Hydrogen Aircraft Market Size, Share & Industry Analysis, By Platform (Urban Air Mobility [EVTOL and Unmanned Aerial Vehicle], Business Jets, and Others), By Power Source (Hydrogen Combustion and Hydrogen Fuel Cell), By Range (Short Haul (<1000 Km), Medium Haul (1000 Km-2000 Km), and Long Haul (>1000 Km)), By Application (Commercial, Military, and Cargo), By Technology (Full Hydrogen Powered Aircraft and Hybrid Electric Aircraft), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

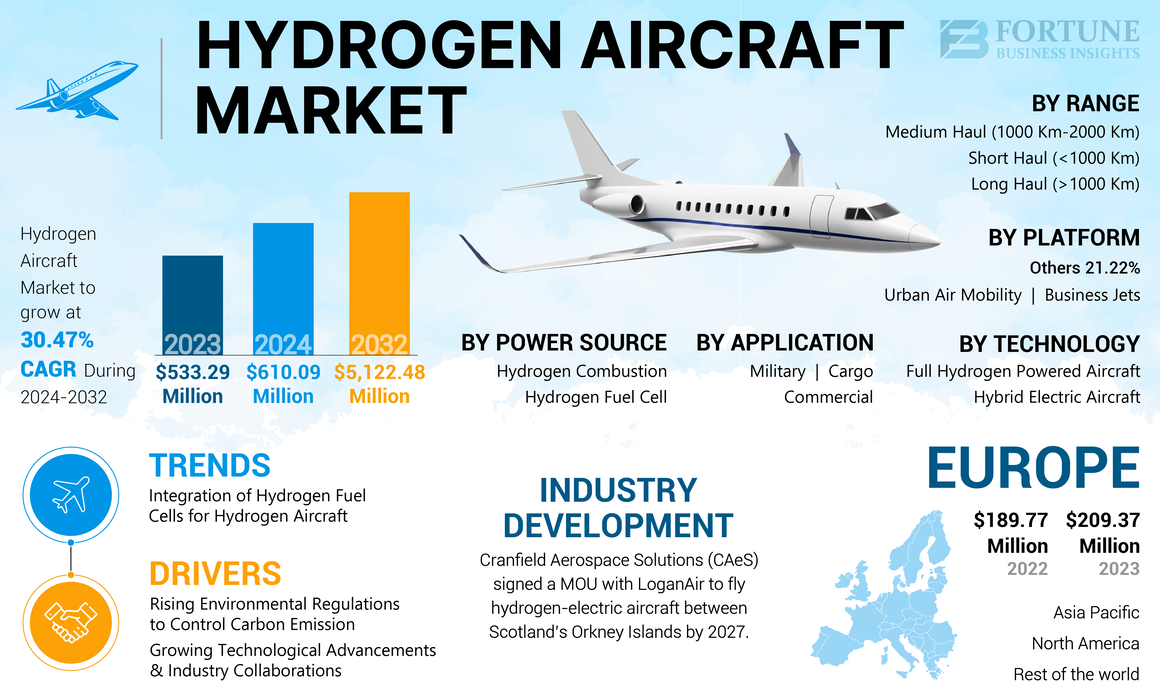

The global hydrogen aircraft market size was valued at USD 533.29 million in 2023. The market is projected to grow from USD 610.09 million in 2024 to USD 5,122.48 million by 2032, exhibiting a CAGR of 30.47% during the forecast period. Europe dominated the hydrogen aircraft market with a market share of 39.26% in 2023.

A hydrogen aircraft refers to an aircraft that uses hydrogen as a fuel and power source for operation. The market is likely to witness tremendous growth during the forecast period. Given that air passenger traffic is increasing day by day across the world, there is pressure on the aviation industry to reduce carbon emissions. Moreover, this industry accounts for about 2.5% of total GHG emissions. Hydrogen has huge potential to decarbonize aviation and may turn out to be a viable alternative to traditional jet fuels. Inherent high energy density and zero emission while flying—the water vapor only that comes out of this process—are what make it most attractive to airlines that are seeking to achieve the tougher and tighter environmental regulations and zero-emission targets set by many governments around the world.

Most countries are working on their national hydrogen strategies to optimize the use of hydrogen technologies in industries such as aeronautics. For instance, European nations such as France, Germany, and the U.K. have started investing in the necessary infrastructure for the production, storage, and distribution of hydrogen, without which the full-scale deployment of hydrogen aircraft would not be possible. Governmental support to this sector will only nourish not just innovation itself, but also private sector investment in hydrogen technologies, further accelerating the pace of market development.

