Huntington’s Disease Treatment Market Size, Share & Industry Analysis, By Drug (Tetrabenazine, Deutetrabenazine, Valbenazine, and Others), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

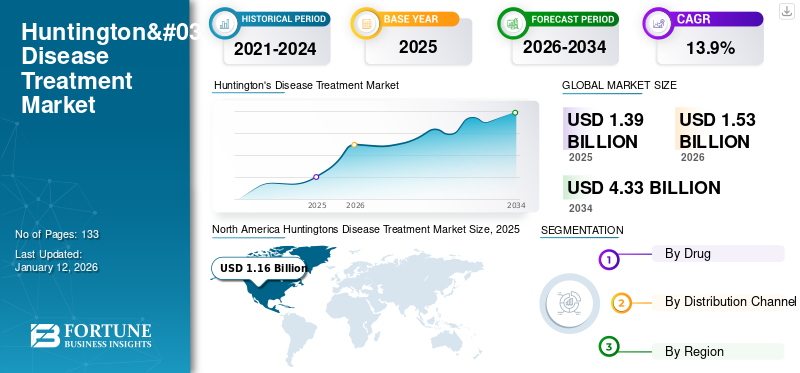

The global Huntington’s disease treatment market size was valued at USD 1.39 billion in 2025. The market is projected to grow from USD 1.53 billion in 2025 to USD 4.33 billion by 2034, exhibiting a CAGR of 13.9% during the forecast period.

Huntington’s Disease (HD) is a rare genetic disorder where the nerve cells in the brain begin to deteriorate over time. While there is no cure for HD, its symptoms can be managed. These symptoms impact both mental and physical health, with mental changes including apathy, depression, irritability, anxiety, Obsessive-Compulsive Disorder (OCD), and, in some cases, psychosis. Physical symptoms include jerky movements known as chorea, which worsen with time but can be treated with approved Huntington's disease treatment drugs such as tetrabenazine, deutetrabenazine, and valbenazine. These drugs are currently the only ones approved across the globe for managing chorea in HD patients.

HD is more common in North America and Europe, presenting opportunities for companies to introduce new medications in the future. Research institutes and government organizations are offering grants and support to accelerate the development of potential treatments for HD.

- In December 2023, uniQure N.V. announced an update on the U.S. and European Phase I/II Huntington's disease treatment trials, which included 30 months of data enrolling 39 patients for the AMT-130.

The COVID-19 pandemic negatively impacted the Huntington’s disease therapeutics market. The negative impact was attributed to the decline in patients’ visits to the hospital and imposition of restrictions over non-essential healthcare services. The rare disease such as Huntington’s disease was considered as non-essential. In addition, the decline in the sales and product revenue of the key products in the market was observed during the pandemic. The decline was attributed to the disruption in the supply chain, decreased demand, and lack of promotional activities for the same.

However, the market got back to the pre-pandemic level with the ease of COVID-19 guidelines and increased patient visits for diagnosis and treatment of the disease. Furthermore, in 2023, the market stabilized due to increasing government initiatives and research activities by key players to launch a new treatment approach for the disease, which is expected to boost the growth of the market during the forecast period.

Huntington's Disease Treatment Market Trends

Emergence of New Therapies for Huntington’s Disease (HD) Treatment and Management is a Prominent Trend

One of the prevailing trends witnessed in the global market is the rising number of new therapy options for controlling neurodegenerative diseases. The options include Antisense Oligonucleotide (ASO) Therapies, RNA Interference (RNAi) Therapies, RNA Targeting Small Molecule Therapies, Zinc-Finger Protein (ZFP) Therapies, Transcription Activator-like Effector Nuclease (TALEN) Therapies, and others.

The market is witnessing increasing research initiatives by key and emerging players to conduct clinical studies with the potential therapeutics options for introducing new drugs in the market.

- As stated in a 2023 article by Synthego, scientists are currently utilizing CRISPR-Cas9 and related technologies to create new treatments for Huntington's disease. The primary CRISPR approaches focus on either targeting the mutant huntingtin (HTT) allele or correcting it by removing the CAG hyper-expansion.

Download Free sample to learn more about this report.

Huntington's Disease Treatment Market Growth Factors

Increasing Number of Cases of the Disease to Boost Market Expansion

The increasing prevalence of this condition in different parts of the world, particularly in the U.S. and major European countries, is a significant factor behind market expansion. This disease is a genetic neurodegenerative disorder with no known cure, but its symptoms can be controlled. Characterized by involuntary twitching movements known as chorea that progressively worsen over time, it primarily affects facial and limb muscles.

