Hydrogel Dressing Market Size, Share & Industry Analysis, By Product (Amorphous, Impregnated Dressings, and Sheet Dressings), By Material (Natural, Synthetic, and Semi-synthetic), By Application (Diabetic Foot Ulcer, Pressure Ulcer, Venous Leg Ulcer, Burn Wounds, and Others), By End-user (Hospitals & Clinics, Home Care Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

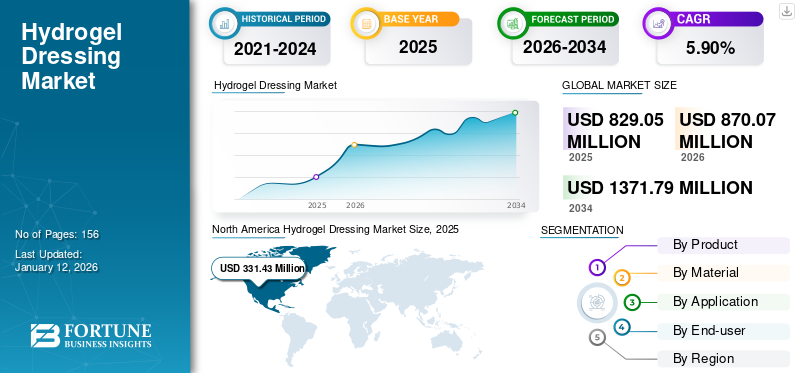

The global hydrogel dressing market size was valued at USD 829.0 million in 2025. The market is projected to grow from USD 870.07 million in 2026 to USD 1,371.79 million by 2034 at a CAGR of 5.90% over the forecast period of 2026-2034. North America dominated the hydrogel dressing market with a market share of 40.00% in 2025.

The healing of chronic wounds is still a challenge in many parts of the world. Hydrogel dressings have proved to be successful in clearing the injury owing to their warm and moist healing environment. The moist quality of the dressing is mainly due to the composition of 90% water mixed in a gel made of insoluble hydrophilic polymers. Therefore, due to the above advantages, they are extensively used to treat chronic wounds in patients.

- For instance, in November 2023, according to the Journal of American Medical Association, diabetic foot ulcers annually affect around 1.6 million in the U.S. and 18.6 million individuals globally. Thus, the increasing prevalence of pressure ulcers, diabetic foot ulcers, and venous leg ulcers has led to a rise in product demand, thereby driving the growth of the global market.

The outbreak of COVID-19 pandemic had a negative impact on the global hydrogel dressing market. Few market players reported a decline in revenues due to decreased product demand and sales amid the pandemic. The closure of healthcare facilities dedicated to wound care departments resulted in a halt in patient visits in the U.S., U.K., India, and other countries. However, the product revenues by key players increased in 2021 and 2022 due to an increase in patient visits and a rise in the adoption of hydrogel dressings. This normalized the market growth post-pandemic.

Global Hydrogel Dressing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 829.0 million

- 2026 Market Size: USD 870.07 million

- 2034 Forecast Market Size: USD 1371.79 million

- CAGR: 5.90% from 2026–2034

Market Share:

- North America dominated the hydrogel dressing market with a 40.00% share in 2025, driven by the increasing prevalence of chronic wounds, growing healthcare expenditures, and rising adoption of advanced wound care products.

- By product, Amorphous Hydrogel Dressings are expected to retain the largest market share due to their superior wound healing efficiency, ease of application, and preference among healthcare providers for treating ulcers and chronic wounds.

Key Country Highlights:

- United States: The rising number of chronic wound cases and substantial healthcare spending are fostering the demand for advanced hydrogel dressings.

- Europe: Efforts to reduce healthcare cost burdens and growing initiatives to enhance wound care treatment efficiency are key drivers in the region.

- China: A large diabetic patient population and increasing awareness of advanced wound care products are accelerating market growth.

- Japan: The rising geriatric population and increased focus on innovative wound care solutions are promoting the adoption of hydrogel dressings.