Improvements in hydrogen fuel cells and internal combustion engines make hydrogen more plausible for aircraft power. Meanwhile, companies such as Airbus and ZeroAvia are currently taking center stage in the process, working on unique solutions that combine the benefits of electrification with structural requirements for aircraft.

Even with these positive trends, a number of challenges have been faced in the market growth, relating to high production costs and the large hydrogen infrastructure during the COVID-19 pandemic. The process of hydrogen aircraft production or conversion is very energy-intensive, and so is the investment in infrastructure development, creating quite high entry barriers for market players. These costs are likely to fall in the future as the technology continues to mature and economies of scale are achieved, thus making hydrogen more competitive. The aviation industry's substantial carbon footprint was underscored by the pandemic, prompting a renewed commitment to environmental sustainability. As air traffic resumes, there is a heightened need to explore hydrogen as a viable fuel source. Airbus and ZeroAvia are leading the way in the development of hydrogen-powered planes, with commercial deployment targets set for 2035.

GLOBAL HYDROGEN AIRCRAFT MARKET OVERVIEW

Market Size & Forecast

- 2023 Market Size: USD 533.29 million

- 2024 Market Size: USD 610.09 million

- 2032 Forecast Market Size: USD 5,122.48 million

- CAGR: 30.47% (2025–2032)

Market Share

- Europe dominated the hydrogen aircraft market with a 39.26% share in 2023, driven by national hydrogen strategies, strong R&D investments, and leadership from players like Airbus.

- By power source, the hydrogen combustion segment held the largest share in 2023 due to growing governmental support for alternative propulsion systems. The hydrogen fuel cell segment is expected to witness the fastest growth owing to zero-emission potential and fuel efficiency improvements.

Key Country Highlights

- France: Airbus is actively developing hydrogen-powered aircraft as part of its ZEROe program and participating in EU sustainability initiatives.

- Germany: Strong public-private partnerships and research support from institutions like DLR drive market innovation.

- United Kingdom: Companies such as GKN Aerospace and Rolls Royce are investing in hydrogen propulsion and storage solutions.

- United States: Government-backed initiatives (e.g., NASA, FAA) and leading players like ZeroAvia and Boeing push commercial viability.

- Japan: JAXA and private sector investment enhance hydrogen integration in aerospace.

- China: Massive investments in hydrogen energy infrastructure contribute to aviation sector adoption.

- UAE: Investment in hydrogen as part of energy diversification strategy positions it as an emerging hydrogen aviation hub.

Hydrogen Aircraft Market Trends

Integration of Hydrogen Fuel Cells for Hydrogen Aircraft to Boost Market Growth

Hydrogen fuel cells offer a significant opportunity for hydrogen-powered aircraft based on efficiency, environmental impact, and recent technology developments. They efficiently convert hydrogen into electricity with a low weight, the latter of which is of fundamental importance to application on board aircraft. Recent innovations, such as those in March 2024 from NREL, have managed to increase fuel cell power density by 20%, thereby enhancing the cells for application on passenger aircraft by raising the power output and reducing weight. Europe witnessed hydrogen aircraft market growth from USD 189.77 Million in 2022 to USD 209.37 Million in 2023.

Environmentally, hydrogen fuel cells could offer a zero-emission alternative to traditional jet engines by producing only water vapor, hence meeting global goals for reducing the carbon footprint of aviation. Moreover, the European Union updated its aviation sustainability plan in May 2024, while hydrogen represents the future technology that will lead to net-zero emissions by 2050. Furthermore, improvements related to durability and reliability are equally impressive. Airbus and a leading fuel cell manufacturer revealed a prototype in June 2024 that sported improved coatings and membrane technologies, which greatly expanded the life expectancy of a fuel cell.

Download Free sample to learn more about this report.

Hydrogen Aircraft Market Growth Factors

Rising Environmental Regulations to Control Carbon Emissions to Drive Product Demand

A key trend that is going to increase demand for hydrogen aircraft in the years to come is the rising stringency of environmental regulatory norms and a focus on ambitious climate goals. Moreover, governments and institutions of international cooperation globally have ratcheted up their efforts to fight climate change, as visibly noticed through the reduction of GHG emissions from all sectors of the economy.