- According to a Rare Disease Advisor article in 2023, the estimated prevalence of Huntington's Disease (HD) was 6.37 per 100,000 people in Europe and 8.87 per 100,000 people in North America.

The increase in the prevalence of the disease in emerging countries such as India, China, and Africa is expected to drive the demand for more effective therapeutic measures to control and manage associated symptoms. These factors are slated to propel the global Huntington’s disease treatment market growth during 2024-2032.

Rising Government Initiatives to Spread Awareness for Huntington’s Disease Treatment to Boost Market Growth

Governments around the world are implementing new programs, campaigns, and support systems to raise awareness and educate individuals about this condition, ultimately leading to more people being diagnosed and creating a higher demand for advanced treatment options.

- As per the Huntington's Disease Society of America (HDSA) 2023 publication, the HD Human Biology Project under the HDSA awarded USD 898,194 to support six new projects with an aim to understand and find new effective treatment methods for Huntington's disease.

Moreover, the increasing government awareness programs to educate the people about the disease and the treatment options available to propel market growth.

- For instance, in May 2022, the Huntington's Society of Canada celebrated Huntington Disease (HD) Awareness Month 2022 to educate the people and boost community spirit and hope by hosting events such as the HD Hockey Classic, Huntington Heroes National Virtual Walk, and others.

RESTRAINING FACTORS

Increasing Adverse Events Associated with the Drug May Hamper Market Expansion

One of the key factors impeding market growth is the side effects of long-term drug consumption. Stringent regulations hinder the widespread introduction of new drugs, and in some cases, adverse reactions associated with medications can lead to limited adoption.

- For example, Austedo's safety information warns of potential side effects for individuals with Huntington's disease, such as depression, suicidal thoughts, irregular heartbeats, and neuroleptic malignant syndrome.

Similarly, Valbenazine (Ingrezza) has been linked to common treatment-emergent adverse events such as drowsiness, sedation, and rash, with a black box warning for the risk of depression and suicidal ideation. Such risks of adverse reactions may decline the adoption of the drug amongst patients, thus hampering the growth of the market.

Huntington's Disease Treatment Market Segmentation Analysis

By Drug Analysis

Higher Adoption of the Tetrabenazine Propelled the Growth of the Segment in the Market

Based on drug, the market is divided into tetrabenazine, deutetrabenazine, valbenazine, and others.

The tetrabenazine segment held the lion’s share in the global Huntington’s disease treatment market in 2023. The tetrabenazine is the very first FDA-approved drug for the treatment of Huntington’s disease. The increasing prevalence of the disease across the globe and the rising number of generic versions of tetrabenazine boost the adoption of the drug in the market. This segment held 64.21% of the market share in 2025.

- For instance, in March 2020, Apotex Inc. released a generic equivalent of tetrabenazine, which is used to treat chorea related to the condition. This availability of a generic alternative at a lower cost for rare diseases is expected to drive greater demand and contribute to market growth in the coming years.

The deutetrabenazine segment held a significant portion of the global Huntington’s disease treatment market share in 2023. The increasing regulatory approval and product launches for deutetrabenazine by key players, coupled with the strong potency of deutetrabenazine over tetrabenazine, propel the growth of the segment.

- For instance, in February 2023, Teva Pharmaceutical Industries Ltd. received U.S. Food and Drug Administration approval for AUSTEDOXR (deutetrabenazine) extended-release tablets. The new once-daily formulation is used to treat adults for Tardive Dyskinesia (TD) and chorea associated with Huntington's disease (HD).

Furthermore, the valbenazine segment held a considerable share of the market in 2023, owing to increasing regulatory approval and drug product launches by key market players.

- For instance, in August 2023, Neurocrine Biosciences, Inc. announced that the U.S. Food and Drug Administration (FDA) has approved INGREZZA (valbenazine) capsules. The once-daily capsules are used to treat adults with chorea associated with Huntington's disease. Such approvals are slated to expand the growth of the segment during the forecast period.

The others segment is expected to record a significant CAGR during the forecast period. The limited product offerings for Huntington’s disease treatment increase the demand for the launch of new treatment options for the disease. In addition, increasing clinical studies and research initiatives by the key players to launch new drugs in the market are poised to expand the growth of the segment during the forecast period.

