Hydrogel Market Size, Share & Industry Analysis By Type (Synthetic, Natural, and Hybrid), By Product (Superabsorbent Polymers, Gelatin/Collagen, and Others), By Application (Personal Care & Hygiene, Wound Care, Drug Delivery, Agriculture, Contact Lenses, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

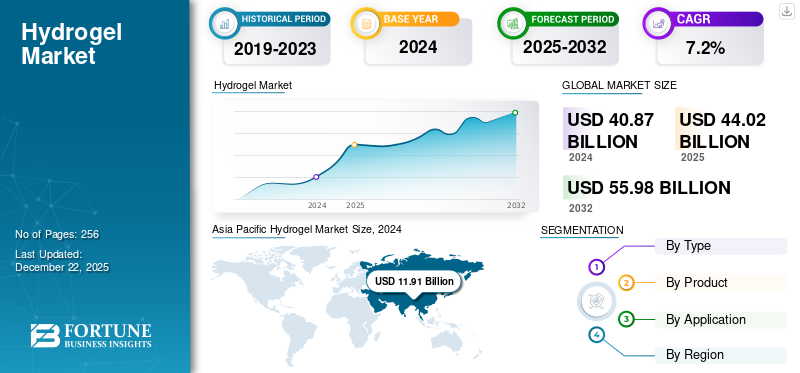

The global Hydrogel market size was valued at USD 44.03 billion in 2025. The market is projected to grow from USD 47.42 billion in 2026 to USD 82.08 billion by 2034 at a CAGR of 7.2% during the forecast period of 2026-2034. Asia Pacific dominated the hydrogel market with a market share of 30% in 2025.

Hydrogels are three-dimensional, cross-linked polymer networks, capable of absorbing and retaining substantial amounts of water while maintaining their structural integrity. These hydrophilic gels exhibit unique properties combining the mechanical characteristics of solids with the diffusion properties of liquids. It demonstrates biocompatibility, tunable swelling behavior, and controlled permeability, making it valuable across medical, personal care, agricultural, and industrial applications. Aging demographics, expanding healthcare infrastructure, and rising demand for advanced wound care solutions drive the market growth. 3M, Johnson & Johnson, Cardinal Health, Smith+Nephew, and Ashland are few prominent key players in the market.

Hydrogel Market Trends

Innovation in Smart and Green Hydrogels Fuels Market Growth

The market is witnessing the development of smart hydrogels, which respond to stimuli such as temperature, pH, or light. These advanced materials enable targeted drug delivery and enhanced wound care by releasing therapeutic agents precisely when needed, improving treatment outcomes. Their biocompatibility and customizable properties make them vital for biomedical applications, including tissue engineering and regenerative medicine.

Sustainability is also driving the market, with a focus on biodegradable products. These eco-friendly materials, designed to degrade naturally, are increasingly used in agriculture for water retention and in personal care products. Innovations in hybrid hydrophilic gels, blending natural and synthetic polymers, offer superior strength and versatility, expanding their use across industries.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Healthcare Infrastructure Expansion Accelerates Global Market Growth

The ongoing expansion of healthcare infrastructure globally serves as a fundamental driver for the hydrogel market growth, creating sustained demand across multiple medical applications. This trend is particularly noticeable in emerging economies, where healthcare modernization initiatives are establishing new facilities and upgrading existing medical infrastructure.

Healthcare industry expansion directly correlates with increased procurement of advanced medical materials. Modern hospitals and clinics require sophisticated wound care solutions, positioning them as critical components due to their superior biocompatibility and therapeutic efficiency. The product adoption rate in wound management has increased significantly as healthcare providers prioritize materials that demonstrate measurable improvements in patient outcomes and healing times.

The market influence extends beyond basic applications such as wound care. Expanding healthcare networks require comprehensive medical supply chains that include products for surgical procedures, burn treatment, and chronic wound management.

Additionally, healthcare infrastructure investment often includes technology upgrades that complement hydrophilic gel applications, such as advanced drug delivery systems and tissue engineering capabilities. The alignment of infrastructure expansion with technological advancement creates multiplicative effects on product demand, forming it as an essential component in modern healthcare delivery systems across both developed and emerging markets.

Market Restraints

High Production Costs and Stringent Regulatory Requirements Limits Market Growth

Elevated manufacturing costs represent a significant barrier constraining market expansion. The production of high-quality hydrogels requires specialized equipment, controlled environments, and premium raw materials, resulting in substantially higher costs compared to conventional alternatives. These manufacturing expenses directly translate into elevated product prices in price-sensitive segments and developing regions.