Hydrogel Dressing Market Trends

Increasing R&D on Novel Hydrogels to Boost Market Growth

In recent years, clinical applications have been proposed for various hydrogel products. Massive research is currently underway to develop novel hydrogel products from natural sources, such as animal tissues, plant extracts, extracellular matrix, and others. Companies are heavily investing in R&D activities and continuously focusing on bringing positive results from clinical trials. For example, Remedor Biomed Ltd. conducts clinical trials on a hydrogel containing erythropoietin to treat diabetic foot ulcers. In addition, a variety of peptides are also being explored for their wound-healing properties in clinical trials. Thus, the conduct of rigorous clinical studies to commercialize novel hydrogel dressing products is anticipated to surge the growth of the global market during the forecast period. Furthermore, the utilization of advanced technologies such as 3D printing and nanotechnology enables the development of highly advanced hydrogel dressings with enhanced properties and functionalities, which is also expected to boost market growth during the forecast period.

Download Free sample to learn more about this report.

Hydrogel Dressing Market Growth Factors

Rising Prevalence of Chronic and Acute Wounds to Propel Market Growth

The increasing prevalence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and others among the general population is expected to drive the number of patients undergoing treatment and fuel the adoption of wound care products during the forecast period. Also, the increasing incidence of acute wounds, including surgical wounds, burns, and others among the global population is anticipated to increase the demand for hydrogel wound dressings during the forecast period. For instance, according to the Wound Healing Society (WHS), surgical wounds represent a significant concern in overall healthcare. Surgical Site Infections (SSI) contribute to mortality in 75.0% of cases worldwide despite all efforts. Therefore, the rising prevalence of infections has exerted a substantial economic burden on the healthcare industry, which is likely to contribute to the launch of advanced products, thus fostering the global hydrogel dressing market growth.

Multiple Advantages of Hydrogel Dressings to Boost Product Demand

Hydrogel dressings are emerging as an ideal choice as when applied to dry wounds and necrotic or sloughing wounds, they keep them clean by removing the infected or necrotic tissues via autolysis. A few advantages include keeping the wound moist, warm, and closed. The dressings can be applied along with topical medications and are suitable for treating all types of injuries. Owing to the above-mentioned advantages, the preference for this type of dressing has increased, resulting in high sales growth for the companies. Therefore, rising product demand is anticipated to drive the development of the market during the forecast period.

RESTRAINING FACTORS

High Cost of Treatment and Inadequate Reimbursement Policies to Limit Growth

Despite the high demand for hydrogel dressings globally, certain factors are limiting the market growth. High costs associated with wound care treatment and lack of adequate reimbursement policies are major factors expected to hinder market growth in the forecast period. According to the Institute for Pressure Injury Prevention, the NHS spends around USD 6.48 billion annually on wound care. It was also observed that surgical wounds and leg ulcers were the most expensive to treat. Thus, the high cost of treatment for chronic and acute wounds and the rising demand for urgent treatment among patients lead to a huge need for cost-effective wound care products in the market.

Higher out-of-pocket expenditure associated with chronic wound treatment and limited reimbursement have been instrumental in lowering the adoption of these types of dressings in the global market. Moreover, the high cost can also lead to challenges related to the availability and accessibility of hydrogel dressings in certain regions, especially in developing countries, which may restrict the market expansion. In addition, the high cost may deter healthcare providers from incorporating these products into their treatment plans, hindering market growth.

Hydrogel Dressing Market Segmentation Analysis

By Product Analysis

Demand for Amorphous Dressings to Augment Segment Growth

The global market includes amorphous, impregnated dressings, and sheet dressings on the basis of product. The amorphous segment held a dominant share of 61.87% in 2026. The dominance is due to the excessive use of amorphous hydrogel over impregnated and sheet dressings to treat ulcers and wounds, as amorphous have an advantage over others in promoting efficient wound healing.