The aviation industry has, for a long time, been a very big player in carbon emissions to the atmosphere for quite a long time. This is because, more often than not, the industry has been very dependent on fossil oil. Policymakers are quite aware of its environmental impacts and hence are at the forefront of implementing full ball game regulatory frameworks with the principal objective of promoting sustainability. The most influential is that of the European Union under its package "Fit for 55" of July 2021, with a review in June 2024. It indicates commitments made by the EU to reduce GHG emissions by 55% by 2030 and to be climate-neutral by 2050. It also identifies requirements, such as forbidding any zero-emission technology in zero-emission fuel use.

Growing Technological Advancements and Industry Collaborations to Surge Market Growth

Technological advancements and increased industry collaboration are driving the revolution in the hydrogen powered aircraft market. They are overcoming the biggest technical challenges and bringing the realization of the first feasible hydrogen aviation solutions closer. This is enabled by an advancement in hydrogen fuel cell technology and aircraft design and storage solutions that are instrumental in making hydrogen a competitive alternative to conventional aviation fuels. The technology at the center of this transformation is hydrogen fuel cells. Recent advancements have ensured that the energy density and overall efficiency of hydrogen fuel cells have increased to acceptable levels for use in aviation. Performance can also be increased through innovations such as high-performance stacks and lightweight and durable materials in the fuel cells. For instance, advanced PEM fuel cells have made it possible to have higher efficiency and power output for realizing the energy needs of aircraft.

Besides, development in hydrogen storage technology also has to keep pace with the development of fuel cells. An important technological challenge in aviation is the compact and weight-efficient storage of hydrogen for safe usage. New developments are reaching from high-pressure tanks to cryogenic storage solutions that allow for compact hydrogen storage with minimum weight and maximum safety. These would be the crucial hydrogen technologies, assuring competitiveness across a needed range and performance characteristics for hydrogen-fueled aircraft compared to traditional aircraft.

RESTRAINING FACTORS

Lack of Hydrogen Related Fuel Infrastructure Support May Hinder Market Growth

A lack of hydrogen-related fuel infrastructure is a major obstacle for hydrogen airplanes to make strides in the aviation market. Despite being heralded as the sustainable alternative to traditional conventional fuels in aviation, a high initial investment required in developing refueling infrastructure at airports with necessary facilities has been a big problem. Other issues relate to low production capacity and regulatory hurdles, which further complicate things in setting up a robust hydrogen fueling network. Uncertainty over the long-term profitability of investments in hydrogen infrastructures, combined with technical challenges in hydrogen storage and distribution, could refrain stakeholders from committing to such a transition. This means that, without huge advances in hydrogen infrastructure, the prospect of hydrogen aircraft playing a major part in decarbonizing the aviation sector remains limited—in turn, limiting any potential market growth and adoption for hydrogen aircraft.

Hydrogen Aircraft Market Segmentation Analysis

By Technology Analysis

Rising Demand for Electric Aircraft to Propel Hybrid Electric Aircraft Segment Growth

Based on technology, the market is divided into full hydrogen powered aircraft and hybrid electric aircraft.

The hybrid electric aircraft segment accounted for the dominating hydrogen aircraft market share in 2023 and is expected to grow significantly in the near future. Rising demand for sustainability drives the aviation sector toward sustainability. The surge in demand for sustainable solutions in aviation is due to the effect of reducing emissions and increasing sustainability. Hybrid electric aircraft are expected to be among the primary solutions in order to meet the market demand through reduced fuel consumption and lesser emissions than conventional aircraft. Advanced technologies in electric motors, batteries, and hybrid propulsion systems make the aircraft increasingly viable and efficient for both commercial and military applications.

The full hydrogen powered aircraft segment is expected to grow at the highest CAGR from 2024 to 2032. This segment is also expected to witness the highest growth rate in the hydrogen aircraft market during the forecast period. It can be attributed to increasing investments in the development of such aircraft. The full hydrogen powered aircraft sub-segment of aircraft with a range up to 20 km is expected to grow with the most substantial CAGR during the forecast period since, with hydrogen propulsion, it will become more viable for shorter flights.

By Platform Analysis

Innovations in Electric Motors to Expedite Urban Air Mobility Segment Expansion

Based on platform, the market is classified into urban air mobility, business jets, and others.

