market is segmented into burger patties, sausages, meatballs, chicken, and others, distributed through retail and food service operators. Chicken held the leading market share in 2023, followed by burger patties, driven by consumer preference for high-protein diets and products mimicking conventional meat. Food service dominated the distribution channel due to partnerships with major players such as KFC, McDonald’s, and Burger King, enhancing accessibility and awareness.

Key Country Highlights:

- Hong Kong: Market growth is driven by increasing health consciousness, environmental concerns, and a growing flexitarian and vegetarian population. Government support through subsidies for sustainable food, combined with celebrity endorsements and influencer marketing, is amplifying demand. Post-COVID recovery and innovation in plant-based meat technologies are expected to fuel future expansion.

Hong Kong Plant-Based Meat Market Trends

Adoption of Veganism Trend Supports Market Growth

One of the most well-liked eating trends that people are gradually embracing across the globe is veganism. Since vegans get all their protein from plant-based foods, there is a fair amount of demand among these consumers for clean meat alternatives. According to the Good Food Institute, the number of vegans in China is around 4%. It is anticipated that this rise in the vegan population is also projected to fuel the Hong Kong plant-based meat market growth in the coming years.

Moreover, the industry has been presenting a change in consumer inclinations toward organic and environmentally friendly food consumption. Thus, producers are employing novel packaging techniques for meat substitutes, such as carbon labeling, to support consumers know the environmental impact of such products’ packaging. Some vendors, such as Tesco made efforts to use carbon labeling on food items and inform buyers about their food. These efforts also push consumers to buy ecological food products.

Download Free sample to learn more about this report.

Hong Kong Plant-Based Meat Market Growth Factors

Rising Need For Plant-based Proteins to Boost Market Growth

In Hong Kong, theres is a drastic change in customer food choices. Consumers are more aware of a healthy lifestyle and embrace a balanced attitude toward protein consumption. To address this, customers are implementing a practical method and enhancing protein consumption to make sure that they stay fit and strong for a long time. Therefore, they are enlightening their dietetic practices and including plant-based protein products in their diet.

Hong Kong is the first foreign market where "Impossible Foods" and "Beyond Meat" launched their products. Additionally, the plant-based pork alternative "Omnipork" is also present in the market to compete with Beyond Meat and Impossible Foods. The business expansions of these brands in Hong Kong are mainly inspired by sustainability and environmental concerns, animal welfare awareness, consumption of substitute proteins, and the growing number of consumers shifting away from conventional meat products.

Rising Concerns About Animal Meat to Boost the Adoption of Meat Substitutes

There are numerous health illnesses linked to eating red meat. A consumer study led by the Harvard School of Public Health concluded that red meat raises the risk of cardiac disease, diabetes, cancer, and other severe diseases among users. Thus, to improve health and reduce the risk of such disease, consumers can replace red meat with vegan protein products, such as tempeh, tofu, deflated soy chunks, seitan, and similar products with meat-like protein products. Such dietetic variations are probable to significantly lessen the risk of health disorders and recover consumers' health.

Additionally, animal farms are one of the key contributors to global warming owing to their higher greenhouse gas emissions and enormous use of fresh water supply and grasslands for rearing. As per the Food and Agriculture Organization data, livestock generates nearly 14.5% of the overall greenhouse gas emissions globally. Comparably, meat substitutes need fewer natural resources and produce fewer greenhouse gases, making them viable alternatives to animal-based products. This is influencing consumers’ shift toward meat substitutes and thus promotes the market's growth.

RESTRAINING FACTORS

High Costs of Products and Intricate Meat Substitute Production Process to Impede Market Growth

Products, including tofu, require widespread processing and the addition of numerous additives to lengthen their shelf life. This can ominously influence the consistency and taste of the products. Consequently, there is a decline in the adoption of these products by consumers who choose healthy products with minimum ingredients. The meat substitute manufacturing procedure is tremendously complex. Meat alternatives sustain major proceedings throughout the production stages. Meanwhile, diverse materials are utilized to create the final product. Producers use techniques, such as batch production. This upsurges the total plant-based meat substitute manufacturing price.

Thus, the complex manufacturing process makes the meat substitutes costly compared to conventional meat products in various retail stores. The high price of vegan meat makes those products less alluring to price-sensitive customers and further hinders market growth. For most consumers, closing the price gap would likely surge the purchase committed toward plant-based products.

Hong Kong Plant-Based Meat Market Segmentation Analysis

By Product Analysis

Rapid Growth in Demand for High Protein Diets among Individuals to Drive the Chicken Segment Growth

Based on product, the Hong Kong plant-based meat market is segmented into burger patties, sausages, meatballs, chicken, and others.