Additionally, the amorphous dressing segment is anticipated to grow faster during the forecast period due to its increasing demand. The impregnated dressings segment is estimated to have a moderate growth rate, owing to its gradual increase in product sales during the analysis period. For instance, the demand for AquaSite Hydrogel Impregnated Gauze, SOLOSITE, and others is likely to contribute to the segment's growth.

The sheet dressings accounted for a considerable global hydrogel dressing market share in 2024. Sheet dressings are designed to absorb excess moisture from the wounds to keep the wound clean and dry. The growing awareness about the importance of proper wound care is leading to the shift of more people toward sheet dressings as an effective treatment option.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Usage of Synthetic Dressings for Applications to Contribute Segmental Growth

By material, the market is classified into natural, synthetic, and semi-synthetic. The synthetic segment accounted for a maximum share of 53.50% in 2026 the global market due to the availability of highly effective dressings made up of polyethylene glycol, polyacrylic acid, and other synthetic materials to treat wounds. Synthetic dressings help in the formation of an accurate wound-healing environment, which is, therefore, highly preferable in the market, leading to sales growth. Additionally, the natural segment is anticipated to grow faster due to the preference shift toward naturally made hydrogel dressings for effective wound healing in patients.

By Application Analysis

Others Segment Dominated With Growth in the Number of Surgical Site Infections and Traumatic Wounds

The global market is classified into diabetic foot ulcer, pressure ulcer, venous led ulcer, burn injuries/wounds, and others, based on application.

Others segment dominated the market in 2024. The others segment comprises surgical wounds, traumatic wounds, and others. The segment’s dominance is due to an increase in the number of cases associated with surgical site infections and traumatic wounds.

- For instance, According to an article published by National Institute of Health (NIH)in 2021, the reported incidence of surgical site infections (SSI) varies widely approx. 2.8% in Australia (2002–2013), 9.7% in the Republic of Korea, 4% in China (2000–2017), and 7.8% in South East Asia and Singapore (2000–2012). Such a rising rate of SSI leads to higher adoption of the hydrogel dressings.

The diabetic foot ulcers holds the second leading position in the market, primarily due to the growth in the sales of hydrogel dressing products for the treatment of diabetic foot ulcers. diabetic foot ulcers segment dominated the market with a share of 25.43% in 2026. According to research studies, the global prevalence of diabetic foot ulcers is estimated to be around 13.5 million patients. Moreover, these ulcers have a more significant healing duration and require frequent treatment, which is responsible for the higher demand for the products. Therefore, the rise in the number of visits for treatment is anticipated to drive the segment’s growth during the forecast period.

Moreover, venous leg ulcers and pressure ulcers segments are expected to witness a moderate growth rate during the forecast period of 2026-2034.

By End-user Analysis

Hospitals & Clinics Hold Leading Position Backed by Increased Patient Visits

Based on end-user, the market is segmented into hospitals & clinics, homecare settings, and others. The hospitals & clinics segment marked the leading position in the market owing to the high flow of patients suffering from chronic and acute wounds in hospitals and clinics, which requires hydrogel dressings for effective treatment. Hospitals & Clinics segment dominated the market with a share of 61.35% in 2026. Additionally, these settings' availability of adequate reimbursement policies in emerging countries is likely to boost the patient preference for treating ulcers or wounds at nearby hospitals or clinics.

Moreover, homecare settings are anticipated to emerge as the fastest-growing segment during the analysis period. The growth is attributed to the rise in geriatric patients suffering from wounds in Europe and Asia Pacific and the rising preference shift among patients from hospital to home care settings. These factors are expected to drive product demand, fostering revenue growth in the forecast duration.

REGIONAL INSIGHTS

Regionally, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Hydrogel Dressing Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America’s market size stood at USD 331.43 Million in 2025 and its dominance is fueled by the increasing prevalence of chronic wounds in the U.S., backed by higher demand for these dressings to manage ulcers/wounds. Also, growing healthcare expenditures for the treatment of wounds by the U.S. government are expected to contribute to the region’s growth. The U.S. market is projected to reach USD 310.2 Million by 2026.