- For instance, in March 2022, PTC Therapeutics, Inc. initiated the PIVOT-HD Phase 2 clinical trial for the evaluation of the PTC518, a small molecule designed to lower huntingtin mRNA and protein in people with HD selectively.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Insurance Coverage Provided by Hospital Pharmacies to Foster Segment Growth

Based on distribution channel, the market is segmented into hospital pharmacies, drug stores & retail pharmacies, and online pharmacies.

The hospital pharmacies segment held the largest share of the market in 2023 due to the fact that the majority of the medications for treatment can only be prescribed after thorough examinations by trained medical professionals at these institutions. In addition, easy access to specialized medicine and provisions for inpatient treatment, along with insurance coverage, leads to increased growth of this segment in the global Huntington’s disease treatment market. The segment is expected to capture 47.57% of the market share in 2026.

The drug stores & retail pharmacies segment held the second-largest market share in 2023, owing to the usage of the settings for the procurement of prescription refills. In addition, the presence of a large number of drug stores & retail pharmacies eventually led to the use of the facility for drug procurement and thus impelled the growth of the segment in the market. The segment is likely to record a significant CAGR of 10.18% during the forecast period (2024-2032).

- For instance, according to the data published by the NHS Business Services Authority (NHS BSA) in October 2023, there were around 11,414 active community pharmacies in England at the end of March 2023.

The online pharmacies segment is expected to grow at the highest CAGR during the forecast period due to the increased adoption of digital pharmaceutical platforms, making medication procurement more convenient with doorstep delivery. These factors are anticipated to fuel the growth of the global Huntington's disease treatment market collectively.

REGIONAL INSIGHTS

The global market is divided into regions, including North America, Europe, Asia Pacific, and the rest of the world.

North America Huntingtons Disease Treatment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market for Huntington’s disease treatment was valued at USD 1.16 billion in 2025 and USD 1.27 billion in 2026. The region is expected to maintain its market dominance in the foreseeable future, fueled by widespread awareness of the disease among the population and increasing support and collaborations between various public and private organizations to advance the research study for the disease. The U.S. market is expected to hold USD 1.22 billion in 2025.

- For instance, in August 2023, The Huntington Study Group (HSG) announced the results of the Phase 3 pivotal KINECT-HD study conducted in collaboration with Neurocrine Biosciences, Inc., which has led to the FDA approval of valbenazine for treating HD-associated chorea. Such collaborations for the launch of new drugs propel the growth of the market in the region.

Europe is the third leading region poised to gain USD 0.09 billion in 2026. Europe held a substantial market share in 2023 due to the rising initiatives by the key players in the market to commercialize the new drug for the treatment of Huntington’s disease in the region. The U.K. market continues to grow, projected to reach a market value of USD 0.02 billion in 2026.

- For instance, in March 2024, Prilenia Therapeutics B.V. announced its plan to submit an application for Marketing Authorization for pridopidine for the treatment of Huntington's disease to the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency's (EMA). Such scenarios thus propel the growth of the region in the global market.

Germany and France are set to be worth USD 0.02 billion in 2025.

Asia Pacific is the second largest market set to be valued at USD 0.01 billion in 2026, exhibiting a CAGR of 6.62% during the forecast period (2026-2034). The Chinese market is expected to be valued at USD 0.05 billion in 2026. Asia Pacific held a notable share of the market for Huntington’s disease treatment in 2023 with increasing partnerships of key players with the regional players to provide access to drugs to the patients of the region suffering from Huntington’s disease. India is predicted to reach USD 0.01 billion in 2026, while Japan is expected to hold USD 0.03 billion in the same year.

- For instance, in February 2024, Teva Pharmaceutical Industries Ltd. partnered with Jiangsu Nhwa Pharmaceutical Co. Ltd for the marketing and distribution of AUSTEDO in China. This partnership intends to increase patient's access to AUSTEDO across China for the treatment of Huntington's disease (HD) and Tardive Dyskinesia (TD).

The rest of the world is the fourth largest market foreseen to hold USD 0.05 billion in 2025. The rest of the world includes Latin America and the Middle East & Africa. It is expected to experience slower growth in comparison to other regions, primarily due to the lower prevalence rate of the condition among the population. This leads to lower adoption rates and slower market growth. However, there is potential for growth in these regions as awareness of available treatments increases and reimbursement policies improve during the forecast period.