Regulatory compliance adds another layer of cost burden and market entry complexity. Hydrophilic gels, especially those intended for medical applications, must undergo extensive testing protocols, clinical trials, and approval processes across multiple regulatory bodies. The FDA, EMA, and other authorities require comprehensive safety and efficacy documentation, extending product development timelines and increasing associated costs significantly.

Market Opportunities

Advanced Stimuli-Responsive Technology Creates Breakthrough Opportunities for Market

Smart and responsive hydrogels represent a significant advancement in material science, engineered to react dynamically to environmental stimuli such as pH changes, temperature variations, electric fields, or specific biomolecules. These intelligent materials can undergo controlled swelling, shrinking, or structural changes in response to predetermined triggers, enabling precise control over drug release, therapeutic delivery, and device functionality. The technology leverages sophisticated polymer chemistry to create materials that adapt to their environment, offering unprecedented precision in medical applications.

The market opportunities are substantial as these smart gels enable breakthrough applications in targeted cancer therapy, where they can discharge drugs specifically at tumor sites, and in diabetic care through glucose-responsive insulin delivery systems. Additionally, they create possibilities for self-healing materials, adaptive contact lenses that adjust to eye conditions, and biosensors that provide real-time health monitoring.

Market Challenges

Technical Complexities and Manufacturing Scalability Constraints Market Expansion

Technical complexities in product formulation present significant manufacturing challenges, requiring precise control over crosslinking processes, polymer concentrations, and environmental conditions. These intricate production requirements make consistent quality maintenance difficult during large-scale manufacturing.

Scalability issues emerge during transitioning from laboratory synthesis to commercial production, as maintaining uniform properties across larger batches becomes increasingly complex. Manufacturing inconsistencies can compromise product performance and regulatory compliance, limiting market growth trajectory and deterring investment in production capacity expansion among manufacturers.

Segmentation Analysis

By Type

Superior Customization Properties & Cost-Effectiveness Allow Synthetic Segment to Dominate the Market

Based on type, the market is classified into synthetic, natural, and hybrid.

The synthetic segment dominates the market due to its superior mechanical properties, customizable characteristics, and consistent performance across applications. Polyethylene glycol (PEG), polyvinyl alcohol (PVA), and polyacrylamide-based hydrogels offer precise control over swelling ratios, degradation rates, and drug release profiles. The synthetic products benefit from cost-effective large-scale production and prolonged shelf life, making them a preferred choice for commercial applications in wound care and drug delivery systems.

Natural segment is rapidly growing with a share of 50.53% in 2026, driven by increasing consumer preference for biocompatible and biodegradable materials. This type of products offer excellent biocompatibility and minimal immunogenic responses. The segment experiences strong growth in personal care applications and wound care.

By Product

Exceptional Absorbency Fuels Superabsorbent Polymers Segment’s Dominance

Based on product, the market is classified into superabsorbent polymers, gelatin/collagen, and others.

The superabsorbent polymers segment held the largest hydrogel market share 64.72% in 2026 due to their exceptional absorbency and extensive use in hygiene products such as diapers, sanitary pads, and adult incontinence solutions. Their application in agriculture as soil conditioners also contributes significantly toward the SAPs large volume contributor to the market.

Gelatin/collagen segment captures a strong value share owing to its natural origin, biocompatibility, and biodegradability. They are widely used in advanced wound dressings, tissue engineering, and cosmetics, supported by rising demand in healthcare and cosmeceuticals, along with the growing focus on regenerative medicine.

By Application

To know how our report can help streamline your business, Speak to Analyst

Premium Beauty Product Demand and Anti-Aging Consciousness Fuel Personal Care & Hygiene Segment Expansion

In terms of application, the market is segmented into personal care & hygiene, wound care, drug delivery, agriculture, contact lenses, and others.

The personal care & hygiene application dominates the market with a share of 60.08% in 2026 and represents one of the fastest-growing segments driven by rising consumer awareness and premium product demand. Hydrogel-based facial masks and feminine hygiene products demonstrate superior performance characteristics. Market expansion is fueled by increasing disposable income and beauty consciousness among various demographics.