- For instance, according to several research studies, U.S. healthcare spends an estimated USD 20.0 billion to treat chronic wounds each year. Moreover, efforts to launch advanced products in the market are anticipated to foster market growth.

Europe

Europe secured the second leading position in the market due to the growing cost burden on European healthcare, which is demanding effective hydrogel dressings. Moreover, growing government initiatives to reduce the cost burden are also expected to aid in the expansion of the market during the forecast period. The UK market is projected to reach USD 49.5 Million by 2026, while the Germany market is projected to reach USD 96 Million by 2026.

Asia Pacific

Asia Pacific is forecast to emerge as the fastest-growing region owing to the large patient population with diabetic foot ulcers in Asian countries, which demands a strong supply of products. The Japan market is projected to reach USD 29.3 Million by 2026, the China market is projected to reach USD 45.7 Million by 2026, and the India market is projected to reach USD 37.4 Million by 2026.

KEY INDUSTRY PLAYERS

Strategic Partnerships and Strong Brand Presence to Foster Company Growth

The global market is semi-consolidated in nature, comprising a few key players dominating the market. The companies marking the leading position include 3M, Smith & Nephew, ConvaTec Group, and Coloplast A/S, accounting for a majority of the hydrogel dressing market share. The strong geographical presence of 3M in more than 90 countries has contributed to large revenue generation, leading to dominance. Higher demand for INTRASITE gel and SOLOSITE gel products has contributed to Smith & Nephew’s leading position. Additionally, growing partnerships among the industry players are likely to aid the penetration of companies in developing countries, thereby fostering the growth of the key market players.

LIST OF TOP HYDROGEL DRESSING COMPANIES:

- Coloplast A/S (Denmark)

- Smith+Nephew (U.K.)

- 3M (U.S.)

- Convatec Inc. (U.K.)

- Integra LifeSciences (U.S.)

- B. Braun SE (Germany)

- Essity Aktiebolag (publ) (Germany)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – Lavior Pharma Inc. announced the launch of its diabetic hydrogel wound dressing and diabetic first aid gel plant-based creams at Walmart across the U.S.

- June 2023 – Researchers at the University of Waterloo developed a novel hydrogel dressing material using advanced polymers to enhance the healing process for burn and cancer patients.

- December 2022 – NEXGEL Advanced Hydrogel Solutions announced the launch of Turfguard, a unique hydrogel dressing, to treat painful turf burns and protect sports-related wounds.

- August 2020 – Integra LifeSciences launched a 360° Advanced Wound Care website to better support its customers. The company said that the website aims to provide focused and easy-to-access content, product information, and educational videos.

- August 2020 – One Equity Partners and The Silverfern Group together acquired a wound-care company, American Medical Technologies (AMT). AMT provides advanced dressings, bedside clinical education and other technologies for clinical and risk management.

- May 2019 – 3M announced the acquisition of Acelity Inc., a manufacturer of wound dressings and other products.

REPORT COVERAGE

The report offers a detailed analysis and forecast of the market and focuses on key aspects, such as leading companies, product types, and top applications of the product. Besides, it offers insights into the market trends, opportunity analysis, and industry highlights. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product

|

|

By Material

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 829.05 million in 2025 and is projected to record a valuation of USD 1,371.79 million by 2034.

Recording a CAGR of 5.90%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2025, North Americas market value stood at USD 331.43 million.

The amorphous segment is expected to be the leading segment in this market during the forecast period.

The increasing number of hospital visits to treat chronic wounds across the globe is driving the markets growth.

North America dominated the hydrogel dressing market with a market share of 40.00% in 2025.

The increasing prevalence of chronic wounds, coupled with a preference for hydrogel dressings over other wound dressings, is likely to drive the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us