List of Key Companies in Huntington's Disease Treatment Market

Teva Pharmaceutical Industries Ltd Dominates Due to Growing Launches of New Formulations of AUSTEDO

In terms of the competitive landscape, Teva Pharmaceutical Industries Ltd. is a major player in the market, with its drug AUSTEDO (Deutetrabenazine) experiencing steady adoption since its FDA approval in 2017. The increasing launches of the new formulations of AUSTEDO by the company boost its share in the market

- For instance, in May 2023, Teva Pharmaceutical Industries Ltd. announced the launch of AUSTEDOXR 6 mg, 12 mg, and 24 mg tablet strengths in the markets of the U.S. for the treatment of chorea associated with HD in U.S. adults.

Other key players in the market include H. Lundbeck A/S, Bausch Health Companies Inc., Sun Pharmaceutical Industries, Inc., Lupin, Dr. Reddy’s Laboratories Ltd., and Hikma Pharmaceuticals PLC, all of whom are generic manufacturers of tetrabenazine.

With a growing patient population and a lack of approved products in the market, there is increasing interest from other players such as Prilenia Therapeutics, SOM Biotech, uniQure, Annexon Biosciences, and Hoffmann-La Roche to develop new drugs to meet clinical demand. The launch of new products is expected to fuel growth of the global Huntington’s disease therapeutics market.

LIST OF KEY COMPANIES PROFILED:

- Teva Pharmaceutical Industries Ltd. (Israel)

- H. Lundbeck A/S (Denmark)

- Bausch Health Companies Inc. (Canada)

- Neurocrine Biosciences, Inc. (U.S.)

- Prilenia Therapeutics (Israel)

- Novartis AG (Switzerland)

- Lupin (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries, Inc. (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Neurocrine Biosciences: Inc. announced that the New Drug Application (NDA) for INGREZZA (valbenazine) oral granules, a new sprinkle formulation, was accepted by the U.S. Food and Drug Administration (FDA).

- April 2023: Prilenia Therapeutics B.V. revealed the top-line findings at the American Academy of Neurology (AAN) Annual Meeting from the Phase 3 PROOF-HD clinical trial, which examined the safety and effectiveness of pridopidine in individuals with Huntington's disease (HD).

- December 2022: The U.S. FDA accepted the supplemental new drug application of Neurocrine Biosciences, Inc. for valbenazine as a treatment for chorea associated with Huntington’s disease treatment.

- December 2021: Novartis AG received Fast Track designation for Branaplam from the FDA for Huntington’s disease treatment. Branaplam is an mRNA splicing modulator that targets the HTT protein responsible for causing the degeneration of nerve cells, leading to Huntington’s disease.

- October 2021: Teva Pharmaceutical Industries Ltd. received marketing approval for the treatment of chorea associated with Huntington’s disease treatment and for the treatment of tardive dyskinesia in Brazil.

- September 2020: Prilenia Therapeutics entered a partnership with the Huntington’s Study Group (HSG) to conduct a global Phase 3 clinical study of Pridopidine in Huntington’s disease treatment.

- May 2020: Teva Pharmaceutical, Inc. received approval for AUSTEDO from the China National Medical Product Administration (NMPA) for the treatment of chorea associated with Huntington’s Disease and Tardive Dyskinesia (TD) in adults.

REPORT COVERAGE

An Infographic Representation of Huntington's Disease Treatment Market

To get information on various segments, share your queries with us

The research report offers both qualitative and quantitative analysis of the global market, including a comprehensive examination of market size and growth rates across various segments. In addition, the report includes market dynamics and the competitive landscape, providing key insights such as disease prevalence in different regions, industry advancements, pipeline analysis, economic implications of treatment costs, regulatory and reimbursement scenarios, and the influence of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.39 billion in 2025 and is projected to reach USD 4.33 billion by 2034.

In 2025, the North America market stood at USD 1.39 billion.

The market is slated to grow at a CAGR of 13.90% during the forecast period (2025-2034).

By drug, the tetrabenazine segment led the market in 2025.

The growing prevalence of Huntingtons disease and active support from government authorities to increase awareness of its treatment measures drive market growth.

Teva Pharmaceutical Industries Ltd, H. Lundbeck A/S, and Bausch Health Companies Inc. are the leading global market players.

North America is set to dominate during the forecast period.

The growing R&D investments in Huntingtons disease treatment by market players to accelerate the development of pipeline candidates are expected to drive the demand for these drugs.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic