Hybrid Power Solutions Market Size, Share & Industry Analysis, By Grid Type (Off-Grid and On-Grid), Configuration (Solar-Diesel, Wind-Diesel, Solar-Wind, and Others), and By End-User (Residential & Commercial, Industrial, and Utility), and Regional Forecast, 2026-2034

Hybrid Power Solutions Market Latest Insights

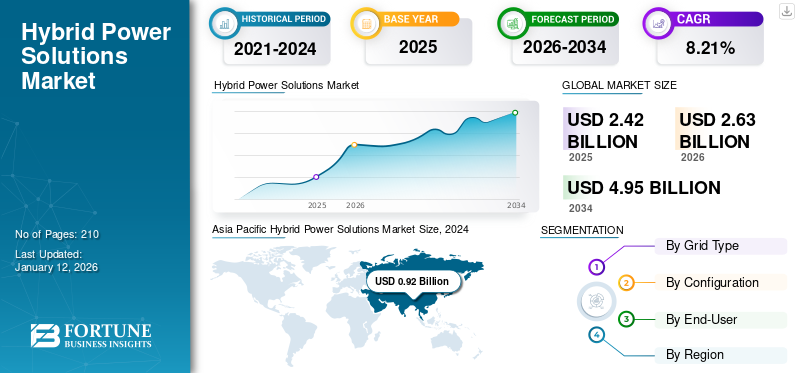

The global hybrid power solutions market size was valued at USD 2.42 billion in 2025 and is projected to grow from USD 2.63 billion in 2026 to USD 4.95 billion by 2034, exhibiting a CAGR of 8.21% during the forecast period. The Asia Pacific dominated the hybrid power solutions market with a share of 38.07% in 2025.

Hybrid power solution systems combine several sources into one complex hybrid technology system. Hybrid systems can include Photovoltaic (PV) modules, wind turbines, hydro turbines, diesel, or gasoline generators. Those individual systems can produce and supply electrical energy to a battery, or the energy produced can be delivered directly to the electricity distribution network.

Global Hybrid Power Solutions Market Overview

Market Size:

- 2025 Value: USD 2.42 billion

- 2026 Value: USD 2.63 billion

- 2034 Forecast Value: USD 4.95 billion, with a CAGR of 8.21% from 2026–2034

Market Share:

- Regional Leader:Asia Pacific held a 38.07% market share in 2025, driven by increasing energy demand, urbanization, industrial expansion, and strong regulatory support for renewable integration.

- Country Highlight: The U.S. market is projected to reach USD 333.90 million by 2032, fueled by renewable energy programs and hybrid power plant demonstrations.

- End-User Leader: The Utility segment dominated in 2024, driven by installations across infrastructure, transportation, and public sector energy facilities.

Industry Trends:

- Carbon Emission Reduction Push: Battery-based hybrid systems reduce generator runtime and fuel usage, supporting sustainability goals.

- Solar-Diesel Dominance: Solar-diesel configurations are gaining ground due to environmental regulations and corporate sustainability initiatives.

- Smart Off-Grid Expansion: Growing relevance of hybrid power in rural electrification, mobile operations, and emergency services.

- Integration of Renewable Sources: Hybrid models now include wind, solar, hydro, and battery systems to improve energy efficiency.

Driving Factors:

- Government Incentives & Support: National investments and energy policies accelerate adoption, especially in off-grid and rural regions.

- Off-Grid Power Demand: Rising electricity needs in remote areas drive demand for flexible, efficient hybrid energy systems.

- Renewable Energy Growth: Solar and wind capacity expansion supports hybrid system deployment across commercial and utility-scale applications.

- Technological Advancements: Optimization tools, smart inverters, and hybrid control systems enhance energy efficiency and reduce emissions.

- Public-Private Collaboration: Strategic funding strengthens hybrid power infrastructure development.

Initially conceived as a combination of traditional non-renewable electricity generation (e.g., diesel generators) and Battery Energy Storage Systems (BESS), the definition has now expanded to include 100% renewable energy-based systems (e.g., photovoltaics (PV) and wind) or combining different energy storage systems (e.g., BESS, fuel cells, and supercapacitors). Hybrid energy solutions have also grown in capacity from small off-grid systems of a few kilowatts, typically designed for low-voltage DC and AC systems, to larger megawatt systems that expand into medium-voltage grid-connected systems.

The COVID-19 pandemic had both positive and negative effects on the development of hybrid energy solutions. The outbreak disrupted supply chains around the world and affected the production and distribution of renewable energy sources, such as wind turbines, hydropower, and solar panels needed to produce hybrid energy solutions. This disruption made it difficult to expand the renewable energy infrastructure needed to create hybrid power. Despite the challenges, research and development of hybrid energy technology continued, and some companies and research institutes focused on optimizing the production of electric fuels and increasing the efficiency of hybrid energy production.