The chicken segment held the leading share of the Hong Kong market, followed by burger patties. The region’s diverse dietary preferences and culinary traditions contribute to the variety of vegan meat product consumption and rapidly rising new product development especially across burger patties and chicken. These products have gained significant popularity due to their ability to mimic the taste, texture, and appearance of conventional meat products. These plant-based chicken and burger patties cater to both vegetarians and meat-eaters, offering a healthier and more sustainable alternative.

Others segment of the product type analysis include products such as pork meat cuts, beef cuts, tenders and cutlets, strips and nuggets, and ground meat. This segment is expected to grow with a steady CAGR, and the demand for these products is expected to flourish in the coming years.

In summary, the plant-based meat market in Hong Kong offers a diverse range of products catering to various consumer preferences and culinary applications. Continued innovation and product development in this space is expected to drive further growth and market penetration in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Surging Demand for Vegan Meat across Food Service Channels to Fuel Market Growth

On the basis of distribution channel, the Hong Kong plant-based meat market is segmented into retail and food service.

The food service segment dominates the market due to strategic partnerships with major operators, such as KFC, McDonald’s, and Burger King, by key players, such as Beyond Meat and Impossible Foods. Furthermore, the region does have diverse preferences and consumption habits with an extensive range of local cuisine dishes.

Retail distribution channels include supermarkets, specialty stores, health food outlets, grocery stores, and online platforms. These outlets offer a wide array of plant-based meat products, making them accessible for home consumption.

KEY INDUSTRY PLAYERS

Market Players Focus on New Product Launches to Extend their Footprint

The Hong Kong plant-based meat market is highly competitive, with several international and local players competing to expand their market shares. A few major players in the market are Beyond Meat, Impossible Foods, Green Monday Holdings, and others. In the fiercely competitive plant-based meat market in Hong Kong, companies vie for their dominance through various means, such as product innovation, taste, authenticity, distribution channels, and marketing strategies. Furthermore, these firms invest heavily in research and development to craft novel and superior plant-based meat alternatives to capture market share.

List of Top Hong Kong Plant-Based Meat Companies :

- Beyond Meat, Inc. (U.S.)

- Impossible Foods Inc. (U.S.)

- Green Monday Holdings (OmniFoods) (Hong Kong)

- Nestle S.A. (Switzerland)

- Unilever (The Vegetarian Butcher) (U.K.)

- Moving Mountain Foods (U.K.)

- ConAgra Brands Inc. (Gardein) (U.S.)

- Good Food Technologies (Plant Sifu) (China)

- Charoen Pokphand Foods PLC (CPF) (Meat Zero) (Thailand)

- Unlimeat (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Good Food Technology (Plant Sifu) announced that the company extended its partnership with the city’s flag carrier, Cathay Pacific, to bring its plant-based pork range to travelers across the globe. This new partnership is the company’s aggressive initiative to expand its geographical presence.

- October 2023 – Haofood Food Technology announced that the company had won laurels for its innovative technology, creating plant-based chicken meals from processing residue. The peanut-protein plant-based chicken meat developed by Haofood (Shanghai) Food Technology uses patented manufacturing technology to create its proprietary protein, which resembles the taste and texture of chicken. The company’s plant-based meat is now available across Mainland China and Singapore through 3,000 sales points.

- June 2023 – Nestle S.A. announced its partnership with Hong Kong-based DayDayCook to create a new range of plant-based meal options. The new collaboration brings to market a line of shelf-stable products that incorporate Harvest Gourmet’s vegan ingredients sourced domestically.

- April 2022 – Hong Kong-based Good Food Technologies launched a new brand of vegan pork and dumplings called Plant Sifu. The pork alternative used in the products is made using AROMAX, the company’s proprietary fat technology.

- April 2022 – UNLIMEAT, the famous brand of plant-based meat, announced that it is launching a dish incorporating its plant-based meat at all Hong Kong IKEA branches. The plant-based Teriyaki beef with rice uses UNLIMEAT Slice, the company's most popular product.

REPORT COVERAGE

The research report provides a detailed analysis of the Hong Kong plant-based meat market and focuses on key aspects such as leading companies, products, and distribution channels. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 14.63% from 2024-2032 |

|

Unit |

Volume (Thousand Tonnes) |

|

Segmentation |

By Product

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the global market consumption was 1.79 Thousand Tonnes in 2023 and is expected to reach 6.12 Thousand Tonnes by 2032.

The market is likely to grow at a CAGR of 14.63% over the forecast period.

By product, the others segment led the market.

The increasing demand for plant-based proteins drives market growth.

Beyond Meat, Impossible Foods, Green Monday Holdings (OmniFoods), Unilever (The Vegetarian Butcher), Nestle S.A., Conagra Brands Inc. (Gardein), and others are the major players in the market.

The rising concerns related to animal meat fuel adoption of meat substitutes.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us