The urban air mobility segment accounted for the largest market share in 2023 and is expected to grow at a high CAGR during the forecast period. UAM technologies can reduce fuel consumption and emissions by up to nearly 90% compared with conventional aircraft, which opens up new applications with eVTOL aircraft. Advancements in the field of batteries, electric motors, and hybrid propulsion systems are also increasing the feasibility and performance of UAM vehicles. The fastest growth is foreseen in segments such as short-haul flights, regional aircraft, and urban air taxis/eVTOLs.

The business jets segment accounted for a considerable market share in 2023 and is expected to grow with the highest CAGR during the forecast period. One of the main drivers is an increasing focus on de-carbonization in the aviation sector. Hydrogen-powered aircraft provide a zero-emission solution against traditional, fossil fuel-based options. Thus, it fits fully into the goal of the aviation sector to decrease its carbon footprint.

The others segments is likely to show high CAGR during the forecast period. The major driving force for hydrogen-powered aircraft is the decarbonization goal of the aviation industry, which can be provided by zero-emission operations. The government promotes aircraft development through initiatives, regulations, and funding support for the goals of sustainability by industries. The others segment is expected to hold a 21.22% share in 2023.

To know how our report can help streamline your business, Speak to Analyst

By Power Source Analysis

Hydrogen Combustion Segment Leads Driven by Increasing Government Spending

By power source, the market is classified into hydrogen combustion and hydrogen fuel cell.

The hydrogen combustion segment dominated the market share in 2023 and is likely to witness a high CAGR in the upcoming years. Government initiatives, funding, and regulations encourage the development of aircraft and subsequently boost wide-scale adoption, including those with hydrogen combustion technology. In this regard, remarkable development has been made in terms of engineering gas turbine engines to run with hydrogen fuel instead of traditional jet fuel.

The hydrogen fuel cell segment is expected to exhibit high growth in the next few years. Hydrogen fuel cells offer zero-emission, clean technology for power generation and air transport applications. They fit into the global decarbonization program and the push for more sustainable energy solutions. Technologically, tremendous progress has been made toward reducing costs efficiently and offering better reliability. It can make fuel cells more viable by bringing advantages to areas such as proton exchange membranes, catalysts, and system integration.

By Range Analysis

Short Haul Segment Secured Leading Position Fueled by Dependence of Regional Economies

By range, the market is classified into short haul (<1000 Km), medium haul (1000 Km-2000 Km), and long haul (>1000 Km).

The short haul segment dominated the market in 2023 and is likely to exhibit the highest CAGR during the forecast period. Short-haul flights play a very vital role in connecting cities and regions lying a few hours from each other by air. It facilitates fast travel for business and leisure passengers, reaching destinations within quick time without wasting hours on ground transport. On the other hand, regional economies depend on short-haul flights both for the development of tourism and business activities and for facilitating local commerce. They facilitate trade and investments by rendering easier and faster transportation of goods and personnel.

The medium haul segment is projected to grow at a significant CAGR during the forecast period. This is attributed to the high demand for medium-haul flights, as frequent travel between main urban centers, business hubs, and popular tourist destinations occurs at high levels. The airlines have multiple daily flights on these routes owing to passenger demand.

The long-haul segment is projected to grow significantly in the coming years. Long-haul flights are faster modes of commute for large distances as compared to ships or trains, which belong to surface transport modes.

By Application Analysis

Increasing Demand for Sustainable Aviation in Airlines to Foster Commercial Segment’s Expansion

By application, the market is classified into commercial, military, and cargo.

The commercial segment dominated the market share in 2023 and is slated to grow at a significant CAGR during the forecast period. Rising demand from airlines, passengers, and regulatory bodies around the world for sustainable aviation solutions is seasoned. Increasing awareness of environmental issues and strict regulations are pressuring airlines to minimize their carbon footprint. Hydrogen powered aircraft could be a powerful solution to meet these demands and differentiate, at the same time, airlines in the marketplace.

It is expected that the cargo segment will grow with the highest CAGR during the forecast period. The segment’s growth is certain as aerospace companies, cargo contractors, and institutions are coming together to cooperate in developing the technology of hydrogen powered aircraft applicable for cargo purposes.

REGIONAL INSIGHTS

Based on region, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

Europe Hydrogen Aircraft Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe, valued at USD 209.37 million, dominated the market in 2023, with sustainability and emphasis on technological innovation in the area. It is followed by Germany and France, where national strategies have been elaborated in each of these countries and by EU programs, such as Horizon Europe. In France, companies such as Airbus are engaged in advancing R&D with their academic and government partners related to hydrogen powered aircraft. Thus, these factors are proliferating Europe’s hydrogen aircraft market growth.