Hybrid Power Solutions Market Trends

Rising Importance of Reducing Carbon Emissions to Increase Use of Hybrid Power Solutions

The introduction of battery-based hybrid power significantly reduces the emission of carbon dioxide, minimizing the continuous operation of the generator and the amount of fuel used. It helps construction sites and factories adopt green practices to reduce their carbon footprint and achieve their sustainability goals.

Hybrid energy solutions are a combination of two or more different energy sources, such as solar, wind, and natural gas. They can help reduce carbon dioxide emissions by decreasing dependence on fossil fuels, which are the main source of greenhouse gases. For example, a hybrid energy system, which includes solar panels and a battery storage system, can help reduce carbon dioxide emissions in three ways: solar panels can generate electricity during the day when there is ample sunlight. This can help reduce electricity demand from fossil power plants during peak hours. The battery storage system can store the excess electricity produced by the solar panels during the day. This electricity can be used to meet the energy demand at night or at other times when the solar panels are not producing electricity.

Download Free sample to learn more about this report.

Hybrid Power Solutions Market Growth Factors

Increased Government Investment in Hybrid Energy Solutions to Boost Market Growth

High initial investments and low connection costs characterize technology-based hybrid power solutions. The abundant availability of component manufacturers and introduction of government incentives have increased the demand for hybrid power systems in developing economies. The lack of grid connection in rural and remote areas and its improbability have increased the installation of these electrical systems in recent years. As renewable energy sources grow, more power generation companies are adopting solar, wind, water, and fuel cells to generate electricity. Thanks to lower carbon dioxide emissions and excellent properties, such as abundant supply and cost efficiency, hybrid energy solutions are becoming increasingly important in modern power generation. The hybrid power system produces maximum energy with less fuel, which will be one of the reasons for the robust global hybrid power solutions market growth in the coming years.

For instance, as part of President Joe Biden's Investing in America program, the U.S. Department of Energy (DOE) announced USD 26 million in awards to eight selected projects to demonstrate how solar, wind, energy storage, and other clean energy sources can support the country’s reliable and efficient power grid. This project shows grid-shaped inverters at the Wheatridge renewable energy facility in Oregon, the first energy center in North America to combine wind, solar, and energy storage systems in one location. If successful, it will be the first grid-connected hybrid power plant in the U.S. and will encourage utilities to consider adding grid-shaping capabilities to their interconnection requirements. Nearly USD 4.5 million were invested in the project.

Growing Emphasis on Off-Grid Power Generation to Boost Product Demand

The strong growth of hybrid power generation in off-grid locations has strongly influenced the development of the hybrid power solutions market. Therefore, increasing political pressure to reduce CO2 emissions, low O&M costs, and favorable government initiatives are also vital factors that will fuel the growth of the market during the forecast period. The growing demand for clean energy and the ever-increasing need for off-grid electricity will have a positive impact on the growth of the market.

According to the International Renewable Energy Agency (IRENA), in 2016, the number of people living without electricity fell below one billion. The world is steadily moving toward universal electricity access, with a global electrification rate of 87% in 2016. Rural areas, where most live without access to electricity, have proliferated and stood at around 76% in 2018, according to the World Bank Group. Strong political commitment to energy access/agenda at the national and global level, combined with financing, local entrepreneurship, and technological innovation, has laid the foundation for the final push to achieve universal access to electricity by 2030. The most important factor influencing the expansion of the market is the rapid growth of investments in rural electrification. Apart from this, the easy availability of manufacturers and government incentives are also fueling the growth of the hybrid power solutions market.

RESTRAINING FACTORS

High Expenditure in Producing Hybrid Power Solutions May Hinder Market Growth

The high initial costs of hybrid power systems compared to traditional diesel generators can significantly limit their widespread adoption. Although hybrid electric systems offer many advantages in terms of durability, reliability, and operational cost savings, the higher upfront investment may discourage potential users, especially in regions or industries with budget constraints or limited access to financing.

The integration of renewable energy components, such as solar panels and wind turbines contributes to the increase in initial costs of hybrid energy solutions. Although renewable energy technologies have become more affordable over the years, their initial costs are still higher than those of traditional diesel generators. Costs associated with the purchase, installation, and operation of solar panels, wind turbines, batteries, and other renewable components can be significant, especially for larger systems with higher capacity. In addition, the need for expertise in the design and implementation of hybrid energy solutions can increase overall costs.