Drug delivery emerges as a high-value segment with substantial growth potential, particularly in controlled-release formulations and targeted therapeutics. It enables precise medication dosing and sustained release profiles, making them valuable for chronic disease management and specialized treatments.

Hydrogel Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Hydrogel Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest market share and was valued at USD 13.02 billion in 2026. The region benefits from robust manufacturing capabilities in China, Japan, and South Korea, supported by established chemical and pharmaceutical industries. Rising healthcare expenditure across emerging economies and expanding middle-class populations drive substantial demand for advanced medical products. The personal care and hygiene products experience exceptional growth, with South Korea and Japan leading the skincare industry.The Japan market is projected to reach USD 1.94 billion by 2026, the China market is projected to reach USD 6.53 billion by 2026, and the India market is projected to reach USD 1.07 billion by 2026.

China Hydrogel Market Share, By Application, 2026 To get more information on the regional analysis of this market, Download Free sample

North America

The North America market maintains a significant share as a mature, high-value region driven by advanced healthcare systems and substantial R&D investments. Strong regulatory frameworks ensure high product quality standards, supporting premium pricing. The region demonstrates consistent demand for advanced wound care products, supported by well-established healthcare reimbursement systems. The U.S. market is driven by leading medical device companies and an extensive pharmaceutical research infrastructure that fosters continuous product innovation.The U.S. market is projected to reach USD 7.84 billion by 2026.

Europe

Europe presents a stable, technologically advanced market characterized by stringent regulatory standards and high-quality product demand. Germany, U.K., and France lead the regional consumption, driven by robust healthcare infrastructure and a focus on advanced medical treatments. The region demonstrates a strong preference for natural and hybrid product formulations, aligning with sustainability trends. European pharmaceutical companies invest heavily in hydrogel-based drug delivery research, generating innovative application opportunities.The UK market is projected to reach USD 1.91 billion by 2026, while the Germany market is projected to reach USD 2.22 billion by 2026.

Latin America

Latin America is an emerging market with significant growth potential, driven by expanding healthcare infrastructure and rising disposable income levels. Brazil and Mexico represent key growth markets, supported by government initiatives to improve healthcare access.

Middle East & Africa

The Middle East & Africa represent a rapidly developing market. Gulf Cooperation Council countries, particularly UAS and Saudi Arabia, drive regional demand through substantial healthcare investments and medical tourism growth. South Africa leads the African market with relatively advanced healthcare systems and growing product adoption in wound care applications.

Competitive Landscape

Key Market Players

Expanding Clinical and Consumer Needs to Reshape Product Strategies

Rising demand for advanced wound healing, regenerative therapies, and premium skincare is compelling producers to reposition portfolios toward high-value segments. Companies are accelerating innovation pipelines, pursuing partnerships for distribution leverage, and diversifying applications to capture resilient, margin-rich growth across healthcare and consumer wellness sectors. 3M, Johnson & Johnson, Cardinal Health, Smith+Nephew, and Ashland are the key players in the market.

List of Key Hydrogel Companies Profiled

- Ashland (U.S.)

- DSM (Netherlands)

- Evonik (Germany)

- Smith+Nephew. (U.K.)

- Cardinal Health. (U.S.)

- Johnson & Johnson (U.S.)

- 3M (U.S.)

- Katecho, LLC. (U.S.)

- EF Polymer. (Japan)

- NEXGEL Advanced Hydrogel Solutions (U.S.)

Key Industry Developments

- July 2025: NEXGEL and STADA expanded their partnership to launch hydrogel-based scar and stretch-mark products in North America, combining NEXGEL’s hydrogel expertise with STADA’s distribution strength to accelerate growth in consumer health solutions.

- September 2020: NEXGEL launched four hydrogel-based consumer products—Fever Cool, Hexagel, ClearComfort, and Nip Defense—strengthening its presence in OTC, sports, and cosmetic applications, and expanding growth opportunities within the global market.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, compositions used to produce these product types, and product applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 7.2% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The global Hydrogel market size is projected to grow from $44.02 billion in 2025 to $71.46 billion by 2032.

In 2025, the Asia Pacific market value stood at USD 13.02 billion.

Recording a CAGR of 7.2%, the market will exhibit steady growth during the forecast period of 2025-2032.

In 2025, personal care & hygiene is the leading segment in the market by Application.

Growing demand from the personal care & hygiene industry is a key factor driving the growth of the market.

Asia Pacific is poised to capture the highest market share during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us