North America held a significant market share in 2023. The region is leading hydrogen powered aircraft development due to massive investments by governmental and private aerospace bodies. The U.S. hosts several ongoing initiatives by NASA, DARPA, and companies such as ZeroAvia in the development of hydrogen propulsion systems. The Federal Aviation Administration (FAA) has a good regulatory base supporting such technologies in aviation.

Asia Pacific is likely to grow at the fastest CAGR over the forecast period. Countries such as Japan and China are developing hydrogen technology diligently, thus driving regional growth. In Japan, JAXA leads aerospace innovation, which is backed by government subsidies and a powerful engineering sector. China is making massive investments in hydrogen across various industries, trying to lead global efforts in carbon neutrality with a focus on coming up with this technology in the aviation sector.

The rest of the world, including Australia and the Middle East & Africa are poised to emerge important markets in the future. The regions are becoming one of the important stakeholders in the world's hydrogen economy because it has been encouraging research and collaboration to further the hydrogen technology used in aircraft. Countries in the Middle East, such as the UAE and Saudi Arabia, are exploring the use of hydrogen in diversifying away from traditional energy sectors which may possibly have impacts on global aviation markets.

KEY INDUSTRY PLAYERS

Major Players Emphasize Developing Advanced Aircraft Components to Gain a Competitive Edge

The market is consolidated with several global players operating in this industry. It is led by several players present in this industry. It is observed that key players offer quality and advanced systems and introduce cutting-edge technologies along with a reduction in carbon emissions. Most of the players involved in the market are focusing on designing advanced aircraft components and systems for various applications of aircraft. The top 5 players in the industry include Airbus, Honeywell International Inc., The Boeing Company, Rolls Royce, and Embraer.

List of Top Hydrogen Aircraft Companies:

- Airbus (Netherlands)

- Bell Textron Inc. (U.S.)

- The Boeing Company (U.S.)

- Embraer (Brazil)

- GKN Aerospace (U.K.)

- Honeywell International Inc. (U.S.)

- Rolls Royce (U.K.)

- Safran SA (France)

- Urban Aeronautics Ltd (Israel)

- ZeroAvia, Inc. (U.S)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: H3 Dynamics planned to supply Airbus UpNext with a 500-kW hydrogen fuel cell for flight demonstration in an Airbus A330 as a replacement for the turbine-based Auxiliary Power Unit (APU) to reduce emissions and noise.

- April 2024: German aerospace center DLR launched a three-year research project to develop a digital environment to automate the design and accelerate the development of future aircraft with hydrogen-electric powertrains.

- March 2024: EasyJet, a low-cost airline, joined an alliance of companies, including Rolls-Royce, Airbus, and GKN Aerospace, in urging ministers to help fund the development of the nascent technology, which offers the possibility of flying with zero emissions in the coming decades but is commercially unproven.

- January 2024: Cranfield Aerospace Solutions (CAeS), a U.K.-based hydrogen aircraft developer, signed a Memorandum of Understanding (MOU) with LoganAir, the U.K.’s largest regional airline, to fly hydrogen-electric aircraft between Scotland’s Orkney Islands by 2027. The partners believe the collaboration could deliver the world’s first commercial zero-emissions flights.

- December 2023: Airbus SE unveiled a new Hydrogen Aircraft and completed its first flight for 100 hours above the sky in France. The aircraft was first launched at the Paris Air Show in 2019. The EcoPulse was developed by Airbus, Safran, and Daher to reduce carbon emissions and lower noise levels.

REPORT COVERAGE

The research report analyzes various aspects such as key players, product offerings, end-users, hydrogen aircraft trends, growth, and size analysis. The report also offers market insights into advanced technologies, trends, competitive landscape, and product pricing and highlights key industry developments. In addition to the aspects mentioned above, it encompasses several direct and indirect factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 30.47% from 2024 to 2032 |

|

Segmentation |

By Platform

|

|

By Power Source

|

|

|

By Range

|

|

|

By Application

|

|

|

By Technology

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market was valued at USD 533.29 million in 2023 and is projected to reach USD 5,122.48 million by 2032.

The market is projected to grow at a CAGR of 30.47% during the 2024-2032 period.

By platform, the urban air mobility segment led in 2023.

Airbus, The Boeing Company, Rolls Royce, and Embraer Corporation are the leading players in the global market.

Europe held a dominant market share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us