Hybrid Power Solutions Market Segmentation Analysis

By Grid Type Analysis

On-Grid Hybrid Power Solutions Dominate with Increasing Usage of Renewable Energy Sources

Based on grid type, the market is divided into off-grid and on-grid. The on-grid type segment dominates the hybrid power solutions market share of 81.05% in 2026. On-grid hybrid energy systems using renewable energy and power storage can reduce interruptions in renewable energy supply. A new investment-based optimization method has been proposed to increase the hybrid power solutions in an on-grid setup. The technique involves linear optimization of a hybrid renewable energy system and a subsequent investment optimization that considers incremental improvements through investment.

Off-grid solutions are mainly used in rural areas but are limited due to high initial investments. With support from the governments, the off-grid segment will grow in the coming years.

By Configuration Analysis

Solar-Diesel Solutions Dominance Led by Growing Sustainability Practices

Based on configuration, the market is divided into solar-diesel, wind-diesel, solar-wind, and others. The solar-diesel segment dominates the market with a share of 53.33% in 2026, due to the convergence of strategic interests and changing dynamics of the solar market. The main driver of the segment’s dominance is the height of environmental concerns and regulatory requirements. This proactive alignment with sustainable practices increases the marketability of solar generator hybrids and positions them as key tools for companies seeking to strengthen their corporate social responsibility efforts.

According to the Energy Institute's 2023 World Energy Statistical Review, electricity produced through solar energy has increased significantly since 2012. Global solar electricity production in 2022 was 1,322.6 terawatt hours, an increase of nearly 25% from 2021. The annual growth of solar energy between 2012 and 2022 was about 29%, showcasing a significant rise in solar energy production since 2021. In addition, the versatility of solar diesel makes it possible to use them in a variety of ways in various industrial and domestic sectors. Hence, as mentioned above, hybrid power systems will dominate the demand for hybrid solar generators during the forecast period.

A wind-diesel hybrid system is any stand-alone electricity generation system that uses wind turbines in conjunction with diesel generators to maximize the proportion of intermittent wind energy in total electricity production while continuously producing high-quality electricity. Due to these characteristics the market is growing steadily. Electricity is made using a combination of renewable energy sources, such as wind and solar, which is called a wind-solar hybrid system. This system is designed to produce electricity with solar panels and wind turbine generators.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Utility Holds the Leading Position Fueled by Hybrid Power Solutions Usage in Several Industries

Based on end-user, the market is segmented into residential & commercial, industrial, and utility. The utility segment dominates the market with a share of 53.5% in 2026, driven by installations in farmlands, government offices, railways, and road infrastructure. VSB Uusiutuva Energia Suomi Oy is expanding its activities in the field of renewable energy. The first hybrid park fully developed by VSB is coming to Haapavesi, where the company is planning a 49-turbine wind farm, Puitionsa, with a total capacity of about 350 MW. In conjunction with the wind farm, a solar power plant of approximately 100 MW is also planned, which will be built on a former peat production area purchased by VSB. In the commercial and residential sectors, the use of hybrid power is on the rise as operating costs and maintenance are cheap compared to conventional power solutions.

In the residential & commercial sector, Hybrid Power Solutions Inc. built a state-of-the-art, expandable manufacturing facility on 2.5 acres, 6,000 square feet of land in Parry Sound, Ontario. This significant development aims to strengthen Hybrid's capacity for producing domestic lithium-ion batteries and wider hybrid energy solutions, including the recently announced Batt Pack Spark.

REGIONAL INSIGHTS

The global market has been analyzed in four key regions: North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Hybrid Power Solutions Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominates the global market in terms of share. Asia Pacific dominated the market with a valuation of USD 0.92 billion in 2025 and USD 1.02 billion in 2026. The growing dominance of the region is due to the culmination of multifaceted market dynamics and strategic requirements. Strategic demands aimed at regional energy consumption patterns of Asia Pacific are supporting the hybrid power market’s dominance in the region. Rapid urbanization, industrial expansion, and increasing demand for electricity in the emerging economies of the region will increase the need for sustainable and versatile energy sources.

The ability of hybrid energy solutions to optimize energy efficiency and the crucial stage of renewable resources synergize with the energy demands of the region, as well as goals and means of energy security restrictions, confirming their importance. In addition, regulatory support and market incentives will strengthen the region's leading position. Government initiatives promoting renewable energy integration and emission reduction, along with favorable policy frameworks and economic incentives, have accelerated the adoption of hybrid energy solutions. The Hybrid power solutions market in the U.S. is projected to grow significantly, reaching an estimated value of USD 333.90 million by 2032. The Japan market is valued at USD 0.16 billion by 2026, the China market is valued at USD 0.23 billion by 2026, and the India market is valued at USD 0.21 billion by 2026.

For instance, India has set an ambitious target of installing nearly 500 GW of renewable energy capacity by 2030, some of which is expected to come from solar energy. This has led to the growth of the country's solar sector, fueled by falling costs and government incentives.

North America

In North America, the growing demand for grid connectivity in renewable energy is increasing with the aim of creating sustainable options for electricity generation. Hybrid Power Solutions Inc. is expanding its program offerings by launching a Power as a Service (PAAS) contract to integrate a state-of-the-art solar/hybrid system on a major commuter line. The PAAS program offers complete power solutions at a fixed monthly price, facilitating a smooth transition to renewable energy and hybrid technologies and ensuring cost savings and lower emissions. The U.S. market is valued at USD 0.19 billion by 2026.

Europe

In Europe, Instagrid offers a sustainable alternative to fossil fuel generators used to power mobile jobs in construction, film, events, and emergency services. The company has shipped nearly 30,000 units of its flagship product to 29 countries since its launch two years ago. Demand for mobile power solutions is expected to remain strong and will be supported by political developments in Europe, so Instagrid's technology has several opportunities and a mature addressable market. The UK market is valued at USD 0.1 billion by 2026, while the Germany market is valued at USD 0.24 billion by 2026.

Rest Of The World

The rest of the world is growing at a slow rate in terms of the acceptance of hybrid power solutions due to lack of investments, but in the future, it has prospects of growth with foreign investments coming to African countries.

Key Industry Players

Hybrid Power Solutions Inc. to Dominate Market Owing to Wide Product Portfolio and Projects across Globe

Hybrid Power Solutions Inc. was founded in 2015 in response to the urgent need for a safer, cleaner, and more efficient alternative to commercial and industrial generators. It designs and manufactures a full line of high-quality portable power supplies, home batteries, and solar systems that deliver high-quality energy. It is owned and operated in Canada, and all of its products are assembled in the country.

LIST OF KEY COMPANIES IN HYBRID POWER SOLUTIONS MARKET:

- Siemens Gamesa (Germany)

- Emerson (U.S.)

- Eltek (Norway)

- Vertiv (U.S.)

- ZTE Corp (China)

- MAN Energy (Germany)

- Vestas (Denmark)

- Fronius International (Austria)

- Clear Blue (Canada)

- SMA Solar Technology (U.S.)

- Shell (U.K.)

- Delta Electronics (Taiwan)

- Huawei (China)

- Meteocontrol GmbH (Germany)

- Hybrid Power Solutions (Canada)

- Prolectric Services Ltd. (U.K.)

LATEST INDUSTRY DEVELOPMENTS:

- April 2024: Hybrid Power Solutions Inc. announced that it had successfully sold and delivered initial units to a global fiber network service provider in California. This initial order represents the supply of continuous fuel backup power to the customer's core infrastructure and plays an essential role in the company's core service department.

- February 2024: Hybrid Power Solutions Inc. announced that it had entered a strategic distribution agreement with Fastening House, a Canadian tool and equipment supplier. This partnership marks a pivotal moment in the development of carbon-free portable energy solutions across Canada, with a strong focus on the construction industry.

- February 2023: Prolectric Services Oy launched its latest hybrid solar power systems for use in remote locations. The ProPower 3-Phase Solar Hybrid Power unit is a high-efficiency system that brings 60 kW of hybrid power to jobs, helping reduce carbon dioxide emissions and diesel use.

- September 2022: Shell announced that it would acquire Daystar Power, a large-scale West African company that provides hybrid power solutions combined with solar energy in the region. The acquisition is expected to improve the company's products and services for commercial and industrial customers.

- September 2021: Siemens Gamesa Renewable Energy started a pilot project in western Denmark to evaluate how its wind turbines can produce green hydrogen for clean fuel. The wind energy supplier is based in Zamudio, Spain, and works with Denmark's Green Hydrogen Systems (GHS). The pilot project used a 3 MW Siemens island-mode wind turbine to power a 400 kW GHS electrolyzer that splits water into hydrogen and oxygen.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, leading product applications, and top market players. Besides, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.21% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Grid Type, Configuration, End-User, and Region |

|

Segmentation |

By Grid Type

|

|

By Configuration

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was valued at USD 2.42 billion in 2025.

The global market is projected to record a CAGR of 8.21% during the forecast period.

Asia Pacifics market size was valued at USD 0.92 billion in 2025.

Based on end-user, the utility segment holds a dominating share of the global market.

The global market size is expected to reach a valuation of USD 4.95 billion by 2034.

The increased government investment in hybrid energy solutions and growing emphasis on off-grid power generation are the key market drivers.

Siemens Gamesa, Emerson, Eltek, Vertiv, ZTE Corp, and MAN Energy, among many others, are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us